The conclusion of contracts for the purchase and sale of land plots is regulated by § 7 “Sale of real estate” of Chapter 30 “Purchase and Sale” of the Civil Code of the Russian Federation (hereinafter referred to as the Civil Code of the Russian Federation).

Due to the requirements of Articles 24, 30 of the Federal Law of July 21.

1997 No. 122-FZ “On state registration of rights to real estate and transactions with it”, contracts for the purchase and sale of land plots owned by a minor citizen, a citizen recognized as partially capable or incapacitated, as well as contracts for the sale and purchase of shares in the right are subject to mandatory notarization common ownership of the land.

- By agreement of the parties, other transactions with land plots can also be notarized.

- When notarizing a land purchase and sale agreement, the notary takes into account the following features.

- In particular, as provided for by the Land Code of the Russian Federation (hereinafter referred to as the Land Code of the Russian Federation) (Articles 5, 15, 27, 35, 37, 39.1):

- Participants in land relations are citizens, legal entities, the Russian Federation, constituent entities of the Russian Federation, and municipalities.

- The rights of foreign citizens, stateless persons and foreign legal entities to acquire ownership of land plots are determined in accordance with the Land Code of the Russian Federation and federal laws.

- The property of citizens and legal entities (private property) are land plots acquired by citizens and legal entities on the grounds provided for by the legislation of the Russian Federation.

Citizens and legal entities have the right to equal access to the acquisition of land plots of ownership. Land plots that are in state or municipal ownership may be made available to citizens and legal entities, with the exception of land plots that, in accordance with the Land Code of the Russian Federation and federal laws, cannot be privately owned.

- Foreign citizens, stateless persons and foreign legal entities cannot have ownership of land plots located in border territories, the list of which is established by the President of the Russian Federation in accordance with the federal legislation on the State Border of the Russian Federation, and in other specially established territories of the Russian Federation in in accordance with federal laws.

- The turnover of land plots is carried out in accordance with civil legislation and the Land Code of the Russian Federation.

- Land plots classified as lands withdrawn from circulation cannot be provided for private ownership, nor can they be the objects of transactions provided for by civil legislation.

- Land plots classified as restricted lands are not provided for private ownership, except in cases established by federal laws.

- The content of restrictions on the circulation of land plots is established by the Land Code of the Russian Federation and federal laws.

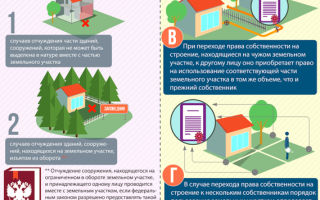

- When the ownership of a building or structure located on someone else's land plot is transferred to another person, he acquires the right to use the corresponding part of the land plot occupied by the building, structure and necessary for their use, on the same terms and to the same extent as their former owner.

- In the event of a transfer of ownership of a building or structure to several owners, the procedure for using the land plot is determined taking into account the shares in the ownership of the building, structure or the established procedure for using the land plot.

- The owner of a building or structure located on someone else's land plot has a preemptive right to purchase or lease a land plot, which is exercised in the manner established by civil law for cases of sale of a share in the right of common ownership to an outsider.

- The alienation of a building or structure located on a land plot and belonging to one person is carried out together with the land plot, with the exception of the following cases:

- 1) alienation of a part of a building or structure that cannot be allocated in kind along with part of the land plot;

- 2) alienation of a building or structure located on a land plot withdrawn from circulation in accordance with Article 27 of the Land Code of the Russian Federation;

- 3) alienation of a structure located on a land plot under the terms of an easement.

- The alienation of a building or structure located on a land plot with limited circulation and belonging to one person is carried out together with the land plot, if federal law allows such a land plot to be made available to citizens and legal entities.

- Alienation of a land plot without a building or structure located on it is not allowed if they belong to the same person.

- Alienation by a participant in shared ownership of a share in the right of ownership of a building, structure or alienation by the owner of a part of a building, structure or premises belonging to him is carried out together with the alienation of the share of the specified persons in the right of ownership of the land plot on which the building, structure is located.

Foreign citizens, stateless persons and foreign legal entities - owners of buildings and structures located on someone else's land plot have a pre-emptive right to purchase or lease a land plot in the manner established by this article, and in accordance with paragraph 2 of Article 5, paragraph 3 of Article 15 , paragraph 1 of Article 22 of the Land Code of the Russian Federation. The President of the Russian Federation may establish a list of types of buildings and structures to which this rule does not apply.

Article 37 of the Land Code of the Russian Federation stipulates that only land plots that have undergone state cadastral registration can be the object of purchase and sale.

