The death of a person is always a grief for his close relatives.

However, behind all the ritual troubles, the process of registering an inheritance inevitably arises.

This can be quite costly. Therefore, the question arises, how much does it cost to inherit? How much do notary services cost when registering an inheritance?

Ways to inherit

The law allows two options for such a step. It is traditional to visit a notary located at the place of last residence of the deceased person.

It is recommended to find out in advance whether the deceased has made a will. After all, a lot depends on its availability and content.

However, you can accept an inheritance through your actual actions.

For example, a citizen remains to live in the apartment of the deceased, takes measures to protect his property, and pays off payments, including debts.

But in any case, it is necessary to have in hand such a document as a certificate of inheritance.

In some situations, you have to enter into an inheritance by court decision. For example, a person missed the deadline and is forced to restore it. If the court decision is positive, the ratio of shares may change.

Sometimes it is the court that determines what property will go to each heir. This happens when it is not possible to allocate shares. In this case, it is established who should retain the property and who is entitled to monetary compensation.

The distribution of the inheritance can also be made by agreement between all heirs. It must comply with the general requirements of civil law.

Visit to a notary

The date of death is recorded either in the certificate or in the court decision regarding declaring the person dead.

In order to receive an inheritance, the notary must write a corresponding application.

It is enough to simply write an application for the issuance of an inheritance certificate. There is no need to write a separate application for acceptance of the inheritance.

The application is accompanied by evidence of the death of the deceased, documents on the degree of relationship (birth certificate, marriage certificate, etc.), all available materials on the property that should be inherited. If we are talking about real estate, then title documents are required. Naturally, you need to take your passport or other identification document with you.

Actions to accept an inheritance can also be carried out under the guidance of a power of attorney. However, the relevant powers must be clearly stated in it.

After 6 months have passed since the death of the testator, you should contact the notary again, but to obtain a certificate of inheritance. The notary will tell you the amount and payment details.

It should be noted that the specified document can be issued either one for everyone, or for each heir according to his share. This nuance must be discussed with the notary in advance.

How much does it cost to enter into an inheritance with a notary?

The costs of registering an inheritance for an apartment or house directly from a notary are divided into two main components:

- state fee for issuing a certificate of inheritance;

- payment for the work of the notary himself (forms, checking data from registers, certifying copies of documents, etc.)

There is no fixed state duty rate for the certificate. Its calculation is made based on the degree of relationship and the value of the property that will ultimately go to each of the heirs. The required scale is given in paragraph 22 of Article 333.24 of the Tax Code (hereinafter referred to as the Tax Code of the Russian Federation).

For example, according to the law of the first category, heirs contribute 0.3 percent, but not more than one hundred thousand rubles. Other claimants for the property of the deceased pay 0.6% (up to a million rubles).

But it is possible that certain costs will have to be incurred before the visit to the notary. For example, if you need to determine the value of a property, you will need to pay for an independent appraisal.

When a citizen misses the time to accept an inheritance, it will have to be restored through the courts. Accordingly, legal costs will also become necessary.

It also happens that not all title documents for the property of the deceased have been preserved or remain intact. Then the restoration of the papers will also entail certain financial consequences.

In a word, each case of inheritance in monetary terms is individual in nature.

Who gets the discount?

However, the Tax Code of the Russian Federation provided benefits for its payment to some categories of citizens.

If you are on the list listed in Section 333.38, you can directly state this to the notary.

In this case, copies of documents related to the provision of benefits are also required.

Now about some numbers. So, if a certificate is issued to disabled people of groups 1 or 2, then the fee is paid only half the amount.

When the heir lived in the apartment (house) with the deceased and continues to remain there, then the state fee for issuing the certificate is not charged.

The issuance of an inheritance certificate in terms of bank deposits, salaries, pensions, and payments for intellectual property is also exempt from state duty.

All of the above applies specifically to the state fee for the certificate. But we should not forget that the rights to some property (transport, land, real estate) should subsequently be registered by the heirs. Here the state duty is already paid. For example, you will have to pay 2 thousand rubles to register the right to inherited real estate.

But such a state duty also does not exclude benefits. To do this, the citizen must be included in the list given in Article 333.35 of the Tax Code of the Russian Federation.

A notary can provide a separate discount on his services. This is done by mutual agreement.

Is it worth entering into an inheritance?

Each heir must answer this question for himself. After all, registration of an inheritance is a human right, not an obligation. Therefore, when deciding to contact a notary, it is important to consider several points.

Thus, the heirs receive not only the property of the deceased, but also his debts.

Therefore, if the deceased managed to accumulate numerous or large loans during his lifetime, then payments on them are inherited.

It is recommended to find out in advance about the deceased’s unfulfilled financial obligations. This can be done using both official and non-official methods.

You should initially understand whether the property is really necessary. After all, the costs of registering an inheritance may exceed the financial or consumer value of the item.

In addition, it is possible that the property may be located in another city, which will cause additional inconvenience.

Finally, you need to have an idea of how the property will be divided among all claimants to the inheritance.

