The purchase of real estate is accompanied by a number of risks for the buyer. The apartment may be encumbered with collateral or third parties may have a legal interest in relation to it.

Such situations are rare; more often we are talking about debts for housing and communal services: water, electricity, gas, and so on.

Let's find out what the consequences of buying an apartment with debts on utility bills can be, how to avoid it and what to do if you still have a debt.

Important information about buying an apartment with debts

The debt for utility services for an apartment in an apartment building is formed from various expense items:

- water supply and sanitation (sewerage);

- electricity;

- gas supply;

- services of a management company or HOA for the maintenance of common property, for example, cleaning of staircases, territory, intercom, elevator maintenance;

- other services provided by a specific management company or HOA under an agreement;

- monthly contributions for major repairs.

Invoices are issued monthly, and if the principal amount is not paid, interest will be charged on payments. Regardless of the amount, this kind of payment debt in itself does not burden the apartment, it is not prohibited to sell such housing - therefore, it is quite possible to buy an apartment with debts on utility bills.

There is only one situation in which Rosreestr will block a transaction for the purchase of an apartment with debts for housing and communal services - if the service organization collects the amount of debt from the owner of the property through the court, and then the bailiff places a security lien on the living space until the entire debt is fully repaid. As long as the apartment does not have a prohibitory note from the FSSP, an apartment with debts can be purchased.

At the same time, the debt carries certain risks for the buyer, who will have to spend time and effort resolving issues regarding its payment after the purchase.

Conclusion. During a transaction for the purchase of housing, not a single administrative authority checks the presence of debts and does not automatically notify the parties of their presence, as, for example, in the case of an official arrest in enforcement proceedings. The buyer will have to check for problems with rent arrears himself.

How to check for debts before buying

In this case, you should not take the seller’s word for it. Before purchasing, it is possible to reliably establish that there is a debt on the apartment only using official documents.

There are several channels of information on how you can check for utility debts before purchasing a home:

- Ask the seller to provide a certificate of absence of debt on utility bills from the management company, homeowners association or other organization servicing the house. This is the main document you should rely on. The certificate must be signed by an accountant and certified by the seal of the organization. The validity period of such a certificate is only 5 days, since outside this period a new debt may be formed.

- If the living space receives not one, but several bills, for example, separately for water and separately for electricity, such certificates must be requested from all utility companies.

- Contributions for major repairs are paid on a separate receipt if the MKD account is managed by a regional fund. It is with the regional fund that before purchasing you need to clarify whether there is a debt on contributions for a specific apartment - management companies or homeowners associations will not be able to provide reliable information.

Note! The accounting department of the utility supply organization issues information only at the request of the current owner. The buyer is not provided with such certificates. Therefore, if the seller refuses to issue a certificate, it is possible that the apartment has a debt of many thousands, which will open after the purchase.

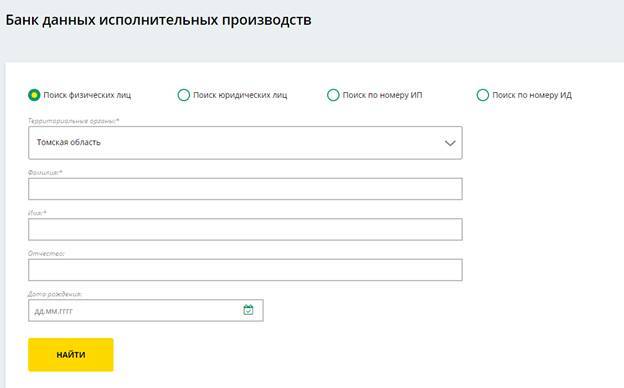

Using an extract from the Unified State Register of Real Estate, you can view records of bans or arrests related to debts that were collected through the court and sent to the FSSP for execution. Before purchasing, you can also check the presence of already “settled” debts for which enforcement proceedings are ongoing using the database of enforcement proceedings. For this:

- Fill in all search fields. You need to enter the name of the current owner of the apartment and his date of birth.

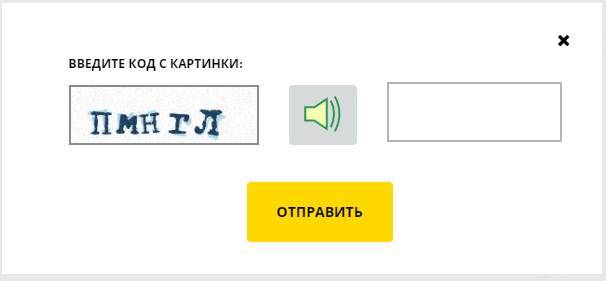

- Enter the code from the picture.

