Property owned by the owner can be sold, inherited, or given to another person. The citizen himself has the right to decide how to deal with it.

It is important to take into account the requirements of land and civil legislation when drawing up a transaction. Therefore, before you formalize the donation of a house and land, you need to contact a specialist. He will talk about the main points of the deal and the nuances provided for in 2023.

Sample passport of a citizen of the Russian Federation

What it is

A deed of gift is a document that confirms the completion of a civil transaction. It provides for the transfer of rights to property. This could be a house and the land underneath it.

The transaction is carried out free of charge. It is important that both parties agree to its implementation.

After registration of the deed of gift, ownership passes from the donor to the donee. From this moment on, he can dispose of the property at his own discretion.

The agreement is unilateral. The transfer of property occurs solely through the actions of the donor. The recipient must only accept the gift. If any conditions for completing a transaction are prescribed in the deed of gift, it is recognized as void or reclassified into another type.

The property may not be transferred at the time of signing the agreement, but after some time. But after the death of the donor, the procedure is not carried out. In this case, a will must be drawn up.

The consent of other owners when donating is not required. Therefore, you can draw up an agreement, bypassing some points. If the land of their house is in joint use with their spouse, then they need to obtain her permission, which is certified by a notary.

- Sample agreement for the donation of a house with a plot of land:

Which form of transfer is more profitable?

There are three main types of transfer of rights to property:

- donation;

- will;

- purchase and sale.

It is necessary to highlight some points that distinguish each of the options. A deed of gift is often compared to a will. After all, the transaction also has a gratuitous basis.

But it is worth noting some advantages and disadvantages of a deed of gift compared to the transfer of property after the death of the owner:

- When drawing up a deed of gift, you can fully control the transfer of rights, since the owner is involved in the transaction. In the case of a will, the procedure is carried out after the death of the copyright holder.

- It is not necessary to contact a notary. A deed of gift, unlike a will, can be drawn up by the parties themselves.

- Donation of the entire house is permitted. At the time of will, it is divided among the heirs.

- It is much easier to challenge a will than a deed of gift.

- Tax is not paid on gifts between relatives.

Instead of a deed of gift, a purchase and sale can be formalized. The transaction is carried out on a reimbursable basis. If the owner wants to draw up a deed of gift to hide the fact of the sale and not pay taxes, he will not be able to do this. The agreement will be declared void.

The transfer of a residential property is much easier using a deed of gift. Therefore, many people use this type of document to formalize relationships.

Sample certificate of land ownership

How to draw up a donation agreement for a house and land

To draw up a deed of gift, a simple written form is used. You can draw up the document yourself without involving specialists. It is also possible to contact a notary who uses a standard agreement.

The deed of gift must include the following main points:

- data of the donor and recipient;

- description of the property being donated, indicating the cadastral number, area, number of storeys, technical characteristics, intended purpose;

- the cost of the building and plot, which is contained in the cadastral passport;

- details of title papers;

- an indication of the presence or absence of an encumbrance;

- rights and obligations of each party;

- other conditions.

Ownership rights arise only after registration of the transaction in Rosreestr. In this case, the real estate is alienated.

- Sample registration certificate for a house:

For minor children

The gift can be transferred to minor children. In this case, you will need to obtain permission from the guardianship authorities or consent given by the mother and father.

When drawing up a deed of gift, you can note in the agreement that the house begins to belong to the son or daughter after they reach the age of 18 years. Until this moment, official representatives must dispose of the property.

In order to exclude the fact of sale of property, it is worth recording this fact in the document. The sale of property and its parts will be prohibited until the minor officially reaches adulthood and assumes the rights of the minor.

To a relative

Often a deed of gift is drawn up between close people. After all, it will be safer to transfer real estate to a relative than to a stranger.

The degree of relationship between the parties must be taken into account. If the property passes into the possession of a close relative, according to the Family Code of the Russian Federation, then there will be no need to pay tax.

Their list includes:

- mother and father;

- son and daughter;

- spouses;

- brother and sister.

Other relatives are not considered close. Therefore, after completing a transaction between them, you will need to pay 13% tax to the state treasury.

Sample of notarized consent

Shares or parts of real estate

Many people do not know how to formalize the donation of a share of a house with a plot of land. The main difficulty is its definition.

It is produced when:

- arrangement of a separate entrance;

- installation of a bathroom and kitchen;

- summing up communications.

But these measures are not enough to complete the procedure.

It is important to conduct a construction and technical examination, during which the following is determined:

- admissibility and partition options;

- redevelopment plan and price of work;

- year the house was built;

- compensation payments to the party who received the smaller area.

If there is a house in joint ownership, it is necessary to obtain the consent of all owners. Once the details are settled, the document is drawn up in simple written form.

What documents are needed

In order to draw up a deed of gift, you will need a certain package of documents. Papers are also required to confirm the gratuitous transfer of property to the donor.

To draw up an agreement, you must provide:

- passports identifying the parties;

- a certificate confirming the fact of state registration of land and house in the name of the donor;

- grounds for transfer of ownership rights to the donor;

- cadastral and technical passports issued by BTI;

- gratuitous transfer agreement, which must be printed in triplicate;

- consent of the spouse when donating an object of common property;

- extract from the house register - Download the house register form;

- permission from the legal representative of the minor child;

- a power of attorney certified by a notary, if the application is submitted by a representative.