After all, there are some pieces of property that cannot simply be physically divided (a car, a one-room apartment, etc.).

In this case, it will be necessary to either formalize the preemptive right to ownership of the thing in court, or seek monetary compensation from other heirs equal to the value of their share.

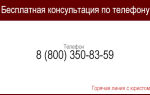

Dear readers, the information in the article may be out of date, take advantage of a free consultation by calling: Moscow +7 (499) 288-73-46 , St. Petersburg +7 (812) 317-70-86 or ask a lawyer a question using the feedback form, located below.

Share:

No comments yet

How much does it cost to register an inheritance?

A person cannot become the full owner of the inheritance simply by having his own desire. The property of the deceased person must be legally transferred to the heir. This procedure takes some time and costs money.

The costs associated with documenting the inheritance should be calculated in advance so as not to be caught by surprise.

How much it costs to enter into an inheritance and what payments make up the costs of processing it will be discussed in this article.

Payments when registering an inheritance

The procedure for officially processing documents for the inherited property of a deceased person involves several stages. The first of these is to contact a notary office in order to declare your right to receive this inheritance. There are costs ahead that make up a significant part of the inheritance payments. To calculate them, you will need to establish the value of the inherited property. Determining its estimated value is the second stage of the inheritance procedure.

The assessment is carried out by organizations that have the right to do so, confirmed by a license. The heir must pay a certain amount for the appraisal service.

The notary must open a file in which all documents related to the opened inheritance are registered. The ultimate goal of coming to a notary is to receive from him a Certificate of Inheritance.

This document is presented when registering the property rights of the new heir with government agencies.

The registration stage also involves payments for services and the issuance of title documents.

Based on the listed stages of re-registration of the testator’s property, the costs of taking it into ownership consist of payments:

- for issuing a certificate of inheritance;

- for services in drawing up an assessment report on the value of the inheritance;

- for registering property with government agencies.

Types of payments to a notary

The notary will have to pay:

- state fee for issuing a certificate of inheritance;

- Additional services.

The amount of the duty is set by the state as a percentage and depends only on the value of the property accepted by the heir. Its fee is the same for all notaries, regardless of whether they are public or private.

Heirs belonging to the first group of family ties must pay 0.3% of the estimated value of the inheritance. The maximum duty for them should not exceed 100 thousand rubles.

Secondary relatives will have to pay 0.6% of the estimated value of the inheritance passed to them. The maximum duty for them is limited to 1 million rubles.

Additional services include:

- consulting heirs;

- disclosure of the contents of the will;

- drafting texts of documents, photocopying them, etc.

Such services are provided only with the consent of the heirs or their representatives who contact the notary. They are not mandatory, so insisting on their provision is unacceptable. Tariffs for these services may vary depending on the location of the notary's office and are advisory.

If the heir has the opportunity to draw up inheritance documents on his own and make photocopies of them, then the notary is obliged to accept them! In this case, he must pay only the mandatory duty.

If several heirs contact the notary, who received different property after the death of a relative, for example, a house, transport, dacha and other property were distributed among them, then with their consent, a general certificate can be issued or a separate document can be issued for the property of each heir.

It is more convenient to use separate certificates for presentation to the authorities when registering inheritance of different types. But in the case of issuing one document for all heirs, the savings are obvious. It is up to the heirs themselves to choose a convenient option.

Heirs who are exempt from paying the fee

Since 2006, the law has exempted heirs from taxes on property that they inherited, obliging them to pay only the state duty on it. The state made an exception for this payment for certain categories of citizens and types of inheritance.

Citizens who are completely exempt from duty are:

- inheritors of real estate if they lived in it together with the testator at the time of his death and after its occurrence;

- the inheritance of the testator's cash savings in banks, payments not received by him in the form of wages, pensions, bonuses, insurance and other funds;

- those who received an inheritance and died while performing their state or civil duty as citizens;

- citizens inheriting property who were repressed for political reasons;

- who have not reached the age of majority at the time of the death of the testator;

- under guardianship due to incapacity;

- participants of the Great Patriotic War;

- received the title of Hero, as well as state highest awards.

It is also envisaged that the fee will be reduced by half for citizens who have received the first and second disability groups.

Property valuation cost

As noted earlier, to calculate the amount of the duty, you need to know the value of the inheritance. There are many organizations involved in property valuation.

The cadastral value of real estate can be obtained from government agencies represented by Rosreestr, and the inventory value from the BTI. There are also private organizations that have received a license for this activity.

They evaluate property based on its market value. You can order an extract of the cadastral value electronically through the Rosreestr website or on paper by contacting the MFC.

The cost of an extract issued on paper at the MFC will cost 400 rubles. The electronic form of the document costs 250 rubles.

Note: The inventory value of real estate used to calculate the tax, recorded in the BTI, has not been determined since 2014. This organization no longer recalculates the value of real estate after its restoration. Certificates are issued based on the value of the property at the end of 2013.

Obtaining a set of documents from the BTI, including information about the value of the object intended for the notary to calculate the duty, will cost the heir a minimum of 500 rubles and a maximum of 1000 rubles.