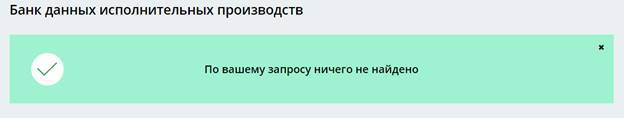

- If the owner has no enforcement proceedings, the picture will be as follows

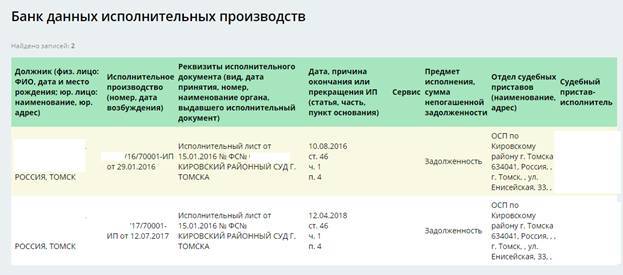

- If there is a debt, then the database will produce the following result. However, the type of debt is not always indicated. These could be utility bills or any other obligations. In any case, there is a risk of imposing a ban on the alienation of the apartment.

Who is responsible for existing debts?

As a general rule, when purchasing an apartment, the debt for utility bills does not transfer to the new owner, regardless of its amount. The moment the new owner takes ownership is the date of state registration of ownership of the apartment under the DCT. Everything accrued before this date is paid by the seller. Everything after that is the buyer.

Often, after the purchase, management companies or homeowners associations mislead new apartment owners about the existing debts of the former owners. It is easier for them to work with a new person than to look for a real debtor, so they in every possible way encourage people to voluntarily pay someone else’s debt. Remember that the following actions of a management company or HOA are illegal:

- the requirement to repay someone else's debt for the maintenance of common property, consumed water, electricity, gas, sewerage, heat;

- threats or disconnection of the apartment from communal resources (for example, if the housing is threatened to be cut off).

If employees of the management company or HOA still disconnect the apartment from utilities in order to force you to pay off someone else’s debt after purchasing the premises, you must immediately contact the local housing inspectorate at the regional administration. The fastest way to do this is by phone, and then duplicate the complaint in writing. Home inspectors tend to respond quickly.

An exception to the general rule is debts for major repairs. The personal account for major repairs is tied to the apartment, and not to the identity of the home owner. Therefore, the entire debt for major repairs that had accumulated at the time of the transaction will pass to the new owner after registration of the purchase.

Attention! Finding a debtor for utility payments is the task of the management company or HOA, not the new owner. However, the debt for major repairs will have to be paid by the buyer.

What to do if you find yourself in rent arrears

If you still have a debt, there are several options for how things could develop. The decision depends on the agreement of the parties and on when this debt came to light.

If the seller does not hide during the purchase that the apartment has a debt on utility bills, then the parties can:

- Draw up a preliminary DCT, according to which the buyer will transfer to the seller a deposit amount sufficient to release the apartment from the debt. After repayment, enter into the main policy agreement.

- You can conclude a preliminary contract without any prepayment, but with a repayment period for the utility debt. If the debt remains, you can painlessly cancel the main deal.

- Agree in the DCP the seller’s obligation to repay the debt before a certain point. In this case, the contract specifies the full amount of the debt.

- Negotiate a reduction in the purchase price, at the expense of which the buyer will pay off the seller’s debt.

If the debt is revealed after the transaction, then the buyer will have to pay off the debt incurred for major repairs, and demands for payment of someone else’s debt for other utility bills can be ignored.

However, if the amount for major repairs is significant, you can go to court with a statement of claim to challenge the purchase and sale agreement on the grounds of misrepresentation.

As a result of the review, the contract will be canceled, the apartment will be returned to the seller, and the buyer will receive the money paid back. The challenge will be successful if the buyer was not warned about the amount of the payment debt.

It is better to discuss the prospects of the case in advance with our lawyer through the online chat form in the lower right corner of the screen.

How to draw up a purchase and sale agreement

A contract for the purchase and sale of an apartment with a debt for utility bills is drawn up in a standard manner, which you can read more about at this link. Debt payments do not require mandatory certification by a notary or obtaining any additional permits from administrative authorities.

But there is an essential feature. If an apartment is sold with payment arrears, this must be clearly stated in the contract, indicating the amount of the debt. Failure to do so may result in the buyer being able to have the agreement voided in court in the future on grounds of misrepresentation. Additionally, you should indicate in what order such debt will be repaid.

Example wording: “The seller declares an existing debt on utility bills in the total amount of 30,000 rubles, of which 5,000 rubles is debt on contributions for major repairs; 25,000 rubles – debt for utilities and maintenance of common property to LLC “UK Zhilishche-98”. The seller undertakes to repay this debt in full by September 15, 2022.”

Buying apartments with debts at auction

The purchase of apartments at auction is carried out if the housing was repossessed for any debt - not only for utility debt.

Most often we are talking about mortgaged apartments, the loan for which the owners were unable to repay, as well as premises seized by bailiffs for other large obligations.

The repurchase can be made from the creditor bank or from the budget, depending on whose balance sheet the housing is located.

More information about buying apartments at auction can be found at this link.

Buying an apartment with debts on utility bills can add problems for the new owner with the management company, HOA, resource supply organizations and the capital repair fund. Therefore, it is necessary to check in advance whether there is a debt on housing and in what amount.

