Family law > Alimony > What state fees will you have to pay when applying for alimony?

- Even if the husband and wife are not divorced, but live separately and the spouse does not participate in raising and providing for the child, the wife has the right to collect alimony from him.

- Alimony payments can also be collected after a certain period of time; the law does not establish a limitation period for the collection of alimony.

- The question remains what the state duty on alimony will be in 2023.

- The courts are financed from the state budget, which is replenished from taxes, fees and charges from people for the provision of services.

The state also imposes a fee for alimony. Therefore, it is worth understanding what the state duty is for collecting alimony and who should pay it.

Who will have to pay the state duty

This is explained by the fact that the state positions itself as a social country that cares about its population.

Such concern is more manifested in relation to weakly protected groups - children, women and the elderly. They are the ones who most often apply for financial assistance. Therefore, it is not surprising that they have no funds.

In Russia, you can go to court to recover money free of charge.

Free access to court was influenced by such factors as the availability of justice.

After all, a woman with a child will be able to seek help faster if they do not demand extra money from her. Thus, the state will be able to quickly restore justice and help those in need. Because the person who files for collection of alimony payments will not pay taxes.

The state duty for alimony in 2023 will be paid by the ex-husband. But not everyone will pay it; there is a certain group of citizens who are protected from paying taxes:

- People who have the first and second disability groups.

- Heroes of the Russian Federation or the USSR.

- Participants in hostilities.

State duty for everyone else is paid differently and in different amounts:

- If the court decides to collect funds from the ex-husband according to the requirements that were stated, taxes will be taken from him in full.

- In the event that the court has ordered the implementation of several clauses from the contract, the fee will be proportional to the amount of cash payments.

When considering the question of whether it is necessary to pay a state fee when applying for alimony, it should be taken into account that in some cases it may be collected from the mother.

This applies to the situation when the spouses are still married, and the woman wants to apply for divorce and alimony payments. Then, in order to submit documents in court, you will need to make a payment.

People are exempt from paying the fee if:

- it is necessary to collect a penalty or penalties from the ex-husband;

- the mother needs to increase child support or wants to reduce it in favor of the child’s father;

- changes must be made in favor of the child's father.

The amount of state duty on alimony in 2023

The amount of state duty for alimony is quite difficult to determine. It will be different for different cases. But you can calculate the state duty approximately.

Taxes for the state can be assessed in different ways:

- If it is not possible to determine the price of the claim, when filing an application for alimony, you need to pay 300 rubles and submit a receipt for payment. This amount is withheld when non-property payments are considered.

- In most cases, in order to collect alimony from a former spouse, writ proceedings are opened. Then a state fee of 150 rubles is withheld when submitting an application.

- If an application for alimony is submitted along with an application for divorce, the plaintiff pays a state fee in the general manner - 400 rubles. This situation does not provide for an exemption from payment.

- In the case where we are talking about the state duty for issuing a court order for the collection of alimony, payment is not required. Because issuing an order means taking a significant action, not considering demands. Such applications can be submitted free of charge.

- In order to avoid paying state fees for alimony, parents can enter into an agreement to pay alimony on a voluntary basis.

- If difficulties arise with determining and fixing permanent alimony payments, then you will have to file a lawsuit to collect alimony.

- In accordance with the law, in order for a court employee to accept, consider and make a decision, drawn up in writing, where all the nuances of the divorce process are spelled out, you will have to pay a state fee.

- It is worth considering that its size may change every year.

How to calculate the state tax when reducing the amount of alimony

At the moment, the state does not provide for the calculation of state duty when reducing the amount of alimony. In this case, several options can be applied.

The first option involves determining the state duty to reduce alimony based on the total amount of payments for the year. Namely:

- If the declared amount is 20,000 rubles per year, then the state fee will be no less than 400 rubles or 4 percent of the amount.

- Up to 100,000 rubles per year - 3 percent, which is at least 800 rubles.

- From 100,000 rubles to 20,000 rubles - the tax will be 2 percent or 3,200 rubles.

- If the amount of alimony is more than 200,000 rubles, then the fee will be 1 percent of the amount.

The second option is used in cases where it is impossible to assess the property . If a woman wants to file an application in court, then 300 rubles will be withheld from her.

When figuring out how much it costs to apply for funds, there are some things to consider.

