The legal structure of the deposit was known back in Ancient Rome (although there it was called “arra”), from where it passed into the domestic legal system.

The concept and functions of a deposit. Legal basis

Download a sample deposit agreement.

- According to Russian legislation, a deposit is a sum of money that is given by one person to another on account of a future payment (payments), as proof of the conclusion of a transaction and to ensure its execution in the future.

- A deposit is a concept that is completely subject to the norms of civil law, that is, it regulates private law relations between citizens, entrepreneurs, and companies conducting commercial activities.

- Articles 380 and 381 of the Civil Code of the Russian Federation regulate issues related to the deposit and establish:

- form of the agreement on deposit;

- distinguishing the deposit from the advance payment;

- consequences of failure to fulfill the obligation for which the deposit was issued.

Article 329 of the Civil Code names a deposit among other ways to secure certain obligations. Certain types of contracts (lease, provision of services, etc.) also contain rules regarding deposits under such contracts.

You should know that a deposit, by its nature, differs significantly from both an advance and a pledge, although in everyday life these concepts are often equated with each other.

In what cases is this agreement necessary?

- the main objective deposit - to guarantee compliance with the terms of the contract (agreement of the parties on something), to show readiness to fulfill the obligations assumed.

- However, it is a mistake to believe that only the person making the deposit thus confirms that he will perform the necessary actions; the second party, accepting the deposit, is also responsible for his actions.

- Since the relationship for the acceptance and transfer of a deposit is reciprocal , bilateral, and is also associated with monetary settlements, the design of a deposit agreement has long been established in legal practice.

- An agreement (or agreement) on a deposit is needed when:

- purchasing real estate or expensive property;

- preparation of a lease agreement (apartment, office, other premises);

- supply of goods for business activities.

They often resort to a deposit not only for the above large transactions, but also when providing services for a certain time.

The deposit is usually made by the buyer, indicating to the seller the intention to purchase the property being sold. But the recipient of the deposit also guarantees the transfer of the specified property into ownership of the buyer.

You should be very careful when drafting a deposit agreement.

Civil legislation clearly establishes the requirements for drawing up an agreement on a deposit, and judicial practice is well established: if the buyer does not pay the agreed amount without good reason exonerating him, he will lose the deposit paid, but if the seller refuses to sell the property contrary to the agreement, he returns the deposit no less than double the amount. This ensures that the parties to the transaction are encouraged to comply with the agreements.

- Thus, it is advisable to draw up an agreement/agreement on a deposit if the parties have firmly decided to enter into an agreement on something, and for this purpose are ready to resort to a security measure in the form of a deposit, which, in fact, confirms the good faith of their intentions.

- The distinctive features of a deposit from an advance are discussed in the following video:

If you have not yet registered an organization, the easiest way to do this is to use online services that will help you generate all the necessary documents for free:

- for individual entrepreneur registration

- LLC registration

If you already have an organization and you are thinking about how to simplify and automate accounting and reporting, then the following online services will come to the rescue, which will completely replace an accountant in your company and save a lot of money and time. All reporting is generated automatically, signed electronically and sent automatically online.

- Accounting for individual entrepreneurs

- Bookkeeping for LLC

It is ideal for individual entrepreneurs or LLCs on the simplified tax system, UTII, PSN, TS, OSNO.

Everything happens in a few clicks, without queues and stress. Try it and you will be surprised how easy it has become!

Form and order of registration

Article 380 of the Civil Code of the Russian Federation establishes the need to formalize a deposit agreement in writing.

If this form is not observed, or if the written text does not contain identifying signs of the deposit, such an agreement will be considered an advance agreement (clause 3 of Article 380 of the Civil Code).

According to Art. 432 of the Civil Code of the Russian Federation, an agreement (any) is considered concluded when the parties have reached agreement on all the most important (material) conditions. For a deposit, these are the amount (clause 1 of Art.

380 of the Civil Code), and a condition on the obligation, which is secured by a deposit (that is, if an apartment is being sold, for example, it is necessary to indicate its exact description as a real estate object, indicate the period of the proposed transaction).

After all the nuances have been agreed upon, both parties (both the seller and the buyer) draw up a written agreement according to the number of parties, sign it personally (individuals) or authorized representatives (from organizations).

Structure and content

The deposit agreement must contain :

- Preamble and full details of the parties, their signatures, bank details if necessary;

- Date and place of detention;

- Subject - an indication that it is the pledge being issued, as well as the exact amount;

- The procedure and timing for the transfer of deposit amounts, the rights and obligations of the parties to the transaction. Since it is in these sections that the relations of the parties are established in case the transaction does not take place, it is necessary to describe in detail the method, nuances of receiving and transferring money, who exactly transfers it, etc.

- The procedure for resolving disputes (in case they arise), responsibility of the parties;

- Duration of the agreement and the possibility of its termination (how, in what cases).

Inaccurate wording in the contract can turn the actual deposit into an advance, or lead to lengthy proceedings in court, so it is necessary to spell out all the nuances established by law as carefully as possible, and also reach agreement on all points of the contract before signing it.