Still have questions about the topic of the article? Ask them to our lawyer in the online chat in the lower right corner of the screen.

- We will be grateful for your like and repost of the article!

- You may be interested in: repurchase of a mortgaged apartment from Sberbank.

What rights does a person who bought an apartment with debts on utility bills have, and what should he do according to the Civil Code of the Russian Federation?

- In contact with

- Classmates

There are situations when, after completing all the paperwork and registering the transaction with Rosreestr, the person who bought the property learns about the existence of a utility debt.

This article describes in detail what rights a person has who, for one reason or another, bought an apartment with certain debts for utilities.

According to the legislative norms of the Russian Federation, debts for utilities are not an encumbrance and the purchase is not prohibited. The only exception can be a separate court decision.

The law clearly states whether the new owner is obliged to answer for the debts of the old one: he does not have to pay for them, but has the right to take upon himself the solution to the problem that has arisen - this is an objective reason to reduce the sale price.

All owners of real estate belonging to the housing stock, in accordance with clause 5, part 2, article 153 of the Housing Code of the Russian Federation and clause 1, art. 131 of the Civil Code of the Russian Federation are obliged to:

- Pay fees for the maintenance of the premises on time and in full, as well as pay for services and work required to manage the apartment building.

- Contribute funds for capital repairs of the building.

- Pay utilities.

The provisions of Article 210 of the Civil Code of the Russian Federation determine who must pay rent arrears : the new owner of the apartment is not responsible for the accumulated debts of the previous owner, since the obligation to pay for housing and communal services lies with the owner and is not tied to the property. The exception is debt for major repairs - it will have to be paid by the new owner.

Paragraphs 1 and 2 of Article 391 of the Civil Code of the Russian Federation also state that the new owner can accept obligations to pay the debt for housing and communal services of the previous owner only after signing an agreement on the transfer of debt. If the buyer has not expressed a desire to take on someone else’s debt, the purchase and sale agreement and the transfer deed should separately indicate the corresponding debt. points.

What to do if they demand payment of utility bills?

Immediate action

Immediately after registering the transaction in Rosreestr, the new home owner should:

- Invite representatives of utility service provider organizations to take meter readings.

- Receive from each of them certificates with data on meter readings and the amount of accumulated debt, current as of the date of entry into rights.

- To the director of the management company or the chairman of the homeowners association, draw up a statement in 2 copies stating that from the moment of registration of ownership, the owner undertakes to pay for housing and communal services and the requirement not to issue future invoices to pay the debt that arose before the actual transfer of rights. It should be noted that if receipts are received with the debt of the previous owner, the actions of the management company will be regarded as extortion (according to Article 163 of the Criminal Code of the Russian Federation).

What should I include with my application?

- A copy of the title document (sale and purchase agreement, etc.).

- An extract from Rosreestr indicating state registration of property rights.

- Certificates issued by representatives of companies providing housing and communal services.

Documents must be submitted to the office of the management company against signature or sent by registered mail with acknowledgment of receipt.

The response must be received no later than 30 days after the documents are submitted.

Further procedure

If your application does not produce the expected result:

- File a complaint with the housing inspectorate . This government oversight body monitors the accuracy and accuracy of billing for utility services provided. If the management company unreasonably continues to include someone else’s debt in receipts, this will be recognized as a violation, and if it is identified, housing inspectorate specialists will conduct an inspection and order the management company to carry out recalculation actions.

- Contact the realtor who handled the transaction . If the real estate purchase and sale agreement was signed with the participation of a real estate agent, a claim can be made against him due to poor quality of services. According to Article 29 of the Federal Law “On the Protection of Consumer Rights,” a new homeowner may insist on the return of part of the fee previously paid to the realtor on the basis of his poor quality work, in particular, poor preliminary verification of the legal purity of the transaction.

- Contact the prosecutor's office . This is the highest supervisory body to which citizens can appeal to appeal the actions of organizations and authorities, including the management company.

About fees for major repairs

The obligation to contribute funds for major repairs of an apartment building passes after signing the purchase and sale agreement to the new owner. If the previous owner had arrears in contributions, the new owner of the premises will also have to pay it (in accordance with Part 3 of Article 158 of the Housing Code of the Russian Federation).

An exception to the rules are those properties that were previously owned by state authorities and local municipalities. In this case, the existing debts will be covered by the previous owners.

In such cases, to register, you should contact the Main Migration Directorate of the Ministry of Internal Affairs of the Russian Federation directly. An application for deregistration at the place of previous registration and for registration at a new address can be submitted at the same time. The most convenient way to do this is through your personal account on the State Services portal.

What to do if the Internet and TV are disconnected?

Necessary:

- Contact the provider's office.

- Request a copy of the contract for the provision of services concluded by the former owner of the property and study it, paying attention to the rights and obligations of the user. Particular attention should be paid to the paragraph on possible debts and arrears.

If the agreement was bilateral in nature, then, according to the laws of the Russian Federation, the new owner of the property does not bear financial responsibility. The services were provided to the former owner and he had to pay in accordance with the terms of the signed agreement.