The price depends on the type of certificate and the characteristics of the property. Rosreestr and BTI provide information on the value only of real estate.

In addition, the cadastral value has recently been often overestimated, which affects the amount of the duty.

In commercial organizations, all types of inherited property are assessed at market price. Given their diversity, you can choose a company whose prices for services will suit the heir. You only need to make sure that its employees are competent and that the company has a license.

The cost of services of such companies depends on the type of property to be appraised, its condition and the location of the appraiser. It can range from 1,000 rubles to 10,000 rubles.

When assessing vehicles, you can use a state expert organization or a commercial company that has the appropriate permit.

Property registration costs

Real estate is subject to registration in the State Register. If the owner changes, it must be re-registered to the new owner. When contacting the registration authorities to enter real estate into the register, the heir must pay from 1 thousand to 2 thousand rubles.

If a car is inherited by a new owner, it is also subject to registration. After the costs of obtaining an appraisal report on its value and paying the fee, the notary who issued the certificate for the right of inheritance will have to pay 850 rubles to the traffic police for registering the car by the new owner. When replacing a car number, the amount will be 2850 rubles.

Conclusion

Before you begin registering an inheritance, you need to calculate all the costs associated with this procedure and choose options that lead to minimal payments.

If the total costs far exceed your capabilities, then you can take your time paying the fee, pausing the registration process until the funds are found.

A six-month period is given only for applying for the right to inheritance, and you can receive a Certificate of the right to inheritance at any convenient time.

Last changes

In 2023, there are no significant changes in legislation on this issue.

Our experts monitor all changes in legislation to provide you with reliable information.

How much does it cost to inherit a house?

Today we bring to your attention an article on the topic: “How much does it cost to enter into an inheritance and the costs of accepting property.” We tried to fully cover the topic, and our specialist Sergey Shevtsov will share important comments based on his work experience. Heirs need to prepare in advance for the financial costs of entering into an inheritance after the death of the testator. Problems associated with notarization always cost time and money.

In order not to overpay for notary services and not waste time, heirs should familiarize themselves with the laws and know in advance how much it costs to enter into an inheritance. The costs of registering an inheritance received in the Russian Federation immediately imply a tax depending on the degree of relationship:

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique.

If you want to find out how to solve your particular problem, please use the online consultant form on the right or call the numbers provided on the website. It's fast and free!

Content:

- How much does it cost to inherit? Basic costs.

- How much does it cost to inherit

- How much does it cost to inherit a house?

- How much does it cost to inherit property? Cost of accepting property

- Cost of notary services when registering an inheritance: calculation of state fees and other expenses

- How much does it cost to register an inheritance and what does the amount consist of?

- How much does it cost to enter into an inheritance with a notary?

How much does it cost to inherit? Basic costs

VIDEO ON THE TOPIC: How much does it cost to register an inheritance with a notary?

When registering an inheritance after the death of the testator, it is necessary to enter into the inheritance. To do this, you need to contact a notary with an application to enter into inheritance rights. Here the question arises: how much does it cost to join and register an inheritance with a notary? The cost of registering an inheritance with a notary will consist of payment of notarial actions and state fees. When entering into an inheritance, it is necessary to pay for notarial actions related to the notary's management of the inheritance case.

So, for opening an inheritance case, a notary charges a fee of up to 2 rubles. After which the notary will require documents from you from various institutions, for which he will issue you notary requests, the cost of each of which varies from - rub. In addition to the above about how much it costs to register an inheritance, it is necessary to clarify the state duty.

The state fee for the production of BTI documents is about 1 rub.

For the issuance of a certificate of inheritance, you will also have to pay a state fee, the amount of which is determined by the article. Currently, the cost of registering an inheritance for an apartment, land, house and other real estate is determined based on the cadastral value of this property.

As for vehicles and other movable property, it is subject to independent assessment.

The cost of registering an inheritance at the YUST Legal Center depends on the type of property being inherited and is determined based on the remoteness of the area of the property.

To do this, you need to come to us twice, once to conclude an agreement on managing the inheritance case and drawing up a power of attorney, and the second time to receive documents on state registration of property rights in your name.

Russian company Legal Center just. Entry into inheritance - with a minimum package of documents. Entering into inheritance - after missed deadlines. Entry into inheritance requires registration of property rights in Rosreestr.

If you have any difficulties with registering an inheritance, here they will help you: restore missed deadlines for accepting an inheritance; establish the fact of relationship; challenge the will or, conversely, protect it from challenge, as well as in other controversial cases.

All situations and services for registration of inheritance. Lawyer for inheritance Notary for inheritance Entry into an inheritance Entry by a notary Registration of an inheritance Registration of treasures or bank accounts Inheritance of an apartment Inheritance of a land plot Cost at the notary Timing of the inheritance Cost at the notary How much does it cost to register an inheritance.

Write your question and our lawyer will call you back within 5 minutes and give you a free consultation. Fill out the form with contact information and receive a free consultation within 5 minutes.