In accordance with the requirements of Article 554 of the Civil Code of the Russian Federation, the contract for the sale of real estate must contain data that makes it possible to definitely establish the real estate to be transferred to the buyer under the contract. In the absence of this data in the contract, the condition regarding the real estate to be transferred is considered not agreed upon by the parties, and the corresponding contract is not considered concluded.

When concluding a purchase and sale agreement, the seller is obliged to provide the buyer with information available to him about the encumbrances of the land plot and restrictions on its use.

The buyer, if the seller knowingly provides him with false information about the encumbrances of the land plot and restrictions on its use in accordance with the permitted use; on permission to develop this land plot; on the use of neighboring land plots, which has a significant impact on the use and value of the land plot being sold; about the quality properties of the land that may affect the buyer’s planned use and cost of the land plot being sold; other information that may influence the buyer’s decision to purchase this land plot and the requirements for the provision of which are established by federal laws, the buyer has the right to demand a reduction in the purchase price or termination of the contract of sale of the land plot and compensation for losses caused to him.

- The following conditions of the land purchase and sale agreement are invalid:

- establishing the right of the seller to buy the land back at his own request;

- restricting further disposal of the land plot, including restrictions on mortgages, transfer of land plots for rent, and other transactions with land;

- limiting the liability of the seller in the event of claims of rights to land plots by third parties (Article 37 of the Land Code of the Russian Federation).

The sale of state or municipally owned land plots, in accordance with the main type of permitted use of which involves the construction of buildings and structures, is not permitted, except for the cases specified in paragraph 2 of Article 39.3 of the Land Code of the Russian Federation, as well as cases of holding auctions for the sale of such land plots in accordance with Article 39.18 of the Land Code of the Russian Federation.

The specifics of the purchase and sale of agricultural land are provided for by Federal Law No. 101-FZ of July 24, 2002 “On the turnover of agricultural land.”

According to Article 8 of the Federal Law “On the Turnover of Agricultural Land,” when selling a plot of agricultural land to a constituent entity of the Russian Federation or in cases established by the law of a constituent entity of the Russian Federation, a municipal entity has a preemptive right to purchase such a plot of land at the price for which it is sold, with the exception of cases of sale at public auction and cases of seizure of a land plot for state or municipal needs.

The seller of a land plot of agricultural land is obliged to notify in writing the highest executive body of state power of a constituent entity of the Russian Federation or, in cases established by the law of a constituent entity of the Russian Federation, a local government body of the intention to sell the land plot, indicating the price, size, location of the land plot and period, before the expiration of which mutual settlement must be made. The period for making mutual settlements for such transactions cannot be more than ninety days.

- The notice is delivered against signature or sent by registered mail with acknowledgment of delivery.

- If a subject of the Russian Federation or, in accordance with the law of a subject of the Russian Federation, a municipal entity refuses to purchase or does not notify the seller in writing of its intention to purchase the land plot being sold within thirty days from the date of receipt of the notice, the seller has the right to sell the land plot within a year to a third party at a price not lower than the price specified in the notice.

- When selling a land plot at a price lower than the previously stated price or with a change in other essential terms of the contract, the seller is obliged to send a new notice according to the rules established by this article.

- A transaction for the sale of a land plot made in violation of the pre-emptive right to purchase is void.

- It is also necessary to take into account the peculiarities of the legal regime of land plots for running a peasant (farm) enterprise.

The legal regime of this property is determined by Articles 257-259 of the Civil Code of the Russian Federation and the Federal Law of June 11, 2003 No. 74-FZ “On Peasant (Farm) Farming”.

The property of a peasant (farm) enterprise belongs to its members on the right of joint ownership, unless otherwise established by law or an agreement between them.

When a peasant (farm) enterprise is terminated due to the withdrawal of all its members or for other reasons, the common property is subject to division according to the rules provided for in Articles 252 and 254 of the Civil Code of the Russian Federation. In such cases, the land plot is divided according to the rules established by the Civil Code of the Russian Federation and land legislation.

A plot of land and means of production belonging to a peasant (farm) enterprise are not subject to division when one of its members leaves the enterprise. Those who leave the farm have the right to receive monetary compensation commensurate with their share in the common ownership of this property.

- In the cases provided for by Article 258 of the Civil Code of the Russian Federation, the shares of members of a peasant (farm) enterprise in the right of joint ownership of the property of the enterprise are recognized as equal, unless otherwise established by agreement between them.

- The procedure for disposing of the property of a peasant (farm) enterprise is determined by an agreement concluded between members of the farm in accordance with Article 4 of the Federal Law “On Peasant Farming”.

- The disposal of the property of a peasant (farm) enterprise is carried out in the interests of the enterprise by its head.

For transactions made by the head of a peasant (farm) enterprise in the interests of the farm, the farm enterprise is liable with its property, defined in Article 6 of the Federal Law “On Peasant (Farm) Economy”.

