Registration of an inheritance is a fairly lengthy procedure that requires a person to spend time and money. Traditionally, inheritance is formalized through a notary. More recently, MFCs began to provide a similar service. Step-by-step instructions for registering an inheritance through the MFC are given in this review.

There are two ways to formalize the transfer of property rights from the deceased to the successor:

- use the services of a notary;

- contact the MFC at the place of residence of the heir.

Important: when registering property rights through the MFC, a certificate of receipt of inheritance is not issued.

It is cheaper to register the transfer of ownership of property at the MFC than through a notary, because a person does not need to additionally pay for his services to verify the authenticity of the documents provided.

It is necessary to enter into an inheritance within six months from the date of death of the testator.

Heirs have the right to apply for registration of an inheritance if they are mentioned in the will or are included in the circle of persons entitled to receive it, approved by law.

Instructions for registering property rights through the MFC

In order to register an inheritance, you need to follow the instructions:

- go to the notary. It is necessary to clarify the list of papers that will be needed to formalize the inheritance and write an application for the issuance of a certificate confirming entry into it;

- pay the government fee. The amount of the state duty is set individually, depending on the type of object for which the heir acquires ownership;

- make an appointment at the MFC at the place of residence of the heir and provide a package of required documents;

- Find out from the MFC employee the date of production of the papers;

- on the appointed day, appear at the MFC and receive documents confirming the transfer of ownership of the inheritance;

- contact a notary to obtain documents certifying entry into inheritance.

Document processing price

The cost of processing documents for inheritance consists of the following components:

- state duty for registration of inheritance;

- Notary Services;

- legal consultation;

- costs associated with additional production of documents necessary to confirm the right of inheritance.

The state duty for accepting the property of the deceased is calculated in the following way::

- 0.3% of the cadastral value of a residential property. The amount of the duty should not exceed 100,000 rubles. This benefit is available only to close relatives of the deceased;

- 0.6% of the cost of housing according to cadastral registration. The tax amount should not exceed 1 million rubles. This tax will have to be paid to distant relatives of the deceased person or to strangers mentioned in the will.

Important: receipts for payment of state fees are issued to each heir. Its size is determined in proportion to the hereditary mass.

The period for registering documents with the MFC from the moment of their submission is 10 working days. The cost of processing documents at the MFC is 4,000 rubles. Documents certifying the transfer of ownership from the deceased to the successor will be produced within 108 days. The application must be submitted to a notary within 6 months from the date of death of the testator.

Sample list of documents

You can find out what documents are required in order to enter into an inheritance from the notary in charge of the inheritance case, or from an MFC employee. The standard list looks like this :

- identity cards of all heirs;

- certificate of the right to inherit property;

- the death certificate of the testator in its original form;

- an extract from the house register certifying that the deceased is registered;

- papers certifying relationship with the deceased.

Additionally, other documents may be required. Their list is announced by a notary or an employee of the MFC.

Refusal to register a document

The reasons for refusal are individual in each case. If an MFC employee refuses, you need to consult him about the reasons for this decision. The most common reasons for refusal to register documents are :

- an application for registration of documents incorrectly completed by the registrar;

- presence of blots and corrections in documents;

- imposition of judicial seizure on inherited property;

- presence of encumbrance;

- litigation regarding the inheritance estate;

- failure to pay state fees or lack of supporting receipts.

Accepting an inheritance is always accompanied by hassle and a large number of required documents. By contacting the MFC, the heir will save a lot of time, because all he has to do is obtain papers certifying ownership of the inherited property. If he has questions, he can get answers to them from an MFC employee.

List of documents for receiving an inheritance and rules for their execution

Once the heirs have learned that they have the right to receive some property from the deceased, the most important process begins - documenting such a right. This process has some complexity, so you need to prepare for it carefully.

Regulating the issue of inheritance registration

The Civil Code, unfortunately, gives only a general concept of what an inheritance is and how to obtain the right to it, but it does not indicate the mandatory list of documents that are necessary for this.

Therefore, when registering inherited property, the notary requires from the legal successors a certain package of documents necessary to complete the transaction.

General requirements for all documents

- They must not contain any corrections, errors, erasures, abbreviations, and must also be compiled on a computer or written with a ballpoint or fountain pen. In some cases, blots and corrections are allowed, but they must be recorded according to the instructions. In an example it looks like this. Date corrected. This means that the one who admitted it must write “corrected believe” and put his signature above the line in this place (if this is an official, then the seal).