Nuances of deposit agreements when drawing up certain types of contracts

Since in Russian law it is possible and customary to secure very diverse obligations with deposits, when drawing up agreements on deposits it is necessary to take into account the specifics of the relevant transactions.

So, deposit agreements have their own nuances .

Apartment purchase

Since a transaction for the purchase and sale of an apartment cannot be completed instantly, as soon as the buyer liked the property and agreed on the price with the seller (it is necessary to prepare documents, decide on the registration of residents, etc.), a deposit is resorted to very often. Having received security, the seller stops showing the property to other buyers, while the price for the property being sold is fixed.

When making a deposit for an apartment , the following must be observed:

- regardless of the amount, the agreement is concluded in writing;

- before signing, all title documents for real estate are checked, and the contract itself is concluded with the owner (not with a realtor or representative), the money is also transferred to him;

- the text describes a specific property (apartment) and directly states that the funds transferred are a deposit;

- when transferring the deposit, a receipt is drawn up indicating that the funds were transferred to pay for the deposit;

- It is recommended that the agreement additionally indicate the seller’s obligation to transfer the apartment (vacate it from its occupants) within a certain period of time, in case of non-compliance with which the deposit will be collected from the seller in double amount.

In addition, one should not confuse the deposit agreement and the preliminary agreement (amounts paid under it are not considered security and are equivalent to an advance). The size of the deposit usually varies from 5 to 10% of the price of the property.

Rental of property

As in the case of purchasing an apartment, the agreement must indicate the specific object, the purpose of the transferred amount as a security measure - a deposit, and also enter into an agreement with the owner of the object.

Important: do not confuse the deposit and the security deposit paid by the tenant as “insurance” to the owner against property damage, non-payment of funds for the last month of residence, etc.

Buying a car

As a rule, a deposit for such a purchase is given if the property is expensive, or the seller still needs to prepare the car for sale and deregister it.

The usual deposit amount is 10%. The agreement must include identifying information (VIN number of chassis, engine, make and model, color).

Purchase of land

The purchase and sale of land involves the preparation of a significant number of documents (both title and technical), so a deposit, which secures the obligation and fixes the price of the property, is very often resorted to.

The deposit agreement must indicate the characteristics of the object (cadastral number, area, location, etc.), the presence of encumbrances (if any), and the deadline for completing the secured transaction.

Supply contract

The deposit agreement specifies the terms and conditions for the delivery of goods after making the deposit, as well as what exactly records the fact of transfer of the goods (that is, the moment of fulfillment of the main obligation).

Providing services to the public

If necessary, you can provide a deposit and conclude a contract for the provision of services.

It should be remembered that such an agreement will additionally fall under the Law on the Protection of Consumer Rights (No. 2300-1 of 2002), and if a citizen refuses the agreement, the courts often recognize the withholding of the deposit as unlawful, contradicting both the provisions on the contract (Chapter 39), and Art. 32 ZoPP.

Regardless of what type of contract is secured by a deposit, the agreement is signed by the parties to the obligation and is made in writing. Notarization of the agreement is possible by agreement of the parties, although not required.

Liability under this agreement

- If the person who paid the deposit is at fault, such deposit will not be returned to him;

- If the responsibility lies with the recipient of the money, he is obliged to return double the amount of the deposit (clause 2 of Article 381 of the Civil Code of the Russian Federation).

The legal essence of this construction is that, since the deposit is of a security nature, the party violating the obligation must be responsible for its actions (incur material losses).

It is interesting that the Civil Code of the Russian Federation does not prohibit the establishment by agreement of the parties of a higher liability under an agreement on a deposit (for example, in a triple amount).

Liability does not apply if the party violated the obligation in the presence of force majeure circumstances (those that the parties could not have foreseen when concluding the contract). In this case, the deposit is returned.

Termination procedure

The deposit agreement, like any civil contract, can be terminated.

Such termination is possible in the following cases :

- agreed upon by the parties themselves when concluding the contract;

- in case of a significant violation by one of the parties to the agreement (Article 451 of the Civil Code of the Russian Federation);

- in other cases provided for by agreement or law.

To terminate, the initiating party must contact the other party with a proposal for termination. If agreed, a written termination agreement is drawn up and signed by the parties. According to Art. 453 the obligations of the parties are terminated.

If the other party does not want to terminate the deposit agreement, the dispute is resolved in court.

Deposits are very common in the practice of domestic civil transactions. It is possible to draw up an agreement on it without involving a notary and without resorting to the services of a lawyer, but it is necessary to strictly observe all the essential points of the agreement: written form, description of the subject of the obligation, the procedure for transferring amounts and a number of other points.

The features of using a deposit when buying an apartment are described in this video material:

Drawing up a deposit agreement when purchasing an apartment

Finally, the cherished dream of owning your own living space has come closer and almost come true! You say “I’ll think about it,” but while you’re thinking, the square meters will be sold. Or the seller will turn out to be untrustworthy.

To prevent the apartment they like from “swimming away” from their hands, many resort to making a deposit. Or for an advance? What's the difference? Meanwhile, it exists, and it is very significant.

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique.

