The issue related to alimony is especially relevant at the present time.

Nowadays, situations are common when a family breaks up and one of the parents does not want to participate in the child’s life and tries to reduce the amount of payments as much as possible.

It is logical that the second parent, who remains with his child, strives to receive the money that can provide the child with a decent life. How to solve this problem? What is the minimum amount of alimony?

Grounds for receiving payments

According to current legislation, both spouses must take part in raising the child.

Children have needs, both physical and moral-intellectual, and who, if not their parents, can satisfy them.

In case of separation, it is much more difficult for the one who remains with the child to do this. Expenses increase significantly, and therefore the second parent is obliged to provide financial assistance.

This fact must be recorded, and therefore you need to sign an agreement on the payment of alimony. In some cases, this action occurs under a court order. It is important to remember that those persons who lived in a civil marriage that was not officially registered can also count on alimony. For this to be possible, the father must provide information on the birth certificate.

Payment of alimony can be made on a voluntary basis. The main thing to remember is that funds must be debited from all sources of income: unemployment benefits, vacation pay, etc.

Minimum amount of alimony

Specific numbers are determined when assessing the child's maintenance and development needs. The legislation of the Russian Federation enshrines a provision according to which parents are obliged to provide their child with comfortable living conditions. In the process, the child must develop his physical, mental and creative abilities.

Usually in a family there are two parents who are equally responsible. The minimum amount of alimony is determined based on this principle. In this case, they turn to regulations. We are talking about a living wage here. This indicator has its own significance in different regions of the country.

The minimum amount of child support may be equal to these data. Since the value of this indicator changes every quarter, the size of payments is also transformed accordingly.

Innovation in legislation

At the moment, there are specific amounts of payments that one of the parents is required to make in the event of separation. According to the Family Code of the Russian Federation, the minimum amount of alimony for one child is about 1,500 rubles. Accordingly, if there are two or three children in a family, the amount of payments increases. Thus, for three people the minimum amount of alimony payment will be 3,000 rubles.

This is a theoretical part, but in practice, alimony obligations are fulfilled in the form of other payments. Typically, the payment amount is calculated by calculating the percentage of the parent's sources of income. The smallest payment is considered if a person has an income that does not exceed the minimum wage (minimum wage).

By law, the employer cannot pay wages that are lower than this indicator. Accordingly, the amount of alimony will be calculated as a percentage of this value. If the person applying for payments cannot provide evidence of third-party sources of income from the second parent, then the payment will be 1,500 rubles.

Amount of alimony

What is the minimum amount of child support? Before answering this question, it is necessary to understand the types of payments. There are only two of them: a share of the parent’s income or a fixed value. In both cases, it may turn out that the amount for maintenance does not correspond to real needs.

The law regulates the amount of payments in percentage shares as follows:

- one child – a quarter of the income;

- two children – a third of all sources of profit;

- three or more children – half of the income.

A common situation is when a person obligated to pay alimony hides his real earnings. In this case, a quarter of the income seems a ridiculous amount and will not meet the needs of the child.

The second type of payment is a fixed value. It is established on the basis of the subsistence level or minimum wage. The judge has the right to impose a mandatory monthly payment in the amount of two minimum wages.

How to increase the amount of alimony?

This question has plagued more than one generation of single women, because in most cases there is not enough money even for half a month. Confirming the income of a departed parent is a rather difficult and practically impossible task. Therefore, the main advice in this case is to identify the costs of maintaining a child.

To do this, you need to collect all kinds of food receipts within one month. If the child is still small, it will be easy to identify the costs for him. That is, the receipt will indicate the purchase of infant formula and other products for babies. In the case of raising a teenager, the amount will be divided among all family members in order to identify the amount of money that was spent exclusively on the child.

Checks for the purchase of clothing, expenses for housing and communal services, kindergarten, and school are also included in the general bill. Based on all these documents, the average cost can be determined. With this result, it is recommended to go to court to increase the amount of payments.

Prospects for increasing the amount of alimony

The minimum amount of child support is one of the most important topics of discussion. The number of bills suggesting an increase in payment is increasing. At the moment, one of them is being considered, according to which the minimum amount of alimony will be 15,000 rubles.

However, in reality this is quite difficult to achieve. After all, equating all people to one amount means that the real earnings of a particular person are not taken into account. This is, to say the least, wrong. Some will be able to make such payments, while others will not. As a result, those who are unable to pay such amounts will stop doing so altogether.

Why set a minimum payout threshold?

The minimum amount of child support allows you to determine a specific amount of money that will help the child meet his needs. Children should have a decent standard of living, and regular payments help achieve this.

In fact, the existing provisions in the law regulating the minimum amount of alimony do not allow the child to fully exist.

The amounts are very small, and most often this money is not enough even for food, not to mention clothing and entertainment. The problem of providing for children falls entirely on the shoulders of parents.