We offer an article on the topic: “how much does it cost to try to enter into an inheritance” with a commentary from a professional lawyer. There is a certain period during which the possibility of transferring property through inheritance opens up.

This time is given to identify persons and participants in inheritance relations. The inheritance is opened on the day when the citizen is officially deceased.

The place of discovery of the inheritance is the last place of residence of the deceased; if such information is not available, then the discovery is the point where the property is located. Dear readers!

How much does it cost to inherit

The procedure for entering into an inheritance is carried out within the framework of inheritance proceedings, which is opened and conducted by a notary.

In order to enter into inheritance rights and receive the property of a deceased citizen, the heirs will have to bear the financial costs associated with paying the notary fee.

In the material presented you can find out how much it costs to enter into an inheritance from a notary, and how the amount of expenses is calculated. The cost of inheritance does not depend on the method of acquiring rights to property.

Moreover, the rules on paying tax on property received as a result of inheritance have now been abolished. The heirs' expenses will only include payments to the notary. Let's consider how much to pay a notary for registering an inheritance, and what benefits are provided for certain categories of heirs.

Inheritance law Cost of notary services when registering an inheritance: In order to enter into inheritance rights and receive the property of a deceased citizen, the heirs will have to bear the financial costs associated with paying the notary fee.

In the material presented you can find out how much it costs to enter into an inheritance from a notary, and how the amount of expenses is calculated. What is it? Inheritance of property assets of deceased citizens is carried out on two grounds: In any of the above options, registration of inheritance rights falls within the competence of a notary.

The cost of inheritance does not depend on the method of acquiring rights to property.

WATCH THE VIDEO ON THE TOPIC: Inheritance by law. Entry into inheritance.

When registering an inheritance after the death of the testator, it is necessary to enter into the inheritance.

If you become an heir, which means, after accepting the inheritance, you become the owner of movable and immovable property, cash, if any, and shares.

Heirs need to prepare in advance for the financial costs of entering into an inheritance after the death of the testator. Problems associated with notarization always cost time and money.

In order not to overpay for notary services and not waste time, heirs should familiarize themselves with the laws and know in advance how much it costs to enter into an inheritance. The costs of registering an inheritance received in the Russian Federation immediately imply a tax depending on the degree of relationship:

The tax on inherited property has been abolished since January 1. In practice, this is a payment for issuing a certificate of inheritance. Let's find out in detail how much it costs to register an inheritance?

How much does it cost to inherit property? Cost of accepting property

Registration of an inheritance usually requires certain monetary expenditures on the part of the heirs. Many heirs ask what the state fee is for entering into an inheritance, what the cost of notary services for inheritance is, and what the total cost of registering the right to inheritance will be.

There is no set price for the services of a notary for opening an inheritance case after death, so a notary cannot charge a fee for opening an inheritance.

However, if the heir needs to receive a notarial request to request documents, information necessary for registering an inheritance or searching for an inheritance, he will have to pay a state fee for issuing a notarial request and notary services of about - rubles will be the fee for 1 notarial request.

Inheritance cases are opened after the deceased, and not for each inherited property separately. Will you arrange an inheritance after 12 deaths? Where do 12 inheritance cases come from?

.

To enter into an inheritance under a will, the heir must pay. Almost everyone is concerned with the question: “How much will you have to pay for.

.

How much does it cost to register an inheritance and what does the amount consist of?

.

How much does it cost to enter into an inheritance with a notary?

- .

- .

- .

- .

How much does it cost to inherit: basic expenses

Receiving an inheritance is, first of all, hassle and financial costs, and only then - material benefits. After all, in order to receive the property of the deceased, you need to take care of all the nuances, from filing an application with a notary to registering the property in your name. All these worries take at least six months, but it is also worth remembering about material investments.

How can you receive an inheritance?

The law provides two ways to receive an inheritance:

- according to the law, in order of priority, if the testator has not expressed his will in writing;

- according to a will, which any citizen has the right to draw up, transferring property not only to relatives, but also to a legal entity, state, organization, charitable society and even a stranger.

At the moment, there are seven main levels of heirs who can receive the property of the deceased. However, as practice shows, things rarely go beyond 3-4 queues. Each subsequent category of relatives can be called upon to inherit if there were no applicants in the previous one.

Important! A will can be contested if the testator does not take into account the interests of those relatives who have the right to an obligatory share, or deprives them of their inheritance with his authority.

The cost of receiving an inheritance: expense items

- The first thing you need to do is pay a visit to the notary. This must happen no later than one day before the end of the six-month period from the moment the death of the testator is established. Here you have to write a statement expressing your willingness to accept the property of the deceased.

The notary will open the inheritance case. You will need to pay for his services, you will find out the amount in the office.

- The second expense item is an expert assessment of the property. This is done necessarily, since depending on the outcome, the cost of obtaining a certificate of inheritance is determined.

- Actually, the state duty for the certificate, which was discussed above.

- Tax when registering real estate in your name (apartment, house, plot of land, garage, non-residential premises, etc.).