A transaction made by the head of a peasant (farm) enterprise is considered to be made in the interests of the farm unless it is proven that this transaction was concluded by the head of a peasant (farm) enterprise in his personal interests.

land plots, subsoil plots and everything that is firmly connected to the ground, that is, objects the movement of which is impossible without disproportionate damage to their purpose, including buildings, structures, unfinished construction objects, as well as parts of buildings intended to accommodate vehicles (machines) -places). Immovable property also includes aircraft, sea vessels and inland navigation vessels subject to state registration. an official authorized by the state who has the right to perform notarial acts on behalf of the Russian Federation in the interests of Russian citizens and organizations (legal entities). actions of citizens and legal entities aimed at establishing, changing or terminating civil rights and obligations. agreement of two or more persons to establish , change or termination of civil rights and obligations. a subject of property, an individual or legal entity who has the right of ownership, acting as the owner, manager, user of the property.

Sale of a share of land

Ownership of a plot of land gives its owner many opportunities. The owner can dispose of his plot as he pleases, including mortgaging and selling.

This right applies when it comes to an entire part of real estate, but if you need to sell a share of a land plot, there are still restrictions.

The legislator has established that in this case the rights of the remaining co-owners must be taken into account.

Owners often believe that they can sell their share to anyone. Their position is clear. Everyone believes that they have the right to dispose of their property in accordance with their will. But shared ownership is joint, hence the restrictions.

What is a share in common property rights?

When property is owned simultaneously by two or more persons, the property is considered joint. Such rules are established by the Civil Code of the Russian Federation, in Article 244. If the part of each owner is determined, then the property is defined as shared.

Taking into account the current priorities in the real estate market, shared ownership is considered more preferable because it minimizes the risk of conflicts, although it does not completely eliminate them. In this case, the part of each co-owner is clearly defined, for example, one owns a third of the object, and the second owns the rest.

Legal regulation

First of all, equity relations are regulated by the Civil Code, since it is it that determines the basic rules of purchase and sale transactions and the legal regime of ownership, including real estate. Thus, Article 250 establishes the right of pre-emption.

Do not forget about the norms of the Land Code. Thus, Article 11.5 establishes the possibility of separating a land plot from joint ownership.

The Federal Law “On the Turnover of Agricultural Land” defines special rules for land in this category, for example, Article 8 talks about the purchase and sale and the procedure for carrying out the transaction, and Article 12 indicates the possibility of selling a share in such a plot.

Rules for selling shares

Thus, you can sell a share in common shared ownership in the following order:

- conduct negotiations with co-owners. If he is alone and wants to immediately buy the property at a price acceptable to both parties, then the transaction can be carried out immediately. If there are several owners, you can sell them the object in equal parts. If there is disagreement, it is better to move on to further points;

- prepare an offer for the acquisition of a share to co-owners. It must contain the price. Sent to everyone. Can be delivered in person or sent by mail. The review and response period is 30 days from the date of receipt. Another option is to receive from such persons a refusal to purchase, certified by a notary;

- begin the procedure for registering a share with other persons if the co-owners refused the acquisition.

Price is important. If initially the offer included one price, but in the end the share was sold to another person for less, the co-owner will be able to appeal the transaction. Therefore, it is important to submit a new offer if the sales price decreases.

Subsequent sales will be carried out according to the general rules inherent in such real estate transactions. You will need to prepare an agreement, collect a package of documentation, pay a fee and contact Rosreestr to register the transfer of rights.

Download the contract for the sale and purchase of a share of a land plot (sample/form)

What documents are required for registration?

The transfer of ownership of a property is registered in Rosreestr or MFC. If we are talking about selling a share, then in addition to the contract you will need:

- certificate of ownership of the share or an extract from the Unified State Register (based on Law No. 218-FZ, since 2017, an extract from the Unified State Register/GKN is replaced by an extract from the Unified State Register of Real Estate);

- previous title document (sale agreement, donation agreement, etc.);

- cadastral passport or extract (based on Law No. 218-FZ, information from the cadastral passport of the object is in the Unified State Register of Real Estate extract on the main characteristics and rights);

- consent of the co-owners to sell the share if the agreement is not concluded with them. The agreement is drawn up through a notary.

- consent of the spouse to the alienation of the object if it was acquired under a commercial transaction during the marriage. Such a document is also drawn up through a notary; a simple written form will not be enough;

- a receipt confirming that the fee has been paid. Please note that the payment details will differ depending on which body the parties apply to - Rosreestr or MFC. This should be clarified in advance;

- power of attorney if the transaction is registered through a representative;

- a document confirming the consent of the guardianship authority to the alienation if the object belongs to a minor or incapacitated person.

You also need to prepare documents that will confirm the identity of each participant in the contractual relationship.