- Documents must be of the established format. If these are technical passports for cars, and papers confirming ownership, then they must be filled out and prepared in the manner required by the instructions of the authorities that issued them.

- If there is a discrepancy between the personal data of the deceased and the successor, although the fact of relationship is obvious, then the latter must apply to the court with a statement of claim and obtain a decision to correct his personal data so that they correspond to the submitted documents.

The period for entering into inheritance is six months from the date of death of the person. It is during this time that all documents must be collected or a refusal must be made.

What documents are needed to register an inheritance with a notary?

In order for a notary to register inherited property for a specific person, he must collect the maximum package of certificates and other papers.

But before contacting the office, the heirs should, if possible, find everything they have and bring it to the notary. To register an inheritance, the following documents are required:

- a certificate stating that a person has died, which is issued by the civil registration authorities (ZAGS);

- identification documents of the citizen who applies to the notary’s office, that is, a passport, TIN code, residence permit, or temporary citizen’s certificate (if the passport is lost);

- for foreign citizens, also a list of the above documents, but they must be translated into Russian;

- further, it is necessary to submit documents that confirm the relationship, this may include certificates of birth, marriage, divorce, court decisions, if the heir applied to these authorities with an application to establish the fact of cohabitation;

- a certificate of the last place of residence of the person who died, this can also be an extract from the house register (for a household or cottage);

- if succession occurs under a will, then it is necessary to provide its original, which must be correctly executed;

- this list also includes certificates and papers confirming the fact of ownership of deceased property (movable and immovable), but for each case they are separate;

- the latter is a representative power of attorney, if the registration of succession is carried out by a representative of the heir (a notarized power of attorney, which clearly indicates the authority to enter into an inheritance).

Principles of hereditary relations.

It is important to remember that the absence of any documents from the required list may lead to the notary refusing to perform the action. If a person does not agree with this, he can challenge his illegal actions in court.

List of documents that will be needed

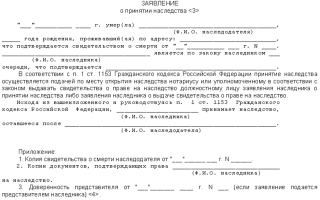

Any heir must come to the notary prepared. It is immediately necessary to make a reservation that the process of registering the right of succession begins with writing a special application, to which is attached the entire package of certificates and other papers, and also by presenting a passport or a document replacing it.

Documents for registration of real estate

The right to own real estate (apartment) arises from the moment it is registered with a specific person, therefore the papers required for its registration are as follows.

- Documents confirming ownership of the entire residential or commercial property, or part of it. This includes originals of purchase and sale agreements, donations, exchanges, acquisition of property at auctions, as well as orders authorizing privatization. If the deceased owns a part, this means a certificate of ownership of it, or a court decision on division, allocation in kind. To this you also need to add a mandatory extract from the state register, which will indicate that the property is registered in the name of a specific person. Technical documentation (technical passport BTI) or cadastral file.

- If this is a plot of land and a house located on it, then in addition to all of the above, you will need a detailed technical plan of the land plot, which will clearly indicate how many meters are allocated for construction, and how much land is for maintaining the building and for a garden.

- If a dacha plot is being registered, which is located in a cooperative, then the notary will need to bring a certificate from this institution that a specific plot of land was allocated to the deceased. If all this is privatized, it means documents confirming ownership and relevant technical or cadastral documentation for land and buildings.

- If the estate includes buildings that do not require separate registration, for example, a garage, then the deceased will have a certificate from the municipal authorities confirming its presence that such a structure was erected and land was allocated for it. This does not apply to permanent garages located in cooperatives. The documents needed for them are the same as for a summer cottage.

To all this it must be added that each piece of real estate must be accompanied by a conclusion or assessment of the real market value. It is needed for tax payments.

It is important to remember that the easiest way out of the situation of collecting technical documentation for real estate and land plots is to obtain form - 2 (certificate of technical inventory and accounting of such objects), issued by the BTI or geocadastre employees.

Certificates required to register a car

In order for a car to be registered, a citizen must provide the following package of documents:

- first of all, this is a technical passport of the vehicle, which indicates the engine and body numbers;

- a document confirming that the car is registered and registered in the database;

- the latter is its estimated value, which can be given by a licensed professional.

It is important to remember that you do not need a driver’s license to inherit a car.

Registration of shares

- To receive shares, you must contact a special government body that controls their movement (depository).

- Its officials are required to issue a certificate, which will describe the movement of shares of a particular enterprise, and also indicate how many of them are listed on the testator.

- An extract of the case must also be drawn up, that is, the movement of these securities across the market and accounts must be described.

