Alimony is withheld by the employer on the basis of a writ of execution from bailiffs. The procedure for deducting child support from wages in 2023 is presented step by step in this article. The material takes into account changes in 2023 and news for accountants.

The article provides information about the indexation of alimony. From April 13, 2023 - new rules on child support!

Child support in 2023: new law

Step No. 1. Register a writ of execution and notify the bailiffs and the employee

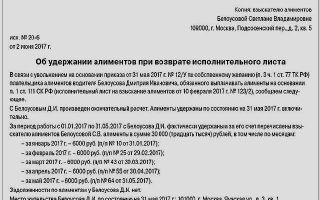

The accounting department withholds alimony if it receives writs of execution, court orders, or a notarial agreement of the parents on the payment of alimony. Previously, alimony was withheld only based on original papers, but in 2023, bailiffs have the right to transfer a copy of the writ of execution to the company (Article 2 of Federal Law No. 101-FZ of May 28, 2017).

The mother of the child who demands alimony has the right to send only the original writ of execution. If you receive a copy, ask for the original.

On the day the accounting department received the executable sheet, the accountant must send a notification to the bailiff. In it, indicate the incoming number and date of receipt of the document, the telephone number of the organization. The notification is signed by the manager and certified with a seal, if any.

Notify the employee from whom you will withhold alimony about the writ of execution. The law doesn't say how to do this. For example, make a column in the writ of execution log for the employee’s signature. It is not necessary to give him a copy of the writ of execution.

Store all executive documents as strict reporting documents in a safe. For more information on how to act if you need to withhold alimony from an employee under a writ of execution, see the article “The employee pays child support.”

Step No. 2. Calculate and withhold alimony

The amount of alimony is determined by the court. Typically this is 1/4 of the employee's income for one child, and for two children - 1/3 of the employee's income. From what payments and in what amount to withhold alimony, see the article “How to withhold debts from employees’ salaries according to the new rules.”

Child support percentage

Below we have presented a table from which you can find out what percentage of the salary alimony is withheld depending on the number of children. But let us emphasize once again that the final percentage is determined by the court.

Child support in 2023: new withholding rules

In 2023, you need to take into account new rules when you withhold child support. In particular, now alimony needs to be indexed. You will learn the rules for withholding child support in 2023 in the article.

New rules for withholding child support in 2023

In 2023, companies must index alimony payments based on writs of execution received from bailiffs (Federal Law No. 321FZ of November 14, 2017).

A detailed example of how to index alimony was given by experts from the Glavbukh Magazine.

Previously, alimony was recalculated only according to writs of execution that were received from the claimant. For the remaining sheets, the bailiffs sent ready-made figures to the company every quarter.

Index alimony if the court determined it to be a fixed amount. You need to adjust it by the percentage increase in the cost of living. Typically, the indicator for a quarter is determined after its end. In this case, for the calculation you need to take the value that was accepted in the region where the recipient lives.

Regional authorities usually set their indicator within a month after the federal one. If this does not happen, the federal value must be applied. Alimony is not recalculated if the indicator has decreased or remained the same. To calculate, select the value for the category of the population to which the alimony recipient belongs. For example, the minimum wage for children.

Amount of child support in 2023: how much percentage to withhold

In exceptional cases, an organization can withhold from an employee up to 70 percent of his income. Penalties in this amount are possible:

- if alimony is withheld for the maintenance of minor children (including for debts for previous periods);

- if damage caused to the health of another person is compensated;

- if damage is compensated to persons who have lost their breadwinner;

- if the damage caused by the crime is compensated.

In what cases is 75% of the salary allocated for the collection of alimony?

Part of the funds can be transferred to the child’s personal account if the payer suspects the recipient of misuse of alimony. To achieve this opportunity, you will need to present to the court the facts of embezzlement of money for the personal needs of the recipient.

The grounds for appeal may be the unlawful lifestyle of the ex-spouse, alcohol abuse, drug abuse. Card holder The holder is a client with whom the bank enters into an agreement to service the card and whose signature is placed on the magnetic stripe.

Please note that the father may try to transfer some of these funds to the child’s account if he proves through the court that the mother is spending the money inappropriately.

Thank you for your attention.