All documents must be prepared in accordance with legal requirements. If papers are lost, they will need to be restored and resubmitted.

Form, content and standard sample of deed of gift

Donation is a mutual procedure. During it, the rights to the property are transferred. It is important to clearly state all its characteristics in the deed of gift.

The document reflects:

- type of building;

- location and area of rooms;

- total area of the building;

- the donated part (if a share is transferred);

- number of floors of the house.

There is no special form of agreement provided. Therefore, any sample taken on the Internet can be used. You can use the example below as a guide.

Sample extract from the house register

Agreement for the transfer of land as a gift

July 28, 2023

Moscow

How to draw up a gift agreement through the MFC

Donation is a popular form of alienation of property. In the article we will talk about the features of a donation, how to formalize it, where to go to register the donation of real estate (a house, an apartment or its share, a plot of land, a garage) and, in particular, how to register a donation at the MFC.

Features of donating property

If you want to donate real estate, its owner must draw up a gift agreement (in everyday life - a deed of gift) and sign it on behalf of the donor.

The recipient must also sign to indicate his agreement to receive the gift.

The agreement does not have to be certified by a notary, but it must undergo a mandatory registration procedure with the Office of the Federal Service for State Registration, Cadastre and Cartography (Rosreestr).

The essence of donation is the gratuitous transfer of property from the donor to the donee. A gift agreement is convenient to use in certain cases, for example, as an alternative to a will, or if you want to free property from the danger of division upon divorce.

This form of transaction has certain limitations:

- the donor cannot be an incapacitated person or his representative;

- It is prohibited to give gifts worth more than 3,000 rubles. officials and social workers;

- a gift agreement cannot be concluded between commercial companies.

The donee is required to pay an income tax of 13%, except when the donor is his close relative, which includes:

- parents and children;

- grandparents and grandchildren;

- sisters and brothers;

- spouses.

For this reason, most often a gift agreement is concluded between close relatives.

Please note that a gift agreement can only be canceled under the conditions specified in the agreement itself, or through the court. For this reason, the donor should carefully consider the possible consequences of the act of donation.

Download a sample (example) of a gift agreement

To draw up an apartment donation agreement, you do not have to go to a notary: you can draw up an agreement yourself using a ready-made form or sample, which can be downloaded below. The samples comply with the legislation for 2017.

A transfer deed may be attached to the agreement, which records the fact of transfer of property to the donee, but the presence of such a deed is not necessary.

Please note that donating a car does not require registration at the MFC or Rosreestr.

Choose the option that suits you, fill in your data, print, sign. You can add your own terms to the contract, for example, specify the conditions for its cancellation (for example, the death of the donee or his careless attitude towards the gift, etc.).

When donating an apartment, notarization of the contract is not required. However, in the case of donating a share of an apartment, a notarized donation agreement is required.

Advice: when notarizing a gift agreement, check with the notary whether he himself can send the agreement for registration for you - many notaries now have this opportunity.

Where to go to register a gift agreement

How to draw up a gift agreement? There are several options:

- personally contact Rosreestr (Office of the Federal Service for State Registration, Cadastre and Cartography), which, in fact, carries out the registration of rights to real estate; You can make an appointment in advance on the Rosreestr website

- personally contact the nearest MFC, which will transfer all documentation to Rosreestr

- send an application for registration by mail to Rosreestr at the location of the property, with a list of attachments and a notification of delivery; in this option, all signatures must be notarized

- submit an application electronically to Rosreestr through their website, but in this option you must have an enhanced qualified electronic signature (UKES), which you must first obtain on your electronic media by personally appearing at a special accredited center of the Ministry of Communications, with a passport and SNILS (for a fee, cost in 2017 from 1500 rubles to 5000 rubles per year).

Below we will tell you how you can register a gift agreement at the MFC (the simplest and most convenient option).

The procedure for registering a donation at the MFC

It is not difficult to draw up a gift deed at the MFC; you just need to follow 4 simple steps.

STEP 1. Prepare the necessary documents and pay the state fee.

What documents will be required when registering a gift deed? The list of documents is given below - using the example of registration of an apartment donation agreement.

- a document confirming the identity of the applicant or representative (if his representative submits the application), in the latter case also a document confirming the authority of the representative

Please note: both the donor and the recipient, or their representatives, must be present with identification documents.

- gift agreement in 3 copies

- receipt of payment of the state fee (optional, but the state fee must be paid in advance)

- certificate of ownership of residential premises: the original “green card” (certificate of ownership), if any, or an extract from the Unified State Register of Real Estate (USRN), confirming the rights of the donor, which should be pre-ordered at Rosreestr or at the MFC

- consent of the legal representative, if the donee is incapacitated or a minor citizen;

- notarized consent of the spouse for alienation, if the donor is married and the apartment was purchased and not received as a gift or privatized.

When registering a donation of other real estate objects, for example, a share of an apartment, a plot of land, a garage, the list of documents may differ. You can clarify the information by calling your MFC, or by calling the Moscow State Services Center phone number +7(495) 777-77-77 - it works 24 hours a day, seven days a week - or by calling Rosreestr 8(800)100-34-34.

