Shares should be allocated to housing purchased or constructed using maternal capitalto all members of the family.

Property is distributed by agreement between the spouses, i.e. the proportion of children may be lower than that of the parents.

Sometimes it is not possible to formalize ownership immediately after the administration of the uterus, in such cases the Pension Fund requires a notarization of shares.

One way of giving shares to spouses and children is to:

- Under the share agreement.

- It's a gift agreement.

Real estate acquired for maternal (family) capital (MC), which does not include the share of all family members, in futureshall be sold or exchangedSuch actions would be considered as seeking undue enrichment, and the citizen would be liable for the injury caused to the State.

Distribution of property in the use of mammary

Federal Act No. 256-FZ of 29 December 2006 on support for families with children does not provide any guidance on how to proceed.Distribution of housing shareThus, the share of each of the parents and children is determined by the spouses themselves,by agreement.

Since no minimum or maximum percentage is established, the property of the parents may exceed the property of the children.

In the future, such real estate will be much easier to exchange, especially if a mortgage contract is in place.

If it is more difficult for children to do so, banks prefer to avoid collateral transactions with underage owners.

Under the agreement, "ideal" shares, i.e. those shares are not allocated in kind. These shares are not tied to a particular room in a dwelling and are "abstructive" (1/2, 1/4, 1/5 etc.).

The distribution should take into account the following factors:

- The ideal proportions for a child are better set at least one size.accounting standardsThe average size of the norm in the Russian Federation is equal to that in the Russian Federation.9-12 m2.

- Although no such requirement is prescribed at the legislative level, shares should be allocated on the basis of the relationship:: The amount of money spent on the mother ' s budgetFor example, if real estate has been purchased (constructed) only by means of an ICN certificate and has a family of four, the ideal share should be 1/4 of the space. In housing worth 1.5 million roubles (i.e., capital covers a third of the value), the minimum share for each member of the same family will be 1/12. Without this requirement, notaries may refuse to enter into a share agreement.

Obligation to allocate shares

ConclusionShare commitmentsIn the case of housing purchased or built by the ICN for money, all members of the family are provided for by Government Decision No. 862 of 12 December 2007 on the rules governing the allocation of the mammary for the improvement of housing conditions.

The Pension Fund requires an obligation when:

Real property is not in the common property of parents and children, as follows:

- The property is owned by the parents or only one of them (the right is not granted to the children).

- Real estate is owned by the recipient of the certificate, but is held by the credit institution.

The right to own housing cannot be registered at the time of application to the RPF.

- A contract of sale has been concluded at a time of payment and ownership will be registered only after the debts have been fully paid.

- The price of the equity contract is paid, and the right is registered after the facility is put into service.

- Participation in a housing cooperative — property is subject to payment of all contributions.

- Construction or reconstruction of the house — State registration takes place after the individual building facility (IWV) is put into operation.

An obligation is to be entered intonotary officeThe document shall take into account all the circumstances of the purchase of the dwelling and specify the condition under which the period of 6 months will begin to be allocated to the share of all members of the family.

The cost of a commitment may vary from region to region.Between 500 and 1,500 rubles.

Children ' s share of post-mortgage mortgage with maternal capital

The funds of the mother ' s capital may be used for the purchase of housing under a mortgage agreement.payment of initial contributionas well as for paymentcore debtor%It does not matter when the loan was received, before the second or subsequent child was born or after.

Once the mortgage has been paid out by the mother ' s capital, the share for each member of the family must be allocated.6 monthsAfter removal of the encumbrance.

When the mortgage is paid in full, it is necessary to obtain a certificate of non-debt and go to Rosreister to remove the encumbrance and register the property right (the applicant will be issued an extract from the EGRN).

- by an agreement on the determination of shares;

- by entering into a gift agreement.

If no agreement has been reached between the parents or one of them avoids the signing of the contract, the shares will be awarded through the court; in practice, it has been established that the court, in accordance with the rules of civil law, grants all members of the familyby the same shares.

Purchase of a flat under a share-sharing agreement (DVC) or through housing cooperatives (WCs)

If the ICN is sent for the purchase of an IUD dwelling or when it enters the LC, the certificate may be spent as follows:

- to be paidthe price of the contract of participationIn the area of construction;

- to be paidIntroductory and/or equity contributionIn the housing cooperative.