For example, for low-income people, the state provides the opportunity to apply for cash payments free of charge.

A fee is also imposed on reducing the amount of alimony; it can be calculated in several ways.

How to pay the government fee

There is a certain procedure for paying state fees for alimony.

First of all, you need to obtain payment details. You can find them at the information stand in the judicial institution or on its official website.

Details include the following data:

- recipient's name;

- TIN and checkpoint;

- OKTMO code;

- Name of the bank;

- recipient's bank account number.

You can make a payment in any way, everyone chooses the most convenient for themselves:

- Through a bank cash desk . The payer contacts the bank with a completed receipt or necessary details. Based on them, the translation will be made. You will also need to present a passport, cash or bank card.

- Cashless payment using online banking . If you have a personal account, mobile device or computer, you can independently calculate the amount of the state duty, make a payment and print a screenshot of the operation.

- Using an ATM in cash or with a bank card.

A receipt for payment of the state fee must be attached to the statement of claim.

State duty for collecting alimony: court order

To collect alimony, you need to apply to the court for a court order . If the debtor appeals it within 10 days from the date of receipt, then you will have to file a claim for the recovery of alimony.

When filing court orders and claims for alimony, you must attach a receipt for payment of the state fee.

The plaintiffs are exempt from paying it. Therefore, the state fee will be paid by the defendant. This also applies to filing an application for a court order.

The state fee for a court order to issue alimony will be 50% of the state fee, which is charged when filing a claim of a property nature. This amount will be paid by the debtor.

The funds received from paying the state duty are transferred to the state budget . The payment must be transferred to a specific account, the details of which can be found in the courts on information stands.

If the plaintiff represents the interests of children, and not his own, then the defendant will pay the state fee.

Similar articles:

- In contact with

- Classmates

- Google+

State duty on alimony in 2023

In cases of order or judicial collection of funds for the maintenance of a child in accordance with Art. 333.19 of the Tax Code of the Russian Federation, state duty is paid for assigned alimony. The amount of payment is determined by the type of application of the applicant. In 2023, the parent with whom the children will live has the right to write a petition if the other party refuses to provide support.

Who pays the fee

According to paragraphs. 2 hours 1 tbsp. 333.36 of the Tax Code, the preparer of the statement of claim is exempt from paying taxes. However, the legislation of the Russian Federation establishes the specifics of the state duty:

- if the court satisfies the plaintiff’s demands, the defendant will have to pay the tax;

- If the claim is rejected, payment of funds for consideration of the case is assigned to the applicant.

The amount of state duty in court for alimony in 2023

Taking into account the possibility of going to court without limiting the statute of limitations, the amount of funds for paying the state duty for alimony differs. Detailed data is presented in the table.

| Payment | Reasons for establishing |

| 150 rubles | For filing a statement of claim in court (Article 333.19 of the Tax Code). |

| 300 rubles | When the content of the claim includes demands for payment of alimony for the child and parent. |

| 400 rubles | Filing an application for alimony at the same time as a claim for divorce. |

| 0 rubles | The plaintiff is released, but the final state fee is set by the court. The defendant will pay it. |

Examples of duty calculation

Based on paragraphs. 1 clause 1 art. 333.19 of the Tax Code, the state duty established for filing an application for alimony payment depends on the price of the claim:

- less than 20 thousand rubles. — 4% (not less than 400 rubles);

- 20-100 thousand rubles. — 800 rubles + 4% of the amount over 20 thousand;

- 100-200 thousand rubles. — 3200 rubles + 2% for an amount greater than 100 thousand;

- 200 thousand - 1 million rubles. — 5200 rubles + 1% for exceeding the 200 thousand mark;

- more than 1 million rubles. — 13,200 rubles + 0.5% of the amount more than 1 million (no more than 60 thousand).

That is, the state duty depends on the cost of the claim, but it can be at least 400 rubles.

Calculation features

How the state duty paid when collecting required alimony is calculated can be seen using examples.

Example 1.

Applicant Kozlova submitted a claim to her husband for divorce, payment of alimony for her and the children, and to determine the child’s place of residence. She must pay a tax of 600 rubles. for divorce. The state duty for alimony is double 300 rubles. and determining with whom the children will live (300 rubles) is collected from the defendant.