The one who pays child support must have a sense of responsibility in order to organize a decent life for the child.

What is the minimum amount of alimony? Most often, this depends on the existing indicators of the cost of living and the level of the minimum wage. The data on this is different in each region.

How much should an unemployed person pay?

A situation often arises when a father who has left the family is not officially employed. In this case, the minimum amount of alimony for a non-working payer will be calculated as a percentage of unemployment benefits. For example, if the debtor is on the labor exchange and receives 850 rubles a month, then the payment amount will be 208 rubles.

If the payer does not work and does not receive benefits, the amount of alimony is established in court. Typically, the basis for deducing the final amount is the minimum wage.

Before naming the amount, the court evaluates the financial and family situation of the debtor and checks for the presence of hidden income, such as receiving interest on a deposit or renting out real estate. Based on this data, the payment amount is determined.

The main thing is that the announced amount of money is sufficient to meet the needs of the child.

If the payer gets a job in the future, he will pay the same money. To increase the amount of payment, you must go back to court to review the case.

Collection of alimony

Parents who, after leaving the family, do not want to support their child are not uncommon in our time. In most cases, he doesn't pay at all. And then those who look after the children have to “knock out money.” 1,500 rubles is currently the minimum amount of child support. Collection methods are not distinguished by their diversity, rather, on the contrary.

Most often, those people who do not pay are those who do not have a permanent source of income, that is, in fact, they are unemployed. In such a situation, you should not give up. There is a certain mechanism that will allow you to achieve payment of alimony. True, the scheme will only operate if there is unofficial income or property that can be recovered.

Typically, such sources of profit are unstable, and therefore it is not profitable to calculate the percentage of them. It is better to set a fixed amount that the parent is obliged to pay monthly. The mechanism for collecting alimony is as follows:

- Obtaining a court decision.

- Help from a bailiff who will collect funds.

- The amount of payments is determined by the court.

- If it is difficult to calculate interest, it is proposed to draw up an agreement with a specific payment amount. A clause should be added to this document according to which the amount may change in proportion to the transformation of the cost of living.

Conclusion

We can conclude that the minimum amount of alimony in each specific situation is different. This is influenced by many factors: from the work of the payer to the number of children. In most cases, the mother remains with the child. It is very rare for Russia for a child to be raised by one father. Mothers almost never pay child support because fathers do not demand it.

The payer in 99% of cases is a man. And this is quite understandable. After all, a woman with a child, in addition to its maintenance and development, needs to live on her own. Working and raising a baby at the same time is a very difficult task. Paying alimony helps solve this problem. Fathers who do not refuse to pay maintain contact with their children, and mothers most often do not interfere with this.

Alimony in 2023

Changes are planned for 2023 regarding the provision of alimony guarantees to persons of pre-retirement age, the abolition of the deferment of conscription for military service for fathers of two or more children who evade their maintenance and have alimony debt.

Other changes may result in the application of administrative penalties for law enforcement officers who neglect the responsibility of supporting their children or parents.

In addition, the possibility of selling the only housing for persistent alimony defaulters is being considered.

The basics of alimony legislation regarding the procedure for assigning alimony, the method of establishing monthly payments, indexing alimony in a fixed monetary amount and conducting enforcement alimony proceedings for 2023 remain unchanged and are regulated by the Family Code (FC) of the Russian Federation and Federal Law No. 229-FZ “On Enforcement Proceedings” from 02.10.2007.

Child support law in 2023: what will remain unchanged

Alimony for the maintenance of minor children, as well as for adult family members in need in 2023, as in previous years, can be assigned:

- on a voluntary basis - with mutual agreement of the parties on all aspects of payments, you can conclude an alimony agreement and have it certified by a notary in accordance with Art. 99 and art. 100 SK (the cost of such a service, for example, in the Bryansk region at the beginning of 2023 is 5,250 rubles);

- forcibly - go to court with a statement of claim or an application for the issuance of a court order.

Payments for a minor child may be established:

- as a share (as a percentage) of the defendant’s income (for example: from a scholarship, pension, salary) in the manner established by Art. 81 SK;

- in a fixed sum of money (if the defendant does not officially work or has an unstable income) in the manner established by Art. 83 SK;

- simultaneously in equity and hard money terms.

For adult needy family members (parents, spouses and former spouses, other disabled relatives), payments are assigned only in a fixed amount .

No legislative act specifies the minimum amount of alimony as such. An important factor when assigning funds in 2023, as before, is maintaining a balance of interests of both parties to alimony proceedings: not only the recipient, but also the payer.

On the one hand, alimony should be aimed at meeting the priority needs of the person in need, on the other hand, it should not be a means of unjustifiably enriching him, while excessively reducing the payer’s standard of living. Therefore, in each specific situation, the courts use an individual approach when establishing the amount of alimony.