- Fee for re-registration of a car with the traffic police.

We have listed the main expenses that make up the total cost of receiving an inheritance. However, in some cases there will be other costs involved. For example, if the testator left a will and made it a condition for receiving an apartment as an inheritance to pay a certain amount to a designated person.

Or the deceased has unfinished loans or debts that must be repaid by the heirs.

Important! The debts of the testator must be repaid not by his immediate relatives, but by those persons who received the property of the deceased. That is, if the wife was deprived of an inheritance by a will or refused to accept it, then she is not obliged to repay the loan or debt of her husband.

Is it possible to refuse an inheritance?

The person himself must decide whether to accept the inheritance or not, but one must know that the heir cannot voluntarily refuse part of the property.

The principle applies here: either everything or nothing, that is, you cannot accept the car and refuse the dacha.

Therefore, before deciding on the advisability of entering into inheritance rights, you should think it over carefully, and even consult with a lawyer.

Sometimes, indeed, it is better to refuse an inheritance, for example, if the deceased has large debts and you will have to repay them.

Of course, the law stipulates that the heir cannot repay a debt that exceeds the total value of the property received, but you will have to spend a substantial amount on registration, which no one will return.

In addition, the property still needs to be sold if it has no personal value. And all this takes a lot of time.

Inheritance registration procedure: legal assistance

Don’t know whether you should receive an inheritance or whether you have enough funds to arrange everything? Consult a lawyer from Pravosfera.

He will give you practical advice and answer all questions regarding the inheritance procedure.

If necessary, a specialist will help you collect the package of documents required for a notary, advise where it is best to evaluate the property and make sure that everything is done in accordance with the law.

Consultations by phone and online chat for residents of the capital and region are free. Customer service is provided around the clock. To receive answers to questions, you do not need to register; such a procedure is not provided by our agency, because we adhere to a policy of complete anonymity and confidentiality.

How much does it cost to inherit: basic expenses

Home / Inheritance / How much does it cost to inherit

Views 10013

If you believe foreign cinema, an inheritance is wealth that suddenly falls on one’s head, consisting of luxurious villas, expensive cars, and million-dollar bank accounts. At the cinema, no one stands in lines, fills out documents, or pays state fees. Movie characters dispose of inherited property almost the next day after the death of their rich uncle.

Real life is far from movie scripts. The procedure for registering an inheritance takes at least six months, requires financial costs and hassle in preparing documentation. And the inheritance itself can represent not only material benefits, but also losses.

Today we will look at how much it costs to inherit an apartment, car, land and other property.

Cost of inheritance

Let us list the main expenses that the heir will have to bear in the process of inheritance by law and by will.

Cost of inheritance according to law

The inheritance procedure, as a rule, begins with a visit to a notary’s office for the heir to submit an application, on the basis of which the notary opens an inheritance case.

Of course, each notary service is paid separately - according to the tariffs of the notary office.

Below we will look at what notary services you most often need to resort to and what their approximate cost is.

- Actual entry into inheritance.

According to the law, actual acceptance of an inheritance is a legal alternative to formal, legal acceptance.

Instead of submitting a written application to the notary's office, the heir can use the inherited property, maintain, repair it, pay debts, taxes and other payments.

These and other actions indicate the intention to become the legal owner of the inherited property. Below is an approximate list of costs that the heir has to bear when actually accepting the inheritance and the procedure for documenting them.

- Valuation of inherited property

A mandatory expense item during inheritance is payment for the services of a licensed appraisal organization or an independent appraiser.

Without a document that contains accurate data on the value of the inherited property on the date of death of the testator, it is impossible to calculate the amount of state duty that the heir must pay for the issuance of the Certificate of Inheritance. Below we will look at where to go for an expert assessment and how much this service costs.

- State duty for issuing the Certificate.

The amount of state duty is calculated on the basis of the estimated value of the inherited property, depending on the relationship between the testator and the heir by law. Details are below.

- State fee for registration of property rights.

Not all inherited property needs to be registered. Only certain types of property are subject to state registration: residential real estate, land plots, vehicles.

Cost of entering into a will

The procedure for inheritance by will is not much different from the procedure of inheritance by law; accordingly, the heirs have to bear almost the same expenses:

In addition to the basic notarial services associated with each inheritance case (for example, accepting applications, verifying signatures on documents, filing notarial requests, etc.

), during the process of inheritance under a will, additional services of a notary may be required. For example, searching for a will in the Unified Information Database (UIB), reading a closed will.

Each notary service is paid separately.

- Valuation of inherited property.

- Payment of the state fee for issuing the Certificate.

The amount of the state duty does not depend on whether the inheritance occurs by law or by will. The amount is calculated depending on the degree of relationship (for close relatives - one interest rate, for distant relatives - another). This will be discussed in more detail below.

- Payment of the state fee for registration of property rights.

What is the amount of state duty for registering different types of property? Read below.

Cost of notary services

To enter into an inheritance, first of all, the heir needs to contact a notary office. He must submit a statement of intent to inherit to the notary.