Example 2

Applicant Kozlova applied to the court to have her ex-husband pay alimony for her minor daughter, as well as for herself to care for a child under 3 years old. The woman does not pay tax because... exempt from penalties.

When considering the claim, the court decided to pay child support; the mother was denied financial support. The defendant paid a tax fee to satisfy the request for child support. The plaintiff paid 150 rubles.

for refusal as an obligation.

Read also: How to obtain guardianship of a child?

Example 3

Citizen Kozlov’s salary is 50 thousand rubles, 12,500 of which he paid for alimony every month. This is 25% of his income. The plaintiff filed a statement of claim to reduce payments to 7,500 rubles. (15% of earnings). The amount of reduction is legally established - 5000 thousand rubles, i.e. the cost of the claim is equal to the amount of alimony for the year - 60 thousand rubles.

Additional requirements in the statement of claim

When an application for alimony contains other requirements, a state fee may be paid for this part of the claim. According to Art. 333.19 Tax Code establishes the following standards:

- for claims for divorce - 600 rubles. for each spouse, the plaintiff pays immediately;

- when determining the procedure for communicating with a child, the fee is 300 rubles, the applicant is exempt from payments;

- if it is necessary to establish paternity - the state duty is 300 rubles, the plaintiff is exempt from payment;

- division of property - the amount of the duty is determined on the basis of clause 1, part 1, art. 333.19 and depends on the amount of the claim, the property share claimed by the applicant.

How to pay the state fee to court for alimony

The court will begin to accept the claim and consider it only after receiving a receipt confirming payment of the state duty. There are several ways to pay a receipt.

At the register

You will need to go to a bank office or Russian Post office with a payment slip containing the recipient’s details. The cashier will issue a payment slip.

In the terminal

In ibox you need to find the “Public Services” section, select the authority, enter details or other data, insert a bill and click “Pay”. Some terminals do not print out the check, but send it by e-mail.

At an ATM

A bank card is used to withdraw funds. You will need to select a recipient and send money. Payment is made without commission.

Online payment

Receipt

An official document issued by the operator confirms that the tax has been paid. Before transferring money, you need to check the information:

- Recipient's name.

- TIN of the organization.

- checkpoint of the organization.

- OKTMO code (can be found at the authority’s address on the Internet).

- Payee's bank.

- Current account for transferring funds.

The receipt also displays the payer’s details - full name, registration, payment amount and date. The payment must have a purpose (type of state duty). The receipt and bank checks are attached to the statement of claim.

Fee for an order to collect alimony

When can I receive an order?

The Family Code and Resolution of the Plenum of the Supreme Court No. 9 establish that a court order for the collection of alimony is issued when:

- it is required to pay funds for the maintenance of children under 18 years of age;

- there is no need to establish or challenge paternity;

- there is no need to involve other persons;

- the amount of payment depends on the defendant’s earnings (according to Article 81 of the Criminal Code).

Read also: Maternity payments for a non-working mother in 2023

The order is not issued if it is necessary to support children of adult age, spouse, other family members, or receive funds in a fixed amount of money.

Executive authorities can assign alimony in an indisputable manner by issuing a court order. Based on the document, the plaintiff will receive a clearly fixed amount. The debtor has no right of refusal. In this case, the court fee is not paid; the tax fee is set individually.

Does the child support plaintiff pay fees?

- fines and penalties for alimony payments are collected;

- the request to increase or decrease payments is formulated by the recipient;

- The procedure for obtaining financial support is changing.

The applicant is not always exempt from paying state fees. When simultaneously assigning alimony and initiating divorce proceedings, the plaintiff contributes funds. The tax is also levied if the court sided with the defendant.

When no duty is charged

The legislation of the Russian Federation establishes the conditions for the defendant’s release from alimony payments. This category of citizens includes:

- persons with disabilities of groups 1-2;

- heroes of Russia and the Soviet Union;

- combatants;

- disabled people and participants of the Great Patriotic War.

The remaining defendants pay the state fee if the applicant's claim is fully or partially satisfied.

State protection of some segments of the population exempts the plaintiff from collecting money when filing a claim for alimony. This is regulated by the Tax and Family Code. Defendants should take into account that the amount of the state duty changes annually.

State duty on alimony in 2023: Table of rates

A request for child support is most often submitted to the court simultaneously with an application for divorce. Therefore, it is generally accepted that the state duty for alimony in 2023 is paid for both applications at once. However, you can file a claim for alimony at any time. In this case, the state duty when collecting alimony is paid separately.