Receiving deposits

In order for deposits to be registered, the heir is obliged to provide the notary with deposit agreements with banking institutions, savings books, or certificates, and other agreements for opening card accounts that belong to the deceased.

It is important to remember that if the successor does not have supporting documents for deposits or deposits, but there is information that they may be in a particular bank, he is obliged to notify the notary about this, and the latter must send a request there and find out this point.

Refusal of inheritance in favor of another relative

If the heir decides that he does not want to be the legal successor of the deceased, then he can refuse to enter into the rights of use.

Application for acceptance of inheritance.

To do this, you need to contact a notary and indicate in the application that the citizen renounces the inheritance in favor of a specific person, or not indicate it.

The notary will accept such an application when the person who wrote it presents his passport, and also attaches to it documents confirming the degree of relationship with the deceased.

It is not necessary for the objector to collect certificates and certificates, as well as other papers regarding the possible inheritance. This can be done by a notary, or by the one in whose favor the refusal is made. It is important to remember that you cannot give up part of the property.

Costs for collecting documents

The costs of registering an inheritance will be as follows:

- payment of the mandatory state fee for obtaining a certificate, for the first circle of legal successors it is 0.3% of the total value of the inheritance that is accepted, for the rest 0.6% but not more than 100 thousand rubles;

- further this is a mandatory assessment of property;

- costs that may arise during the restoration of documents, production or issuance of new ones.

In order to register an inheritance, you will need documents confirming the relationship, as well as certifying the existence of property to the deceased. To obtain a certificate, you will need to pay a state fee, but it cannot exceed 100 thousand rubles.

Necessary documents for registering an inheritance with a notary after death

After the death of a relative or person who bequeathed the property, the period set aside by law for registering the inheritance begins. Even if the heir has accepted the property and is already disposing of it, documentary registration of inheritance rights is mandatory.

How can you enter into an inheritance?

The person whose turn is considered closest according to the rules of inheritance can inherit after the death of a relative.

If the deceased made a will during his lifetime, then it is considered to take precedence over family relations.

In this case, after the death of the testator, his property will be received by those indicated in the will, where all orders regarding the further fate of the property can be written.

So, inheritance can be done in two ways:

- according to a will drawn up during life;

- according to the order of priority according to the degree of relationship.

What documents are needed for registration?

Registration of inheritance is most often carried out by a notary. It is he who needs to submit the following package of documents:

- statement. It is written on the spot on the day of application. The writing of such a statement is made in order to legitimize one’s newly emerged rights to inheritance;

- passport. It does not need to be left with the notary; it is necessary to verify the identity of the person who applied for registration of inheritance;

- a document confirming the death of the testator. This is the death certificate. This document must be obtained from the registry office in exchange for a medical report and a certain certificate of death issued by police representatives;

- certificate from housing services authorities. The certificate must confirm the last place of residence of the deceased;

- if the deceased lived in a private house, an extract from the house register is required. After the death of the testator, this document can be obtained from the same housing services (management company, housing department, etc.);

- certificate of deregistration. Sometimes notaries require this document, which can be obtained at the passport office at the last place of residence of the deceased;

- a document confirming that the heir who submitted the application and the deceased testator were related by family ties. The document depends directly on the nature of the relationship. This could be a marriage certificate, etc.;

- will (if drawn up).

Thus, the required complex includes those papers that confirm the feasibility of opening a specific inheritance case.

The list most often corresponds to the one given, but it is worth considering that for each specific inheritance case it may differ slightly. It is better to check the final list of documents with a notary.

Documents for registration of some property

The list of documents that need to be collected to register certain types of inherited property may expand. This depends on the specific type of inherited property.

Real estate, land

Inheritance of real estate, as well as a land plot, requires the submission of documents:

- an agreement or court decision on the transfer of property to the testator;

- state registration of rights. This document is the main document confirming that the testator transferred property that belonged to him by law;

- real estate or land valuation. Reflects the value of the inherited property (land) in monetary terms;

- technical passport or cadastral plan of the property;

- a certificate provided by the housing service, which contains a list of everyone registered on this property (if the property is inherited).

When inheriting both real estate and land, it is better for the heir to immediately find out whether any encumbrance has been imposed. After accepting the inheritance, the encumbrance is not automatically removed.

Deposits, securities

If funds in bank accounts or securities are inherited, the following documents are required to register the inheritance:

- valuation of securities. It must be current on the date of death of the testator;

- an extract provided by the joint-stock company stating that the testator owns shares of this company;

- savings book, certificate, agreement on opening a deposit, etc.