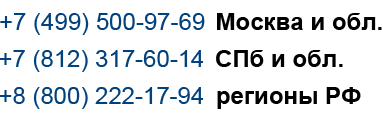

If you want to find out how to solve your particular problem, please contact the online consultant form on the right or call the numbers below. It's fast and free!

Advance or deposit when buying an apartment?

An advance is a certain amount of money or a valuable item that is given by the client as an advance payment. By handing it over to the seller, the buyer, as it were, “books” the property he likes. The transaction did not take place, no matter whose fault - the advance is returned to the client in full .

The advance payment for the apartment is drawn up in writing; the document contains the following points:

- Between whom and by whom the contract is concluded, passport data;

- Characteristics of the apartment;

- The total cost;

- The amount that was decided to be considered an advance.

What is a deposit? A deposit is a certain amount transferred to the other party to the contract as a guarantee that the obligations dictated by this contract will be fulfilled.

In essence, this is a guarantor of the financial security of the parties - after all, if due to some circumstances the transaction does not take place, then one party will lose money. The concept of a deposit is described in the Civil Code of the Russian Federation (Article 380, Part 1).

If the buyer changes his mind about taking the apartment, the deposit is not returned. If the seller is the seller, he is obliged to return the deposit to the client in double amount.

The fact of transfer of money can and should be recorded in writing, but the document does not need to be certified by a notary - unlike a receipt for receipt of a deposit.

An advance is just a cash “tranche”, without any guarantees , except one - what you have “staken out” for yourself will not be sold to someone else.

The deposit acts both as an advance and as a guarantee that the party will fulfill its obligations. Moreover, the receipt directly states that the amount the buyer pays for the apartment is a deposit.

Why such scrupulousness? This is necessary in case the matter comes to trial in court, which is not so rare.

How to apply correctly?

The deposit is drawn up so that the seller has no doubts about the seriousness of the client’s intentions, that he is going to buy, and not “just came to see.”

The amount of the deposit may vary, it depends on the benefits of the transaction. There are no strict rules or any clear framework. In practice, 5-10% of the total transaction value is given as a deposit. This figure, however, may change - by agreement of the seller and the client.

Both the seller and the buyer can insist on the minimum. You should be wary if the seller does not ask for an increase in the amount and easily agrees to the minimum. This happens if the amount was initially underestimated and there is another candidate for the apartment chosen by the client who puts forward more attractive conditions.

If you want to learn how to legalize the redevelopment of an apartment yourself, we advise you to read the article.

The deposit received for the apartment acts as:

- An interim measure for the execution of a contract;

- Evidence that the contract was signed;

- Payment - if all terms of the contract are met, the amount is counted as payment.

Signing the agreement to receive the deposit is the final step.

First, a contract for the purchase and sale of an apartment is signed, then the selling party receives a deposit. Only in this order.

If you do the opposite - first hand over the “insurance”, and then formalize the purchase and sale, such a deposit is worth nothing from a legal point of view.

Sometimes the agreement is signed at the office of a real estate agency. In this case, the agency can keep the deposit until the transaction is fully completed.

If you want to find out how to rent an apartment correctly so as not to be deceived, we advise you to read this article.

The provisions regarding the deposit are described in Articles 380-381 (clause 7) of the Civil Code . It is concluded, as a rule, by a preliminary agreement (usually both the owners and realtors insist on this).

According to Article 429 of the Civil Code, the deposit is a confirmation that the parties are satisfied with the terms of the preliminary agreement and it is on them that the transaction document will be based.

The following forms are used for this:

- agreement or preliminary contract;

- receipt.

Sample deposit agreement

We advise you to secure the payment of the deposit and all the terms of the transaction in the preliminary agreement.

A deposit agreement is concluded in order to ensure the fulfillment of obligations under the main agreement.

It is signed if it is not possible to immediately conclude a final purchase and sale agreement, with entry into the Unified State Register. Moreover, it must be clearly indicated that this amount is precisely a deposit.

We offer you a sample deposit agreement when purchasing an apartment: Download the form.

The deposit agreement must contain clauses:

- Personal data of those signing the contract;

- Registration and actual place of residence;

- Characteristics of the apartment;

- The total cost;

- Deposit amount;

- Time frame for complete completion of the transaction.

Receipt of money can be additionally supported by a receipt . It should, among other things, state that this amount is a deposit and nothing else. The receipt is written by the seller in his own hand and always with a ballpoint pen.

We invite you to download a receipt for receiving money (deposit) when purchasing an apartment here.

What should you pay special attention to?

It should be remembered that the seller has no right to take a deposit if:

- None of the owners is present at the signing of the contract;

- Someone is renting this apartment and there is a document about it;

- Registered by someone who is not the owner;

- The redevelopment was not legalized.

What is a preliminary agreement or deposit agreement when purchasing real estate? Why it is needed and what points it must contain, we suggest you watch a video on this topic.

In any case, such a complex issue as buying an apartment deserves to invite a competent lawyer to assist you - after all, your financial security is at stake. You should also discuss and draw up a deposit with him.

Didn't find the answer to your question? Find out how to solve exactly your problem - call right now: It's fast and free!