You can also use the online service for selecting the necessary documents on the Rosreestr website.

STEP 2. Select the MFC closest to you and make sure that they provide the service: “Cadastral registration and registration of real estate rights.” A reliable list of MFCs by region of Russia with telephone numbers and websites is presented on our website. Pay the state fee, the cost for individuals is 2000 rubles.

You can usually download a sample receipt from the selected MFC website. An example of a receipt (for the Voronezh region) can be downloaded here.

Please note: if the property is located in another region, you should not contact the MFC, but directly to the Rosreestr in your region.

STEP 3. Personally appear at the selected MFC for both parties to the gift transaction and submit all documents to the employee. An MFC employee will fill out an application for registering a gift for you, which you will sign, check the documents, give you a receipt for receipt of the documents and inform you of the deadline for readiness. By law, this period does not exceed 10 days from the date of receipt of documents at Rosreestr.

STEP 4. After the expiration of the period allotted for registering the donee’s right to the donated property (this period will be indicated in the receipt received from the MFC employee), come to the MFC and receive back the gift agreement with a mark from Rosreestr on the registration of the right, as well as an extract from the Unified State Register with seal of Rosreestr on registered rights.

Grounds for refusal of registration

If the law is violated when concluding a gift agreement, you may be denied registration of the gift agreement. Examples of such situations are listed below.

Timing and cost

In accordance with the law, the maximum period for providing the service of registration of a gift agreement is 10 working days from the date of receipt of documents by Rosreestr. When drawing up an agreement at the MFC, 4-6 days may be added to this period, necessary for the transfer of documents between the MFC and Rosreestr.

The state fee for registering a gift agreement is 2,000 rubles. (2017).

Conclusion

In this article, we answered the question “is it possible to formalize a gift agreement in a multifunctional center” and tried to explain the nuances of concluding such a transaction and its execution.

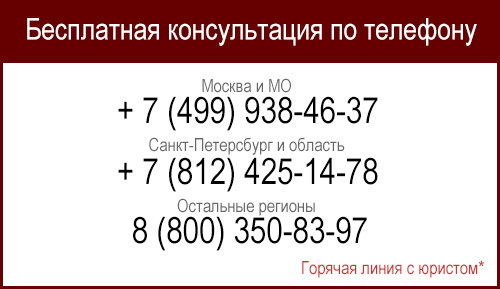

- If you have any questions, please call our toll-free hotline:

- 8 (800) 350-20-43 for regions of the Russian Federation

- 8 (499) 577-02-04 for Moscow

- 8 (812) 425-60-51 for St. Petersburg

- or use the form for a free consultation:

| Please note: lawyers do not make appointments, do not check the readiness of documents, and do not advise on the addresses and operating hours of the MFC. |

Donation agreement for a house and land between relatives

The rules, conditions and nuances of drawing up donation agreements for houses and land plots are regulated by the legislation of the Russian Federation. The Civil Code contains provisions that real estate donation transactions can be concluded between close relatives (for example, when a power of attorney is issued for a grandmother for a child), as well as with third parties. You can download the text of the civil law from the link. This article will discuss the details of drawing up a gift agreement, will present a list of necessary documentation for drawing up a deed of gift, and will also indicate the procedure for registering the deed and the possibility of challenging it in court.

Deal Features

According to the law, a gift agreement is a unilateral agreement, the purpose of which is to transfer ownership of property - a house, land, apartments, valuables, etc., from one person to another. The participants in this case are the donor (the owner of the house and land) and the donee (the citizen to whom the ownership rights to real estate are transferred).

The conclusion of a donation agreement for a house and land between relatives has an important advantageous feature. It consists of a tax exemption of 13%.

In accordance with generally accepted legal norms, all transactions relating to real estate (residential or non-residential - it does not matter) are subject to income tax of 13%.

But the exception is a gift deed executed between close relatives.

According to the law, the following persons are recognized as close relatives:

- husbands and wives in official marriages;

- moms and dads;

- child (children), in this case it does not matter whether they are adopted or relatives;

- brothers and sisters;

- relatives and grandparents.

A tax benefit is possible when drawing up a donation agreement for a house and a plot of land only between the above-mentioned persons. They are recognized as close relatives at the legislative level and other family ties do not apply to this definition.

Important features of drawing up this agreement for the donation of a house and land include the prohibition on the execution of the document by certain persons. According to the law, you cannot issue a deed of gift:

- on behalf of citizens under the age of majority;

- on behalf of people with limited legal capacity or incapacitated people, as well as on behalf of their representatives (guardians);

- among commercial establishments;

- on behalf of people and their relatives in relation to representatives of: medical and educational institutions, social organizations;

- against employees of municipal and state bodies on the basis that they fulfilled their official obligations.

How to apply?

A deed of gift for a house and a plot of land is drawn up by the donor himself or a specialist from a notary office. If the owner of the home and the territory adjacent to it independently draws up a document of donation, then you need to know that some nuances must be spelled out in it.

The following must be included in the deed of donation of a house and land:

- a provision that the donor has the right to live in this residential premises. The inclusion of this clause is especially important for older people; it provides them with a guarantee that they have the right to live in the house until their death;

- the document can be drawn up by a representative if there is a power of attorney with notarization;

- the ability of the donee to refuse to take ownership of the house and land. This paragraph should describe the conditions for refusal.