The Pension Fund should be provided with a statement of disposalobligation to allocate sharesAt the time of the transfer of maternal capital, real estate will not yet be put into service, which means that ownership cannot yet be registered.

The equity contract is usually concluded with one of the spouses; once the real property is put into service, the property is first made into the property of one of them and the joint property is issued after the date on which it is entered into; therefore, the obligation includes a condition upon which the owner undertakes to allocate shares to the spouse and children.

In the construction or renovation of the house

Where the mammary is directed for the construction or reconstruction of the house, it is always preparedobligation to allocate sharesThis is due to the fact that common property cannot be registered with housing at the time of the application for an order, as:

- An individual housing construction facility (IWV) has not yet been built (completed);

- In the case of reconstruction, the ISS facility will have other technical characteristics upon completion of the work, and ownership is registered for the completed facility.

The obligation to allocate shares must be fulfilled6 monthsOnce the building has been completed and the house has been put into operation, as in the case of the mortgage, the share of the building can be allocated through an agreement or a gift agreement.

It should be noted that shares will have to be allocated not only in the premises, but also in the land, but not in the federal law on maternal capital, which does not, however, provide in article 14.

35 The Land Code states that the removal of the building must take placealong with the land section.

Since the building permit is granted only to one of the spouses, ownership will initially be registered and further allocation of shares will be considered an exclusion transaction.

Agreement on the distribution of shares

It is preferable to allocate shares in housing purchased with the funds of maternal capital in the following way:of an agreement on the allocation of shares.

If the family has more children in the future who can also claim shares, the property can simply be redistributed.A gift deal.However, it cannot be cancelled.

So the next kids will only be able to get their shares out of their property.

The Maternal Capital Act (No. 256-FZ) does not require notarization of the membership agreement, however, under article 42 of Federal Act No. 218-FZ of 13.07.2015.

"On State Registration of Real Estates..." all transactions involving registration of lawjoint propertyReal property is subject to notarization (except for transactions involving the assets of the equity fund).

In the case of uterus, this is true if the owner is one of the parents or the home is in their joint property, and the separation follows the following pattern:

- First sharesfor spousesThis can be done by an agreement on the division of jointly acquired property (under art. 38 of the SC), which is also to be registered with a notary, or by concluding an agreement on the allocation of shares with the corresponding provision (i.e. shares will be allocated directly to all members of the family).

- Then out of the common property of the spouses, the sharesSelected for Children.

However, if a dwelling purchased or built with an ICN certificate is located inindividual property(e.g., if the mother is the sole owner and has no spouse), an agreement to allocate a percentage of the children does not require notarization.

In order to finalize the agreement, the notary must be provided with the following documents:

- Passport.

- Right-making documents for housing (contract of sale, share-building, etc.).

- A document confirming the State registration of ownership of real property.

- Marriage certificate.

- Birth certificates for all children.

- A copy of the notary obligation to allocate shares to the children and the spouse.

How much is it worth to allocate a percentage of the children's maternal capital to a notary?

SizeMinister for Notary ' s ServicesArticle 333.24 of the Tax Code of the Russian Federation regulates the agreement on the allocation of shares for certification.

5 The rate for the certification of contracts to be evaluated is0.5 per cent of contract amount(costs of housing) This value may not be lower than300 rublesAnd more.20000 rubles.

It is also necessary to pay for legal technical services (notaries set their costs).

The amount of the contract specified by the parties shall be accepted in the calculation of the State budget, but may not be less than one of the following costs (the payer elects for himself):

- Inventory;

- Market-based;

- Inventory.

If more than one document showing the value of real estate has been provided, the smaller one is selected to calculate the duty.

It is also worth taking into account the provisions of the letter from the Ministry of Finance.of 11 October 2016 No. 03-05-06-03/59079On the amount of government revenue in the case of property acquired with the funds of the mother ' s capital in the total share of the property.

It states that a fee must be levied for the certification of the share allocation agreement.500 rubles- As is the case for transactions whose subject matter is not to be evaluated (art. 22.1, para. 5) on the basis of Russian legislation on notaries.

In practice, however, notaries suggest that the agreement be certified asevaluation transactionI don't take into account the letter from Minfin.