How to apply for a deposit when buying an apartment: features, samples

Having found the right option, you want to be sure that the seller will not walk away from the deal. In turn, the seller, who is interested in selling, is ready to secure oral agreements with guarantees. To do this, when purchasing an apartment, both parties draw up an agreement or a deposit agreement, a sample of 2023, which you will find below.

Legally, this step is not mandatory, and the seller does not have the right to demand funds from a potential buyer before the main transaction is completed. However, often it is the receipt and transfer of the deposit that imposes certain obligations on both parties and they willingly agree to this measure.

When transferring funds, you cannot rely on word of mouth and good relations that may develop during the discussion of the upcoming transaction. Only an official contract will serve as a guarantee that the buyer will not be left without an apartment and part of the money. The deposit agreement can be drawn up in regular written form, but it is better to have it notarized.

What is a deposit for the purchase of an apartment?

The deposit is part of the funds transferred by the buyer and received by the seller, as assurance that the parties to the transaction agreement are ready to fulfill its terms. The term and procedure for transferring deposit funds are established by Article 380 of the Civil Code of the Russian Federation.

It should be clarified that the amount of the deposit is taken into account when completing the main transaction for the sale of the apartment, i.e. when concluding a purchase and sale agreement, it appears in its text and the buyer transfers funds to the seller minus those previously transferred.

Transfer rules

The Civil Code requires written confirmation of the transfer of the deposit in the form of a contract or agreement, regardless of its amount. In addition to this document, it is necessary to issue a receipt confirming the fact of transfer of money. The receipt is written by hand by the seller; corrections are not permitted.

If an apartment is being sold that is jointly owned by spouses or privatized for several family members, then all owners must be present at the time of signing the preliminary contract. If the document is signed in the presence of a notary, the presence of two independent witnesses will be required.

Transferring the deposit imposes serious responsibilities on both parties, and it would be unprofitable for either of them to refuse the transaction:

- if the seller changes his mind before completing the purchase and sale transaction of an apartment, he is obliged to return the amount of the deposit to the buyer in double amount ;

- If the buyer changes his mind, he forfeits the deposit amount.

In this case, the buyer has the right to insist on concluding a purchase and sale agreement and transferring the apartment at the agreed price. If there is a preliminary agreement and part of the funds for housing have been transferred under it, then within 6 months he can achieve the completion of the transaction.

Difference from advance

If the parties have agreed on a deposit, this imposes a number of responsibilities on them:

- conclusion of a contract or agreement;

- refund in case of cancellation of the transaction in double amount on the part of the seller and loss of the deposit amount on the part of the buyer.

Everything is easier with an advance payment. It is stipulated in the main transaction agreement, which sets the deadlines for depositing the remaining funds. If, due to some circumstances, the parties had to renegotiate the terms and abandon the transaction, then the advance amount is simply returned to the buyer. There are no consequences here.

How to properly fill out a deposit

Transfer of the amount under the preliminary agreement occurs only with the preparation of a written document and its signing by both parties.

Let's clarify a few more points:

- It is imperative to review the documents of the owner of the apartment in advance, whether there is one owner or several. If there are several, then everyone must be present at the signing of the contract or agreement. Minor children who have a share in real estate are no exception. Parents or guardians sign for them.

- It is recommended to draw up the deposit in the presence of a notary with the involvement of several witnesses. They must not be related to either party. These could be colleagues, friends, etc.

- The preliminary agreement must indicate the full cost of the residential property and indicate the amount of the deposit. In this case, it is necessary to state that it will be taken into account in the final calculation.

The agreement is drawn up in two copies, one for each party.

Size

The parties independently agree on the amount of payment that will act as a deposit; it is not regulated by law. Most often this is 5-10% of the cost of the apartment.

If your intention to buy this particular home is final, you can offer a larger amount. However, not all sellers go for this option.

Therefore, if the seller offers to set less than 5% of the transaction amount as a deposit, then think about whether he is sure that he is ready to sell this apartment to you.

If he finds a buyer at a higher price before completing the transaction, he will not lose too much.

Main points of the contract

You can draw up a contract or agreement on the deposit yourself. If the parties doubt that they will be able to take into account all the essential points, then they can contact a notary office.

Correct execution of the contract consists of filling out all the points in order:

- date and place of document preparation;

- name both parties to the transaction, indicating the addresses according to the stamp in the passport and passport data (if there are several owners, indicate all of them);

- the full cost of the apartment and the amount of the deposit paid in figures and words;

- information about the apartment (all data that will then be present in the main contract: postal address, living and total area, etc.). The description of the apartment must be complete, even when selling only a share in it. When selling a share, it must be indicated;

- the exact date for signing the transaction agreement. This may be a specific date or conditions upon the occurrence of which the purchase and sale agreement will be concluded. Such a condition may be, for example, entering into an inheritance;

- other significant points, for example, if there are debts for housing and communal services, their repayment period;

- It is imperative to indicate the responsibility of the parties in case of refusal to complete the transaction. It is indicated that the seller in this case returns the deposit and an additional fine in the same amount.

- signatures of the parties (all owners on the seller’s side and at least one buyer).

Additionally, you can specify other clauses that will be in the main agreement.