Automobile

When inheriting a vehicle, the following documents are required:

- PTS;

- the assessment made on the date of death of the testator;

- car registration.

If several types of property are inherited at once: both real estate and a car, for example, a package of documents is collected for each object separately.

Therefore, what kind of papers are needed to formalize an inheritance after the death of the person who left it depends on the characteristics of the inherited property. When opening an inheritance case, the notary accepts documents that are common to any type of property. Without them, it is impossible to start registering an inheritance. The final list is specified in each case individually.

Share this article with your friends:

Documents for inheriting an apartment: list

How often do people run around various offices in search of the necessary information about where they can obtain the required documentation for registration of inheritance law.

And the reason for such running around sometimes lies in the fact that people themselves simply do not know which documents are required. To avoid such confusion, you must first seek help from a notary.

He will assess your situation and be able to draw up the necessary list of documentation.

Documents required

All measures for registering an inheritance are carried out by a state notary office according to the place of registration of the deceased person or the location of the inherited living space. The heir is required to submit an application for inheritance within the established 6-month period. Read about the deadline for entering into inheritance according to the law here.

To do this, he requires some more documentation, which we will consider in more detail:

- Evidence confirming that the owner of the apartment has died. In this case, you need evidence from the person who left you the inheritance. Relatives of the deceased receive it from the local registry office. To obtain a death certificate, you also need to present some documents. This should include a medical certificate and documents that confirm your identity and degree of relationship with the deceased. In this case, we are talking about a birth certificate, about cancer, and so on.

- A certificate indicating the number of people registered in the inherited living space.

- A document that will confirm your identity.

- A certificate confirming that you are a relative of the deceased.

- Will, if present. The will must be written in your name, and you should ask your notary for the following information: whether any changes were made to the will during the lifetime of the person who drew it up.

- A document that lists the intended heirs of the living space, as well as telephone numbers and addresses. But how inheritance of an apartment is carried out between close relatives is detailed in this article.

When preparing documents for an apartment or entering into an inheritance, which also requires registration, you must pay attention to the fact that it will simply be impossible to enter into an inheritance even in the absence of one of the listed documents. The only exception is a will, since without it it will still be possible to take ownership of the living space.

Contacting a notary office

When all the documentation has been collected, you should not think that your torment is over.

After collecting documents and certificates, you need to go to the notary’s office, where the notary will begin to formalize the right to inheritance. He opens a case regarding inheritance of property.

In this case, this is the right to inherit living space. This material will tell you what documents are needed to register ownership of an apartment.

If you are applying to a notary’s office for the first time, you will need to stock up on the following list of documents for ownership of inherited housing:

- A certificate confirming the right to an apartment.

This documentation confirms ownership of the real estate apartment. In this case, it is worth preparing the following certificates: a certificate of ownership, a contract of sale and donation of an apartment, and lifelong maintenance. - A passport that proves your identity.

- If there are any benefits, then it is worth providing preferential certificates. It is worth providing them already on the first visit to the notary. This is tedious to do in order to reduce the state duty that the country imposes on each heir. There is a specific category of the population who, when registering the right to inherit an apartment, do not have to pay. The following category of people should be included in this category: Heroes of the Soviet Union and the Russian Federation, participants in the Second World War, holders of the Order of Glory.

But from this article you can find out what the procedure for entering into an inheritance without a will is.

It is also not recommended to pay a state fee for people who are going to register the right to inherit a home that is suitable for living and in which they previously lived with the testator. This link will tell you about the transfer of ownership of real estate.

Of course, preparing all these documents is a lot of work. After all, it’s worth visiting some establishments and standing in line. But no matter how much we would like to do everything faster, without this set of documents it will be impossible to solve the tasks.

Registration of inheritance for an apartment and a list of necessary documents

Registration of this or that property as an inheritance is a fairly routine task, not to mention the disputes that arise between heirs on almost every second occasion. For this reason, it is necessary to have enough knowledge about the inheritance procedure to avoid unexpected situations.

Registration of inheritance for an apartment - legal framework

The law of the country regulates the inheritance procedure quite clearly. The main regulations in this area are:

- Civil Code of the Russian Federation;

- Law of the Russian Federation “On Notaries”;

- Instructions of the Ministry of Justice on the procedure for office work in notary offices;

Basic rules - imperative substantive norms by which the list of persons authorized to inherit the property of a deceased person and other main points are determined, enshrined in the Civil Code.