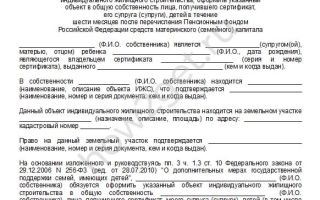

Agreement on the allocation of shares in maternal capital: sample 2023

There are two types of agreement on the allocation of shares in maternal capital:

- With the initial incorporation of the property into the general ownership of the certificate holder and his/her spouse (without the need for an agreement on the division of common property acquired during marriage).

- With the transfer of the dwelling to the common property without the allocation of shares (without the initial allocation of the share to the spouses).

The following data should be specified in the agreement:

- Date and place of the deal.

- FIO of the parties to the agreement, their passport and registration addresses.

- FIO of children, date of birth, series and number of birth certificates, if there is a passport, passport data.

- Real estate description and address.

- Type of ownership (joint or joint ownership) as well as the share of active owners.

- Name of the legal document and its number.

- The size of the share of all family members and the conditions for their distribution.

- Conditions for possible redistribution of property in the future.

- Signature of participants.

Model agreement for the determination of shares in the original presentation of real estateto general equity propertycertificate holder and spouse

Model agreement for the determination of shares in housing arrangementsjoint property

Registration of ownership of spouses and children

Once an agreement has been reached on the distribution of shares, it is necessary to registerright to propertyThere is no need to register the agreement itself, only the transfer of property from parents to children is subject to State registration.

The procedure is as follows:

- The agreement is certified by the Secretary-General of the United Nations on behalf of the Secretary-General of the United Nations and the Secretary-General of the United Nations on behalf of the Secretary-General of the United Nations and the Secretary-General of the United Nations on behalf of the Secretary-General of the United Nations and of the Secretary-General of the United Nations on behalf of the Secretary-General of the United Nations on behalf of the Secretary-General of the United Nations on behalf of the Secretary-General of the United Nations on behalf of the Secretary-General of the United Nations on behalf of the Secretary-General of the United Nations on behalf of the Secretary-General of the United Nations and the Secretary-General of the United Nations on behalf of the Secretary-General of the United Nations.Notary.

- Payment for registration of an individual ' s rights to immovable property (under article 333.3, paragraph 22, of the Criminal Code)2,000 rubles).

- Submission of documents to Rosreister. Registration will take no more than5 working days.

Information on ownership will be included in the Single State Real Estate Register —EGRN.

You do not have to go directly to the Rostreestra office to register property rights.Multifunctional centreto send it by mail, as well as to do it remotely through the portal.Public servicesorRostreestra website.

Donation agreement

The share is a free transfer of part of the property to another person.

Previously, the award of a gift contract was considered to be a priority, since the provisions on such transactions were clearly regulated in the Russian Civil Code.

In 2023, an increasing number of families entered into a share-sharing agreement, as it allowed for the redistribution of property in the future.

The pressure may be determined as follows:

By way of conclusiontwo separate treatiesin such a case, the children ' s shares will be allocated from each parent ' s property.

One gift each:

- If the mother is not married, a document shall be drawn up indicating the gift(s) and the amount of the share for each of them.

- When a marriage contract is concluded with the husband, under which the purchase of the dwelling is the property of the woman, the property will be allocated to both the children and the husband under one contract (under the law on maternal capital, the spouse is still entitled to a share and the property must be allocated to him).

From 2016 onwards, the share contract may be processed.Notary only.

Allocation of shares in maternal capital: how and when to allocate

Procedure for allocating shares to children and spouses after the use of maternal capital.

Maternal capital is designed to stimulate the birth of children, so it is the direct responsibility of parents who own certificates, the essence of maternal capital in improving housing conditions and the allocation of shares.

Explain what and how.

General information on the allocation of shares

When a State grants a grant in the form of maternal capital, it expects children to receive their "bunk of pie" is a square metre, i.e. a share in real estate.

The State expressly requires the holders of certificates to distribute shares in the purchased or constructed housing, and the holder of the maternal capital will have to:

- Formalize housing into the common property of parents and children;

- Share and record shares among family members.

Important point: If a certificate is obtained during marriage, it is necessary to allocate a share not only to the children but also to the spouse.

Size of shares allocated

Do not have to be equal, nor do you have any legislation that determines the size of the share strictly and clearly, and to whom you will be given the amount of the share.

Important point: Guide the Russian Housing Code. According to the Code, the minimum percentage is 6 square metres, but so little can be distinguished, the standard is 12 square metres.