But even when families break up, former spouses still have the responsibility to support their children, which not everyone is willing to fulfill voluntarily. Therefore, your accounting department may receive a document providing for the withholding of alimony for minor children from income under Art.

“Alimony” guide for an accountant

The amount of alimony that will be deducted monthly from the salary of the person receiving alimony consists of several components and directly depends on the method of calculating payments to the child - shared withholding or in a fixed sum of money.

If the alimony recipient is unemployed or has unstable earnings, for example, is an individual entrepreneur, receives a salary in foreign currency, etc.

In situations where the alimony provider has incurred arrears in payments, the percentage of deduction from wages or other income by law can be no more than 70 percent; this maximum is established by Part.

The maximum withholding of child support from wages in the amount of 70 percent applies only to child support obligations in relation to minor children.

That is, for example, this condition does not apply if alimony is paid for the maintenance of a spouse, parent or other relative - in these situations, the amount of deductions under executive documents cannot exceed 50 percent.

The amount of child support payments is established by a notarial agreement between the child’s parents or a court decision and directly depends on the following factors:.

If there is no alimony debt for the person obligated to pay, the amount established in the agreement or court decision will be deducted monthly from his income, no more or less, since the basis for deduction from wages is the above-mentioned agreement or writ of execution and the requirement stated in it .

In itself, the amount of monthly alimony deductions cannot change either up or down without the payer or recipient filing a lawsuit to change the amount of alimony or the method of assigning it under Art.

The only exception is alimony in a fixed amount (hereinafter referred to as TDS), which is subject to quarterly indexation in proportion to the increase in the cost of living per child in the region of his residence, that is, as the cost of living increases, the TDS will also increase each time.

The obligation to index alimony now lies entirely with employers. The law is dated. If payments are assigned to 3 or more children, according to Art.

If among the needy children there is a disabled child, naturally, a larger amount should be spent on his maintenance than on other children, however, they should not receive payments that infringe on their normal life activities.

In such situations, the court may immediately order the withholding of 70 percent of the income of the alimony payer, see

Recipients of funds are satisfied with this state of affairs, but payers find it illegal, and they seek to appeal such actions of bailiffs, the accounting department of the enterprise at their place of work, or even the court decision itself.

Indeed, errors and inaccuracies in the calculations of bailiffs when making decisions on the calculation of debts or accounting departments at the place of work that make deductions are often not excluded.

Therefore, a conscientious alimony payer must treat such situations with great attention.

If an error was made by officials when calculating alimony or arrears, the person who made this error must return the excessively withheld funds to the payer.

If the monthly write-off of a percentage of wages or other periodic income has become the harsh reality of the debtor, there is a way out of this situation, but not for everyone.

In particular, valid reasons for the unintentional formation of alimony debt are:.

If there are really good reasons, the debtor has the right to appeal to the magistrate's court with a statement of claim for full or partial exemption from payment of alimony debt to reduce its amount in accordance with Art.

To the Magistrate's Court of the Fokinsky District of Bryansk, Bryansk, st. Sadovaya, Plaintiff: Mikhail Yuryevich Andropov, Koroleva, village Defendant: Irina Vyacheslavovna Andropova, Krasnoarmeyskaya, village Statement of claim for exemption from payment of alimony debt.

Based on the writ of execution from At the time of collection of alimony payments, I had a permanent place of work, my salary was 15 rubles. In addition to alimony payments, I regularly congratulated my daughter on her birthday, March 8, Knowledge Day, New Year, gave gifts, sometimes purchased items of clothing and shoes, although rarely, I brought food.

While communicating with the child, we did not maintain a relationship with my wife. In April of this year, there was a reduction in staff at my workplace, and as a result I was fired.

Knowing that I had alimony obligations, I tried to find a job, but given my age - 47 years old, I was unable to find a job, and therefore, for alimony payments from this period, alimony arrears were accrued in the amount of the average monthly salary in the Russian Federation in the amount of 62.75 rub.

In September of this year, I found myself in a difficult life situation: my house in which I live burned down, as a result of which I ended up in the hospital with burns, was discharged at the end of October, and currently live with my mother. I am not hiding from the bailiff; I also spoke with the recipient by phone and told about my plight.

I also haven’t found a job yet, but I’m going to register with the employment center to apply for some kind of job.

Considering my difficult financial situation related to recovery from burns, lack of housing, from Art.