However, there are two values from which you can start to determine the approximate alimony minimum:

- minimum wage (minimum wage) - when alimony is assigned as a share of the defendant’s income in accordance with Art. 81 SK;

- subsistence minimum (LM) - when establishing alimony in a fixed amount of money in accordance with Art. 83 SK.

How to calculate alimony from the minimum wage?

Alimony as a share of income can only be assigned for child support . Basically, by share method, alimony payments are collected from persons who are officially employed full time and receive a stable salary. According to labor legislation, wages cannot be lower than the established minimum wage.

From January 1, 2023, the federal minimum wage will be 11,280 rubles, but it must be remembered that alimony is withheld after deduction of personal income tax. The amount of alimony in shared terms should be 1/4 of income for an only child, 1/3 for two children, 1/2 for three or more children .

The calculation of alimony payments based on the minimum wage established for 2023 will look as follows. First, we calculate the amount of income after tax withholding: 11,280 rubles. — 13% = 9813.60 rub. Next, from the amount received, we obtain the approximate minimum amount of alimony:

- 9813.60 rub. / 4 = 2453.40 rub . - for 1 child;

- 9813.60 rub. / 3 = 3271.20 rub . - for 2 children;

- 9813.60 rub. / 2 = 4906.80 rub . - for 3 or more children.

In cases where the share of alimony is withheld from other income (for example, from a pension or scholarship), the minimum wage indicator is accordingly not taken into account .

Alimony in a fixed amount (FDS) is assigned not only to minor children, but also to any categories of recipients: needy parents, spouses, de facto caregivers, and other relatives.

The basis for calculating the amount of alimony when assigning it to the TDS is the subsistence level of the socio-demographic group (children, workers or pensioners) for which alimony is established in the recipient’s region of residence.

In most cases, the judge sets half of the monthly allowance for child support from the paying parent (due to the equal responsibility of the father and mother to support their child).

Example

The minimum allowance for a child in the 3rd quarter of 2018 in the Bryansk region was 9,720 rubles, therefore, the claimant parent has the right to demand from the court the assignment of alimony at least half of this figure, which is 9,720 rubles. / 2 = 4860 rub.

As for other categories of claimants (parents, spouses, etc.), the amount of alimony will be set for each situation individually , based on many related factors.

, it is almost impossible to determine in advance the amount of maintenance funds without knowing the specific family situation.

According to Art. 117 of the Insurance Code are subject to indexation of alimony payments established only in hard monetary terms . Alimony payments are indexed (that is, increased) in order to compensate the recipient for the constant increase in consumer prices.

It is important to note that indexation of alimony in the TDS occurs only when the PM indicator increases , and when it decreases, the amount of alimony payments does not decrease, but remains the same.

Previously, until November 2017, the responsibility to monitor and index alimony lay with bailiffs . However, it was carried out rather ineffectively: a large number of recipients were left without indexation and did not even know about the existence of their right to it.

Now, the actual employers of the payers , and in relation to unemployed citizens, the bailiffs continue to do so.

This edition has made tangible positive changes in the implementation of the law: employers who pay alimony have a lower workload in terms of the number of enforcement proceedings than employees of the Federal Bailiff Service (FSSP), therefore, it is easier and simpler for them to track payers of funds in the TDS and exercise the claimant’s right to indexing.

Since alimony is assigned in proportion to the corresponding amount of the monthly minimum, which is reviewed quarterly , then maintenance funds must be recalculated with the same frequency.

If the recipient of funds in the TDS does not observe a quarterly increase in the amounts paid, he has the right to apply for mandatory indexation of alimony to the payer’s employer or bailiff.

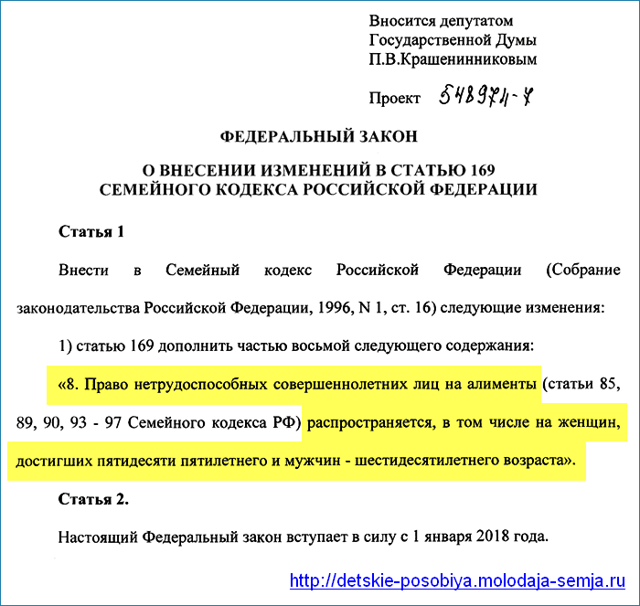

In 2018, a reform related to raising the retirement age . As a result, for the category of persons who would have retired under the old law, the state has provided a number of social guarantees from 2023.