In what cases and when?

The shares are mandatory, but this happens in different ways, depending on the situation.

Rates of construction per mother ' s capital

As you can see, it's problematic to single out shares in housing that don't exist yet.

The Pension Fund will not authorize the issuance of a certificate unless you "promise" that you will take children's interests into account; this requires a notarized commitment to the share that you will deposit with the Pension Fund office, together with an application for management of maternal capital and other documents.

Notary obligation to allocate shares

A notary obligation is a guarantee that shares will be allocated in the future, in cases where it is not possible to arrange housing for all members of the family at once.

Here's what it looks like:

Where is the obligation:

- Construction of a private house;

- Purchase of real property by one family member, i.e., housing is not common property;

- Participation in joint construction.

The notary is bound by a duty, which is worth 500 to 2,000 rubles.

The important point is that the Act does not establish a single form of obligation, and we advise the Pension Fund office to specify the appropriate form they will take in order not to alter it.

- So, the commitment is made, it's given to the Pension Fund, and the construction money is received -- when is it to be fulfilled?

- Within six months of giving the house a cadastre number.

- To fulfill the "promised" to you as a notary, it is to draw up a contract or an agreement on the allocation of shares.

Share agreement

When you get a home cadastral number, you draw up a share contract -- that's how you meet the obligation to the Pension Fund.

A contract is an agreement between family members, which prescribes to whom and how many square metres are to be given.

He's making a contract, again, a notary, which costs between 1,500 and 3,000 rubles.

Once completed, register the contract in Rosreister or IFC.

All right, before the law, you're clean, you used the certificate legally.

Purchasing shares

We repeat, improving housing conditions — it is necessary to allocate shares, but two options are possible to purchase.

Buying for all family members

The most convenient way for a certificate holder to allocate shares is to prescribe them in a sales contract.

So you buy housing at the same time, and you allocate shares, which is convenient for two reasons:

- You immediately fulfil your obligation to the Pension Fund, the children and the spouse, avoiding problems;

- You're saving a notary's money.

Not all family members buy, one person buys

In practice, it is not always possible to buy from everyone by writing out shares in the contract, for example, when you buy real estate with a loan or mortgage.

If you go to a bank, you can only buy one — that's how banks keep themselves safe.

Until you pay the loan, the dwelling will be burdened, and if it has a share, then it will be more difficult to dispose of it in sad cases, that is to say, to take it away.

If you go to the Nizhegorod credit union, we'll look at the credit history.

If the credit history is normal, let's buy it for everyone, if it's not perfect, it's gonna have to buy it for one.

In the case where you buy one, the scheme is as if it were built:

- Make a notary commitment.

- Within six months of the removal of the encumbrance, draw up a contract for the allocation of shares and register it with the IFC or Rosreister.

Refusal to select

Surprisingly, there are no laws or regulations that establish liability for non-payment of shares.

Nevertheless, the answer will have to be, see how the test is done in practice:

- What's the risk if we don't make a cut?

- Enforcement of judicial shares;

- Recovery of maternal capital;

- Cancellation of the property sale.

Nothing good, actually, you're gonna take care of the guardianship authorities and the D.A.'s office by filing a lawsuit to eliminate violations of children's rights.

In a separate case, if a check reveals the fraud of the mother's capital, and it does, then we recommend that we immediately study article 159 of the Russian Criminal Code — fraud — we risk up to five years' imprisonment.

Usually, shares are not allocated for two reasons:

- From ignorance or irresponsibility;

- If you want to sell your own housing, it's a fraud, because you tricked your own children.

Absolutely not, use the certificate legally.

Children ' s share of maternal capital

You can use maternal capital to buy an apartment or other housingChild 3 years of ageAn exception is the case where a family has housing acquired under a mortgage or loan contract, in which case the funds may be directed towards the payment of the debt to creditors.

The Pension Fund (FDF) makes it possible to use funds to purchase housing on condition that it is processed.to the common property of all members of the familyHowever, mainly the mother ' s capital is paid only for a portion of the value, and real estate can only be disposed of after all payments have been made and the encumbrance lifted.

In such cases, the RPF allows for the early use of the right to the certificate, but after the issuance of the certificateCommitmentsUnder the terms of which the buyer will give shares to all members of the family once the real estate has been converted into full ownership, the share transaction shall be made in Rosreister on the basis of a share agreement or a gift contract.