In the case where we are not talking about writing off the resulting debt with maximum monthly payments as a percentage of the salary, but about the usual monthly deduction of alimony established by the court, including in total for several writs of execution, the payer subsequently also has the right to reduce the amount of the requirements of the writ of execution in court in accordance with Art.

The plaintiff’s claims for a reduction in alimony accruals must have a sufficient evidentiary basis, accompanied by documentary substantiation of his words. If the court considers the requester’s arguments convincing, the amount of alimony may be reduced, since in alimony legal relations an important role is played by the balance of interests of both the recipient and the payer.

It's clear. For example, if they are paid in a fixed amount due to the fact that the payer does not have a regular income. An example of such a situation. The subsistence minimum per child in the region of residence is rubles.

The payer has irregular earnings, which on average over several months amounts to rubles per month. Can this happen in practice? This is not clear from the article.

The closest thing to an answer to this question is the situation given in the second sample statement of claim.

Could this be established by the court from the very beginning? Why give almost all your income to your child, he needs the money more. Of course, in the case when the court assigns a fixed sum of money, its size is established taking into account the primary needs of the child. However, the court should not neglect the social and family status, as well as the solvency of the payer.

Therefore, it is better to immediately present all arguments against the established amount to the court. Example 1.

After warning the bailiff about the mandatory payment of alimony and taking an explanation, Petrov got a job with an official salary of 16 rubles. Example 2.

Evseev has three minor children from different marriages. The third wife gave birth to a disabled child, but Evseev left the family, and she also decided to collect alimony.

When making its decision, the court established a percentage deduction from the defendant's wages, taking into account the disability of the last child. Multifunctional legal center Moscow, st.

In what cases is alimony paid for the maintenance of a wife until the child is 3 years old?

If the parents divorce, and if one of them applies to the court to collect alimony, the other must pay it for the maintenance of the common child.

But our Russian legislation also stipulates the possibility of exacting alimony from the mother or, with rare exceptions, from the father for their own maintenance, if their common child is under three years old at that time.

Alimony, which is paid for a child under three years of age, differs from other similar types of payments. At this age, the child still needs constant care, which is most often provided by the mother. In rare cases - the father.

The maximum deduction of alimony from wages is 70% - how to live with this?

The amount of alimony that will be deducted monthly from the salary of the person receiving alimony consists of several components and directly depends on the method of calculating payments to the child - shared withholding or in a fixed sum of money.

If the alimony recipient is unemployed or has unstable earnings, for example, is an individual entrepreneur, receives a salary in foreign currency, etc.

In situations where the alimony provider has incurred arrears in payments, the percentage of deduction from wages or other income by law can be no more than 70 percent; this maximum is established by Part.

The maximum withholding of child support from wages in the amount of 70 percent applies only to child support obligations in relation to minor children. That is, for example, this condition does not apply if alimony is paid for the maintenance of a spouse, parent or other relative - in these situations, the amount of deductions under executive documents cannot exceed 50 percent.

70 from salary court collection of alimony

Write your question and our lawyer will call you back within 5 minutes and give you a free consultation. Fill out the form with contact information and receive a free consultation within 5 minutes. Some fathers have only one thing in common with their children - the obligation to pay child support.

And unfortunately, not everyone strives to show their fatherly love and care in at least this way. Instead of improving the financial situation of their children and supporting them at a higher level, they are looking for ways to pay as little as possible. Of course, life situations are different, and a father is not only a wallet.

Therefore, in this article we will look at legal ways to reduce the amount of alimony.

Reducing, reducing the amount of alimony

According to Art. Login Try. All blog entries. We calculate alimony.

The amount of alimony paid for the maintenance of children in Russia is usually low. This depends on the low level of average wages, as well as on the great desire of those paying alimony to hide their income in order to pay alimony as little as possible.

According to an alimony agreement voluntarily drawn up by the parties, alimony can be assigned not by a judicial institution, but by the parents themselves, and in this case, it must be said that there are no maximum limits for the amount of monetary payments.

The amount, as well as the method of transferring alimony, can be set absolutely any, the main thing is that it is not lower than what is provided by law to meet the needs of the child, but at the same time is not too high and does not violate the rights of the paying parent.