If the company insists on paying the debt, then it is necessary to write a statement addressed to its director with a demand to remove the obligation on the basis that the company did not enter into any agreements with the new owner. If after this the owner continues to receive notifications demanding payment of the debt, he should write a statement to the prosecutor’s office about the illegality of the actions of the provider company.

When faced with claims from the management company and housing and communal services providers, you should remember that judicial practice provides reliable protection for the new owner of the apartment from unreasonable demands for payment of someone else’s debt.

If you find an error, please select a piece of text and press Ctrl+Enter.

- In contact with

- Classmates

Is the previous owner obligated to pay debts for major repairs?

An apartment is not a cheap purchase, so when concluding a transaction you should not rely on the honesty and decency of its owner. Judicial practice shows a lot of excitement around this issue - new owners, after paying a large sum, discover the fact of fraud, while the culprit is rarely found.

Another common problem is debt for major repairs from the previous owner. The reason for falling for any of the tricks regarding property issues is the buyer’s negligence in checking all the documents.

Without examining documents, checking all receipts, or trusting the recommendations of friends, you can irrevocably lose your money.

Who is responsible for paying debts?

Property legal relations are regulated by the norms and provisions of the “Housing Code of the Russian Federation” dated December 29, 2004 No. 188-FZ, as amended and supplemented.

Starting from January 2013, homeowners in apartment buildings are required to pay for funds spent on major repairs.

It is calculated based on the square footage of the premises registered with the owner.

Paragraph 3 of Article 158 of the RF Housing Code regulates two scenarios for the development of events:

- Obligations to pay the debt are assigned to the owner of the property, regardless of when they arose. That is, the new owner who bought the property from an individual who owes money to the state for major repairs is obliged to pay them himself.

- If the previous owner was a government body or a subject of the Russian Federation, a municipal or public entity, the debt obligations will not be transferred to the new owner. If he decides not to risk it and pays the debts owed by the state or municipality, then the entire amount is transferred to the account for future payments.

Note: if the debt for utility resources used for normal life - electricity, gas, water, heat and electricity is registered with the person, and will not be transferred to the new owner, then unpaid payments for major repairs belong to the apartment, that is, debts for major repairs are transferred to a new owner.

Home inspection before purchasing

In order not to have to go to court with an application against your predecessor to collect debts from him for major repairs, it is worth carefully checking how regularly he paid for the services for the maintenance of common property in the apartment building in which his apartment was located.

Before buying an apartment, you should make sure that there are no debts on it

Before concluding a purchase and sale agreement, you must request:

- The seller has receipts confirming that he has paid all contributions for major repairs in the prescribed amount. On the day of sale, the owner should not have any debt.

- The paying agent, homeowners association or management company has a statement of the personal account of the owner who decided to sell the property. It reflects all debts. The potential buyer has the right to request such documents.

Note: if the new management company began to fulfill its obligations after the registration of ownership of the property by the seller, the relevant documents must be requested from its predecessor. This will delay the process, but the buyer will be able to make sure that there are no debts and avoid problems in the future.

In some regions of Russia, an online service has already been launched that allows you to track information whether receipts for utilities and major repairs have been paid at a specific address. This system speeds up the process, because there is no need to wait until the documents are sent to the manager by mail.

Sometimes the seller unknowingly leaves such debts, forgetting in the hustle and bustle to pay the receipts received in recent months.

This issue can often be resolved amicably by showing a certificate issued by the HOA or management company, which confirms that the bills were not paid for the period when the seller was registered as the owner of the apartment.

Conscious citizens make such payments voluntarily; the matter does not come to court proceedings.

How to buy an apartment with debts

Next, you should find out whether it is possible to sell an apartment with a debt for major repairs. It is relevant both for unscrupulous sellers and for buyers who are careless in checking all documents and receipts. The question is clear - such a possibility exists, and the debts are transferred to the new owner of the apartment along with the property.

A properly drafted purchase and sale agreement will help protect yourself

In order to somehow protect yourself and be able to legally recover the appropriate amount from the seller, you must:

- In the purchase and sale agreement, include a clause obliging the seller to provide receipts confirming the fact of payment for major repair services for the entire period of ownership of the property.

- Request receipts. Even if the seller provides fake documents, it will be easier for the buyer to prove his case in court.

Having bought an apartment with debt for major repairs, you should know how not to incur additional expenses after purchasing the property. Having the above documents in hand, you can safely go to court. In this case, it is advisable to pre-pay off the debts and demand full compensation from the previous owner.

Note: if we are talking about a small amount of debt, and the previous owner refused to pay it voluntarily, it is not always advisable to go to court. You will have to spend a lot of time and effort, as well as pay legal fees.

Who is exempt from paying contributions?

The following are exempt from payments for major repairs:

- residents of emergency housing;

- owners of apartments in multi-storey buildings subject to demolition;

- owners of property located on a land plot seized by state or municipal authorities.