According to the law, real estate received under a gift agreement is not subject to division between spouses after divorce proceedings. A gift transferred to one of the family members is considered only his property, unless otherwise stated in the agreement.

Important details when drawing up and executing this agreement for the donation of a house and land area:

- written consent of the spouse to sign this document;

- Minors cannot act as donors. According to the law, in this transaction they can only act as donees;

- Incapacitated persons or citizens with limited legal capacity have the right to act as a donee. In this case, trustees and representatives will act on their behalf.

If the text of the agreement is drawn up by a notary, he will provide a standard gift agreement between relatives. It will only be necessary to include in the document the individual nuances of the deed of gift for a house with a plot of land.

When donating a share of a house and land

A deed of gift for a share of a house and land implies mutual agreement to own the property jointly. By law, it is possible to transfer a share of ownership at the present time or in the future. If there are several owners, and only one of them wants to transfer the share, then written consent is required from the others.

When transferring a share of real estate residential property and land, a detailed description of the entire object is required. For example, the number of rooms and floors, how the rooms are located, whether there are utility rooms, the area of all rooms located in the house is indicated. In accordance with the share gift agreement, the transferred share must be described in detail.

In most cases, donating a share to a close relative implies the allocation of property in kind. Carrying out this procedure means creating conditions for the existence of an independent part of the house, namely:

- separate entrance;

- separate bathroom;

- separate communication system.

After resolving this issue, a construction and technical examination is carried out. The final stage of its implementation is the division of the house between close relatives. Then, such a procedure must be registered, and only after that can the share of housing be donated.

When the object of donation is housing and land, the area of the land is also subject to special registration. To transfer ownership of part of a residential building and a plot of land, a close relative needs to draw up an agreement.

According to the law, a donation agreement for a share of a house and a plot of land can be drawn up in person, or it can be drawn up in a notary’s office.

List of documents

Any real estate transaction requires the collection of a special package of documents, and a gift agreement is no exception.

What documents are needed to draw up a donation agreement for a house and land? Let's list:

- ownership papers;

- written permission to make a gift from all owners of real estate. The permission must be notarized;

- a receipt for payment of a certain amount of state duty;

- Russian passports of close relatives - the donor and the recipient;

- powers of attorney, if the parties are represented by other persons;

- representative's identity card;

- cadastral passport;

- certificates from the BTI;

- information from the house register;

- papers indicating the absence of tax debts;

- other documentation may be required depending on the situation. For example, if minor children live in the house, then additional papers from the guardianship and trusteeship authorities are required.

If the parties provide an incomplete list of documentation, then the execution of a land and house donation agreement will not be possible.

Sample deed of gift

According to Russian law, gift agreements between close relatives are not subject to mandatory notarization. Requesting the services of a notary office is the wish of the parties. But there are essential conditions that must be indicated in the text of the gift agreement. These include:

- description of the details of the object of donation. It is necessary to indicate the name, characteristics, place where the gift is located, number obtained from the cadastre and other information;

- ownership.

In general, the land and house donation agreement must contain the following clauses:

- document's name;

- the city where the transaction is concluded;

- Date of preparation;

- information about the donor and the recipient. According to the norms of the law, about these two individuals it is necessary to indicate - last name, first name, patronymic, year and place of birth, address, passport series, identity card number, when and by whom it was issued, passport validity period;

- the essence of drawing up this document is a complete description of the house and land plot;

- responsibilities of close relatives when concluding this agreement;

- responsibility of the donor and the recipient;

- other provisions that are subject to mandatory inclusion in the contract under the legislation of the Russian Federation;

- signatures of the parties to the agreement.

In order to correctly draw up your gift agreement, it is recommended that you familiarize yourself with the provided sample. You can download the sample from the link.

What is the price?

The cost of registering a gift agreement between relatives is minimal.

When concluding this agreement, the parties will have to pay a state fee for notarization of the document and for state registration.

Additional costs include drawing up an agreement by a specialist at a notary office, as well as issuing a power of attorney to represent interests.

An important feature of drawing up a gift agreement between close relatives is exemption from income tax. The tax amount is 13% of the value of the gift - the house and land in total.

According to the law, if there is no degree of relationship between the participants in the gift transaction and the donee does not have Russian citizenship, then a tax of 30% of the entire value of the property is paid.

When calculating the amount of this tax, the cadastral value of the donated object is taken into account.

How to register?

All transactions made with real estate must be registered with a special government agency.

The procedure for registering a deed confirms the transfer of ownership rights and is therefore mandatory.

To register a donation agreement for a house and a plot of land, you must contact the Rossreestr or a multifunctional center. Both institutions are required to provide a certain package of documentation.

The main package of papers consists of:

- statements from the donor and recipient of the gift. You can view a sample application for state registration here ;

- information about paid state duty;

- passports of both parties;

- agreement on donation of a house and a plot of land in three copies - one for the donor, the second for the recipient, and the third for the state registration institution;

- papers on ownership of property and land.