The main condition: the agreement reached by the parents must be in writing and certified by a notary.

Alimony 70 percent in what cases

- The article “Statement of Claim to Change the Amount of Alimony (Sample)” is devoted to this topic.

- According to an alimony agreement voluntarily drawn up by the parties, alimony can be assigned not by a judicial institution, but by the parents themselves, and in this case, it must be said that there are no maximum limits for the amount of monetary payments.

- The amount, as well as the method of transferring alimony, can be set absolutely any, the main thing is that it is not lower than what is provided by law to meet the needs of the child, but at the same time is not too high and does not violate the rights of the paying parent.

In what cases is alimony paid 70

The main condition: the agreement reached by the parents must be in writing and certified by a notary.

Then the document will have legal force equivalent to a court decision, and, in case of failure to comply voluntarily, it can be compulsorily executed through bailiffs.

Alimony of 75% is withheld from my salary when the position is 55 thousand per child, the bailiffs did not report anything! deduction of alimony from wages, what percentage of the salary is alimony Collapse Victoria Dymova Support employee Legal expertTry to look here: In what cases is up to 70% of wages withheld?

- In Labor legislation, a general rule most often applies, according to which an amount not exceeding 20% can be withheld from an employee’s salary.

- Possible nuances If the defendant’s income is unstable or heterogeneous, the court may do the following: assign a combination of a fixed amount of money and shares of the salary.

- For example, 1/6 of the salary and an additional third of the minimum wage per child in the region.

Many women believe that collecting alimony based on the minimum wage is much more profitable than collecting alimony based on a percentage.

According to the Labor Code of the Russian Federation, deductions from salary cannot exceed half of it, but alimony is an exception.

- In each case, the court makes a decision purely individually, focusing on the material (for example, level of income, presence of credit obligations, maintenance of dependents) and family (number of children), social (living conditions, health) status of the parents.

- An equally, or perhaps even more important factor in determining the amount of child support payments is the needs of the child.

- Thus, the court takes into account all circumstances that deserve attention.

In what cases is 70 percent of the

You can read more about the procedure and amount of alimony in a fixed amount in the article “Child support in a fixed amount for 2018.”

The peculiarity of calculating alimony in a constant amount is the possibility of filing a claim with the court to revise the amount upward or downward due to the changed family, financial, and social situation of the payer.

Article 81 of the Family Code of the Russian Federation provides for the withholding of 25 percent for one child, 33 percent for two children, and 50 percent for three or more children of wages or all other income of the person obligated to pay alimony.

The total amount of deductions under Family Law cannot exceed 50 percent of income.

But the Labor Code of the Russian Federation in this regard operates with a different figure - 70 percent.

Contents In what cases can 70 percent of wages be withheld for alimony?

- By agreement between parents on the voluntary payment of alimony, the amount of deductions for child support can reach 70%, since they themselves have the right to accept any conditions regarding the amount and frequency of payments.

- Parents are obliged to take care of the material support of their common children together.

- But one of them does not always remember this, and sometimes both are negligent about the baby’s needs.

- In this case, multiple factors are taken into account: the level of income of the payer and the recipient, whether the former has deductions under other writs of execution (for example, if there are other children, a loan). Dear readers, our articles talk about typical ways to resolve legal issues, but each case is unique. According to the law of the Russian Federation, the maximum percentage of deductions from the net income of the alimony payer is usually 50 percent (for 3 children or for a child under 3 years of age).

- If you want to find out how to solve your particular problem, please contact the online consultant form on the right or call: 7 (499) 350-83-27 Moscow and Moscow. The minimum is 25% per child of the older age group. Such circumstances may be: For example, the alimony payer has other dependents, for example, a pregnant wife, a child born to another wife, as well as a wife with a child from birth to 3 years old, elderly parents.

- All these circumstances are also taken into account by the court when assigning the amount of alimony payments.

For example, an alimony payer who has become disabled and lost his previous job cannot pay alimony in the same amount as if he was in good health; therefore, he can ask the court to reduce the amount of alimony payments.

For example, the income of the alimony payer is very high, therefore, alimony calculated as a percentage of income exceeds the reasonable level of financial support for the child. If a woman does not have access to the funds set aside for the child’s book, she may well go to court, and the payer will be charged with alimony for the period when he kept the book and will also be fined for late payment.