The agreement is drawn up by a number of parties, including Rosreestr. One copy will be kept in his archive.

Allocation of a share in joint ownership

Under a payment agreement, a share in the right of common ownership can be transferred subject to the conditions of the pre-emptive right. Free disposal of the plot is possible only if the share is allocated in kind. In some cases, although this is practically feasible, it requires certain actions from the owner, including land surveying.

The actual division of the land plot can be carried out if the remaining participants give their consent. Otherwise, permission will need to be obtained through the court.

The selection procedure looks like this:

- if cadastral registration has been carried out and all participants in joint ownership are not against the allocation of a share, it is necessary to carry out land surveying and, on the basis of these documents, register the right of sole ownership in Rosreestr;

- if cadastral registration has not been carried out, land surveying is first carried out, and then the plot is registered with the cadastral chamber;

- then, in accordance with the general procedure, the right to one’s part of the allotment is registered.

The allocation of a share will allow the plot to be sold without obtaining consent from the co-owners; there will be no restrictions on the sale.

Is it possible to sell a plot if land surveying is not carried out?

It is possible to sell a plot without land surveying, but in this case we will be talking about transferring a share in the right of common ownership. The consent of the remaining co-owners will be required.

In some cases, this option seems to be the only possible one. Local legislation contains rules defining the minimum size of a land plot. So, in a residential area it is most often 4 acres.

Often there are 2 houses on the territory of one plot, the owner decides to sell one, but cannot do this without transferring the right to the plot, since the land must follow the fate of the building. In this case, there are two options:

- highlight a part in kind;

- transfer to a person a share in the right.

If the plot is initially small, for example, 5 acres, and in a given municipality the minimum requirement for allocating a separate address is 4 acres, then it will not be possible to sell half of the plot, since a plot of 2.5 acres cannot be registered. In this case, the purchase and sale agreement states that the object of the transaction is the ownership of the house and a share in the right of common shared ownership of the plot in a certain amount.

Is it possible to sell a share without the consent of the co-owners?

The need to obtain consent from the remaining co-owners is the main rule and the main problem that arises during the sale. As a general rule, such consent is mandatory, but it is not always possible to obtain it.

Sometimes such persons simply refuse to draw up a document; in some cases, there is simply no contact with them.

In this case, there is another option - send them a proposal and wait for the deadline set by the legislator for a response.

From the date of notification, individuals must be given 30 days to respond! Otherwise, they may subsequently challenge the concluded agreement for the alienation of the share.

Undoubtedly, this option seems to take longer. It’s easier and faster to get a simple refusal, but in the absence of a practical possibility, you have to act this way.

The notification will need to be sent to the registered address. You can clarify the information in an extract from the Unified State Register or send it to the address of the plot, especially if there is a residential building on it.

Download the notice of intention to sell a share of the land plot (sample)

Sale of a share in land with located buildings

If there is a building on the site, it will be impossible to sell it separately from the land. The law does not allow you to own a building without rights to the allotment. However, the land does not have to be owned. This could be a lease, the right of perpetual use, and so on.

That is, when selling a house, it is not necessary to sell the land as well. The entire building can be sold, but the land can be transferred in part. You can allocate a part or transfer the right to shared ownership, both options are acceptable.

Conclusion

Selling a share of a land plot is possible in two ways: the owner allocates part of the land in kind and sells it as separate property or transfers the right to a common share of property to a person.

If the property was previously common ownership, then first a part must be offered to the remaining co-owners and only then sold on a common basis.

Otherwise, the contract may be terminated.

Share of land and shared ownership

A plot of land can belong to one person or to two or more, which determines the emergence of the right of common ownership.

The right of common ownership of a land plot involves the distribution of a set of rights and obligations in relation to this plot between two or more persons who are its owners. The types of common property are shared and joint.

With shared ownership, the share of each owner is clearly defined and recorded in the appropriate registration document. If the property is joint, then the share of individuals is not determined.

However, when carrying out any actions or transactions with it (division, sale, registration of lease or ownership, provision of part of the site for rent) or disputes, the need inevitably arises to allocate the share of each owner.

A share of a land plot implies the opportunity for the owner to use, own and dispose of his part of the land plot at his own will and discretion, regardless of the presence or absence of the consent of other owners.

The concept of common ownership of real estate is enshrined in Art. 244, clause 4 of the Civil Code of the Russian Federation, which notes that this is the ownership of property by two or more persons that cannot be divided without changing its purpose. Since land is a special resource with a limited property, the right of common ownership of land has certain specifics.

What areas can be divided into shares?

Land plots, according to the legislation of the Russian Federation, can be divisible and indivisible.

Divisible are those areas that, when divided, do not lose their essential characteristics and can continue to be used for their intended purpose.

For example, to remain suitable for construction, running a personal subsidiary or agriculture, carrying out business activities, etc.