When applying to the judicial authorities, it is necessary to take into account the specifics of filing a claim. Otherwise, if the stipulated rules are not followed, it will be returned or left without consideration. To avoid this, it is worth clarifying some points in advance.

The most convenient way to get a free consultation is on our website.

To do this, you just need to formulate your question and ask it through a special form in this article. In a few minutes, one of the family law specialists will give you a comprehensive, detailed answer. In the meantime, let’s look at how much it costs to file a claim and who must pay the required amount.

What is state duty and why is it needed?

State duty is a fee for the provision of government services. It is collected from citizens and legal entities when applying to state authorities and local self-government. But only in cases where it is necessary to perform legally significant actions in favor of the applying citizen. For example, receiving documents and their duplicates, registering rights, etc.

The state fee for cases considered by the court is the so-called legal costs. It is entered when filing an application for alimony. More precisely, before the transfer of the claim. Payment of the fee is mandatory. A receipt for payment of the state fee when submitting an application guarantees its consideration.

The list of cases requiring the payment of state duty in cases heard in court, as well as its amount, is regulated by the Tax Code.

The same normative act also contains rules for exemption from paying duties in certain cases.

Or the return of this payment at the request of the party who filed the claim, if the application is left without consideration or if the proceedings for the collection of alimony are terminated.

Amount of state duty in 2023

The fee may be fixed. For example, in cases where claims of an intangible nature are stated. When dissolving a marriage in court, the amount of the state fee is the same for everyone and is 400 rubles. This, as it happens, will be an example of similar demands that do not have a material assessment. The divorce procedure itself is paid for through the court.

Filing a child support claim in 2023 is also subject to a fee. The amount of state duty on alimony depends on who it is intended for.

If the claim requires maintenance only for common children, then the fee will be 150 rubles.

And if the application also contains a request for the allocation of funds for the maintenance of their mother, then the receipt should already contain an amount of 300 rubles. which is logical, because two demands have already been stated.

However, there is one more rule in the tax complex that exempts the plaintiff, that is, the parent who sues for alimony, from state duty. This does not mean that financial support will be collected from the second spouse free of charge. These legal costs will simply be borne by the defendant. Who will pay them along with the assigned alimony.

But no longer in a fixed size. When determining the final amount, the court will apply the same rules that are used to determine the fee when considering property disputes.

That is, for alimony you will have to pay a fee calculated as a percentage of the amount in accordance with the provisions of Art. 333.19 Tax Code of the Russian Federation.

In addition to the request for alimony, the plaintiff also does not pay a state fee when filing a claim for the following:

- increase in the amount of payments;

- covering part of the costs of treatment and rehabilitation of the child;

- collection of accumulated alimony debt.

Methods of paying state duty

Alimony is transferred to the account of the recipient of these payments. But the state duty is included in the budget. And it is not paid to the judge himself, the secretary or the bailiff. They are only presented with a receipt for such an action. The fee must be deposited in the bank, to the appropriate account.

There are quite a lot of ways to do this today. You can choose any convenient payer:

- through a bank teller;

- through a payment terminal;

- via Internet banking;

- through an ATM with a card;

- from an electronic wallet, etc.

However, in any case, payment details will be required. You can find them at the information stand in the court office. Or at a similar stand of the nearest bank. Court staff can also help you find the information you need. You will need:

- recipient's name;

- TIN and codes according to various classifiers;

- recipient's bank account number;

- Name of the bank.

When paying through an ATM or a special payment terminal, you will not need to fill out receipts with this information. You will only need to enter information about the payer and the purpose of the payment - the state fee for the lawsuit. A printed receipt with legible data must be attached to other documents that are submitted along with the claim. It is advisable to keep a copy.

about the author

Share:

Rate this article:

No comments yet

Alimony in Belarus (2019) - all aspects

- Alimony is a payment of funds (one-time or periodically) to a person who is entitled to financial assistance from another person.

- Alimony can be paid both voluntarily (transfer of funds or deduction from wages) and in court (collection of alimony in court).

- Naturally, no one will simply pay alimony to a stranger, so there are a number of conditions under which these funds are paid to a person:

- fact of family or kinship connection (between the person who pays alimony and the person who claims to receive it)

- inability of the alimony recipient to provide for himself

- termination of common farming

Who is eligible to receive alimony?