The legislation provides for subsidies for disabled people and unemployed pensioners. To register it in 2018, you will have to confirm that the owner of the property belongs to one of these categories.

- Experts recommend: to avoid problems after the purchase, you should make sure that there is no debt for major repairs when selling the apartment, and also check the authenticity of all other documents.

- From the video you can learn about the debt for major repairs to the new owner:

-

Debt for major repairs is purchased along with the apartment

It happens that after purchasing an apartment, it turns out that this apartment has a debt to pay contributions for major repairs. The buyer has a lot of questions about who should pay off the debt and where to go.

Typical example:

An apartment was purchased on the secondary market through a Sberbank mortgage; the documents were verified only by Sberbank itself. Three months later, it turns out that this apartment has a debt for major repairs in the amount of 40 thousand rubles.

This is what paragraph 3 of Art. 158 of the Housing Code of the Russian Federation:

The obligation to pay the costs of major repairs of common property in an apartment building applies to all owners of premises in this building from the moment the ownership of the premises in this building arises.

When the ownership of premises in an apartment building is transferred to the new owner, the obligation of the previous owner to pay the costs of major repairs of common property in the apartment building, including the obligation not fulfilled by the previous owner to pay contributions for major repairs, is transferred to the new owner, with the exception of such an obligation not fulfilled The Russian Federation, a subject of the Russian Federation or a municipal entity that is the previous owner of premises in an apartment building.

That is, if the apartment did not belong to the state before the new owner, then the debt to pay contributions for major repairs that the former owner of the apartment accumulated goes to the new owner of the apartment.

In such a situation, you need to understand the difference between fees for major repairs and utility costs. The debt to pay for utilities remains with the previous owner of the apartment; the new owner can receive only the debt for major repairs with the purchased apartment.

It turns out that when buying an apartment on the secondary housing market, the buyer himself must find out whether this apartment has debts for major repairs. You can request receipts from the seller or obtain information from the management company.

If the buyer of the apartment did not do this, then it is actually considered that he agreed to buy the apartment with accumulated debt. Perhaps this was the reason to get a discount.

Much may depend on the terms of the purchase and sale agreement. It may state that there is no debt and the seller of the apartment is responsible for this. It may be directly stated that in accordance with paragraph 3 of Art. 158 of the Housing Code of the Russian Federation, the buyer accepts the apartment with the obligation of the previous owner to pay the costs of major repairs of common property in the apartment building.

You can go to court with a claim for termination of the contract, in accordance with Art. 450 of the Civil Code of the Russian Federation, in connection with significant violations of the contract by the seller, again, if there is a clause in the contract that can be “caught on”.

If it was not possible to terminate the contract, after repaying the debt, you can subsequently collect this debt from the previous owner of the apartment, but only through the court, by way of recourse. To do this, you will need to provide evidence that the debt accumulated before the purchase and sale transaction.

There is only one conclusion and it is simple - in order to avoid unnecessary problems, it is necessary to check the apartment for the presence of arrears in payment of contributions for major repairs of common property in an apartment building.

We bought an apartment with housing and communal services debts...

You decided to move and bought an apartment. The transaction went smoothly, we received a certificate from Rosreestr. Let's go register with the management company. And then they tell you that there will be no registration until you pay off your utility debt...

Common situation? Alas, yes. Not all apartment sellers are conscientious, and even conducting a transaction with a realtor is not a 100% guarantee that there will be no problems with your new home. What can you advise a new apartment owner if they are trying to bill him for the debts of the previous owner?

What does the law say about buying an apartment with utility debts?

In this case, the law is on the side of the new apartment owner.

Article 153 of the Housing Code of the Russian Federation directly states that the obligation to pay for utilities and maintenance of housing for the owner of an apartment, room and other housing arises from the moment of acquiring ownership of this living space.

From a legal point of view, this moment is considered the date of issuance of a certificate of ownership to the new owner of the apartment. Accordingly, all housing and communal services debts that arose before this date must be repaid by the previous owner of the apartment.

However, there is an important nuance here: sometimes the new owner of the apartment still has to pay off the debts of the old owner for utilities. This happens if, when transferring the apartment, you completely forgot to check and record the meter readings.

In this case, it is difficult to establish what readings were on the water or electricity meters at the time when you received the apartment. It would be good if the previous owner at least regularly transmitted the evidence to the management company.

If the testimony was not transmitted at all, or the old owner of the apartment regularly underestimated it, the amount of the debt may increase significantly.

To avoid paying off utility debts for the old owner of the apartment, make an act of acceptance and transfer of the apartment in 2 copies and sign it together with the seller. In the act you need to note the meter readings for water, heating, electricity, gas on the actual date of transfer of the apartment.

The management company demands to repay the debt of the previous owner of the apartment

Alas, management companies and HOA chairmen do not always know the law well. A very common misconception among utility workers is that the debt does not rest with the owner, but with the apartment itself. Actually this is not true.

If the previous owner moved out without paying for utilities, his debt does not go away and does not transfer to the new owner of the apartment.