The application is accompanied by basic documents (passport, death certificate, documents confirming family ties with the deceased, a document about the last place of registration and residence of the deceased).

In addition to the basic documents listed, additional documents may be required to register an inheritance, the list of which depends on the composition of the inheritance and the number of heirs. For example, title and technical documents for property.

Details can be found in the article “What documents are required to enter into an inheritance.”

In the process of conducting an inheritance case, various notary services . Starting from opening the envelope with the will, submitting notarial requests, making and certifying copies of documents, ending with the issuance of a certificate of inheritance.

- The cost of notary services is the same in all notary offices in the country, for example:

- 100 rubles – for certification of the testator’s will;

- 500 rubles - for certification of the testator’s order to cancel the will;

- 300 rubles – for opening the envelope with the will;

- 100 rubles - for certification of an application for entry into inheritance and issuance of a certificate of the right to inheritance;

- 500 rubles - for certification of refusal to enter into inheritance;

- 100 rubles – for issuing duplicate documents;

- 50 rubles – for a notary request.

The total cost of legal and technical work performed by a notary can range from 100 to 3,000 rubles. However, imposing unnecessary notarial services by a notary is unacceptable.

The notary fee for obtaining a certificate of inheritance is paid separately. We will talk about the amount of the notary fee below.

Actual entry into inheritance. Expenses

In addition to the standard procedure for entering into an inheritance by submitting an application to a notary's office, the law provides for another option - actually entering into an inheritance. What does it mean?

An heir is considered to have entered into an inheritance if he...

- incurred expenses for maintenance or repair of the inherited property;

- paid off the debts of the testator;

- accepted funds addressed to the testator from unauthorized persons;

- protected the inherited property from attacks by unauthorized persons, ensured its safety and integrity;

- took possession of property;

- began managing the inherited property.

All these material expenses and targeted actions indicate the acceptance of inheritance rights and responsibilities. An heir who has actually entered into an inheritance has the same rights and obligations as an heir who has gone through the standard procedure of submitting an application to a notary and receiving a certificate.

However, there are conditions under which the actual acceptance of an inheritance can be legally recognized and documented.

- The actual entry into the inheritance must occur within the 6 month period established by law from the date of death of the testator. After the expiration of this period, the actual heirs can receive a certificate of right to inheritance on an equal basis with other heirs who have gone through the standard procedure.

- To obtain a certificate, you must provide the notary with evidence of the above actions . Such evidence may include:

- Certificate of residence in the inherited residential premises;

- Receipts for payment of utility debts;

- Tax payment certificates;

- Receipts for the purchase of construction and finishing materials, spare parts;

- Receipts for payment for repair work.

If the notary considers the evidence provided sufficient to recognize the actual acceptance of the inheritance, he will issue a certificate.

If the notary does not consider them convincing or sufficient, he will refuse to issue the certificate. In this case, the heir will have to go to court to legally establish the fact of inheritance.

Valuation of inherited property

One of the documents that will need to be submitted to the notary's office to register an inheritance is an assessment of the value of the inherited property:

- real estate objects;

- Vehicle;

- valuable papers;

- shares in the authorized capital of LLC;

- copyright;

- other property.

An assessment of the cost is necessary, first of all, in order to correctly calculate the amount of the state duty for issuing a certificate of inheritance.

The value of real estate and land can be determined by government agencies and territorial divisions that keep records of real estate and land (Rosreestr) or non-governmental organizations licensed to assess the value of real estate and land.

The value of a vehicle and other property can be determined by state forensic institutions, appraisal organizations licensed to assess the value of property.

The cost of appraisal work can range from 1,000 to 10,000 rubles, depending on the property being assessed.

That is, valuation services are provided by both government agencies and non-state licensed organizations.

Depending on where the heir applies for an assessment of the value of the inherited property, he will receive a document on the cadastral or market value.

If the heir has several assessments, the indicators of which differ, to calculate the amount of the state duty, smaller indicators of the value of the property will be taken into account.

The notary has no right to insist on the choice of a certain valuation and impose the services of a certain valuation organization.

The assessment must be made as of the date of death of the property owner.

State fee for issuing a certificate by a notary

Before the heir receives a certificate of inheritance, he must pay a state fee for issuing the document.

As mentioned above, the amount of state duty is calculated based on the value of the inherited property. In addition, the relationship between the deceased owner of the property and his heir is important for calculating the state duty.

- 0.3% of the value of the inherited property , but not more than 100 thousand rubles - the amount of duty for heirs of the first and second priority.

- 0.6% of the value of the inherited property , but not more than 1 million rubles - the amount of duty for the remaining heirs.

Thus, the more expensive the inherited property, the more expensive the inheritance registration will be. But close relatives of the deceased testator (wife or husband, parents, children, brothers and sisters) will still pay half as much as distant relatives or strangers (for example, heirs under a will).

And some categories of citizens can take advantage of benefits or complete exemption from paying state fees.

Who gets the discount?

Some categories of citizens have the right to count on benefits for paying state fees when registering an inheritance.