If the request is decided to be satisfied, you will be given an identification document, which must be submitted to the accounting department at your place of work or to the bailiff service. The money you plan to transfer to your daughter's or son's account will only be considered part of child support if the mother (recipient) has access to it. The initiator can be either the recipient or the payer.

If you don’t know how to draw up a paper correctly, contact the civil office during business hours for advice. An increase in the amount can be made due to indexation of payments, as well as due to rising prices and an increase in the cost of living for minors in the region of their residence.

The amount of alimony that will be deducted monthly from the salary of the alimony-obliged person consists of several components and directly depends on the method of calculating payments to the child - shared withholding or in a fixed amount: In situations where the alimony provider has allowed arrears in payments to arise, the percentage of deduction from wages or his other income by law can be no more than 70 percent (this maximum is established by clause. That is, for example, this condition does not apply if alimony is paid for the maintenance of a spouse, parent or other relative - in these situations the amount of deductions under executive documents is not may exceed 50 percent.

The maximum withholding of child support from wages in the amount of 70 percent applies only to child support obligations in relation to minor children.

- If there is no alimony debt for the person obligated to pay, the amount established in the agreement or court decision will be deducted monthly from his income (no more or less), since the basis for deduction from wages is the above-mentioned agreement or writ of execution and stated in there is a requirement.

- In itself, the amount of monthly alimony deductions cannot change either up or down without the payer or recipient filing a lawsuit to change the amount of alimony or the method of assigning it under Art. The only exception is alimony in a fixed amount (hereinafter referred to as TDS), which is subject to quarterly indexation in proportion to the increase in the cost of living for the child in the region of his residence (i.e.

- As the cost of living increases, the TPV will also increase each time).

- The responsibility for indexing alimony now lies entirely with employers (Law No. 321-FZ).

- The question of the legality of withholding 70% of alimony from wages and other income of payers worries both recipients of such amounts and claimants.

- Recipients of funds are satisfied with this state of affairs, but payers find it illegal, and they seek to appeal such actions of bailiffs, the accounting department of the enterprise at their place of work, or even the court decision itself.

- In most situations, withholding a large portion of 70% of monthly earnings in favor of minor dependents is a legal measure, especially if it is: However, in practice, faced with the problem of receiving a paltry amount of 30% of the expected salary, alimony debtors tend to convict ex-wives, employer or bailiffs of illegal actions or abuse of power.

- In such cases, the interests of the latter are protected by the guardianship service and the court.

- The amount of alimony can be quite high, but not more than half of the salary or 70% in rare cases established by law.

- In this case, multiple factors are taken into account: the level of income of the payer and the recipient, whether the former has deductions under other writs of execution (for example, if there are other children, a loan).

- But the state protects, first of all, the interests of the minor, so even if the father is ordered to pay 50–70% of the salary, he may demand that half of this amount be sent directly to the child’s bank details if there is evidence of misuse of funds by the mother.

- According to the law of the Russian Federation, the maximum percentage of deductions from the net income of the alimony payer is usually 50 percent (for 3 children or for a child under 3 years of age).

The minimum is 25% per child of the older age group. But in life it also happens that the father pays much more - up to 70% inclusive.

Such an amount may be justified (reimbursement of debt), or it may simply be a consequence of negligence on the part of executive bodies and accounting departments at the place of work.

- For example, money can be deducted from the “dirty” salary before deducting various contributions and taxes.

- As a result, it turns out that more than half of the funds that the payer receives in hand is collected.

- The main condition for the forced assignment of alimony payments is the parent’s evasion of participation in the maintenance of the child.

In what cases is 70 percent charged?

- The second parent, usually a woman, in this case bears the full burden of responsibility for the minor and has every right to sue the evader or contact a notary (if a child support agreement has been drawn up).

- It also happens that mother and father both avoid their direct responsibilities.

- Then the procedure for assigning payments will be organized by the guardianship service.

- That is, each parent will be charged a certain amount to provide for the minor.

- Both men and women are interested in the question of whether it is possible to legally receive/pay more than fifty percent for child support.

Indeed, bailiffs can recover up to 70% of income (see.