Among them is the right to alimony due to disability (currently only disabled people of I , II and III and actual pensioners ).

This bill was adopted by the State Duma in the first reading in November 2018 and involves amendments to Art. 169 SK. The purpose of the amendments is to preserve the right to alimony for women from 55 years of age and men from 60 years of age , who, according to the new pension legislation, will be considered pre-retirees.

These innovations relate to the issues of supporting needy parents in accordance with Art. 87 SK, spouses - current (according to Art. 89 SK) and former (according to Art. 90 SK), as well as other relatives in accordance with Art. 93 - 97 SK.

These innovations relate to the issues of supporting needy parents in accordance with Art. 87 SK, spouses - current (according to Art. 89 SK) and former (according to Art. 90 SK), as well as other relatives in accordance with Art. 93 - 97 SK.

Cancellation of deferment from the army of alimony debtors

One of the holders of the right to a deferment from military service are men who have two or more children , or one child and a spouse who is more than 26 weeks pregnant.

However, for some of them, it is proposed to limit this right: a bill is currently being considered that would involve in military service those with child support debt for minors.

Such a measure should become one of the incentives to pay alimony and repay debts on it. Military commissariats will have to request information about the status of enforcement alimony proceedings from the FSSP branches in order to verify the presence or absence of alimony debt from a potential conscript.

The government of the Russian Federation approved the draft law taking into account some comments . It is recommended to finalize the document in terms of its extension to situations of non-payment of debt in relation to disabled children before they reach the age of 3 years.

In addition, it is necessary to specify the provision of information from the FSSP departments to the commissariats, since information only about the presence or absence of alimony debt may not be enough, and a more detailed approach to each alimony case is needed.

Can they take away their only home for alimony debts in 2023?

According to Part 1 of Art. 446 of the Civil Procedure Code (CCP) of the Russian Federation, the debtor’s only home cannot be seized in order to pay off the debt. However, the specification of the boundaries of such “property immunity” was proposed by the Constitutional Court of the Russian Federation several years ago within the framework of Resolution No. 11-P of May 14, 2012.

This document proposed to seize and sell the only residential premises if it exceeds the “reasonable needs” of both the debtor himself and the family members living with him.

In 2018, the Ministry of Justice began preparing amendments to the Federal Law “On Enforcement Proceedings” and a number of articles of the Code of Civil Procedure. Initially, it was planned to resort to such a measure only in relation to persistent defaulters in socially significant enforcement proceedings , which primarily include alimony.

However, later it was proposed to sell the only housing of debtors for any debt obligations, but only if the debtor was officially declared bankrupt .

However, a detailed study of many aspects of this issue is required: for example, it is impossible to leave a person and his family members completely without a home. When the court makes decisions on the sale of housing, it is necessary to simultaneously consider the issue of purchasing the debtor another place of residence , a smaller one, which also has a number of legislative nuances.

Debtors living in modest-sized houses and apartments should not worry: even if the bill comes into force, such an innovation will not affect them .

Responsibility for non-payment of alimony for security forces

The Ministry of Justice of the Russian Federation is preparing amendments to Art. 2.5 of the Code of Administrative Offenses (CAO) of the Russian Federation.

Now, according to this article, contract military personnel, customs service employees, employees of the Federal Penitentiary Service, the National Guard, the Investigative Committee and the Ministry of Internal Affairs are exempt from administrative measures for non-payment of alimony, and are subject only to disciplinary penalties .

According to the Ministry of Justice, such an approach to security forces allows the latter to treat issues of supporting children or needy parents in bad faith.

The essence of the amendments has not yet been disclosed, however, if this initiative receives support, then there is a high probability that employees of law enforcement agencies and departments (along with other defaulters) can be brought to standard types of administrative liability provided for non-payment of alimony, under Art. 5.35.1 Code of Administrative Offenses of the Russian Federation:

- compulsory work up to 150 hours;

- administrative arrest for a period of 10 to 15 days;

- administrative fine in the amount of 20,000 rubles.

Alimony for a non-working ex-spouse

At the end of 2018, the Chairman of the National Parents Committee I. Volynets made a rather controversial proposal at the Ministry of Labor. The essence of this initiative is the possibility of receiving alimony by a former non-working spouse with whom common minor children remain living.

It is proposed to tie the amount of alimony paid to the minimum wage: it must be at least one established minimum wage. In this case, the conditions for payment should be the absence of a job for the parent, as well as the minor age of the common child (children).