Distribution of shares in the dwelling using the math capital

If the funds of the mother ' s capital are used for the purchase of housing, in accordance with article 10, paragraph 4, of FL No. 256 of 29 December 2006, the property must be the property of all members of the family, as follows:

- Children- with whom the holder of the certificate has a blood link, as well as adopted persons;

- of spousesThe mother and father of the children, including the adoptive parents, are not among the persons mentioned.

Share all family membersmust be the buyer of the dwellingacquired using maternal capital.

- If the property is registered to one of the parents, then the children and his spouse must have a share in it, and the spouses shall have a share in it; and if the property is registered to one of the parents, then he shall have a share in the share of the children and his spouse; and if the property is registered to one of the parents, then the spouses shall have a share in the share of the property; and if the property is registered to one of the parents, he shall have a share in the share of the children and his spouse; and if the property is registered to one of the parents, the spouses shall have a share in the share of the property; and if the property is registered to one of the parents, he shall have a share in the share of the children and his spouse; and if there is a share between the spouses, the spouses shall have a share in the share of the property; and if the property is registered to one of the parents, he shall have a share of the property.right to joint propertyas the acquired property is jointly acquired.

- If both parents are buyers of the dwelling, there is a relationship between them.Right to share propertyIf both spouses or one of them refuses to provide the children with a portion of their share, the persons concerned may apply to the court and do so in the event of the refusal of one of the parents to provide the children with a portion of their share.

Shares need to be allocatedAll childrenincluding adults or born after receiving funds and acquiring housing.

However, if all members of the family were entitled to ownership, but another child was subsequently born, the percentage should be allocated.from parents ' property.

Since the disposal of minors ' property may take place with the permission of the guardianship and guardianship authorities and only for the purpose ofIncrease in residential space.

How to allocate the share of children in a mother-to-child apartment

The allocation of shares in the purchase of an apartment to maternal capital may occur in several ways, depending on the manner in which the dwelling is purchased.

With the acquisition of ready-made real estateSales contractShares can be allocated at the time of signature and registration of ownership.

It is then necessary to provide the Pension Fund with an EGRN statement confirming the transfer of the right as well as the availability of a housing pledge.

After the transfer of the mother ' s capital to the seller ' s account and the full payment of the contract, the encumbrance shall cease.

If an apartment is bought in a different way (in instalments, mortgages, etc.), it is not possible to allocate shares at the time of purchase.

Accordingly, in order to benefit from the maternal capital of the RPF,notary obligationunder the terms of which the owner undertakes to give shares to all members of the family.

Provision of funds under the obligation shall be made in the following circumstances:

- Participation in equity construction — shares can only be allocated once the house has been handed over and the property rights have been issued;

- The use of capital for the construction or reconstruction of a house - ownership arises after the completion of the building and the placing of the building on cadastral records;

- Mortgage may be granted with the approval of the bank or after payment of the loan;

- Participation in a housing cooperative — real estate management is possible after all contributions are paid;

Within 6 monthsWhen it becomes possible to dispose of the property, the owner must be given a share of the family member; this may be done by means of a gift contract or a share agreement.

Children ' s share of post-mortgage mortgage with maternal capital

Maternal capital may be used to make an initial mortgage contribution as well as to pay the principal debt or interest.

With this method of using the funds, it is only possible to convert real estate into the common property of all members of the family.after full payment of the loan.

Until then, the property is in the bank ' s deposit and can be disposed of only after the proof of payment has been provided to Rosreister.

In most cases, the bank allows the mortgage onlyfor one of the spousesThe second parent, however, acts as a borrower.

As the property will be ownedSeveral citizensthat part of it will be much more difficult to realize.

The bank is thus insured in the event that the main borrower is unable to fulfil the obligation and pay the amount of the loan.

Accordingly, it will not be possible to make a mortgage for the children.up to the full repayment of the loanHowever, these circumstances are left to the creditor ' s discretion and, if the mother ' s capital is used to pay for the mortgage, the bank may permit the establishment of housing as common property of all family members.

What documents are needed to identify the proportion of children

After removal of the encumbrance, the parties to the transaction must:Go to RosreisterThis can also be done through the Multifunctional Centre (IFC).