Divided plots can be in shared or joint ownership, and joint ownership can be transformed into shared ownership by allocating the shares of individual entities.

indivisible plots into separate shares without causing irreparable harm to their rational use for their intended purpose and loss of their value.

If the division leads to a violation of town planning regulations, sanitary and fire safety standards, environmental requirements, or the area of the newly formed plots is less than the standards established by local authorities for the corresponding type of intended purpose, then it is not subject to division.

Thus, the plot on which an apartment building or agricultural building is located may be indivisible. For them, if there are two or more owners, only the right of joint ownership is applicable.

The procedure for allocating a land share

Any subject of shared ownership may demand the allocation of his share in the common land plot.

First of all, you should make sure that there is no direct prohibition on allocation, that the plot is truly divisible and when dividing it or allocating the shares of individual owners, the rights of third parties will not be violated.

If the plot is indivisible, then the person who initiated the allocation of the share can receive compensation from the remaining owners in cash.

Among the characteristics of one plot of land that has two or more owners, real or ideal shares are distinguished. A real share is a part of the land with boundaries established on the ground.

The ideal share is simply an indication of the fractional part belonging to a particular owner in relation to the total area of the plot (1/2, 1/3, 1/4, etc.), and is not displayed on the ground.

To allocate their share from the divisible agricultural land plot, a general meeting of all participants having the right of shared ownership is convened. The location of the share on the ground must be indicated on the plan and its boundaries must be marked.

If the consent of the remaining participants is obtained, then it is formalized in a protocol and serves as the basis for subsequent procedures for registering ownership of this land plot. In other cases, if it is impossible to convene a meeting, you should notify all other owners without exception in writing and obtain their consent.

If no objections are received within a month, then the location of the site can be considered agreed upon.

If an agreement with other owners on the allocation of a share cannot be reached, then you can file an application with the court.

Next, if there is the consent of other owners or a positive court decision, a project for dividing the site is drawn up and land surveying is carried out. For this purpose, a cadastral engineer of the territorial body of Rosreestr or a private person with a license is invited.

Registration of land share ownership and its registration

To register the allocated share, it must be transferred to a new status - as a separate land plot.

Based on the survey document and the title document for the land share, the plot is registered in the cadastral register with the territorial body of Rosreestr. However, the assignment of a cadastral number is not yet sufficient to transform an object into independent real estate.

The owner's rights come into force only after the right to the land plot is registered with the registration chamber. Upon registration, a corresponding Certificate is issued. Then you can obtain a cadastral passport for the plot.

When allocating a share of a land plot, the right of common ownership is terminated, since it results in the creation of two or more separate plots with different owners. It is also possible that several or even all participants in shared ownership register their shares at the same time.

Features of transactions with shares of land plots

The procedures for the purchase and sale of a share of a land plot have such a feature as “preemptive rights of purchase ”. They are owned by all other owners who have shares in the same land plot.

This means that in order to formalize a transaction to sell your share to a third party, you must obtain the written consent of the remaining shareholders, certified by a notary. And before that, you must definitely offer each of them to purchase the plot for sale, indicating its final price.

If all shareholders refuse to purchase, this price cannot be changed for a third-party buyer.

If at least one shareholder was not notified of the sale of a share of land, did not give consent, or the share was sold to a third party at a lower price than that offered to shareholders, then the transaction can be protested by other owners of the land in court within 3 months from the date signing and registration.

Other materials on this topic: pre-emptive right to lease a land plot. How the purchase of land from lease to ownership occurs is described in detail here: http://www.landatlas.ru/help/vykup-zemelnogo-uchastka-iz-arendy.htm.

Shares of a land plot can be leased to other persons, inherited or donated in accordance with the general norms of the legislation of the Russian Federation. But at the same time, a number of additional obligations are imposed on the owners or tenants of land shares:

- timely payment of rent or land tax;

- use of land efficiently and in accordance with its intended purpose;

- preventing environmental pollution of the land or deterioration of its natural properties;

- compliance with the rights and legitimate interests of other owners of shares of this land plot or legal tenants;

- carrying out construction on its site in accordance with land management, urban planning, fire safety, sanitary and other standards; for the tenant - mandatory coordination of actions for the construction of buildings with the owner and other shareholders.

Unclaimed land shares

An unclaimed land share (for agricultural land) is considered to be the share of:

- the rights to which are not registered in the manner prescribed by law, and the citizen-owner has not provided it for rent or disposed of it in any other way for 3 or more years in a row;

- information about the owner of which is missing in the decisions of local governments on the privatization of agricultural land;

- the deceased owner in the absence of heirs who have claimed the right to inheritance.