If the parent receiving alimony gets a job, the payment of funds for his maintenance stops, but such employment must be documented . Another condition for terminating alimony payments to a former spouse is that the child reaches 18 years of age.

This initiative is very doubtful and may infringe on the rights of payers, who, if such a proposal is approved, may themselves be left without a livelihood , which contradicts the balance of interests of both parties in alimony legislation and judicial practice.

Child support in 2023: minimum amount, indexation, payments

In recent years, alimony obligations in Russia have often been discussed at the state and legislative level. The surge in interest was partly due to the current economic and social situation of citizens in the country. The procedure for paying alimony and the introduction of a fixed or minimum amount to be paid are discussed.

However, in 2023 the legislation remains unchanged. A fixed amount of alimony, equal for everyone, has not yet been introduced even at the draft level: different groups of the population have completely different incomes, and a potential fixed value for some segments of the population may turn out to be unbearable.

The law defines alimony as a means of determining the responsibility of family members to each other and necessary for the fulfillment of certain obligations. Often, the amount of alimony may depend on the payer’s position in society and his monthly income.

Child support payments in 2023

Child support is a mandatory payment. Alimony payers are divided into two groups:

Child support is a mandatory payment. Alimony payers are divided into two groups:

- Those who do it voluntarily;

- Those who do not want to pay, then debt collection from the payer occurs in court;

Payers who agree to pay alimony voluntarily, as a rule, negotiate amicably with the other party on the amount of payments. If the amount of alimony cannot be agreed upon, this issue is resolved in court.

Typically, the amount of alimony is assigned as a share of the salary (for 1 child - ¼, for two - 1/3, for three or more - 1/2). In cases where this is difficult to do, for example, the salary is not permanent or unofficial, the person does not have a permanent job or is an individual entrepreneur, alimony is prescribed in the form of a fixed amount linked to the subsistence level.

Voluntary alimony payments

If the alimony payer is ready to make voluntary payments, he must submit an application to the accounting department of his company to withhold alimony from his salary.

It must indicate:

- Start date of alimony payments;

- Retention amount;

- The timing of the transfer of money to the recipient of alimony;

- Recipient's bank details;

In addition, a copy of the voluntary agreement on the payment of alimony (or a writ of execution, if the amount was determined by the court) must be attached to the application.

In the event of a disagreement regarding alimony, the court has the right to determine the amount of alimony based, for example, on the defendant’s salary. For example, a quarter, a third or half of a parent's official income for one, two or three children, respectively.

At the same time, the court takes into account that the official salary should not be lower than the minimum wage, which in 2023 was 11,280 rubles. In 2018 it was 9,489 rubles, with an increase to 11,163 rubles by May 2018. In 2017, the minimum wage was 7,500 rubles. From July 1, 2017, the minimum wage will increase to 7,800 rubles. In 2016, the minimum wage was 6,204 rubles, increasing to 7,500 rubles by July 2016.

There is an opinion that the minimum amount of child support allowed by the court for a parent who has no other dependents and does not have a disability can be calculated from the minimum wage of 11,280 rubles established for 2023. Then the minimum alimony will be 2,820 rubles for one child, 3,760 rubles for two children and 5,640 rubles for three or more children. If you have disabilities and dependents, the amount can be further reduced.

If the parent is officially unemployed, then the minimum amount of alimony is dependent on the subsistence level established in the region of residence of the child. In such cases, alimony is usually firmly fixed by the court and can change proportionally in accordance with changes in the cost of living.

Collection of alimony debt from the debtor

Not all alimony payers are ready to fulfill their functions. Some try to avoid payments. The debt accumulates, and it can only be collected with the help of bailiffs. The court determines the collection period to be three years from the date of application to the bailiff.

If the debtor is officially employed, the amount of his earnings and the employer are known, the debt is determined based on earnings, or in a fixed amount of money (if such an amount was previously assigned). In this case, the writ of execution for debt collection is sent to the employer. The employer will withhold the arrears from the salary in installments.

If there is no data on the debtor’s earnings and employer, then the amount of debt is calculated based on the average earnings in the country (for the period of 2018 this is 42,550 rubles), or in a fixed monetary amount.

In this case, recovery may be applied to other income, to the property of the debtor, or to earnings from the future official employer.

In addition, for each day of delay, the alimony debtor must pay 0.5% of the total debt.

Indexation of alimony in 2023

According to the Family Code of the Russian Federation, the annual indexation of alimony concerns only those fixed amounts that the defendants (the alimony payer) are determined by a court decision. As has already been said, these amounts are determined based on the size of the subsistence minimum, so indexation occurs in proportion to the change in the average subsistence level.

According to data for the 3rd quarter of 2018, the average monthly living wage in Russia is:

- Per capita - 10,451 rubles;

- For the working population - 11,310 rubles;

- For pensioners - 8,615 rubles;

- For children - 10,302 rubles.