The following documents should be made available for registration of the transition:

- Registration application.

- A legal instrument is a gift contract or a share agreement.

- Documents certifying the identity of the parties are passports and birth certificates.

- Exposition from the EGRN on ownership of property.

- A contract for the sale of housing.

- A bill of 2,000 rubles for the payment of the Ministry of State.

If the property is registered for a minor child, he or she is entitled to take possession of the property.with permission of legal representativesFor children under 14 years of age, parents sign the contract and the application for registration, after 14 years the child must be involved in the transaction.

Allocation of shares in the apartment: notary ' s value

If the allocation of shares is possible only on the basis of previously compiledCommitmentsthe document in questionmust be assured notarized.According to article 333.24, paragraph 6 of the Russian Federation ' s article 333.24, the value of such a certificate is:500 rubles.

According to article 42, paragraph 1, of FL 218 of 13.07.2015, the disposal of shares is subject to a notarization certificate; accordingly, if children are granted shares of the right to share property, they must pay a State duty of a value equal to0.5 per cent of housing pricebut not more than 20,000 rubles.

Allocation of shares in the dwelling by maternal capital: How correct

With the birth of children, almost every family thinks about expanding their homes so that if not a separate room for each child, at least not all of them can live alone.

Therefore, the State ' s maternal capital allocated at the birth of a second child is most often used to improve housing conditions.

We'll tell you how to allocate a percentage of children ' s maternal capital and whether it is necessary to do so.

Do you have to allocate shares in the housing purchased for the mammary?

In accordance with article 10, paragraph 4, of Federal Act No. 256 of 29 December 2006 on additional measures of State support for families with children, accommodation acquired or constructed with the use of maternal (family) capital shall be issued to the parents and all children in the common property and the amount of the share shall be determined by agreement.

Accordingly, the allocation of a share in the use of maternal capital is necessary not only for children but also for the second spouse, but this may vary depending on the manner in which the family makes real estate.

Conditions for obtaining maternal capital

How to provide children with shares in an apartment purchased without borrowing

When the spouses plan to buy housing that has already been built without the use of mortgages, the simplest option is to immediately enter into a sales contract for all family members with a percentage.

If the buyers are not all family members or if the right to own the dwelling is not yet registered when applying for the funds of the uterus, the buyer is required to provide a written commitment to the Pension Fund within six months of the transfer of State support funds to the housing seller by the Fund to regularize the purchased apartment into the common estate of the recipient of the certificate, the second spouse and all the children; without this, the money will not be provided.

When housing is purchased under an equity agreement

Children ' s shares in the use of maternal capital to pay the price of the equity contract are also paid on the basis of a written undertaking, in which case the contributor is required to place the flat in the common share ownership of all family members within six months of the completion of the construction and transfer of the dwelling.

Obligation to allocate shares

The obligation is only to the notary on a coat of arms form.

How to allocate shares of maternal capital in mortgage

Theoretically, the law does not prohibit the purchase of housing using mortgage to cover all members of the family, but banks generally do not want a portion of the real estate held by them to be owned by minors.

In practice, therefore, in most cases, the spouses arrange for the purchase of the dwelling and write the same obligation — consent to the allocation of a share of the mother's capital to children within six months of the repayment of the mortgage and the removal of the encumbrance.

That we should build a house

If the family has decided to improve housing conditions through the construction of an individual housing home, the commitment to regularize part of the dwelling for children and a second spouse within six months of the entry into service of the house is written by the spouse who is authorized to build, in which case the Pension Fund will transfer two tranches of money: 50 per cent immediately and the remaining 50 per cent after six months, provided that the basic construction work is completed.

How many children should be allocated: size of the share

The law does not specify the proportion of children in terms of their mother ' s capital, it is the responsibility of the parents to decide on their own. Note that when signing an obligation, it is not necessary to specify the specific shares that will be transferred to the property.

- Share property equally among all members of the family;

- Calculate the share of each according to how much of the family capital is equal to the value of the entire dwelling and what other funds have been spent on the acquisition of real estate.

In the opinion of the Supreme Court of the Russian Federation, in the absence of an agreement between the parties, the proportion of children using maternal capital should also be determined on the basis of the equal share of parents and children in maternal capital spent on the purchase of housing rather than on all the funds from which it was acquired.

An example.