No. 99 of the Federal Law “On Enforcement Proceedings”), if the wife proves that she and her common minor offspring have nothing to live on or there are other reasons: Please note that the father may try to transfer some of these funds to the child’s account if he proves through the court that that the mother is spending money inappropriately.

If under the 1st writ of execution (IL) an employee is charged 70 percent, then for other ILs (for example, for a loan) they no longer have the right to charge up to fifty inclusive.

- That is, the total limit should not exceed 70 from all income.

- If you are charged more than that in total, it is clearly illegal and requires investigation.

- The notary office only needs a passport and a document confirming your social security. After registration, each party receives a copy of the agreement.

- The alimony payer cannot always be sure that his money is spent exclusively on his offspring. Option 2 - Deductions under writs of execution can occur not only for alimony.

To avoid inappropriate expenses on the part of the second parent, the legislative possibility is provided for transferring part of the funds directly to the bank account of the minor.

If the debtor has repayment obligations under executive documents related not only to payment of child support, but also to others, for example, payment of a debt to a bank under a loan agreement, then deductions from wages will reach 70 percent, until the debt to the bank is fully paid.

The amount of such deductions as a percentage is no more than 50 of the total amount of regular accruals. After this, deductions will be made only for alimony in the amount established by the court or agreement.

Is it possible to withhold damages and

The accounting department is obliged to allocate half of Petrov A.’s earnings for the monthly maintenance of children, and 20 percent for debt repayment, until the resulting debt is 35,000 rubles. Option 3 - Deductions under several executive documents for several children.

This situation is rare, but it does occur when mothers of children from different marriages independently file for alimony through a court order, at different times, without indicating that the payer has other children, and the payer does not use his right to challenge the order. The remaining 5 percent underpaid will accumulate as debt.

The total withholding rate may exceed 70 percent. I received a copy of the order, but did not file an application to contest it; the order entered into force and was sent to the bailiffs.

Accounting is obliged to make deductions for both documents, but maximum from Kovalev A.

When such situations arise, the payer needs to be more active in challenging unfounded court orders in order not to pay more than is required by law.

At the same time, all documents acquire legal force, therefore the bailiff is obliged to initiate proceedings on them and send them to the debtor’s place of employment for execution, and the accounting department must execute these documents. filed an application for a court order to collect from him alimony for their common child of 25 percent of the salary.

The bailiffs, after initiating the proceedings, sent the documents to the place of work of Kovalev A. The accounting department had two court orders pending execution - the first to withhold from Kovalev A.

If objections to disagreement with the court order are submitted to the court, indicating the presence of alimony already paid, the order will be canceled, the case will be considered in the lawsuit procedure, and alimony will be assigned a smaller amount.

Neither the bailiff nor the accounting department have the right to challenge these documents; this right belongs exclusively to the alimony payer. pays alimony - half of his earnings for two children from his first marriage. At the same time, in the statement, the wife did not indicate that A. Kovalev also has two more children, for whose support deductions are made from his salary.

Thus, alimony reaches 70 percent only when the parents independently and voluntarily establish this amount in an agreement, as well as when it is deducted from the debtor’s wages during enforcement proceedings and forced collection.

On the pages of my magazine, I collect interesting information about human rights from various sources on the Internet, process it, check it and post it.

If he does not use it, deductions will be made in strict accordance with the documents, the maximum deduction will be 70 percent of the salary. If you see errors and inaccuracies, write about them in the comments, in the VK group or Odnoklassniki. Ask them on the corresponding page at the top of the site.

Many people think that 20 percent is the limit on the amount that cannot be withheld from an employee’s salary. It is possible to legally expedite the collection of money owed to the company from an employee.

Sludge retention up to 70

It turns out that now he will have nothing to gain at all. tags: 70% of alimony, alimony, writ of execution, withholding of alimony category: legal advice If there is a Court Order, it means that 70 percent of the salary must be withheld.

According to Article 138 of the Labor Code of the Russian Federation, a limit on deductions from employees' wages is limited to no more than 50 percent.

But part 3 of the same article allows the collection of alimony and alimony debt for the maintenance of minor children and withholding 70 percent, but no more.

This is the maximum percentage.

As for the employee, who is obliged to pay according to the writs of execution and survive on the amount remaining for him, he himself chose this path for himself.