The local government body compiles a list of unclaimed land shares, publishes them in the official territorial media and on its website, and also provides it to the general meeting of shareholders for approval. After the list is approved by the assembly or after 4 months, the local government goes to court to recognize the indicated plots as unclaimed and then transfers them to municipal ownership.

Within a month after the court decision, the local government body publishes a notice about the possibility of acquiring land shares in ownership at a price of 15% of the cadastral value.

Shareholders of the same land plot have a priority right to purchase them.

If a buyer is not found within 6 months, the plot is registered as a separate one and sold under the general conditions established for the sale of land, including using auctions.

Sale of a share in common property

- Selling an apartment in joint ownership now raises many questions.

- And this is happening in connection with the entry into force of the new law FZ-218 “On state registration of real estate.”

- Article 42 of which requires a mandatory notarial form of the transaction when selling or other alienation of real estate that is in common shared ownership.

- Reference: The Unified State Register of Real Estate - EGRN was founded in 2016.

From a year until this date, the Unified State Register of Rights functioned, and even earlier, the register of rights was maintained in the BTI. Often, ordinary people consider property acquired jointly during marriage to be common joint property.

- Jointly acquired property can be registered as sole, common shared or common joint property.

- In 2009, amendments were made to the law “On State Registration of Rights to Real Estate and Transactions with It,” and Federal Law No. 218 came into force this year.

- Now the alienation (sale, donation, exchange) of real estate located in the state is subject to mandatory notarization.

- In connection with this, owners of joint property have unfounded fears about the high costs of certifying their alienation transaction with a notary.

Your transaction does not need to be certified by a notary!!!

Sale of a share in the right of common ownership of real estate

- BUT, if you ask for this service, they will not refuse you, sometimes they will even offer it.

- The same procedure applies when selling an apartment that is jointly owned by non-spouses. Sometimes it becomes necessary to sell (allocate a share to children) a share in an apartment that is jointly owned by spouses.

- Now such a transaction is possible in simple written form.

Since on July 1, 2018, amendments to the Procedure for maintaining the Unified State Register came into force.

- And now you can register common joint property for a share in the right and not divide the jointly acquired property of the spouses.

- Allocation of shares to children from common joint property Common joint property of persons not related by marriage is rare.

- So, you are faced with the situation of selling a share in an apartment.

- Today we will tell you how to cope with this task in the best possible way, prepare the documents correctly and not overpay taxes, which in practice means shared ownership of an apartment: after reading this article, selling a share in an apartment will not present any difficulties for you.

- Shared ownership of an apartment What is an ideal share?

- Sale of a share in an apartment by one of the co-owners How to properly formalize compliance with the pre-emptive right of the co-owners?

Ways to bypass the preemptive right to purchase What transactions with shares in an apartment cannot be made? The reasons for the emergence of shared ownership of an apartment can be: It is worth knowing that a standard apartment that is in shared ownership is not physically divided in any way.

https://www.youtube.com/watch?v=_vqy9hNxzQU

To divide a residential premises, as lawyers say, “in kind” it is necessary that such premises have a separate entrance, separate connections to centralized networks (gas, water, electricity).

All this can only be realized in “apartments on the ground”, when one individual housing construction house is divided by the heirs into several real shares.

In other cases, so-called “ideal shares” arise. One of the owners is not the owner of the apartment - he has a share in his property, which is one of the types of rights to real estate, but not the real estate itself.

It is necessary to understand that the ideal share is not part of the apartment, it is a share in the right. That is, each owner of an apartment has the right to own and use it without violating the rights of other owners.

Sometimes, in order to exercise this right in practice, it is necessary to establish a regime for using the apartment: for example, in a three-room apartment, allocate a room for personal needs to each of the two owners, provide for a schedule for using the kitchen and living room.

If the court, establishing the mode of use of the apartment for the owners (we proceed from the fact that each has ½ share in the right to the apartment), allocated a room of 10 sq. m. to one person as a bedroom. m, they will continue to pay utility bills and property taxes in equal shares.

The main difficulties begin when the need arises to sell a share in an apartment or the entire apartment in shared ownership.

This schedule does not mean that one owner owns each room. If only one of the apartment owners sells his share of the right to it, this, of course, will not have a positive effect on the speed of sale and the price of this share.

There are not many people who want to share housing with strangers.

However, this is not the only difficulty when selling a share in common property.

The fact is that the co-owners of the seller of the share have the pre-emptive right to purchase it. When selling a share, you must offer it, indicating the basic conditions of purchase and sale, to other apartment owners. If the co-owners refuse or do not buy the offered share within 1 month from the date of their notification, then you can sell it to strangers.