Sample agreement of deposit for an apartment in 2023

Sample deposit agreement when purchasing an apartment - Download

Receipt for receipt of funds for the apartment

In addition to the agreement, when transferring money, the seller must draw up a receipt confirming receipt. In this case, several rules are observed:

- drawn up by the seller himself with a blue ballpoint pen in the presence of the buyer;

- no corrections are allowed;

- information about the parties to the transfer of funds is listed;

- the amount of the deposit transferred and the fact that it is a deposit and not an advance are indicated;

- The date and time of transfer and receipt of money is required.

These points are very important so that there are no problems with the return of funds if the case goes to court. If there are corrections in the text, it is unlikely that you will be able to prove that they were not made after signing. If it is not indicated that this is a deposit, the amount will be considered by the court as an advance, and it will not be possible to return it in double amount.

Receipt form - Download Completed sample - Download

Video: All about the deposit when buying an apartment

A practicing lawyer answers your questions!

Deposit agreement for an apartment upon purchase

Helpful information

The deposit agreement for the purchase and sale of an apartment is used very often.

It allows the seller to receive a guarantee that the buyer is interested in the purchase, and gives the buyer confidence that the seller will ultimately conclude a deal with him.

Earnest money is a sum of money that one party transfers to the other party as evidence of a future transaction. This amount is issued as payments under the agreement.

Features of the deposit agreement for the purchase and sale of an apartment

The Civil Code of the Russian Federation puts forward special requirements for the deposit as a way to secure obligations:

- The deposit can only be money. If the execution of the contract is secured by property, a pledge agreement must be concluded.

- The deposit agreement is concluded in simple written form.

- The deposit is issued against payments under a future contract and encourages the parties to act in accordance with agreements or bear responsibility for failure to fulfill obligations.

How to draw up a deposit agreement when buying an apartment: sample 2023

The parties to the transaction must first agree on the subject of the agreement - the amount of money that will be issued to secure the obligations. A standard deposit agreement for the purchase of an apartment also contains the following clauses:

- names of the parties;

- deposit size;

- duration of the agreement;

- rights and obligations of the parties;

- liability for violation of conditions;

- procedure for changing and terminating the contract;

- priority method for resolving disputes;

- Force Majeure;

- addresses, details, signatures of the parties.

Along with a sample deposit agreement when purchasing an apartment, you should download the appendices to it. Among the accompanying documents that may be needed: a protocol of disagreements, a protocol of reconciliation of disagreements, an additional agreement.

Is it possible to return the deposit?

When concluding a transaction, it is important to know that you can return the money after signing a sample apartment deposit agreement between individuals.

The law establishes the conditions under which monetary security not only can, but must be returned.

For example, money is returned in full if, after concluding the contract, the parties agreed that they are no longer interested in it.

If the buyer refuses to fulfill his obligations, the seller will have the right not to return to him the money received as a deposit. If the party that received the deposit is to blame for the failure of the transaction, it is obliged to return it to the other party in double amount.

We offer to download a sample deposit agreement for the purchase of an apartment, current for 2023, in a convenient format - Word or PDF.

Deposit agreement for purchasing an apartment in 2023 - sample, how to draw up, correctly, payment, standard

By transferring a deposit for the purchased apartment, the buyer obtains a guarantee that the transaction will be completed. If the seller cancels the transaction, you may receive some compensation.

How is a deposit made when purchasing an apartment in 2023? The transfer of a deposit when buying and selling real estate acts as a guarantee for both parties.

Each participant receives confidence that the failure of the transaction due to the fault of the opposite party will be compensated. But how to properly draw up a deposit in 2023?

What you need to know

In real estate transactions, prepayment is often used. This is a certain part of the cost, transferred as confirmation of the intention to complete the transaction.

Prepayment options are advance payment and deposit, which is used more often. There were previously some restrictions regarding the deposit.

They concerned certain categories of contracts. Thus, contracts concluded in relation to residential real estate were considered concluded only after state registration.

Accordingly, the provision on the deposit included in such a document was recognized as valid only after the registration of the agreement.

In controversial situations, the courts recognized the deposit as an advance payment, which somewhat changed the legal consequences. For this reason, it was common practice to draw up a separate deposit agreement.

In most cases, a preliminary agreement was used for this, which came into force from the moment of signing and did not require registration.

In 2023, only the transfer of ownership of an apartment is subject to state registration. The contract itself does not need to be registered.

But lawyers still recommend drawing up a separate agreement, since this allows all the important nuances to be spelled out in detail.

Basic Concepts

Often people don’t see much of a difference between an advance and a deposit. If the transaction is concluded in accordance with the agreements, then the option of prepayment is not of fundamental importance.

However, refusal by one of the parties to complete a transaction leads to completely different legal consequences..

Earnest money is the amount of money that the buyer gives to the seller for future payments. The goal is to ensure the execution of the transaction and confirm the seriousness of intentions.

The advance payment is also transferred towards future payments under the transaction. It confirms the buyer's intentions, but does not guarantee the execution of the transaction.

And if the civil legislation contains entire articles and very precise definitions about the deposit, then there are no separate articles about the advance payment.