The following have the right to receive alimony :

- minor children from parents

- disabled adult children from parents

- ex-wife from ex-husband during pregnancy, if pregnancy occurs before divorce

- ex-spouse caring for a common child under 3 years of age, or a disabled child under 18 years of age, or an adult disabled child

- disabled parents from able-bodied children in need of financial assistance

- by court decision - one of the former spouses who has become disabled and needs financial assistance from the other former spouse

Voluntary payment of alimony

Parents (parent) can meet each other and enter into an agreement on the payment of child support for children (child). This agreement determines the procedure and amount of payments, as well as the method of such payment. To conclude such an agreement you will need: passports of both parents, birth certificate of the child. Also, a document is provided confirming the parent’s ownership of the property, if the agreement concerns the rights to this property. Next, with this set of documents, you go to the notary and enter into an agreement.

However, the agreement cannot specify the amount of alimony payment, which is less than the amount established by law. Also, it is necessary to indicate the specific form and method of payment: cash payment or by bank transfer.

By the way!

The alimony payment agreement may provide for a combination of different payment methods (cash and non-cash payments). Read more about the agreement...

The agreement can be terminated or amended at any time by agreement of the parties, and it is made in the same form as the conclusion. Modification or termination of the agreement is not permitted unilaterally.

Types of alimony payments:

- a fixed sum of money paid periodically

- a fixed sum of money paid in one lump sum

- percentage of earnings

- transfer of ownership of property

Collection of alimony through court

- Collection of alimony through the court is possible at any time, despite the fact that it is paid voluntarily.

- To do this, you need to fill out a statement of claim, which looks like this:

- Important!

When filing a claim for alimony recovery in court, you are exempt from paying the state fee for filing such a claim.

Alimony can be collected for no more than 3 previous years , provided that up to this point measures have been taken to obtain these funds.

In case of non-payment of alimony, arrears are accrued. The amount of debt is determined based on the income of the debtor parent received during the period of non-payment.

If the parent who is obliged to pay child support did not work at this time, then the debt is calculated based on the income received at the moment.

However, if the place of work is currently unknown, then the debt is determined from the income received from the last place of work. In a situation where this is also unknown, then the average salary in the country is taken into account.

Interesting!

The court, taking into account the financial and family situation, as well as due to illness or other valid reasons, has the right to partially or completely exempt from payment of arrears of alimony.

The payer of alimony, in case of delay in this obligation, pays a penalty in the amount of 0.3% of the amount of unpaid alimony for each day of delay. A parent who evades payment of child support for more than 3 months during the year may be subject to criminal prosecution.

It is worth noting that paying alimony does not relieve the parent from the responsibility to raise the child, as well as from the obligation to participate in unforeseen expenses for the child.

Amount of alimony

The amount of alimony is expressed as a percentage of wages, namely:

- 25% of income - for 1 child

- 33% of income - for 2 children

- 50% of income - for 3 children

At the same time, the legislation establishes an amount below which the amount of alimony cannot be. This amount is tied to the subsistence level budget, which is 214.21 rubles . Let's consider the minimum amounts for alimony:

- for 1 child - 50% of the subsistence level budget

- for 2 children - 75% of the subsistence level budget

- for 3 children - 100% of the subsistence level budget

A reduction in the amount of alimony is possible if the alimony-paying parent files a corresponding claim in court.

The court reduces the amount of alimony in the following cases:

- if the alimony parent has other minor children who, when collecting alimony, are less well off than children who receive alimony

- if the parent paying alimony is a disabled person of groups I and II

- if the child support parent cannot pay child support for objective reasons

Attention!

Alimony is calculated from the moment the application is submitted to the court, i.e. from the day when the statement of claim was accepted in court. The end of child support payments occurs when the child becomes an adult, i.e. until he reaches the age of 18 years.

Child support for adult children

There are exceptions to almost every rule - this also applies to alimony. Maintenance funds are paid for minor children, but there are cases when adult children also receive alimony.