Procedure for selling a share in common property

Ways to bypass the preemptive right to purchase What transactions with shares in an apartment cannot be made? The reasons for the emergence of shared ownership of an apartment can be: It is worth knowing that a standard apartment that is in shared ownership is not physically divided in any way.

https://www.youtube.com/watch?v=_vqy9hNxzQU

To divide a residential premises, as lawyers say, “in kind” it is necessary that such premises have a separate entrance, separate connections to centralized networks (gas, water, electricity).

All this can only be realized in “apartments on the ground”, when one individual housing construction house is divided by the heirs into several real shares.

In other cases, so-called “ideal shares” arise. One of the owners is not the owner of the apartment - he has a share in his property, which is one of the types of rights to real estate, but not the real estate itself.

It is necessary to understand that the ideal share is not part of the apartment, it is a share in the right. That is, each owner of an apartment has the right to own and use it without violating the rights of other owners.

Sometimes, in order to exercise this right in practice, it is necessary to establish a regime for using the apartment: for example, in a three-room apartment, allocate a room for personal needs to each of the two owners, provide for a schedule for using the kitchen and living room.

If the court, establishing the mode of use of the apartment for the owners (we proceed from the fact that each has ½ share in the right to the apartment), allocated a room of 10 sq. m. to one person as a bedroom. m, they will continue to pay utility bills and property taxes in equal shares.

The main difficulties begin when the need arises to sell a share in an apartment or the entire apartment in shared ownership.

This schedule does not mean that one owner owns each room. If only one of the apartment owners sells his share of the right to it, this, of course, will not have a positive effect on the speed of sale and the price of this share.

There are not many people who want to share housing with strangers.

However, this is not the only difficulty when selling a share in common property.

The fact is that the co-owners of the seller of the share have the pre-emptive right to purchase it. When selling a share, you must offer it, indicating the basic conditions of purchase and sale, to other apartment owners. If the co-owners refuse or do not buy the offered share within 1 month from the date of their notification, then you can sell it to strangers.

Donation of a share in the right of common shared ownership, donation of an apartment or

- But only on the same terms, at the same price, as was offered to the co-owners.

- If this procedure is violated, other owners may demand through the court the transfer of rights under the purchase and sale agreement to themselves.

- Such a claim can be filed within 3 months from the moment the co-owner learned of the violation of his preemptive right.

- To avoid such problems, you need to carefully prepare the documents: send the offer to purchase a share to the co-owners in writing and be sure to arrange confirmation of receipt.

- So, you can transfer a notice of sale of a share in an apartment from hand to hand and ask the co-owner to sign a duplicate of the notice with the obligatory indication of the date when it was delivered.

- Or send it by registered or certified mail with return receipt requested.

- It is not always possible to reach an agreement with other owners.

- Lawyers can suggest ways for you to “get around” the right of first refusal.

- We do not believe that these methods are exceptionally bad, but if you resort to them, you should be aware that they are associated with a certain risk.

If the buyer is dishonest, the seller who bypasses the pre-emptive right through an imaginary or feigned transaction runs the risk of not receiving payment under the contract. For the buyer: the transaction may be declared invalid as an imaginary one, concealing a purchase and sale behind it, and the co-owner in this case will require the transfer of rights under the transaction to himself.

When donating a share, the pre-emptive right of co-owners does not apply. As a result, the buyer will part with the acquired share.

- For the seller: the buyer may simply not pay and it will not be possible to recover this money from him using legal methods.

- To ensure that co-owners refuse to buy a share, an offer is made to them at too high a price.

- In reality, the buyer pays significantly less.

- An unpleasant consequence here will be an increase in the tax on the sale of a share in the apartment (after all, the tax base is calculated according to the documents attached to the declaration, the same receipt).

- In each specific case, you need to balance the cost of the share and the amount of the tax deduction due, and also find out whether the obligation to pay personal income tax arises at all (in some cases, the sale of an apartment or a share in it is not subject to tax).

In such a situation, a loan agreement is concluded for an amount equal to the purchase price of the share in the right to the apartment and at the same time an agreement to secure this loan with a pledge of the share in the right to the apartment. The state fee for registering a mortgage is 1000 rubles.

By the way, this collateral agreement is called a mortgage (did you think that this is a loan for maternity capital? Then the “debtor-borrower” misses the deadline for repaying the loan. And the buyer of a share in the apartment, supposedly the “lender-creditor,” pays recovery of a share in an apartment.

In order not to be associated with the legal system, this is formalized in a compensation agreement.

In this agreement, the parties agree that instead of the amount borrowed, the “lender” will receive a pledged share of the right to the apartment.

How to sell an apartment in common shared ownership

There is also a risk of cancellation of the compensation agreement at the request of other apartment owners as a transaction covering the actual sale of a share in the apartment.

If this claim is successful, the following consequences will arise for the buyer and seller. The seller will remain in debt to the buyer under a fictitious loan agreement: after all, the compensation that paid off this supposed “debt” will be declared invalid.