The order of the Ministry of Labor and Social Protection of the Russian Federation “On establishing the cost of living per capita and for the main socio-demographic groups of the population in the Russian Federation as a whole for the 4th quarter of 2018” is expected in March 2023. The draft can already be viewed on the federal portal of draft regulatory legal acts.

In accordance with the plans of the Ministry of Labor and Social Protection, the cost of living per capita may decrease by 238 rubles and will be:

- Per capita - 10,213 rubles;

- For the working population - 11,069 rubles;

- For pensioners - 8,464 rubles;

- For children - 9,950 rubles.

We recommend that you use our maternity leave calculator. Try working in Kontur.Accounting - a convenient online service for calculating alimony, maintaining accounting and sending reports via the Internet.

Minimum alimony per child established by law

Sad recent statistics indicate that child support payments are withheld from men (13 percent) and mothers (about 2 percent) throughout Russia. In this case, most often deductions are made for one minor.

The legislator has provided for the provision of children and parents raising minors with a certain amount of money, which makes it possible to satisfy basic needs.

The calculation of child support under the new legislation (according to the latest changes in the RF IC) occurs according to the same requirements as before. The expected amendments were never adopted, but it is quite possible that they will be considered by the legislative body (the State Duma) in 2018.

First of all, we are talking about establishing minimum alimony in Russia for a minor and state guarantees of payments when a parent evades alimony obligations.

The minimum amount of alimony per child in 2018 is not enshrined in the legislation of the Russian Federation. This indicator varies depending on the social and economic status of the payer. Let's consider how much the minimum child support may be.

Ways to formalize alimony relations

Voluntary fulfillment of alimony obligations

The best way to formalize alimony relations is to draw up an agreement on the payment of funds. Documentation of this kind stipulates all the basic requirements for the fulfillment of obligations, including the amount of payments. The agreement in this situation will reflect the minimum amount of alimony.

Please note! I would like to warn those who believe that by concluding an agreement it is possible to significantly reduce the amount of alimony payments. Their value in fact cannot be lower than that determined by the judge on the recipient’s claim, guided by the current law.

Thus:

- for an employed parent, the amount of child support obligations under the contract cannot be lower than the percentage of the official salary;

- for those who are not working or have inconsistent earnings - not less than a fixed fixed amount, which is based on the value of the subsistence minimum (subsistence level).

The amount of alimony may be reduced or increased by a judicial authority taking into account the family or financial situation of the parties and other valid reasons.

Collection by court decision

If it is not possible to sign an agreement on the payment of alimony payments, the claimant can apply to the court to issue an order against the parent of the minor. The minimum amount is determined by the judge based on the payer’s employment data.

Minimum child support in 2018

What is the current minimum child support in 2018? These payments should be based on the actual costs of children.

The legislation has determined that parents are obliged to provide their children with decent maintenance for the normal physical, intellectual and moral development of the individual.

In this case, alimony payments for a minor as an element of civil liability are established as a percentage of the citizen’s income or in a fixed amount of money. If in percentage, then the size is:

- for one child or teenager - 25% (a quarter of income);

- for two children - 33.3% (one third);

- for 3 or more - 50% (half of all sources of income (Article 81 of the RF IC).

The judge will take these values into account when making a verdict.

If the recipient fails to prove to the judge that the parent of the minor has other income, the minimum amount of alimony will be (monthly):

- for one child - 2372 rubles. 25 kopecks;

- for two children - 3,160 rubles;

- for three or more children - 4,745 rubles.

But these amounts can also be reduced if the defendant has other dependent citizens or is disabled.

As for the fixed amount of money that is paid every month, it is determined by the minimum wage. In addition, the judge sets a fixed amount of payments for the child, for example, in the amount of 1 minimum wage, 2 minimum wages, etc.

If the payer’s income is small, most likely he will pay payments in a fixed amount and in accordance with the PM in the region of residence.

It may happen that the established amount of maintenance does not correspond to the real needs of the minor. For example, a parent deliberately reduces his income, which he receives officially, and a quarter of his salary turns out to be meager.

Or the fixed amount of alimony payments in the amount of 1 minimum wage is insufficient to meet the needs of the minor. Situations vary.

That is why citizens are increasingly asking the question about the minimum payment of alimony for minor children.

It is possible that in the near future the legislator will adopt changes that relate to the clear designation of minimum alimony payments.

It is possible that in the near future the legislator will adopt changes that relate to the clear designation of minimum alimony payments.

In addition, guarantees from the state (special fund) are planned for alimony payments in case of evasion or inability to provide the minimum wage.

Living wage for alimony payments

The minimum amount of child support in 2018 may represent a share of the PM. The payer's lack of finances does not relieve him of the obligation to provide maintenance for his children.