The procedural rules enshrined in the Civil Code are presented:

- grounds of inheritance;

- deadlines for submitting documents;

- procedure for assessing inherited property, etc.

Other procedural features of inheritance are reflected in the Law “On Notaries” and the instructions of notaries. Thus, these regulations provide for:

- procedure for submitting documents;

- list of required documents;

- procedure for pre-trial dispute resolution;

- procedure for appealing the actions of a notary, etc.

Also, legislation on the activities of notaries ensures the safety of inherited property. So, if the testator himself has not identified the person responsible for the execution of the will, then the authorized notary automatically becomes such a person.

How to register an inheritance for an apartment

In order to register an inheritance for an apartment or other real estate, the inheritance first of all needs to establish the appropriate authority.

Thus, eligible persons to receive inheritance at this stage are:

- heirs at law;

- persons named as heirs in the will.

In this case, persons who are heirs by law are inferior to persons who are heirs by will. The exception is for persons who are designated in the law as obligatory heirs.

According to the law, only relatives can act as heirs and only in order of priority, according to the degree of their relationship in relation to the deceased person:

- The first priority includes family members: spouses, children, parents;

- the second line includes grandfathers, grandchildren, brothers and sisters, etc.

In total, the legislation distinguishes 8 lines of heirs. A separate category are persons who receive a share in the inheritance without fail:

- minor children of the testator;

- disabled dependents of the testator who were dependent on him for at least one year immediately before his death.

Thus, before registering an inheritance, it is necessary to ensure that the relevant testator has the right to inherit the property.

The procedure for inheriting an apartment and what is needed for this

Procedural regulation of inheritance includes a whole array of rules of civil law and legislation regulating the activities of notaries. In order to carry out procedures as quickly as possible, you need to know in advance where and how to apply, what documents to collect and other procedural nuances.

Where to contact

Notarial bodies are authorized to conduct inheritance processes in Russia and most foreign countries. However, you need to know which notary you need to contact. So:

- in the case where there is a will, it is necessary to contact the notary who certified this will;

- if there is no will, then the authorized notary is the one who operates at the place of last registration of the testator;

- if the main inherited property is an apartment, then, as an exception, the inheritance procedure can be carried out at the location of the apartment.

In some cases, the probate procedure may be carried out separately in several places, in accordance with the above rules.

Application deadlines

Legislation limits the time frame during which citizens can formalize their inheritance rights. So:

- to submit an application for receiving the corresponding apartment by inheritance, persons are given six months from the moment the legal owner of the property dies;

- interested citizens are given one year to appeal the actions of a notary;

- six months are given to challenge the rights of heirs who have already assumed their rights;

- other property disputes arising from inheritance relations can be resolved within three years from the date of death of the testator or from the moment when the interested person became aware of a violation of his powers and interests.

Thus, all the deadlines established for civil law relations, to one degree or another, also apply to inheritance relations. Violation of these deadlines leads to the loss of relevant powers by interested parties.

Valuation of the inherited apartment and state duty

The legislation provides for a state duty when registering an inheritance for an apartment, which is paid by the persons accepting the inherited property. Thus, the amount of such a duty depends on the degree of relationship between the heir and the testator:

- close relatives, that is, family members and first-degree heirs, pay only 0.3% of the value of the corresponding inherited property;

- all other persons acting as heirs pay 0.6% of the value of the property registered as an inheritance.

Tax legislation also contains cases when persons are exempt from paying state taxes.

Thus, if the heirs are persons who lived with the testator in the inherited apartment and ran a common household with him, then they, at their own request or by a court decision, can be exempted from the duty. Of course, evidence of the above is necessary in such cases.

Required documents

So, what documents will you need first?

The main one, necessary for inheriting an apartment, is an application to a notary, where the interested person indicates his inheritance authority, as well as his willingness to accept all the property of the deceased, or part of it.

The following documents must be attached to this application:

- a copy of the heir's identity document;

- a certificate certifying the death of the testator;

- a document certifying the existence of a corresponding relationship between the deceased testator and the heir;

- receipt for payment of state duty.

Regarding the inherited apartment, notaries will in any case request the following documents for entering into inheritance:

- a document certifying the deceased person’s right to own the apartment;

- conclusion of a private appraiser on the value of the inherited apartment on the date of death of its former owner;

- certificates from the housing organization about the persons living in the relevant apartment.

However, depending on the specifics of the case, notaries may request other documents.

Certificates of inheritance for an apartment - how to obtain

The main document certifying the heir's right to property, that is, an apartment that he received by inheritance, is a certificate. This certificate must be obtained from a notary and registered with the body that registers the rights of ownership of real estate - in Rosreestr.