If one of the above papers is not transferred to authorized persons of the registration institution, then registration of the agreement will be refused. For state registration of a gift agreement, in addition to the required papers, depending on the situation, the following documentation may be required:

- written consent of another owner of housing or land, necessarily certified by a notary;

- if there are minor owners, then papers from the guardianship authorities are provided, indicating the permission of authorized persons to draw up a deed of gift;

- consent of the representative in writing, if the owner does not have the right to independently dispose of his property due to incapacity, minority or limited legal capacity;

- papers proving that the property is not encumbered. For example, collateral;

- if the interests of one of the parties are represented by another person, it is required to provide Rosreestr with his passport and power of attorney with notarization.

Typically, a deed of gift for a residential building and land plot is registered with Rosreestr within 10 days.

Is it possible to challenge?

It is possible to appeal a deed of gift for a house and land within the period strictly established by law, which is 3 years. In this case, it is worth filing a claim in court, but only if there are compelling reasons.

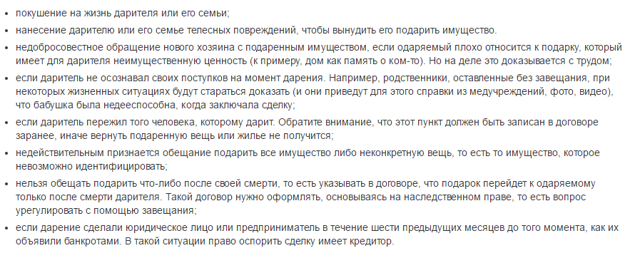

Reasons to challenge a gift agreement between relatives:

- The text of the contract is incorrectly drawn up, there are onerous clauses. According to the law, the deed of gift must be unconditional;

- the donor died before registering the act of donation in Rosreestr. In such cases, the house and land are the inheritance of the deceased and are divided in accordance with the law;

- the citizen, at the time of drawing up the act of donation, was under the influence of alcohol, drugs or any psychotropic substances;

- if at the time of drawing up the contract the donor was incapacitated or partially incapacitated;

- there is no written permission from the spouse to donate the house and land;

- the donor does not have the authority to carry out this transaction;

- the recipient has no right to accept such gifts;

- the gift transaction is imaginary;

- the donor did not realize what consequences could arise after the execution of the donation agreement for the house and land;

- forced a person to write a deed of gift;

- a relative, recipient of a house and land, improperly uses the donated property, causes harm and damages the property;

- a close relative (the donee) died;

- the donor, in accordance with Russian legislation, is declared bankrupt within 6 months after the deed of gift is issued.

If one of the above grounds exists, you can file a claim against a close relative in court . To apply, you must correctly write a statement of claim, which should reflect some information:

- information about the plaintiff - last name, first name, patronymic, date of birth, residential address, passport details - number, series, date of issue, validity period, issued by whom;

- information about the defendant - the same list of data is indicated as about the plaintiff;

- if the application is submitted by a representative on the basis of a power of attorney certified by a notary, then his full data must be indicated;

- name of the claim;

- indication of the characteristics of the contract;

- a description of the reasons for which the claim is being filed. For example, a statement of claim to declare a transaction invalid;

- a summary of the requirements to the court;

- a list of documentation that will be attached to the claim;

- plaintiff's signature.

When writing a statement of claim against a close relative, it is important to indicate references to the legislative norms of the Russian Federation. Mention of articles of laws will indicate the legality of the appeal. For a clear example, you can familiarize yourself with a sample claim.

You can download the application here.

In addition to the claim for a gift between relatives, the following documentation is submitted to the court:

- a copy of the donation agreement for the house and land;

- copies of ownership papers;

- evidence of the existence of grounds for appeal;

- cadastral papers for the land plot - plan and passport;

- extract from the Unified State Register;

- copies of the statement of claim are submitted in the quantity corresponding to the number of participants in the trial;

- receipt of paid state duty;

- power of attorney, if the interests of the plaintiff or defendant are represented by another person;

- other papers at the request of the court.

It is important that all submitted papers contain correct information, otherwise they will not be accepted for consideration.

If you have questions, consult a lawyer

You can ask your question in the form below, in the online consultant window at the bottom right of the screen, or call the numbers (24 hours a day, 7 days a week):

Registration of a deed of gift for a house and land: necessary documents

The real estate gift agreement is drawn up according to certain rules. The law establishes the form of such an agreement and the mandatory clauses that must be included in the content. In addition, when drawing up a deed of gift, the parties always have a choice - to do it themselves or contact a notary. It all depends on the desire and degree of preparedness of the participants in the transaction.

Deed of gift for house and land

You can donate a plot of land with a house located on it using a donation agreement. It is drawn up in simple written form. This document is not one of those that requires notarization. However, if the parties wish, they can assure it.

When drawing up a contract in person, it is necessary to take into account that the law provides for mandatory clauses with information:

- about the donor. It is necessary to accurately indicate your full name. the donor, his passport details and place of permanent residence;

- about the donee. It is necessary to indicate similar data of the recipient of the gift;

- about the subject of the donation. Without indicating the subject of the donation, the contract is automatically considered void. That is why it is necessary to indicate in as much detail as possible the characteristics of the object: area, number of floors, address of the house, presence of additional outbuildings, area of land, its location;

- if the deed of gift is intended to transfer the gift in the future, then it is necessary to indicate the date when this will happen;

- signatures of the parties.