If the debt is not paid, the management company can always collect the debt for housing and communal services from the old owner in court - which, by the way, is the direct responsibility of the management company, for which the residents pay it money. The new bona fide owner of the apartment should in no way suffer for the “sins” of the previous owner.

Most often in this unpleasant situation, the management company threatens:

- “Until you pay off the debt, we won’t issue your registration.”

- “If you don’t pay, we will turn off your water.”

- “Pay now, or we’ll charge you a penalty.”

All this, of course, is illegal.

The debt for contributions for major repairs is transferred to the new owner of the apartment

We will separately discuss the situation with contributions for major repairs. Part 3 of Article 158 of the Housing Code states that the obligation to pay the costs of major repairs in apartment buildings arises for the owners from the moment the ownership of the premises in the house arises.

However, in the event of a transfer of ownership (for example, when selling an apartment), all obligations of the previous owner of the apartment to pay the costs of major repairs are simultaneously transferred to the new owner.

That is, debts on contributions for major repairs remaining from the previous owner will have to be repaid by the new owner of the apartment.

An exception to this rule is provided by law for apartments that previously belonged to the Russian Federation, constituent entities of the Russian Federation or municipalities: they will have to pay off their debts on contributions for major repairs until the transfer of ownership to the new owner.

What to do if the apartment has debts from the previous owner?

- Immediately inform the management company about the change of owner of the apartment.

As soon as possible after registering the transaction with Rosreestr and receiving a certificate of ownership of the apartment, go to an appointment with your management company or the chairman of the HOA.Bring a copy of the certificate of ownership or an extract from the Unified State Register for the apartment, as well as a copy of the apartment acceptance certificate with meter readings and ask to change the information in your personal account. Now all bills for housing and communal services should be issued in your name, and without other people's debts.

- Write a complaint to the management company.

If the employees of the management company insist that you should cover the debts of the previous owner of the apartment, first politely describe the situation to them and refer to the legislation (Article 153 of the Housing Code of the Russian Federation). In many cases, a competent conversation helps to remove all complaints. Couldn't you reach an agreement? Submit a written application addressed to the director of the management company or the chairman of the HOA.

In this statement, in any form, again describe the whole situation, quote the law, and attach copies of documents for the apartment. Print the application in 2 copies so that the management company signs for its receipt on your copy.

- File a complaint with the housing inspector.

This government body monitors the correctness of payment for utility services.If the management company unreasonably includes other people's debts in the receipt, this is a violation. The Housing Inspectorate can verify the correctness of charges for utility services and issue an order to the Criminal Code to recalculate.

- Write a complaint to a real estate agent.

If a realtor handled the purchase and sale of an apartment for you, we recommend filing a claim with him due to poor quality of services. According to Article 29 of the Russian Federation Law “On the Protection of Consumer Rights,” you can, for example, ask to return part of the cost for the poor work of a realtor who poorly checked the legal purity of the transaction.

The management company refuses to register due to the debts of the previous owner

Some particularly persistent management companies may create problems when registering for a new apartment, refusing to accept passports of the new owner and members of his family.

If passport officers from the management company make the possibility of registration subject to the condition of repaying the debts of the old owner of the apartment, apply for registration in a new apartment directly to the Main Directorate for Migration of the Ministry of Internal Affairs of the Russian Federation in your city.

An application for deregistration at the old address and for registration at the new address can be submitted simultaneously. It is convenient to do this through the State Services website.

How to register for State Services without queues and passport officers?

How not to buy an apartment with debts for housing and communal services and major repairs?

- Request confirmation of the absence of debts for housing and communal services and major repairs.

Before signing any contracts, transferring money and registering with Rosreestr, ask the owner of the apartment to document that he has paid off all his debts for utilities and contributions for major repairs. Let him show you a certificate from the management company, energy sales, water utility (if utilities are paid directly by them), or the regional capital repair fund about the absence of debt. - Check the apartment yourself.

There are many publicly available methods that will allow you to check the integrity of the transaction and the absence of debts.

You can call the management company or check the list of debtors on its website, look at the amount payable in the Sberbank payment terminal (by apartment address, personal account number). It is also worth checking the owner of the apartment and all residents according to the Bank of Enforcement Proceedings of the Bailiff Service. We have detailed instructions for checking the apartment you are buying on our website:

How to check the apartment yourself before buying? - Record meter readings.

If the apartment has individual meters for electricity, water, heating, gas, be sure to check their readings. When signing the apartment transfer and acceptance certificate, reflect in it the final meter readings with which the previous owner gives you the apartment. In case of disputes with the management company, you will have documentary evidence of the testimony for which the previous owner is responsible. Additionally, you can ask the management company, in connection with the upcoming sale of the apartment, to check the accuracy of the readings taken by the old owner of the apartment.

photo: Alan Cleaver, flickr.com, CC BY 2.0

Article from the Vesti Prava website. Legal advice

What to do if you bought an apartment with debts on utility bills?