State registration of an apartment after inheritance, what documents are needed for it

State registration of ownership of real estate, including an apartment, is mandatory. It is carried out in specially authorized bodies:

To register an apartment after inheriting, you must submit an application and attach the following documents to it:

- passport;

- original certificate of inheritance for the apartment;

- receipt of payment of state duty.

Registration is carried out within 10-15 days and, following the results, all original documents submitted are returned to the applicant.

Cost of registration with a notary

In addition to the state fee for registering an inheritance, the notary must pay for his services according to the tariff schedule established by regional associations of notaries. On average in Russia, notary services will cost:

- 2000 rub. – acceptance and execution of the application;

- 5000 rub. – preparation of documents;

- 10-15 thousand rubles. – issuance of a certificate of inheritance.

Of course, notaries also adhere to the rules for providing benefits in accordance with legal requirements.

Is it possible to register an inheritance through a representative, what will be needed for this?

As a rule, inheritance is the power to register property, exercised by each person personally. However, the law allows cases when another person can participate in the process for him in accordance with the general rules of representation.

So, for this you need to issue a notarized power of attorney. It is advisable to issue such a power of attorney from the same notary who is handling the inheritance matter. In rare cases, individuals resort to professional assistance from lawyers and lawyers.

However, most notaries prefer to work directly with the heirs themselves and, in rare cases, allow their replacement by representatives. So a sufficiently serious and compelling reason is required for representation.

Thus, the inheritance procedure has its own nuances. When the object of inheritance is an apartment, it is also necessary to know the peculiarities of civil circulation of real estate objects established on the territory of the relevant state.

List of documents for registration of an apartment by inheritance

An apartment is one of the most common objects passed on by inheritance. The procedure for registering an inherited apartment is regulated by the Civil Legislation of the Russian Federation. This process is associated with the execution of various papers, on the basis of which the heir becomes the owner of the apartment left to him by a relative after death.

Immediately after a citizen learns of the death of a relative, whose presumptive heir he is, he must contact a notary with an application to open an inheritance case. But first, he must collect a set of mandatory documents, without which it is impossible to receive an inheritance.

Documents for opening an inheritance

The list of documents with which the heir applies to the notary includes:

- death certificate of the testator (issued in the registry office at the place of residence of the deceased);

- a package of documents confirming family ties with the deceased (birth certificate, marriage certificate, divorce certificate, papers recognizing paternity, adoption, etc.);

- an extract from the house register indicating the persons registered in the inherited apartment;

- technical passport for housing;

- cadastral passport;

- will (if there is one).

An application to the notary is attached to this package, which is drawn up using a special form.

If there is a will, the heir applies to the notary with an application for the publication of this document. But it happens that the heir does not know about the existence of the will, moreover, it was drawn up in another notary’s office.

The presence of such a document can be verified both by the heir himself and by a notary. To do this, you should send a request to the central notary office, which has access to information from all subordinate organizations.

Important: in the absence of a will, the heir must contact a notary within six months after the death of a relative, and if there is one, the inheritance case is opened six months after the death of the testator.

Documents for registration of heir certificate

The heir's certificate is issued on the basis of a citizen's application, which is written in a special form. After verifying the authenticity of all submitted documents, the notary opens an inheritance case, but in order to issue a certificate of inheritance, he requires an additional set of papers from the applicant, which include:

- appraising an apartment to obtain a certificate of inheritance (this procedure must be entrusted to appraisers or companies that are members of the SRO, otherwise the submitted report on the market value of housing for notaries will not have legal force);

- a receipt for payment of the state duty (the amount of the state duty is 2000 rubles and it is paid in all banks);

- heir's passport;

- registration certificate of the apartment;

- an extract from the house register, which indicates all the persons registered in this living space;

- documents confirming family ties with the deceased testator.

At the end of checking all the specified documents, the notary issues a certificate of the heir, which the legal heir submits to the Rosreestr authorities to register ownership of the inherited apartment.

After this, the heir becomes the full owner and can dispose of the housing at his own discretion, this could be the sale of an apartment received by inheritance, rental, donation to another person, etc.

Problems also arise when it turns out that the apartment that was left after the death of a relative has not been privatized. In these cases, the laws are very strict; normal inheritance procedures do not apply here.

In this case, only the one who lived with the owner is considered the heir of such housing. You should also contact the housing department to sign a new tenancy agreement.

Based on this document, it will be possible to begin privatization of the apartment.