Thus, a former spouse who has the necessary means is obliged to financially support:

- ex-wife during pregnancy, during pregnancy before divorce

- disabled spouse, if it occurred before the divorce, as well as within 1 year after it

- a minor able-bodied child

- ex-spouse caring for a child under 3 years of age

- ex-spouse caring for a disabled child under 18 years of age

- ex-spouse caring for a common disabled adult child

The right to financial support is lost when:

- the conditions that are the basis for receiving financial assistance have disappeared

- ex-husband remarried

Need work? See vacancies in Minsk at the link: https://praca.by/rabota-minsk/

State duty when applying for alimony

Alimony is monetary payments aimed at supporting a dependent. The procedure for determining and assigning revenues involves two options: voluntary and judicial (mandatory, lawsuit proceedings). The involvement of government agencies is associated with the payment of a fee for the provision of services in resolving a dispute, which is called the “state fee for the collection of child support.” The mechanism for calculating court fees is regulated by the provisions of the Civil and Tax Codes of the Russian Federation.

Is a state fee required when applying for alimony?

State duty is a payment that compensates for state legal costs.

Establishing alimony involves two options for resolving the situation:

- Voluntary - signing an agreement between parents on the payment procedure.

- Compulsory – involvement of a judicial authority:

- writ proceedings - applied in the absence of a dispute about the right with a percentage type of calculation;

- claim proceedings – the existence of a dispute combined with additional requirements (divorce, division, property, establishment of paternity).

If the issue of collecting alimony occurs in court, payment of the state duty is a mandatory item when filing a statement of claim (the exception is for preferential categories of citizens, which we will discuss below). Payment is made to cover legal costs that may arise as a result of the dispute. The mechanism for calculating court fees is regulated by the provisions of the Civil and Tax Codes of the Russian Federation.

Resolving the issue of financial support for a child peacefully is characterized by the signing of an alimony agreement, which does not require payment of the amount to the state budget. This fact does not mean that there are no costs; in this case, you will have to pay for notary services, according to the tariff.

Who pays the state fee for alimony?

The obligation to pay tax is assigned to the defendant – the person liable for alimony (Article 103 of the Code of Civil Procedure of the Russian Federation). The legislator provides for categories of claims with tax benefits - exemption from financial burdens. The state provides vulnerable categories of the population with the opportunity to seek the help of a judicial authority free of charge in the case of alimony.

The Tax Code of Russia provides for preferential categories of citizens exempt from compensation for legal costs:

- disabled citizens with 1st and 2nd disability groups;

- persons with the status of “Hero of Russia, USSR”;

- combatants;

- veterans and disabled people of the Great Patriotic War;

- migrants, refugees;

- pensioners.

The remaining defendants cover the costs of government services in proportion to the claims satisfied. In this case, determining the amount of state duty in each individual situation is not so easy.

A claimant who has repeatedly applied to the court is not burdened with state duty for the following cases:

The appeal of the alimony obligee with the above-mentioned subjects of dispute to the court does not provide for exemption from the court fee, since the essence of the claim affects personal interests, and not the child.

Amount of state duty for alimony

Free legal consultation We will answer your question in 5 minutes!

In accordance with Article 103 of the Code of Civil Procedure of the Russian Federation, fees for public services are collected from the defendant. As practice shows, plaintiffs often make a mistake in assigning alimony disputes the status of a property nature with the possibility of assessment and pay a state fee. This should not be done based on the following facts:

- a dispute regarding the financial support of a child is not subject to assessment;

- the claim price does not apply.

The duty calculation process involves the following steps:

- Determining the form of assignment - a percentage of earnings (depending on the number of children) or a fixed amount.

- Identification of preferential grounds for paying state duty.

- Selecting a court in accordance with the requirements of territoriality and jurisdiction (type of proceedings).

Current legislation regulates the following rules for calculating state duty:

- consideration of the case in the order of writ proceedings obliges to pay a court fee in the amount of 50% of the cost of the claim of a property nature;

- appeal – half the price of the application for a non-property dispute;

- the share ratio in payment of state duty is fixed by the Tax Code of the Russian Federation in cases of property claims;

- simultaneous requirements of a different nature are determined by the rule for paying tax for each type separately.

This is also important to know: How to force the father of a child to pay child support?