The process of buying an apartment has always been quite troublesome and difficult, as it required close attention to all the nuances, including legal ones. One of the main problems that you may encounter when purchasing housing on the secondary real estate market is debts for housing and communal services of the previous owner.

Of course, you might think that there is nothing wrong with this, but it is worth remembering: such a debt can turn out to be a fairly large amount (for example, several hundred thousand rubles), which will unpleasantly surprise the new owner.

All legal owners of residential real estate, in accordance with clause 5, part 2, art. 153 Housing Code of the Russian Federation and clause 1 of Art. 131 of the Civil Code of the Russian Federation, are required to contribute:

- Payment for the maintenance of the premises, including services and work for managing an apartment building; current repairs and maintenance of common property (expenses for cold and hot water, electrical and thermal energy); wastewater disposal;

- Funds for major repairs;

- Payment for utilities (hot and cold water supply, sewerage, electricity and gas supply, heating).

Important! Art. 210 of the Civil Code of the Russian Federation states that the new owner of the apartment, according to the general rule, is not liable for the debts of the previous owner, since the obligation to pay for the premises and utilities lies with each owner.

The only exception is the obligation to contribute funds for major repairs in an apartment building, which is transferred from the previous owner of the residential property to the new one. In addition, if the previous owner of the apartment had a debt on these contributions, then the current owner will have to pay it off (Part 3 of Article 158 of the Housing Code of the Russian Federation).

According to paragraphs 1, 2 of Art.

391 of the Civil Code of the Russian Federation, a new owner of residential real estate can accept obligations to pay for utilities of the previous owner only after a debt transfer transaction has been completed, which is carried out with the consent of both parties.

If the buyer of an apartment does not express a desire to take on someone else’s debt, then it is advisable to include clauses in the purchase and sale agreement and the transfer and acceptance certificate stating that all obligations for non-payment of utilities remain with the seller.

If a situation occurs where residential real estate was purchased with utility debts, then you can defend your legal rights and still not repay these debts in the future by following these steps:

- Request a certificate from the previous owner of the apartment about the status of the debt , and in the absence of one, you should independently contact the management company, HOA or residential complex to obtain the necessary information. If the listed organizations began managing the house later than the date of registration of the seller’s ownership, then in this case a certificate of debt status will be provided by the previous responsible company;

- Notify the management company, HOA or residential complex about the change of owner of the apartment by writing a statement and attaching to it a copy of the purchase and sale agreement and a certificate of registration of ownership;

- Notify the previous owner of residential property about received demands to repay the debt for utility services for the period when he was the current owner of the apartment. Perhaps the previous owner will voluntarily fulfill his obligations.

Conclusions - what to do if you bought an apartment with rent arrears

If the purchased apartment turns out to be in debt, then even in this case the law is always on the buyer’s side, but hassle still cannot be avoided. A document confirming the owner’s responsibility for paying housing and communal services bills - Art. 153 part 2 clause 5 of the Housing Code of the Russian Federation.

It states that the owner of the property is obliged to pay bills for rent and utilities “from the moment the ownership of the residential premises arises . Consequently, the new owner has every right not to take on other people's debts.

Very often situations arise when the management company begins to demand that the current owner of the apartment repay debts for previously provided services that he did not use.

That is, there is a conflict of interests: on the one hand, the new owner, who has the right to pay only his own bills, and on the other, the management organization, which can demand payment for its work for three years until the statute of limitations expires.

The only way out of this situation is to agree with the seller of the apartment to sign a purchase and sale agreement with the condition that the agreement will come into force only upon registration of the transaction.

In addition, the buyer must , between the registration of the purchase and sale agreement and the issuance of a certificate of ownership, but before accepting the housing, go to the management organization to open his personal account so that the debts of the apartment seller remain on his account.

Additionally, it is recommended that both the previous owner and the current owner record all current meter readings in the transfer and acceptance certificate of residential real estate , which will oblige the seller to pay for the services he consumed. And the management company will be required to enter into new agreements with electricity and gas suppliers.

Dear readers! If you still have questions on the topic “What to do if you bought an apartment with debts on utility bills?” or have any other questions, ask them right now - use the online consultant form or call us at 8(800)-350-30-02 (the call and consultation are free for all regions of Russia)!

Share:

No comments yet

Is it possible to sell an apartment with a debt for major repairs?

Wavebreakmedia/Depositphotos

The lawyer of the national legal service "Amulex" Dmitry Tomko answers:

Yes maybe. In this case, in order to avoid additional expenses, it is advisable for the buyer, before completing the transaction, to make sure that there are no arrears in payment for housing and communal services by the previous owner, in particular, contributions for major repairs. Otherwise, he will have to pay debts on contributions for major repairs to the previous owner of the property.

Can I sell or exchange an apartment with a debt?

Should I sell my apartment now or is it better to wait?

Elena Mishchenko, head of the urban real estate department of the northeastern branch of the NDV-Real Estate company, answers:

In this case, you can purchase an apartment with debts and pay them off, essentially, with your own funds. In other words, the seller will not receive exactly the amount that he owes to the utility services.