You can only donate land that has been privatized.

After signing a deed of gift for real estate, it is necessary to register the newly created ownership right. This can be done through any registration authority that operates at the location of the land plot and house.

When carrying out state registration, you must follow the sequence of actions:

- Contact the MFC or other registration authority.

- Submit an application drawn up according to the established template, attach the necessary documents. The employee receiving them will issue a special receipt, which confirms the fact of delivery of the papers.

- On the specified day, appear with a receipt for the papers, including the completed certificate.

After registering ownership of real estate, you must pay a tax at a rate of 13% of its value. Only close relatives of the donor do not pay tax.

You can draw up an agreement for the gratuitous transfer of real estate with the help of a notary. This will be significantly more expensive, but in the event of a challenge to the deed of gift, it may protect against this.

What documents are needed to donate land and house?

To draw up a gift agreement, a certain set of documents is required. They are needed not only to confirm that the things being transferred free of charge are the property of the donor, but also to correctly fill out the data in the contract.

In addition, a similar package of documents is submitted during state registration of property rights.

So, to draw up a deed of gift with registration of rights you will need:

- passports of the donor, donee;

- certificates of state registration of the house and land in the name of the donor, as confirmation that these objects are his property;

- documents on the basis of which the objects were acquired by the donor (agreements, court decisions, etc.);

- cadastral passport for land;

- technical passport of the house. Moreover, if there are additional buildings, then they must have the appropriate documents;

- the gratuitous transfer agreement itself, drawn up at the rate of one copy for each participant in the transaction, + 1 for the registering authority;

- if the property that is donated is considered jointly acquired during marriage, then the notarized consent of the second spouse is required;

- extract from home books about those assigned to the house;

- if a minor is involved in the case, then documents from the legal representative are required, as well as permission from the guardianship authorities for certain actions;

- a notarized power of attorney, if someone acts not independently, but through a representative.

All documents must be prepared in accordance with the law. If something is lost or not formalized, you will have to first prepare documents and then proceed with the registration of the donation transaction.

Sample deed of gift for a house and land

When drawing up a gift agreement yourself, you need to study its sample.

Download a sample “Donation agreement for a residential building and land plot”

- It is best to start from the standard contract form, filling it out according to the relevant documents.

- Even when contacting a notary, you should first familiarize yourself with the sample deed of gift in order to know what documents for the house and land you need to take with you and what items to provide.

Thus, a gift agreement can be concluded for the purpose of transferring a house and a plot of land free of charge. The transition of two objects at the same time is not surprising, since they almost always must have a common fate. The deed of gift can be drawn up without the participation of a notary or be certified by him. It is important to ensure that all necessary documents are ready in advance so that when drawing up the contract you do not have to restore the missing papers.

Donation of a share (part) of a land plot

In accordance with Art. 572 of the Civil Code of the Russian Federation (Civil Code of the Russian Federation), donation is understood as the gratuitous transfer of property into ownership from the donor to the donee. In turn, in this case we are talking not just about property, but about the share of a land plot, i.e. shares in the right of common ownership thereof.

Such deeds of gift are characterized by a simple written form and procedure for state registration of the transfer of ownership. In addition, there are certain features of donating a share of a land plot to relatives, minors, as well as its alienation together with a share of the house.

What is a share (part) of a land plot?

When donating a share (part) of land, interested parties need to have an idea of what it is. Art.

6 of the Land Code of the Russian Federation (LLC RF) provides a complete list of objects of land relations, among which it distinguishes land (natural object and resource), land plots and their parts. This article not only does not disclose the concept of share, but also does not relate it to such objects.

When referring to the norms of civil legislation of the Russian Federation, in particular to Art. 128 of the Civil Code of the Russian Federation, it can be seen that they also do not belong to the objects of civil rights.

Then a logical question arises about how certain transactions for the alienation of shares of property, including their donation, are carried out? The answer to this can be found by analyzing Chapter 16 of the Civil Code of the Russian Federation (provisions on common property).

In accordance with Art. 244 of the Civil Code of the Russian Federation, shared ownership means the ownership of several persons in relation to one property with the definition of the shares of each of them.

It is important that it does not relate to the division of the property itself, but is a share in the right of common ownership of the land.

This means that any of the owners of one land plot has the right to use it without dividing it into any parts, to the extent that it is necessary for him (if his part is not allocated - Article 11.5 of the Land Code of the Russian Federation), but he can only dispose of it his.

The determination of such shares is carried out in accordance with the rules specified in Art. 245 of the Civil Code of the Russian Federation, i.e. by agreement of the parties, or in its absence, they are recognized as equal between all co-owners. Exercising the powers specified in Art.

209 of the Civil Code of the Russian Federation, is also carried out by the co-owners of the site by mutual agreement, but there are restrictions on its disposal.

In this case, it is necessary to obtain the consent of the remaining owners of the site, and when expropriating it for compensation, the rules on the pre-emptive right to purchase must be observed. This follows from Art. 246, 250 of the Civil Code of the Russian Federation.