Amount of state duty (RUB)Content

Regulatory framework

| Statement of claim for alimony by the plaintiff. The obligation to pay the fee is assigned to the defendant in the amount determined by court decision. | Art. 333.36 Tax Code of the Russian Federation | |

| 150 | Collection of alimony by opening a claim proceeding | Article 333.19 of the Tax Code of the Russian Federation |

| 300 | Collection of alimony for children and ex-spouse | |

| 600 | Divorce and alimony obligations | |

| 300 | Establishing paternity | |

| Determining the order of communication with children | ||

| Depends on the cost of the claim | Property division | |

| 300 | Additional requirements | |

| 0.5-4% of the difference (not less than 400) or 300 | Changing the amount of alimony support | Part 6 Article 91 Code of Civil Procedure of the Russian Federation Art. 333.19 Tax Code of the Russian Federation |

| from 250 for notary services | Certification of the agreement on the procedure for financial support of minors | Art. 99-100 RF IC Article 333.24 RF Tax Code |

An example of calculating the state duty for a claim for the recovery of alimony for children and mother

The state duty for each claim in relation to the mother and minors is 150 rubles, in total - 300 rubles. The number of children does not matter. When submitting documents to the court office, the citizen did not pay the state fee on the basis of entering a preferential category exempt from this tax.

During the consideration of the case, the court partially satisfied the claim, refusing to provide for the obligation to provide financial support for the ex-wife.

State duty of 150 rubles. for a claim against a minor child recovered from the defendant, the remaining 150 rubles. remained with the plaintiff.

An example of calculating state duty when reducing the amount of alimony

Citizen Kononov V.V. filed a lawsuit to reduce alimony payments: from 25% to 20% of earnings. Attached to the application is a check for depositing the state duty into the budget account in the amount of 300 rubles. The plaintiff determined that the claims were of a proprietary nature and could not be assessed.

The court left the appeal without progress and pointed to the rule for calculating the court fee in accordance with Part 1 of Art. 91 Code of Civil Procedure of the Russian Federation.

- salary – 45,000 rubles;

- alimony (1/4) – 11,250 rubles;

- the required amount of alimony payments is 9,000 rubles;

- difference (amount of reduction) – 2250 rubles;

- the amount of the difference for the year is 27,000 rubles.

State duty: 800 + 210 = 1100 rubles.

The calculation is made on the basis of the rules defined in paragraphs. 1 clause 1 art. 333.19 of the Tax Code of the Russian Federation, where, subject to the price of the claim, from 20 to 100 thousand rubles. The court fee is 800 rubles. and 3% of the amount more than 20 thousand.

An example of calculating the state duty when collecting alimony, the further place of residence of the child and divorce

The state duty payable by the plaintiff is 600 rubles. We are talking about divorce. The remaining amount is 600 rubles. (300) is subject to recovery from the defendant, since a person acting in the interests of a minor is exempt from the obligation to make a tax payment.

Procedure for paying state duty for alimony

Payment of the court fee is not carried out when submitting a statement of claim with a package of documents to the office of the judicial authority.

The payment procedure requires a certain sequence of actions:

- Obtaining payment details on the official website of the judicial system, information stand in court:

- name of the addressee – state budget;

- TIN;

- checkpoint;

- OKTMO;

- name of the banking institution;

- recipient's current account.

- Filling out a payment order:

- Full name of the addressee;

- registration data;

- purpose of payment;

- amount in monetary terms;

- calendar date.

- Payment by one of the following methods:

- bank cash desk;

- online banking (non-cash);

- self-service technical means – ATM (cash/plastic card).

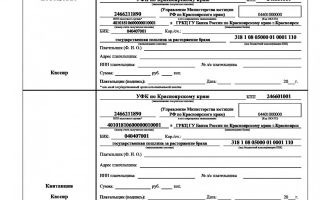

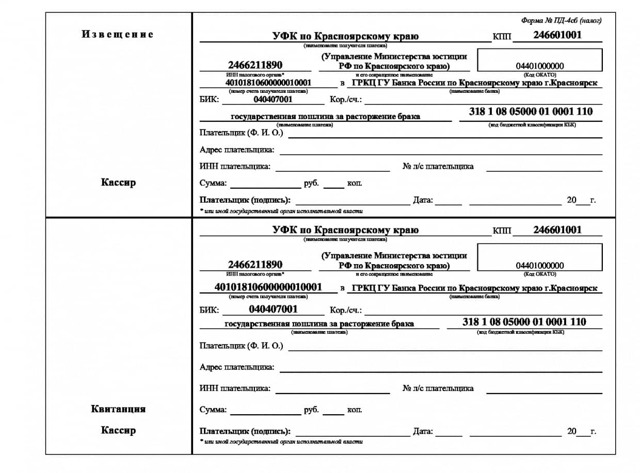

Example of a receipt for payment of state duty:

A payment receipt must be provided at the time of filing your claim.