If such transactions are carried out. We recommend obtaining a certificate of the amount of debt for major repairs and be sure to indicate in the purchase and sale agreement that you undertake to pay part of the cost of the apartment, covering the seller’s debt for major repairs after state registration of the transfer of ownership to your name.

Thus, on the transaction you deposit money in the amount of the cost of the apartment minus the debt for major repairs.

Answered by lawyer, K. Yu. n. Yulia Verbitskaya:

As a rule, before selling real estate, the buyer checks that the seller has no debts on utility and other payments, including deductions for major repairs.

In most cases, on the date of conclusion of the contract, the absence of obligations is recorded in a separate clause in the purchase and sale agreement itself.

But it often happens that after concluding an agreement and registering it with Rosreestr, overdue debts “pop up”, including those related to the recalculation of utility rates and deductions for major repairs.

If, after concluding an agreement for the purchase and sale of an apartment and transferring ownership of it, you receive payments from previous periods, you need to immediately contact the seller and inform them of the need to pay them before signing the acceptance certificate for the apartment.

If the seller refuses to pay this debt, you can inform the management company so that it sends this invoice to the proper person - the previous owner. Or you can pay the debt yourself and subsequently demand compensation from the seller in court.

Can I sell retail space if I have debts for other properties?

How to exchange an apartment that is under arrest?

Dmitry Rukhanov, head of the legal service of the law firm LawPro24.ru, answers:

Unfortunately, the debt for major repairs falls on the shoulders of the new owner. And there is no option to refuse to pay the former owner’s debt. The law says that the debt for major repairs passes to the next owner. It is believed that such a debt is assigned not to the owner, but to the property.

It is worth noting that in 2016, the State Duma considered the possibility of assigning the debt for major repairs to the previous owner.

However, the State Duma Committee on Housing and Communal Services did not support the proposal, and it was rejected. So at the moment, debts for major repairs are assigned to the new owner.

Debts of the former owner for electricity, water and heating are not transferred to the new owner, unlike debts for major repairs.

In order to avoid problems when buying an apartment, it is necessary to check how conscientiously the previous owner made all the necessary payments.

To do this, before concluding a purchase and sale agreement, you must request receipts from the seller confirming the fact that he has paid all contributions for major repairs in the prescribed amount. On the day of sale, the owner should not have any debts.

In addition, you need to order a statement of the seller’s personal account. It is in this certificate that all debts are reflected.

To protect yourself when buying an apartment, it is also recommended to include in the purchase and sale agreement a clause that obliges the seller to provide receipts confirming the fact of payment for major repair services for the entire period of ownership of the property. And request such receipts. In this case, it will be much easier to prove your case in court.

If the apartment has already been sold and the new owner has received ownership, there is a small chance of recovering money from the seller through the court. But you will have to prove that you were deceived and, for example, when completing the transaction, fake receipts for payment of the debt were provided.

But in any case, the new owner will have to pay off the debts, as required by law, and only then try to compensate them through the court. Unfortunately, the chances that the trial will end successfully for you are extremely low.

However, if you follow the above recommendations, it still exists.

Buying an apartment with an encumbrance

Do I need to pay for major repairs?

Director of Amethyst Group of Companies Andrey Tolochko answers:

The owner can sell an apartment with a debt for major repairs. In accordance with Part 3 of Art. 158 of the Housing Code, the new owner will be required to pay the debt.

When making a transaction for the purchase and sale of an apartment, the buyer can request from the settlement and information center (RIC) information about the debt of the previous owner to pay for housing and communal services and to pay for major repairs. Debts for housing and communal services must be repaid by the previous owner. This burden does not fall on the shoulders of the new owner.

However, debts for major repairs are legally assigned to the apartment. And, unfortunately, the new home owner cannot be freed from paying the debt even through court proceedings. The buyer can negotiate with the seller an additional discount on the apartment in the amount of the overhaul debt.

We advise real estate buyers to carefully check all documents for the apartment in advance, including the payment history of the owners, so as not to get into such situations and not take on the debts of previous owners.

- Text prepared by Maria Gureeva

- Do not miss:

- All materials in the “Good Question” section

- Is it possible to return contributions for major repairs paid on old bills?

- Are major repairs included in utilities?

- 25 texts on how to sell an apartment, room or share

The articles do not constitute legal advice. Any recommendations are the private opinion of the authors and invited experts.

The provisions of Article 210 of the Civil Code of the Russian Federation determine who must pay rent arrears : the new owner of the apartment is not responsible for the accumulated debts of the previous owner, since the obligation to pay for housing and communal services lies with the owner and is not tied to the property. The exception is debt for major repairs - it will have to be paid by the new owner.

The provisions of Article 210 of the Civil Code of the Russian Federation determine who must pay rent arrears : the new owner of the apartment is not responsible for the accumulated debts of the previous owner, since the obligation to pay for housing and communal services lies with the owner and is not tied to the property. The exception is debt for major repairs - it will have to be paid by the new owner.