The differences between the concepts under consideration are in the legal consequences in case of cancellation of the transaction. If an advance is paid and the deal falls through, the amount is simply returned to the buyer.

The law does not provide for any additional sanctions, unless they are specified in the agreement.

In the case of transfer of the deposit, it matters who refused to conclude the transaction.

When the buyer refuses to purchase, the deposit remains with the seller. If the transaction is canceled by the seller, then he must give the buyer a double deposit.

Purpose of the document

- If we consider the deposit from the position of greater benefits, then it is most preferable for the buyer.

- However, if the buyer is not sure of his intentions, then it is better to use an advance payment, which is simply returned if the transaction is cancelled.

- For the seller, the choice depends on whether he intends to sell the apartment to a specific buyer or continues to look for better options.

- In the first case, a deposit is preferable, which can be kept if the buyer refuses the transaction.

Receiving an advance allows you to continue searching for a more profitable client, since the advance can simply be returned to the potential buyer in the same amount.

In purchase and sale transactions, it is advisable to use a deposit. Sanctions provided for by law encourage both parties to comply with the terms of the contract.

In case of refusal, either party will suffer financial loss. In this case, the size of the deposit is determined by the parties to the transaction and sometimes reaches very impressive values.

The advance does not provide any guarantees to the participants in the purchase and sale. He only convinces the seller that the buyer really wants to buy the apartment. But the advance can be returned without any consequences.

The main disadvantage of a deposit is that in controversial situations involving litigation, it is most often recognized as an advance payment.

The buyer, of course, gets his money back, but there is no talk of any compensation. This is why it is so important to draw up the deposit agreement correctly.

Legal regulation

The deposit is mentioned in Article 380 of the Civil Code of the Russian Federation. This is a partial prepayment towards future payments as evidence of the conclusion of the contract and to ensure its execution.

The law also specifies the procedure for returning the deposit in case of non-fulfillment of the contract. It is provided that cancellation of the transaction due to the fault of the buyer allows the seller not to return the deposit.

The seller who cancels the transaction is obliged to return double the amount of the deposit. Clause 3 of Article 380 of the Civil Code states that the deposit is recognized as an advance unless otherwise proven, namely, the transfer of the deposit must be formalized in writing (clause 2 of Article 380 of the Civil Code).

Various design options are possible:

The consequences of failure to fulfill obligations under the deposit are considered in Article 381 of the Civil Code.

But judicial practice on this issue is extremely ambiguous; every word in the prepayment agreement matters.

How to properly fill out a deposit when buying an apartment

The deposit must always be submitted in writing. This allows you to confirm the fact of transfer of money, and also indicate that it is a deposit and not an advance that is being used.

If there is an oral agreement on a deposit, the consequences provided for in Article 162 of the Civil Code occur.

Participants in a transaction are deprived of the right to refer to the testimony of witnesses, but have the right to present written evidence.

For example, in a purchase and sale agreement there is a condition for partial prepayment, but it does not indicate what is taking place, an advance payment or a deposit.

The buyer can establish his right to receive double the advance payment amount by providing a proper receipt from the seller. It should state that the seller accepted the deposit.

If there is no written confirmation and the content of the contract/agreement does not allow one to accurately identify the type of prepayment, then the use of an advance payment is recognized.

And this is only part of the upcoming payment and does not perform any security functions.

As for the size of the deposit, it is usually set at 5-10% of the cost of the apartment. But at the request of the parties, a fixed amount can be determined, which is indicated in numbers and in words.

The need to draw up an agreement

A deposit made without agreement or under a preliminary agreement is in most cases recognized as unjust enrichment.

This is due to the lack of a proper agreement. Of course, it can be argued that the deposit clause can be included in the preliminary agreement.

But you need to understand the essence of this document. The preliminary contract establishes the terms of cooperation for the future.

It guarantees that the main contract will be signed on pre-agreed terms within a certain period.

If you include a condition about a deposit in such a document, then an unscrupulous seller may well declare that the receipt of the deposit was only planned. The buyer will have to prove the fact of transfer of money.

An oral agreement on a deposit does not provide any guarantees at all. Firstly, the requirement for mandatory written documentation is violated.

Secondly, nothing prevents the seller from declaring that he did not take any money, but it is practically impossible to prove the opposite.

At best, the buyer can obtain recognition of the fact of the transfer of the advance. Among other things, a written agreement allows you to describe in detail the details of the transfer of the deposit.

This is the amount of the deposit, which is determined solely by agreement of the parties. But it is desirable that the value is not symbolic, otherwise the inherent meaning of the deposit is lost.

An amount that is too small cannot motivate the parties to fulfill the contract, since the potential losses are not significant.

It is important to mention the consequences of canceling the transaction. In particular, these are situations when the deposit remains with the seller or is returned to them in double size.

Although the consequences are described in the law, such a mention once again proves that it was a deposit and not an advance that was applied.

In addition to the deposit agreement, a receipt is drawn up indicating receipt of funds by the seller. Money should only be transferred in exchange for a receipt.

Procedure for filling out the standard form

There is no single form for drawing up an agreement on making a deposit when purchasing an apartment; the sample only indicates the basic conditions.