Thus, heirs are exempt from paying the notary fee for issuing a certificate of inheritance...

- a residential building, a plot of land with a house, apartment, room located on it, in which the heir lived together with the testator before and after the death of the latter.

- property belonging to citizens who died while performing civic duty, state or public duties, or politically repressed;

- bank deposits, funds in bank accounts, wages, pensions, royalties, insurance payments.

Minors and incompetent heirs (under guardianship or trusteeship) are exempt from paying the state fee

Disabled people of the first and second groups pay only half the cost of notary services.

State fee for registration of property rights

After receiving the Certificate of Inheritance, you need to contact the registration authorities to enter information about ownership in state registers.

The ownership of real estate is registered in Rosreestr. For state registration, heirs (individuals) are charged a fee of 2,000 rubles.

The ownership of the vehicle must be registered with the traffic police. You will have to pay 850 rubles for the procedure (if the heir does not need new numbers) or 2850 rubles if replacing the numbers is necessary.

Bottom line

For more than 10 years now (since July 1, 2005, in accordance with Law No. 78-FZ), citizens of the Russian Federation have been relieved of the obligation to pay tax on property acquired by inheritance. But this does not mean that the inheritance procedure has become free. The heirs still incur expenses when registering an inheritance - they pay a state fee, pay for notary services and the services of expert appraisers.

If you still have questions, contact the lawyers of our portal to learn more about mandatory contributions and payments during the inheritance process. Free legal advice will allow you to avoid unnecessary financial expenses when registering an inheritance.

How much does it cost to enter into an inheritance from a notary in 2018 - the main expenses

Ask a lawyer a question for free!

Briefly describe your problem in the form, a lawyer for FREE and call you back within 5 minutes! We will solve any issue!

All data will be transmitted over a secure channel

Fill out the form and a lawyer will contact you within 5 minutes

Entry into inheritance is of a declarative nature. Inaction is equivalent to abandonment of the property of the deceased owner.

Therefore, the heir must independently contact a notary, prepare documents and re-register the received objects in his name.

One of the most important points when accepting property is paying the costs associated with entering into an inheritance. Let's consider how much it costs to enter into an inheritance from a notary in 2018.

Do I need to pay money when entering into an inheritance?

Entering into inheritance is not a free procedure. The law provides for a number of expenses on the part of recipients when accepting inherited property.

Important! The amount of expenses directly depends on the region of circulation.

On the topic “How much does it cost to enter into an inheritance from a notary in 2018 - the main expenses” we have collected examples of documents that may interest you.

Cash expenses upon inheritance

Lawyer's opinion. If property disputes arise among heirs, it is advisable to immediately involve a qualified lawyer. Delay in this matter is fraught with loss of a share in the deceased’s property or complete disinheritance. As a result, the costs of legal services will be recouped from the resulting property.

Expenses upon entering into an inheritance under a will

The law provides for the following options for obtaining rights to the property of the deceased owner (Article 1111 of the Civil Code of the Russian Federation):

A will is a written expression of the will of the owner of the property, drawn up in accordance with the norms of civil law. In it, the owner can distribute property at his own discretion, without relying on family ties.

The document can be certified:

On the topic “How much does it cost to enter into an inheritance from a notary in 2018 - the main expenses” we have collected examples of documents that may interest you.

- notary;

- a person replacing a notary (chief physician, commander of a military unit, head of a nursing home);

- two witnesses (when making a will in emergency circumstances).

The document may include orders for the entire property, for individual objects, or for a certain part of the owner’s property.

Payments to receive property if there is an expression of will

If there is a will drawn up in emergency circumstances, it must be certified in court (Article 1129 of the Civil Code of the Russian Federation). A duty will also be charged. It is 300 rubles .

Expenses upon entering into an inheritance by law

Inheritance by law is based on family ties. First of all, property is due to spouses, parents and children.

The acquisition of the property of a deceased person is legally possible in the following cases:

- without a will;

- if there is property that is not specified in the will;

- if there are errors in the will regarding property;

- when a document is declared invalid.

Receiving the property of the deceased owner according to the law is carried out in order of priority (Article 1141 of the Civil Code of the Russian Federation). The procedure is provided for by the Civil Code.

Each subsequent turn is called upon to receive it if the relatives of the previous one are absent or have abandoned the property. Thus, the entire inheritance mass is divided among the recipients of the same line.

The costs of obtaining property by law are identical to the costs of the heirs under a will. A special feature of inheritance under the law is the possibility of actually acquiring rights.

In such a situation, the recipient uses the property of the deceased, ensures safety and pays for maintenance. The costs of protecting and maintaining the property must be borne personally by the recipient.

Notary services of legal and technical nature

Technical work when registering an inheritance includes:

- opening an envelope with a closed will;

- certification of the heir’s signature on the application for inheritance (when registering property from another city);

- certification of a written refusal of inheritance;

- sending a notary request.

The maximum fee for notary services is set by the regional notary chamber. Therefore, the amounts will be different in different regions of the Russian Federation. The maximum established amounts by region can be found in the service of the Federal Notary Chamber.