A family with two children purchased a two-room apartment for 1,800,000 rubles, of which 453,000 rubles were paid for by the funds of the uterus, which was approximately 1/4 of the cost of the purchase. Accordingly, at least 1/4 per cent should be divided into 4 members of the family and the proportion of each child should not be less than 1/16.

How to formalize the allocation of shares

In order to allocate a percentage of children ' s maternal capital, the documents would have to be notarized, and the notary would have to be contacted twice.

First, both or one parent must assure the notary of the obligation to transfer a portion of the property to the children.

In the future, it is possible to do so in two ways:

- To conclude an agreement on the allocation of shares in maternal capital;

- To enter into a contract for the giving of a part of the house or apartment.

What happens if you don't fulfill your obligation?

There is no specific liability for breach of the obligation to provide for children ' s share of the law; the legislator has not yet clearly established who should monitor the performance of such duties; offenders may face the following risks:

- Problems in finding a buyer for an apartment, as the transaction can be declared invalid - realtors check the dwelling for uncompleted obligations towards minors;

- Coercion by the courts to fulfil an obligation, on the basis of an application by a growing child, a guardianship agency or a procurator's office.

How do you get a share of the kids in the apartment if you're using a uterus?

Please tell me about the child ratio algorithm after the mortgage is paid out as a mother's capital.

We have two children in the family, and the apartment is fully booked for me, and I read on the Internet that first it's necessary to allocate a share to the spouse, then each spouse gives a share to each child... it's very difficult. Is there any way to make it easier?

My wife tells me that you don't have to rush into this manipulation because you're gonna have to spend money, and I'm worried that some day I'm gonna have social workers or bailiffs coming to see me, and they're gonna get a quick cut or they're not gonna let me go abroad.

With respect, Michael H.

And when you have paid the mortgage and lifted the burden, it is lawful for you to give a share to your children for a period of six months.

The law doesn't say exactly how much to allocate, so in theory you can set aside one metre so that this share can't be allocated in kind and sold later, but you can divide the apartment into equal parts and share the same shares, in your case, 1/4.

Notaries recommend a share equal to the amount of maternal capital invested, the same position being held by the courts, and let's say you have an apartment of 45 square metres, which costs 4 million rubles.

You've invested 450,000 of your mother's capital, which is 11.25 percent of the cost of the apartment. The rest of the money was shared between you and your spouse, and you don't participate in the division. You have four family members, which means you each have 11.25 percent / 4 = 2.8 percent.

Or, if you count within metres of the total area of the apartment, 1.3 m. Accordingly, you assign 1.3 m to your wife and to each of the children.

In the share agreement, this number has to be written in shares. In order not to do difficult calculations, the number can be rounded up. For example, for an apartment of 45 square metres, one metre in shares is 1/45.

We need to draw at least 1.3 m, so round it to 2 meters — 2/45 in shares.

We state in the agreement that both children and wife are allocated 2/45, your share is also 2/45, and the joint property remains 37/45.

You can use a fraction calculator as an assistant in your calculations.

In our example with a flat of 45 square metres, it will look as follows: the proportion of children is 2/45 each, and you and your spouse have 41/45 in joint ownership.

This option is not appropriate if the apartment is arranged on both sides of the estate, but the notary is required to deal with the equity property, but it's not your case.

Now we have to register the share allocation in Rosreestre, which requires the following documents to be submitted through the IFC:

- Passports are yours and your spouses.

- Birth certificates for all children.

- Agreement in simple writing in three copies.

- Marriage certificate.

- Cheques for payment of the mistress.

This means that it has to be divided by the number of future owners and paid on individual receipts to each of you, four of you: you, spouse, two children.

- The Rosreister will register the percentage of children, and you will fulfil your obligation in this way.

- You are in breach of your notary obligation to allocate shares.

- If the Public Prosecutor ' s Office conducts a review, you may be required to pay court shares, return State funds to the pension fund or prosecute fraud under article 159 of the Criminal Code of the Russian Federation.

- If you decide to sell an apartment without giving a share, the transaction may be declared invalid in part of the undistributed children ' s shares, such as in Chelyabinsk.

A spouse may also file a complaint and order you to give her and the children a share; there are also examples of such court decisions.

If you have a question about personal finances, expensive purchases, or family budgets, write.We'll answer the most interesting questions in the magazine.