It is important to know!

- Each case is individual and requires special attention. The information presented on the site is general and does not guarantee a solution to your specific problem.

- We carefully monitor changes in legislation and try to make changes in a timely manner, but this does not always happen quickly.

Therefore, 24-hour legal assistance on any issues is available to you FREE OF CHARGE! Ask your question right now!

State duty on alimony in 2023, amount of state duty on collection of alimony

By the way: Do you know about our “Stress-Free Divorce” service? More details

Almost every legally significant action is subject to various types of state duties and councils. When applying to a court, payment of the state duty established by the Tax Code of the Russian Federation is mandatory. Its size is established depending on the type of appeal and citizens are required to pay the specified amount to the local budget before filing a claim.

If you believe the law, then alimony is no exception. In a number of cases, when the parents of a child after a divorce were unable to agree on an amicable determination of the amount of financial support, one of them goes to court and demands to collect alimony from the non-resident parent.

The provisions of Article 333.19 of the Tax Code of the Russian Federation indicate that the amount of the state duty when filing a claim in a court of any level (world or district) is 150 rubles. A special case is also stipulated: if the plaintiff insists on collecting monetary support not only for the child, but also for himself, the amount of the state fee to the court for alimony will double and amount to 300 rubles.

Is the state fee paid to the court for alimony when filing a claim?

It would seem that Tax legislation makes payments quite accessible to protect one’s rights and interests, but here too the state took care of protecting the child and his parent who is demanding the collection of alimony maintenance.

IMPORTANT: The norms of Article 333.36 of the Tax Code of the Russian Federation, namely clause 2, part 1, directly state that persons filing a claim for the collection of alimony payments are exempt from the obligation to pay a state fee before filing an application.

What is this? Legal conflict? Inaccuracy? No one will pay a fee for alimony?

Not at all! According to the norms of the Code of Civil Procedure of the Russian Federation, the party in whose favor the court verdict was made is awarded all the costs incurred within the framework of the court case and confirmed by documents. Since the fee is not actually paid when filing a claim for alimony, the court collects it from the defendant in favor of the local budget.

If for some reason the claim for alimony is denied, the state duty in cases of alimony collection will be collected from the plaintiff who filed an unfounded claim.

State duty on alimony along with a claim for divorce

When filing a claim for alimony along with a divorce petition, only a claim fee is paid, from which the applicant is not exempt.

That is, if a lawsuit is filed in court to terminate a marriage, assign alimony and determine the child’s place of residence, the applicant will only need to pay a state fee in the amount of 600 rubles.

The alimony claim is not paid with a fee for the reasons stated above, and the requirement to determine the child’s place of residence falls under the benefits prescribed in Article 333.36 of the Tax Code of the Russian Federation and provided for claims filed in defense of the rights and interests of minors.

When filing a claim for division of property, the amount of the fee will be calculated depending on the value of the claim and added to the claim for divorce.

Further appeals to the court related to alimony (changing its amount, debt collection, etc.) are not subject to state duty.

To summarize what has been said, we can briefly summarize the answers to the questions considered:

- The state duty for alimony is 150 rubles, if you require maintenance for yourself (the parent) and the child - 300 rubles.

- When filing a claim for alimony, the plaintiff does not pay it; the fee is collected from the party that lost the dispute.

- When combining claims, each claim is subject to a fee in accordance with the requirements of the Tax Code of the Russian Federation.

Lawyers at ICPI “Planet of Law” will help you prepare all the necessary documents for cases of alimony collection and will take on the hassle of handling your cases in court. Special legal program “Alimony? “Elementary!” will reduce to a minimum the need for your presence in courts. Call + 7 (495) 722-99-33.

Alimony is a payment of funds (one-time or periodically) to a person who is entitled to financial assistance from another person.

Alimony is a payment of funds (one-time or periodically) to a person who is entitled to financial assistance from another person.

By the way: Do you know about our “Stress-Free Divorce” service? More details

By the way: Do you know about our “Stress-Free Divorce” service? More details