How to draw up a donation agreement for a share of land

The donation agreement for a share of a land plot is drawn up according to the rules regulated by Ch. 32 of the Civil Code of the Russian Federation. They can be divided into general and special . Among the common ones, we highlight the following:

If these general rules are not observed by the parties to the transaction, the donation will be declared invalid (§2 of Chapter 9 of the Civil Code of the Russian Federation).

Giving involves two parties - the donor and the recipient. The object can be any property, unless it is withdrawn from civil circulation, regardless of cost. In addition to the above, such an agreement may contain conditions precedent for the transfer of the plot to another person (consensual agreement) or contain conditions on legal succession.

Example

Conditions precedent for donating a plot of land include the wedding of the donee, the birth of a child, etc.

Special requirements for registering a donation of a share of a land plot include the following:

- The presence of the will of one party to transfer a gift, and the other to accept it.

- The transfer of ownership of a share of a land plot is subject to state registration in accordance with the requirements of Art. 25 of the Land Code of the Russian Federation, Federal Law No. 122-FZ of July 21, 1997 “On state registration of rights to real estate and transactions with it.”

- The object of the donation - a share of a land plot - involves indicating the characteristics, in particular the address of its location, cadastral number, the total area of the entire plot, the size of the transferred share (if possible, its area), type of permitted use, category of land, reference to the donor's title documents, indication for buildings, if any.

- The deed of gift must determine the value of the transferred share of the plot.

- A reference to the presence or absence of restrictions, encumbrances, or prohibitions on it.

- The possibility of the parties to unilaterally terminate the contract (Articles 573, 577, 578 of the Civil Code of the Russian Federation).

In order for all of the above conditions to be determined by the deed of gift when it is executed independently, it is necessary to adhere to a certain structure , in which the following components can be distinguished:

- name (donation agreement for a share of land);

- date and place of his imprisonment (preferably in words);

- preamble (name of the parties to the transaction, information about them - full name, place of residence and registration, passport details);

- subject of the contract;

- rights and obligations of the parties;

- special conditions;

- final and transitional provisions;

- signatures.

Donation of a share of a house and land

When donating a share of a house and land, compliance with all the above rules for its registration is required. At the same time, taking into account that the transferred object is not only a share of the land plot, but also the house located on it, it is necessary to indicate in the deed of gift, among other things, such information as:

- Address of the location of the house in which the share is being alienated, its area, material of manufacture, number of floors and rooms, cadastral (or conditional) number, size of the transferred share of the house.

- Information about the donor's title documents for the transferred share of the house.

- Since the house belongs to the category of residential premises (Articles 15-16 of the Housing Code of the Russian Federation), it is necessary to indicate in the deed of gift those persons who live in it and use it, regardless of the size of the alienated property.

- The cost of shares of a house and a land plot should be differentiated from each other.

Taking into account all of the above, it should be noted that the transfer of ownership of the shares of both real estate objects is subject to the state registration procedure .

To carry it out, the parties to the transaction need to collect a certain package of documents, as well as pay a state fee ( 350 rubles for a land plot and 2000 rubles for a share of a house - clauses 22, 24, 25, clause 1, article 333.33 of the Tax Code of the Russian Federation (Tax Code of the Russian Federation).

Only after this procedure has been completed, the donee will become the full owner of this property.

At the same time, after the transaction is completed, this person is obliged to pay personal income tax (NDFL) in accordance with the requirements of Chapter. 23 Tax Code of the Russian Federation. The amount of this tax is determined based on the value of the transferred property (tax base - Article 210 of the Tax Code of the Russian Federation) and the tax rate, usually 13% (Article 224 of the Tax Code of the Russian Federation). In the case where the donor and donee are close relatives, then from payment The donee is exempt from personal income tax (clause 18.1, clause 1, article 217 of the Tax Code of the Russian Federation).

Donation of 1/2 share of land

Cases often arise when a land plot is owned by two persons, and the shares between them are equal by virtue of Art.

245 of the Civil Code of the Russian Federation, or if it is jointly owned (but the share is allocated). In this case, upon alienation of 1/2 share of such a plot, all donation rules specified in Chapter.

32 of the Civil Code of the Russian Federation, taking into account the provisions on common shared ownership and the Land Code of the Russian Federation.

At the same time, in practice, alienation through gift transactions is becoming commonplace not of the entire share of the land plot owned by the donor, but of a certain part of it, say 1/2. In this case, the deed of gift is executed in accordance with all the previously discussed rules, taking into account the fact that the transferred share must be specifically defined in the agreement.

Example

Ivanov wishes to give his grandson 1/2 share of his 1/2 share in the land plot. At the same time, in the deed of gift you can write the wording simpler, like 1/4 share.

The transfer of ownership under such deeds of gift is subject to state registration, and the donee bears the burden of paying personal income tax in accordance with Chapter. 23 of the Tax Code of the Russian Federation (unless he is a close relative of the donor).

Donating a share of land to a relative

Donation of property can be made between any persons, both relatives and complete strangers. As a rule, the donor wishes to transfer his share in the land plot to persons with whom he has a trusting relationship, and these are mainly those with whom he has any family ties.

Donating a share of a land plot to a relative is no different in its procedure and registration from donating to any other person. Here it is important to adhere to the rules mentioned above.

A distinctive feature of such deeds of gift is the ability to indicate the degree of relationship between the donor and the recipient. All other conditions remain unchanged.