Having understood that a quarter of the money is withdrawn not only from the official salary, but also from other income, we will determine those financial receipts that are subject to the calculation of child support;

- Wages officially calculated by the enterprise, passing through the tax authorities;

- Black wages and other income in the form of additional accruals of a permanent nature, officially not taxed;

- Royalties;

- Income from patent payments;

- Dividends;

- Income from business activities;

- Fees;

- One-time and periodic receipts not related to official work activities

It is legally established that any financial income of the defendant is subject to the accrual of alimony in the amount of a set percentage of income.

But the state protects, first of all, the interests of the minor, so even if the father is ordered to pay 50–70% of the salary, he may demand that half of this amount be sent directly to the child’s bank details if there is evidence of misuse of funds by the mother.

How much is usually deducted from income?

According to the law of the Russian Federation, the maximum percentage of deductions from the net income of the alimony payer is usually 50 percent (for 3 children or for a child under 3 years of age). The minimum is 25% per child of the older age group.

For two – 33.33%. But in life it also happens that the father pays much more - up to 70% inclusive.

- there is arrears of alimony (that is, payments in such an increased amount will continue until it is repaid);

- compensation for damage to persons who have lost their breadwinner;

- the payer is serving correctional labor;

- compensation for damage caused to the health of another person;

- the payer has committed a crime and must compensate for damages in connection with this in relation to the injured person.

Please note that the father may try to transfer some of these funds to the child’s account if he proves through the court that the mother is spending the money inappropriately.

Important! If under the 1st writ of execution (IL) an employee is charged 70 percent, then for other ILs (for example, for a loan) they no longer have the right to charge up to fifty inclusive. That is, the total limit should not exceed 70 from all income.

In April 2017, there was a reduction in staff at my workplace, and as a result I was fired.

Knowing that I had alimony obligations, I tried to find a job, but given my age - 47 years old, I was unable to find a job, and therefore, for alimony payments from this period, alimony arrears were accrued in the amount of the average monthly salary in the Russian Federation in the amount of 62,728, 75 rub. (according to the resolution on the calculation of the debt of the bailiff V.M. Tiushina).

In September 2017, I found myself in a difficult life situation: my house in which I live burned down, as a result of which I ended up in the hospital with burns, was discharged at the end of October, and currently live with my mother.

I am not hiding from the bailiff; I also spoke with the recipient by phone and told about my plight.

- The amount of the payer's salary.

- Social status, standard of living and health status of the parties (claimant, payer, child).

- The number of other children in need of alimony from the payer, etc.

If there is no alimony debt for the person obligated to pay, the amount established in the agreement or court decision will be deducted monthly from his income (no more or less), since the basis for deduction from wages is the above-mentioned agreement or writ of execution and stated in there is a requirement.

In itself, the amount of monthly alimony deductions cannot change either up or down without the payer or recipient filing a lawsuit to change the amount of alimony or the method of assigning it under Art. 119 RF IC.

Such an amount may be justified (reimbursement of debt), or it may simply be a consequence of negligence on the part of executive bodies and accounting departments at the place of work. For example, money can be deducted from the “dirty” salary before deducting various contributions and taxes.

As a result, it turns out that more than half of the funds that the payer receives in hand is collected. The last option can be adjusted and revised, because it is almost impossible to survive on the remaining pennies, especially with a small salary.

Let's consider possible cases of withholding more than 50 parts from the child support payer's income and their legality, as well as the prospect of transferring part of the funds directly to the child's account.

Do they have the right to withhold 70% of alimony from their salary?

The mother may also request to transfer a certain amount to the child’s account, and for her there are no such percentage restrictions as for the payer.

In this situation, everything depends on the amount that the child actually needs and the income that the defendant has.

Of course, in the case when the court assigns a fixed sum of money, its size is established taking into account the primary needs of the child.

However, the court should not neglect the social and family status, as well as the solvency of the payer.

Therefore, the court tries to assign a fixed amount for payment, which will approximately correspond to that established by law for shared recovery (25% of earnings for one child, 33% for two and 50% for three or more).

But situations may still arise when the size of the fixed payment may actually be equal to 70% of the defendant’s unstable salary - for example, if it is very low and in a smaller volume simply does not meet the needs of the minor.

The withholding limit depends on the situation. The Labor Code established three maximum amounts of deductions. The most common of them is 20 percent of salary.