The deposit agreement must include the following information:

- data of the parties (all owners and buyers);

- passport details of participants, full name, residential addresses;

- the cost of the apartment as a whole and the amount of the deposit paid (amounts are indicated in numbers and in words);

- description of the subject of the transaction (address, area, significant characteristics);

- period of completion of the transaction (payment of the remaining amount);

- additional conditions determined by the parties;

- date and signatures of participants.

A deposit agreement is drawn up according to the number of participants in the transaction and everyone receives their own copy. Cancellation of a transaction is the fact of non-compliance with the time limits specified in the contract.

If the terms of the contract are not fulfilled within the designated period, then the parties have the right to demand compensation in the form of retaining the deposit or returning it in double amount.

Upon receipt of the deposit, the seller writes a receipt. It is drawn up entirely by hand, since in controversial situations the authenticity of the document can be verified through graphological examination.

Blots, corrections, and strikethroughs are considered unacceptable. If several owners participate in a transaction, each of them writes a receipt (the deposit is divided among all).

The receipt does not need to be certified by a notary, but it is possible to attract witnesses who will put their signatures on the document.

The contents of the receipt indicate:

- date and place of document preparation;

- information about the parties (receiving and transferring the deposit) indicating passport details;

- deposit amount;

- the purpose of receiving a deposit (for an apartment at...);

- confirmation of the absence of claims and receipt of the deposit in full;

- last name, first name, patronymic and signature.

The receipt is also issued in one copy for each party.

Emerging Responsibilities

A deposit when purchasing an apartment acts as a guarantee instrument. The parties are confident that the deal will be completed.

Otherwise, you will have to suffer losses in the amount determined by the contract for the deposit. For both sides the damage is equal.

As a rule, the parties try to agree on a fairly substantial amount of the deposit. Sometimes this value turns out to be equal to almost a third of the cost of the apartment.

It is clear that neither side will be willing to endure such damage. But sometimes various nuances arise.

Video: preliminary contract for the purchase and sale of housing

Thus, the parties to the transaction can ignore the drafting of the deposit agreement and limit themselves to a receipt. A receipt not supported by a contract does not allow you to demand a double refund.

And it is quite difficult to challenge such a document in court in the absence of strong evidence. A receipt is needed, but only as confirmation of receipt of funds under the deposit agreement.

Nuances when completing a mortgage transaction

Purchasing an apartment with a mortgage requires obtaining the consent of the lending institution. Only after this can the transaction be formalized legally.

Submitting documents and reviewing the application can take a lot of time. If we are talking about buying a specific apartment, then you need to make sure that the owner does not sell the home before a certain time.

The deposit becomes a guarantee of completion of the transaction. The parties agree on the amount of the deposit and the period during which the seller undertakes not to sell the apartment to other persons.

- Based on the agreements reached, a preliminary purchase and sale agreement and a deposit agreement are drawn up.

- The drawn up agreement is subsequently submitted to the creditor bank along with the documents for the apartment.

- If the selected property meets banking requirements and the loan application is approved, a purchase and sale agreement is drawn up on the terms of a preliminary cash contract with the seller and a mortgage agreement with the bank.

After this, the amount minus the deposit is transferred to the seller’s account. The deposit itself acts as a partial payment.

But the bank may not approve the borrower’s candidacy or the selected apartment may not meet the requirements. In this case, the deposit will remain with the seller.

Therefore, you should enter into a deposit agreement with the seller only after receiving the lender’s approval for the mortgage and carefully checking the parameters of the apartment.

The deposit is a very convenient tool that guarantees the fulfillment of obligations under the transaction. But it is important to remember the possible consequences.

Even if the transaction is canceled due to unavoidable circumstances, the seller is not obliged to return the deposit and here everything depends only on his desire.

When drawing up a deposit agreement, you should assess the risks in advance and only then enter into an agreement.

Attention!

- Due to frequent changes in legislation, information sometimes becomes outdated faster than we can update it on the website.

- All cases are very individual and depend on many factors. Basic information does not guarantee a solution to your specific problems.

That's why FREE expert consultants work for you around the clock!

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

Sample deposit agreement for purchasing an apartment in 2023

A sample deposit agreement for the purchase of an apartment in 2023, the contents of which will protect one party from the dishonesty of the other, will be provided via the link at the end of the article.

But the parties need to not only fill out the contract form, but also clearly understand what kind of document it is and why it should be drawn up. The issue of the deposit is an essential condition of the apartment purchase and sale agreement (APA).

Therefore, it is necessary to focus attention on this topic. Let's look at everything in order.

Download a sample deposit agreement for purchasing an apartment in 2023

Deposit as a way to ensure the fulfillment of an obligation

Chapter 23 of the Civil Code of the Russian Federation lists ways to ensure the fulfillment of obligations by the parties to the contract. Security means the inclusion in the contract (in our case, in the DCP) of conditions that will serve as a kind of insurance for the injured party.

In simple terms, the party that violates its obligations under the SPA must suffer some kind of “punishment.”

A deposit is one of the ways to ensure the fulfillment of agreements fixed by the parties. And I must say, in a fairly effective way, provided that everything is done correctly.