Important! Only first-line heirs living with the deceased have the right to privatize such an apartment. Other relatives cannot apply for this housing.

In practice, the process of obtaining an inheritance rarely goes smoothly, especially when the inheritance object is an apartment. Difficulties arise when several legal successors claim the inheritance and do not agree with their share. Disputes are resolved in courts, sometimes lasting several months or even years.

List of documents for registering an inheritance for an apartment with a notary

Receiving an inheritance involves, in addition to the emergence of property rights, also the emergence of certain hassles. After all, in order to enter into an inheritance, you need to collect a complete package of necessary documentation.

From today's article you will learn what documents are needed to register an inheritance, depending on the basis on which the inheritance is carried out and the type of property. It will also tell you what needs to be presented to the notary on your first visit.

What documents are needed to register an inheritance with a notary?

An inheritance case is opened upon receipt of the first application from any of the heirs. To do this, you need to contact the notary office at the place of permanent residence of the deceased. What should you take with you?

A passport is required. for identification of the heir.

Other documents (confirming the fact of death, family ties and the last place of residence of the deceased, as well as a will, if there is one) can be submitted later, by the time the inheritance certificate is issued. However, it is still advisable to have them on your first visit to the notary. This will allow you to obtain more information that may be important for further management of the case.

If the heir, due to some circumstances, cannot appear in person at the office, the inheritance can be accepted through a representative. In this case, the required documents will include the passport of the authorized person and a power of attorney to exercise the relevant powers.

The second option, if it is impossible for the heir to apply independently (if he lives far from the place where the inheritance case was opened), is to send an application for acceptance of the inheritance by mail, preferably by registered mail. In this case, the applicant’s signature must be certified by another notary, to whom it is possible to get access.

It is not necessary to attach additional documents to the application.

Documents for obtaining a certificate of inheritance

Documents for obtaining a certificate of inheritance

Now let's talk about the documentation required for registration of inheritance rights, which must be submitted before the issuance of an inheritance certificate. Depending on the basis of inheritance, this list will be different.

List of documents for entering into inheritance under a will

- death certificate or certificate

- issued by the civil registry office

- house register (and if the deceased lived in an apartment - an extract from it) or a certificate from the passport office containing information about the last place of residence of the deceased and the persons who lived with him

- documents for property (more about them will be discussed below)

- property valuation document (act, report, certificate of value, etc.)

- will

- evidence that the will was not subsequently revoked or changed.

List of documents for entering into an inheritance without a will (by law)

If there is no will in the case, the heirs will need the same documents as indicated above to register their rights, with the exception of paragraphs. 5 and 6.

Instead, they will need to prove the existence of a family connection with the deceased, i.e. provide documents confirming relationship. These are certificates (certificates) issued by the civil registry office:

- about birth

- about marriage

- about changing your name

- about adoption, etc.

Documents for entering into inheritance after the death of a spouse

If the surviving spouse takes over the rights of inheritance, he must provide a photocopy of the marriage certificate among the documents (the original is also presented to verify the authenticity of the copy).

In addition, if a marriage contract was concluded between the spouses. changing the content of the parties' rights to property acquired during marriage, it must also be presented to a notary to determine the composition of the inheritance mass.

Documents required for inheriting a house (other real estate)

Documents for inheriting an apartment

To register rights to a residential building or other real estate, in accordance with paragraph 3 of the above list, you must provide the following documents for the property:

- title-setting . those. those on the basis of which the deceased became the owner. They can be a gift agreement, sale and purchase agreement, exchange agreement, privatization agreement, inheritance agreement, court decision, etc.

- lawful . certificate from justice on state registration of the right (if a residential building with a privatized land plot is inherited, there must be two certificates - one for each type of property)

- cadastral passport for the property

- certificate from the Bureau of Technical Inventory (BTI). containing information about the inventory value of the property as of the date of death of the testator.

Due to the fact that the BTI certificate indicates the value of the real estate, on the basis of which the amount of the state duty is calculated, the presentation of additional assessment documents is not required.

However, at the request of the heir himself, such a document can be provided.

This is usually done to reduce the amount of the notary fee if the property in the additional document is valued at a lower value than indicated in the BTI certificate.

Documents for the right to inherit a car

Documents for the right to inherit a car

If a vehicle is inherited, the notary will need documents for the car (PTS, vehicle registration certificate).

Note! A power of attorney to drive a car issued by the testator in the name of the heir is not included in the package of documentation necessary for registration of the inheritance. This is explained simply: from the moment of death of the principal, the power of attorney is terminated.