Alimony funds from a non-working parent can be collected in a fixed amount, as well as as a part of the average earnings in the Russian Federation. Moreover, the new legislation is based on the average salary in Russia. According to official information from Rosstat, its size is 32,000 rubles.

In reality, this amount does not correspond to the current income of the majority of the population. The parent is interested in providing the bailiff with the true state of his income.

The calculation of child support for a non-working citizen, if there is arrears, is carried out by a bailiff and can be carried out by the other parent receiving the funds.

The judicial authority establishes the amount of payments collected for a non-working person, based on the size of the established minimum wage in the region of residence of the minor.

In addition, the court order fixes the final indicator of the amount of money, indexed according to the change in the size of the PM.

If the debtor does not report his income to the bailiff service, the debt can be calculated without taking into account the actual income of the parent.

Please note! The cost of living per child according to the new law on alimony payments in 2018 is confirmed periodically at the regional and state level. At the federal level it is 9,434 rubles.

They plan to make the minimum payment for alimony obligations equal to the monthly minimum.

Minimum child support can be determined based on the subsistence level established in each region of the Russian Federation.

Alimony according to the minimum wage in 2018

As a rule, wages cannot be lower than the minimum level. A parent seeking to reduce the amount of child support payments often submits a salary certificate that is equal to the minimum wage. Therefore, this is the generally accepted reference point for the minimum wage, from which the minimum alimony payment is paid for one child in Russia.

In 2017, the legislator made changes regarding the establishment of the minimum wage. It will increase gradually, and ultimately should reach the PM level.

The minimum wage and the cost of living are indicators that change their values by region. In addition, different categories of persons (working-age population, minors, pensioners, etc.) have their own minimum wage amounts determined, and they change throughout the year depending on the economic situation.

Minimum minimum wage for calculating alimony in 2018

The size of the minimum wage also plays a role in establishing the minimum amount of alimony obligations, calculated as a share of income. Providing income certificates at the minimum wage level remains relevant today.

Therefore, the amount of cash payments for a minor may be meager. Thus, from January 1, 2018, the federal minimum wage reached 9,489 rubles. Thus, the fourth part of it for one child or teenager will be 2,372 rubles. 25 kopecks

Regional minimum wages are found even more in certain regions of the Russian Federation, but the federal level is mainly used for calculations. Increased size is available in some regions. For example, in Moscow the minimum wage is approaching 19,000 rubles.

In regions such as Siberia, the North and the Far North, this figure reached 13,000 - 16,000 rubles. Minimum wage. The same wide range is typical for the subsistence level.

Minimum amount of child support per child in 2018

Alimony in 2018 is calculated and collected according to the previously established procedure, based on the norms of the RF IC. Changes affect the minimum amount, as well as the age of the recipient. Changes are envisaged in the legislation on enforcement proceedings.

Please note! There is a bill in the State Duma that implies an increase in the minimum wage for alimony (for child support) to 15,000 rubles. This amount is supposed to be calculated regardless of the material well-being of the parents.

There are mixed reactions to such a bill, because the real average income in the regions of Russia for many payers is lower. The minimum amount of alimony per child in 2018 has not been determined. The calculation is carried out according to the rules of the RF IC.

If there is no written agreement between the parents regarding payment, then the funds are collected through the court.

Summary

The minimum amount of alimony payment for the maintenance of a minor is a certain value based on which they determine what standard of living a child should have. This minimum must provide for all the developmental needs of a child or teenager and guarantee that his needs are met one hundred percent.

The minimum amount of child support for one child is currently not established either at the level of federal legislation or at the regional levels, including in Moscow.

Thus, the only requirements are the norms of the RF IC regarding the amount of alimony payments paid (25% per minor).

Indexation of the amount of alimony is carried out taking into account changes in the cost of living.

Are you interested in a question related to minimum child support payments for one child? On the Pravoved.ru portal you will always find what you need. An extensive database of answers to questions, as well as experienced lawyers in this field are at your disposal.

Minimum alimony

The amount of alimony is an amount that is not clearly fixed by family law, therefore there are no such concepts as a “maximum” or “minimum” amount of alimony.

However, the amount of alimony payments can be abstractly correlated with two factors. With the shared method of collecting funds, the amount of alimony cannot be lower than the established norm of Art. 81 of the Family Code of the Russian Federation.

- When collecting alimony in a fixed amount of money, the established amount of alimony depends on the cost of living for the child in the region of his residence, the social status of the payer and recipient, as well as the actual needs and state of health of the child.

- If alimony is collected by force , the court will monitor the legality of establishing the amount of monthly payments.

- In the case where parents voluntarily enter into a child support agreement and independently determine the amount of payments, the notary exercises control to ensure that the periodic amount in the document is not indicated below that established by law and meets the needs of the child.