However, a specific notary office may set the cost of work less than the specified amount. But the recipient does not have the right to choose a notary office at established prices for services. The law obliges a citizen to contact a notary at the place of last registration of the deceased owner.

Additional fee for notary

Property valuation

A prerequisite for inheritance is an assessment of the property of the deceased (Federal Law of 1998 No. 135). The assessment is carried out on the day of the owner’s death.

Assessments can be of the following types:

- inventory (Rosreestr);

- market (specialized appraisal organizations).

How much to pay for an assessment depends on the organization. The cost of Rosreestr's work will be 850 rubles . However, a notary may refuse to accept a certificate from Rosreestr, since the inventory value is significantly less than the actual value.

Important! In 2018, the law does not establish what type of assessment must be carried out upon inheritance. Therefore, the heirs have the right to submit a certificate from Rosreestr and pay a fee based on the inventory value.

The cost of an appraisal in a commercial organization depends on the type of property. Real estate appraisal costs from 3,000 rubles , a vehicle – from 5,000 rubles .

However, the exact amount depends on the specific organization and region of circulation.

Important! When concluding an appraisal agreement, it is necessary to check whether the organization has a license to conduct appraisal work in relation to a specific type of property. If the report is completed by an unauthorized company, the notary will not accept it. In this case, the organization will not return payment for the work performed.

Legal assistance

Legal assistance when entering into inheritance may be needed in the following cases:

- the recipient also inherits another city;

- the recipient cannot independently collect documents;

- the heir initiates legal proceedings;

- other recipients wish to recognize the heir as unworthy.

The list is not exhaustive. The cost of work depends on the region of application of a particular law firm and the citizen’s request.

The cost of preparing a claim will be from 1,500 rubles. Representing the interests of the heir in court will cost from 10,000 rubles .

Thus, the assistance of a lawyer during inheritance may be needed if a citizen needs a representative when entering into an inheritance and during legal proceedings. Legal support for citizens who experience difficulties in obtaining inherited property can be provided by the lawyers of our website.

State duty for a certificate of inheritance rights

The amount of the state duty directly depends on the value of the share of property that is due to the recipient. In addition, the Tax Code establishes that duties are tied to family ties between the deceased and the recipient of the property.

- 0,3% from a share in property - payment for spouses, children, parents, brothers, sisters of the deceased;

- 0,6% from a share in property - payment for other citizens and legal entities.

The maximum payment for the first category of recipients is 100,000 rubles, for the second - 1,000,000 rubles .

Example. Citizen Molodozhenova’s father died. The man owned an apartment worth 2,000,000 rubles. He bequeathed it to his daughter. There was a typo on my daughter's birth certificate. The letter “ё” was missing from my father’s surname.

Thus, the relationship between the daughter and father was not proven. To establish the fact of relationship it was necessary to go to court. However, the woman submitted her documents late. In this regard, she would have to miss the deadline for entering into inheritance.

Therefore, she had to pay a fee as an outsider (0.6% of the cost of the apartment). The payment amounted to 12,000 rubles.

Benefits upon inheritance

The law provides for several categories of citizens who are entitled to benefits when registering an inheritance. These include:

- Disabled people of groups 1–2 . They are entitled to a 50% discount on all types of notarial acts.

- Individuals who lived with the testator at the time of death and continue to live in the apartment/house after his death.

- Legal successors of employees who were insured at the expense of the enterprise . Issuance of a certificate of inheritance of insurance amounts is free of charge.

- Citizens suffering from mental disabilities (provided that guardianship has been established over them).

- Minors and minor heirs.

- Legal successors of citizens who died in the performance of public duty.

Also, the state duty is not withheld when inheriting deposits, insurance amounts, wages, copyrights and remuneration due from them (Article 333.38 of the Tax Code of the Russian Federation).

Legal costs

A statement of claim is not filed in court in every case. However, if there is a dispute about the law, litigation is inevitable. Grounds for filing a claim:

- Missing the deadline for submitting an application;

- division of property;

- infringement of the interests of compulsory heirs;

- priority right to an indivisible thing;

- refusal of a notary to issue a certificate;

- contesting a will;

- debt collection through inheritance.

The list is not exhaustive. Interested parties may file a claim on other grounds.

When submitting an application, payment of the state fee is a mandatory condition. Without supporting documents, the court leaves the statement of claim without progress.

The applicant is given a period to eliminate the comments. The amount of the fee depends on the type of legal proceedings and the nature of the claims. Property claims are subject to a higher tax rate.

The payment amount is calculated based on the claim price. The link goes to the estimated value of the inheritance. The fee amount is calculated according to two criteria - a fixed rate and a floating percentage. It decreases as the amount of claims increases (Article 333.19 of the Tax Code of the Russian Federation).

If the plaintiff's demands are satisfied by the court, the applicant may recover attorney's fees from the defendant. These include expenses for filing a claim, legal support, and property valuation.

Calculation of fees for property claims

In accordance with the Tax Code, the duty is calculated based on the value of the disputed property.