- There are complete restrictions on transactions with shares in the right to an apartment.

- Russian civil law knows this type of transactions with rights and shares in them as assignment of rights (cession).

- Assignment is often used when alienating the share of one of the founders of an LLC, but it is prohibited to sell a share in an apartment in this way. The only case when it is allowed to sell a share (without any workarounds) without observing the pre-emptive right is a sale at public auction.

- In this way, creditors sell a share in an apartment when the debtor’s other property and money are not enough to pay off the debts.

- However, not every share in an apartment can be collected against the debt (after all, as a general rule, it is impossible to take away the only residential premises).

- There are only two cases when such collection is permitted: Shared ownership in an apartment.

- Selling an entire apartment A small apartment with several owners who do not live in it or do not want to live together are clear prerequisites for selling an apartment in shared ownership as a whole.

If all co-owners agree, selling an apartment in shared ownership will not be a problem. We can offer 2 methods: The first option is convenient if the co-owners live close to each other.

It is more profitable in terms of paying the state fee for registering the buyer’s property rights, because

You will have to pay for 1 object - an apartment (the state fee is 1000 rubles.

) The second, separate sale of each share in the apartment, may be preferable for the buyer if the co-owners do not communicate with each other or live in different places and do not want to give one of them a power of attorney to sign the agreement. for each share in the right, and in addition, comply with the above-described procedure for the pre-emptive right to purchase.

Below we will look at how the right to a tax deduction differs for the above methods of sale.

This situation arises when several owners want to sell an apartment they no longer need and divide the money among themselves. Here a lot depends on the size of the shares of these owners.

- If the share of a person who resists the sale of property is small, it is possible to forcibly buy out his share.

- To do this, you need to go to court with a corresponding claim.

- Having justified your demands by the negligible size of the co-owner’s share, you need to ask the court to oblige such a co-owner to transfer his share to other owners in exchange for providing monetary compensation.

Of course, if a co-owner lives in a shared apartment, then the court cannot force him to sell his share, because

- The reason for this is not only the small size of the share, but also the lack of interest in using the shared apartment.

- Money received from the sale of an apartment or a share in it is income on which you are required to pay tax (personal income tax) in the amount of 13% of the amount received under the agreement.

- There is also a risk of cancellation of the compensation agreement at the request of other apartment owners as a transaction covering the actual sale of a share in the apartment.

If this claim is successful, the following consequences will arise for the buyer and seller. The seller will remain in debt to the buyer under a fictitious loan agreement: after all, the compensation that paid off this supposed “debt” will be declared invalid.

- There are complete restrictions on transactions with shares in the right to an apartment.

- Russian civil law knows this type of transactions with rights and shares in them as assignment of rights (cession).

- Assignment is often used when alienating the share of one of the founders of an LLC, but it is prohibited to sell a share in an apartment in this way. The only case when it is allowed to sell a share (without any workarounds) without observing the pre-emptive right is a sale at public auction.

- In this way, creditors sell a share in an apartment when the debtor’s other property and money are not enough to pay off the debts.

- However, not every share in an apartment can be collected against the debt (after all, as a general rule, it is impossible to take away the only residential premises).

- There are only two cases when such collection is permitted: Shared ownership in an apartment.

- Selling an entire apartment A small apartment with several owners who do not live in it or do not want to live together are clear prerequisites for selling an apartment in shared ownership as a whole.

If all co-owners agree, selling an apartment in shared ownership will not be a problem. We can offer 2 methods: The first option is convenient if the co-owners live close to each other.

It is more profitable in terms of paying the state fee for registering the buyer’s property rights, because

You will have to pay for 1 object - an apartment (the state fee is 1000 rubles.

) The second, separate sale of each share in the apartment, may be preferable for the buyer if the co-owners do not communicate with each other or live in different places and do not want to give one of them a power of attorney to sign the agreement. for each share in the right, and in addition, comply with the above-described procedure for the pre-emptive right to purchase.

Below we will look at how the right to a tax deduction differs for the above methods of sale.

This situation arises when several owners want to sell an apartment they no longer need and divide the money among themselves. Here a lot depends on the size of the shares of these owners.

- If the share of a person who resists the sale of property is small, it is possible to forcibly buy out his share.

- To do this, you need to go to court with a corresponding claim.

- Having justified your demands by the negligible size of the co-owner’s share, you need to ask the court to oblige such a co-owner to transfer his share to other owners in exchange for providing monetary compensation.

Of course, if a co-owner lives in a shared apartment, then the court cannot force him to sell his share, because

The reason for this is not only the small size of the share, but also the lack of interest in using the shared apartment.

Money received from the sale of an apartment or a share in it is income on which you are required to pay tax (personal income tax) in the amount of 13% of the amount received under the agreement.