- The declared legislative initiative of a number of deputies of the State Duma to establish the minimum amount of alimony for minor children, equal to 15,000 rubles per needy child, was rejected by the Committee on Family, Women and Children due to the fact that family legislation, when establishing the amount of payments, must take into account material and the social status of both parties to alimony legal relations, and such a situation cannot be established and calculated for each of the parties in advance and in the same terms for all.

Minimum amount of alimony under an alimony agreement

The best modern and diplomatic way to establish the amount of alimony is to conclude a voluntary agreement between the child’s parents on the maintenance of their son/daughter. However, such a document can be obtained from a notary only with mutual agreement of the parties on all key points of payments:

- size;

- timing;

- method of calculation, etc.

Features of the alimony agreement:

- the minimum amount of payments in the document if the parent has a fixed income cannot be lower than established by Art. 81 RF IC; in the absence of a stable income for the payer, it must best meet the needs of the child;

- the funds established for payment can be transferred for the child not monthly, but periodically (at another time convenient for the parties), up to once a year - as the parties agree among themselves (as long as this situation suits them).

When negotiating the terms of the alimony agreement, parents need to remember that an inflated amount as a payment for the child can be indicated (this condition would subsequently be met), but an underestimated amount cannot be specified.

Minimum amount of alimony collected in court

When the funds necessary to support a child are assigned compulsorily (i.e. by going to court), the amount of alimony payments is established by the court depending on:

- Actual employment of the future payer or his other status (retired, unemployed, disabled, student).

- Social status of the parties to the claim (mother, father, child).

Each of these methods has its own characteristics, which are discussed below.

Share method

If the respondent parent has a fixed income, alimony is assigned in shares of this income in accordance with Art. 81 RF IC:

However, the legislation of the Russian Federation does not prohibit changing the amount of alimony and the method of collecting it at the request of any of the parties to alimony proceedings: alimony can be either increased or decreased by the court, taking into account the justified demands of the applicant (Article 119 of the RF IC).

Example. From the defendant O.P. Simonov By a court decision, alimony was assigned in the amount of 1/4 of the payer’s earnings for the maintenance of the daughter. At the time of the decision, the payer worked at a private enterprise, his income was 20,000 rubles. Soon Simonov O.P. He was seriously injured, was in the hospital for a long time, and underwent surgery.

After being discharged from the hospital, the debtor filed a claim to change the method of collecting alimony with a share of a fixed sum of 3,000 rubles, justifying his demand by dismissal from his job (due to the impossibility of continuing his professional activities) and expensive rehabilitation.

The claim was satisfied by the court, taking into account the life situation and health status of the payer.

The grounds for assigning alimony in a fixed amount are:

- The defendant has no income (unemployed).

- Engagement in entrepreneurial activity.

- Instability or variability of income.

- Receiving wages in foreign currency.

- The shared method of accrual significantly violates the needs of the recipient.

When establishing alimony in a fixed sum of money, the court takes the basic value of the minimum subsistence level per child in the region where the case is being considered, and if such a value is not established, the average cost of living in the Russian Federation is taken as the basis and divided in half - due to the equal obligation of parents to participate in the maintenance of their child .

Example. As of the beginning of 2023, the cost of living per child was 9,950 rubles, therefore, the optimal amount of alimony that a claimant can count on in fixed terms is approximately 4,975 rubles.

If the plaintiff, when collecting funds in a lawsuit, proves that the child needs an increased amount of alimony (due to additional expenses for his treatment, sports, art, etc.), the court may decide on a higher amount of payments.

The minimum amount of alimony in hard monetary terms is an amount that will directly depend on:

- the child's needs;

- his state of health;

- social status of parents;

- the defendant's solvency.

The court, when making decisions on the topic of alimony maintenance, is primarily guided by the interests of the child and only then compares them with the capabilities of the person obligated for alimony.

Minimum Child Support Law

Back in 2013, a number of deputies submitted for consideration and approval by the State Duma a bill establishing a fixed minimum amount of alimony equal to 15,000 rubles. Such an initiative was interpreted as follows:

- children and the parents raising them, who have the legal right to receive alimony payments, do not have the opportunity to actually realize it;

- Courts awarding funds are not guided by any minimum allocation limit, which subsequently often leads to negligible monthly payments.

However, the Committee on Family, Women and Children recommended rejecting the bill on the minimum alimony in the first reading and, as a result, such an initiative did not find its legal approval.

Conclusion

The minimum amount of alimony is an amount not established by law in fixed terms.

The amount of alimony payments is set by the parents voluntarily or by the court in conjunction with a number of factors, which are the social status of the parties, the actual needs of the child, and the method of assigning funds (equity or hard cash).

The amount of alimony, as well as the method of collecting it, can be changed by both the payer and the recipient of funds in a judicial proceeding to a greater or lesser extent in the presence of noteworthy circumstances (Article 119 of the RF IC).