Deposit for an apartment transaction

A deposit is a certain amount agreed upon by the parties, transferred by the buyer to the seller to ensure the execution of the agreed transaction with a specific apartment owned by the seller.

When accepting a deposit, the seller must understand that if he refuses to execute or conclude a transaction that the buyer is counting on, he may suffer material damage. The buyer must understand the same when he makes a deposit. He will also suffer material damage if he refuses to fulfill the apartment purchase and sale agreement.

Those. With the help of a deposit, the parties insure themselves against the dishonesty of the other party and possible financial losses.

Is a deposit required?

It is advisable to always make a deposit when concluding a transaction with an apartment, because... the parties will be confident with a high degree of confidence that they are protected from unforeseen situations when one of the parties has found a better option for itself.

Mandatory payment of a deposit when purchasing an apartment is not required by law. The parties themselves determine the need and amount of the deposit. But more often than not, the parties have circumstances in which it is impossible to immediately sign a written agreement for various reasons.

But they have already reached an agreement on all the essential aspects of the deal. And they want to secure it somehow. There is a wonderful document for this called a preliminary purchase and sale agreement. In it, the parties undertake to conclude the main agreement when everything for its execution is ready.

In such cases, a deposit is usually paid.

If the parties have made a firm decision on the need for a deposit and determined its size, then this should be documented.

Registration of the deposit

The deposit is drawn up by drawing up the relevant document in 2 copies, always in writing. If the written form is not observed, it does not legally exist.

It must be clearly understood that the deposit ensures the fulfillment of contractual obligations that have already arisen when signing the preliminary contract. It is impossible to ensure the fulfillment of non-existent obligations.

The earnest money agreement is actually called an earnest money agreement. This does not change the essence, this is just how this document is called in the Civil Code of the Russian Federation.

The deposit is drawn up as an independent agreement. Also, the parties are not prohibited from entering information about the deposit into the preliminary purchase and sale agreement.

What is included in the agreement

The deposit agreement includes several permanent positions:

- name of the document, date and place of its preparation;

- names of the parties: seller (creditor) and buyer (debtor);

- full details of the seller and buyer,

- name of the obligation to secure which the deposit is made;

- the total amount of the obligation and the maturity date;

- the amount of the deposit and the deadline for its payment;

- consequences of failure to fulfill an obligation;

- signatures of the parties with transcripts.

How and when is the deposit transferred?

The deposit is transferred after signing the preliminary purchase and sale agreement and the deposit agreement.

Before transferring the deposit, make sure once again that the funds will be transferred to the owner of the apartment or his authorized person. Authority must be confirmed by a notarized power of attorney.

Funds transferred as a deposit in any way convenient for the parties must be recorded in the form of a receipt. Those. A receipt is required.

The presence of the buyer only with a receipt from the seller for receipt of funds in the absence of an agreement on a deposit may be grounds for the court to consider such funds as an advance, even if the word “deposit” is used in the receipt.

This entails certain legal consequences, we’ll talk about them a little later.

The receipt must indicate the full details of the parties, the date of transfer of money, links to the deposit agreement, the preliminary DCT and, most importantly, the full details of the apartment for the purchase of which a deposit is paid. The receipt issued to the buyer by the seller must be certified by his signature with a transcript. Probably, no one needs to explain why a receipt is needed.

Why a deposit and not an advance?

A deposit and an advance are two different things. There is only one thing that unites them. The amount paid before the final payment will be applied towards the entire cost of the apartment.

But the deposit is a potential fine that ensures the fulfillment of the obligations undertaken. And an advance is just that: an advance. Part of the cost of the apartment paid in advance.

And it’s also good if the buyer took a receipt from the seller for the advance payment.

If the deal is not concluded, the advance will simply return to the buyer, regardless of the fact that the failed seller could use these funds to obtain additional profit.

Please take into account these differences between an advance and a deposit when completing a transaction with an apartment. Because if it is not clear from the documents whether the transferred amount is a deposit, it is considered an advance by default.

We bring to your attention a video from a practicing lawyer.

Consequences of failure to fulfill obligations secured by a deposit

If one of the parties refuses to fulfill the obligation to fulfill the contractual agreement secured by the deposit and the conclusion of which is an obligation assumed under the preliminary agreement, unpleasant legal consequences will arise for it.

When the buyer is guilty of failure to comply with the contract for an apartment, the entire amount of the deposit remains with the seller, i.e. The deposit is not returned to the buyer.

And if the seller is to blame for failure to comply with the contract, then he must pay the buyer double the amount of the deposit.

The law also provides that the party guilty of failure to fulfill an obligation shall compensate the other party for losses associated with failure to fulfill. True, the existence of losses and their size will most likely have to be justified in court.

If the obligation is not fulfilled, the parties discuss the order in which payments will be made by the guilty party in favor of the other, in accordance with the terms of the deposit agreement.

But usually this becomes the subject of a trial, where the guilty party will definitely try to prove that it did everything possible to fulfill the obligation to conclude and execute the contract for the apartment.

Remember, when buying and selling an apartment there are no trifles. This fully applies to the execution of the deposit agreement.

It's fast and free!

It's fast and free!