The main thing that you should pay attention to here is taxation, since if a transaction is made between close relatives, then tax legislation exempts the donee from paying personal income tax (clause 18.

1 clause 1 art. 217 of the Tax Code of the Russian Federation). To the category of close relatives Art. 14 of the Family Code of the Russian Federation includes spouses, parents and children, adoptive parents and adopted children, grandchildren, grandparents, full and half brothers and sisters.

All other relatives, when receiving a share of a land plot as a gift, bear the burden of paying personal income tax according to the general requirements of Chapter. 23 Tax Code of the Russian Federation.

Example

Other relatives include aunt, uncle, nephews, cousins, in-laws, son-in-law, etc.

Donation of a share of land to a minor child

When donating real estate to a minor, it is necessary to take into account the fact that he always acts through a representative (clause 12 of Art.

5 of the Criminal Procedure Code of the Russian Federation, a legal representative means parents, adoptive parents, guardians and trustees).

Thus, the deal is concluded on behalf of the child , but is signed by one of the legal representatives.

Taking into account this feature, it is necessary to indicate not only information about the donee in deeds of gift, i.e. child, but also all the data of his legal representative, since it is he who gives consent to accept the gift and bears the burden of taxation when the minor does not have his own income to pay it in accordance with paragraph 2 of Art. 27 of the Tax Code of the Russian Federation (except for cases of close relationship with the donor).

Documents for donating a share in a land plot

When registering deeds of gift, the subject of transfer of which are shares of a land plot, either independently or with the help of a notary (Article 163 of the Civil Code of the Russian Federation), it is necessary to have a certain package of documents , which will subsequently be needed to register the transfer of ownership of this share. Among these documents are the following:

- The donor's title documents for the alienated property. As a rule, this includes a certificate of state registration of property rights, as well as the basis on which it was issued (certificate of inheritance, purchase and sale agreement, exchange, donation, etc.)

- Passports of the donor and the recipient.

- If one of the parties acts through a representative, then documents confirming his authority are required.

- Cadastral passport of the land plot, as well as technical documentation for buildings, if any.

- A share valuation report or a certificate from the relevant authority about its value and the value of the entire land plot.

- Notarized consent of the donor's spouse, if the share was acquired during marriage and is jointly acquired property.

- Documents confirming the degree of relationship between the parties, if we are talking about close relatives (marriage certificate, extracts from birth certificates).

When contacting the registration authority, in addition to the specified documents, interested parties to the transaction must have in their hands a signed gift agreement (three copies), a corresponding application for this procedure, a receipt for payment of the state duty, and the consent of the guardianship and trusteeship authorities may also be required in cases where, together with the share of a plot of land, a share of the residential building located on it is transferred, and minors or incapacitated persons live in it.

Is it possible to donate a share of a house without a plot of land?

Often in practice we come across the question of whether it is possible to donate a share of a house without a plot of land? In order to answer this question, let us analyze the following norms of the current legislation of the Russian Federation.

Firstly, it should be noted Art. 209 of the Civil Code of the Russian Federation, which states that the owner of property has the right to own, use and dispose of the property belonging to them, if this does not contradict the law. In turn, Art. 35 of the Land Code of the Russian Federation provides for situations when the transfer of rights to a land plot is carried out during the transfer of ownership of the building or structure located on it.

In particular, if the land plot (part of it) and the share of the house belong to the donor by right of ownership, they are alienated jointly, except for the following cases:

- when alienating part of the building, if it cannot be allocated in kind along with part of the site;

- the land plot is withdrawn from circulation.

As for the alienation of a share in the right of common ownership, the law in this case is categorical - joint alienation of shares of both the house and the land plot.

However, in some cases, alienation of a share of a house is possible without the land plot on which it is located.

This is the case where the donor does not have title to the land in question, i.e. it is in his use under another proprietary right.

In this case, the Land Code of the Russian Federation provides that the same rights of use that the donor had will be transferred to the new owner of the share of the house.

Conclusion

When considering the topic of donating a share (part) of a land plot, I would like to once again draw attention to the following:

- A share and a part of a land plot are not equivalent concepts in their content.

- A share of a plot of land is a share in the common ownership of it by several persons.

- When donating such property, it is necessary to comply with the requirements for a simple written form of the agreement, state registration of the transfer of ownership, and the prohibition of making a transaction on behalf of minors and incapacitated persons.

- On behalf of minors, their legal representative takes part in such a transaction.

- A transaction involving the alienation of a building (a house or its share) also implies the alienation of a land plot (its share), if both of these objects are owned by the same person.

- When donating a plot to a close relative, the latter is exempt from paying tax on the income received.

Question answer

Can I draw up an agreement to donate a share of a land plot to a distant relative without the consent of the owners of other shares.

Yes, you have this right. When donating, you do not need to comply with the requirements of Art. 250 Civil Code of the Russian Federation.

How can I donate a house to my mother if the land on which it is located is municipal? Do I have to purchase it as my property to register a deed of gift for the house?

You do not need to purchase land to donate a home. In this case, a transaction is made in relation to the house, and the right to use the land plot that you had passes to the new owner of the house.

Do you have any questions?

Advantages:

- Complete anonymity

- For free

- Opportunity to discuss any topics related to giving