In addition, to calculate the amount of the notary fee, a report (act) on the assessment of transport on the date of death of the testator is required.

Save it or you’ll forget:

What documents are needed to inherit an apartment?

When the heir acquires his new status, he is not always ready for it. As a result, many problems arise. For example, it is not clear what documents to collect to enter into an inheritance.

Documents for inheriting an apartment

Undoubtedly, how quickly and easily it will be possible to register an inheritance for an apartment depends on the correctness and timeliness of collecting documents. This is the most important stage of the entire inheritance process.

- It is better to check the list of documents that will be required in each individual case with the notary who will handle the case.

- To navigate through the variety of papers, certificates and statements, you should carefully study the issue.

- In practice, to register an inheritance for an apartment, you need to provide a notary with a whole package of documents. All the papers included in it can be divided into:

- to mandatory ones. Such documents are required to open any inheritance case

- special. Such documents are necessary to register an inheritance for certain types of property.

Are common

To register any type of property as an inheritance, you must submit certain documents to the notary:

- death certificate of the testator. A document without which there can be no talk of opening an inheritance case. It is issued on the basis of death certificates from the competent authorities in the registry office

- passport of a citizen of the Russian Federation of the applicant. It serves as reliable proof of identity. The document must not be expired

- a document confirming the testator’s recent place of residence. It is most often issued at the passport office or housing authorities at the last place of residence of the deceased

- a document that confirms the complete absence of debt on all payments for utilities. You need to get it from the management company, housing department, etc.

- when the heir was a dependent of the deceased, additional documents relevant to the case are required. (about disability, incapacity, etc.)

- when receiving an apartment by law, documents are required that can reliably confirm the degree and existence of relationship between the heir and the deceased

statement of the heir drawn up by a notary. Thus, it is impossible to register an inheritance without submitting certain documents. In this case, you should prepare copies in advance; they may come in handy. If documents are lost or damaged, they will have to be restored.

Special

In addition to those documents that are required to inherit any type of property, some special papers are required. Such as:

- a certificate that can confirm the absence of debts on payments for utility services. It can be obtained from the management company, housing department, etc.

- passport for the apartment, which contains all the technical specifications. It is issued by the BTI and must be in the hands of the owner

- a certificate confirming the legality of the redevelopment, if any

- a document that is the basis for acquiring ownership of an apartment. This can be any agreement on the basis of which the deceased received an apartment. For example, buying and selling

- property registration. It had to be carried out by the owner in the relevant authorities. Such registration is considered the only objective evidence of ownership of the apartment by the deceased

- apartment appraisal. It allows you to determine the amount of the state fee for registering an inheritance and make the correct division of the apartment into shares, if necessary.

Thus, it is necessary to submit to the notary not only those documents that are mandatory for everyone, but also special ones for inheriting an apartment.

This will have to be done no later than 6 months from the date of death of the testator.

When the deadline expired

What to do when documents are not submitted to the notary within the prescribed period? Where to go and what additional documents are needed?

If the deadline has expired and the application has not been submitted to the notary, there is only one way left - to the court. When you apply there, you will have to write another application, as a result of which the court will consider the matter of inheritance.

To do this, you will need all of the above documents and additional ones. For example, you will have to prove in court that the deadline was missed for an important reason that did not depend on the will of the heir.

To do this, you must submit certificates, contracts and other documents confirming this.

If the reason for failure to appear before the notary was treatment, you should provide data from hospital certificates, cards, extracts, etc.

Thus, to enter into an inheritance, the most important thing for the heir is the timely and correct collection of documents. To inherit an apartment, in addition to general documents, you will have to submit special documents.

They confirm that there is registration of property, that there is no debt for utilities and everything related to this property.

The speed of inheritance depends on how accurately all the requirements for documents are met.

Documents required for registration of inheritance rights. (Inheritance documents)

General documents for all heirs: (Submitted to the notary once for all types of property).

Death certificate (original + photocopy).

A certificate from the EIRC about the last place of residence of the deceased, indicating the persons living together on the day of death.

An extract from the house register indicating the deceased and a note about his deregistration due to death.

Documents confirming relationship with the deceased (birth certificate, marriage certificate, etc.) (originals + photocopies).

If there is a will, a note from the notary who certified it that it has not been changed or revoked6. Title documents for inherited property

When visiting a notary, you must have your passport and money with you.

In order to register an inheritance for an apartment or other real estate, the inheritance first of all needs to establish the appropriate authority.

In order to register an inheritance for an apartment or other real estate, the inheritance first of all needs to establish the appropriate authority.