The procedure for citizens to enter into inheritance rights, in particular when it comes to living space in an apartment building, consists of a number of sequential actions, the main role in which is played by the preparation of all the required documents for inheriting an apartment. Their list largely depends on the prevailing circumstances, for example, whether there is a will or those on the waiting list are called by law, whether the heir declared himself in a timely manner, whether he has the right to an obligatory share, and so on.

The entire process is clearly regulated by the current regulations of Russian legislation, namely the Civil (Part Three) and Tax Code.

During the opening of the inheritance case (six months from the date of death of the testator), the successors voluntarily and on their own initiative submit appropriate applications to the notary to exercise their rights.

If this deadline is missed, it can only be restored in court and with compelling reasons.

Our articles talk about typical ways to resolve legal issues, but each case is unique. If you want to find out how to solve your specific problem, please contact the online consultant form on the right →

It's fast and free! Or call us by phone (24/7):

If you want to find out how to solve your particular problem, call us by phone. It's fast and free!

Documents for inheritance

- Explication issued by the Technical Inventory Bureau or other authorized organization;

- An extract from the Unified State Register of Real Estate (USRN), which is ordered from Rosreestr;

- An extract from your personal account confirming the absence or presence of utility debts.

In addition to these papers, of course, others are required, as discussed below.

In law

If the apartment is inherited in accordance with the law, the documents required for registration have a fairly extensive list. In order not to have to waste time on unnecessary visits to the notary, it makes sense to prepare for what documents will be needed when legally registering an inheritance for a residential or non-residential apartment:

- Handwritten application for entry into rights;

- Certificate of death of the testator or a court decision declaring him dead or missing;

- The applicant's personal passport and identification code;

- Papers confirming relationship with the deceased (official marriage certificate, birth certificate, etc.);

- An extract from the house register from the last place of registration of the deceased about his deregistration and about your joint residence, if this took place (taken from the territorial migration service);

- Papers confirming that the property belonged to the deceased person;

- Valuation of abandoned property.

Of course, documents for opening an inheritance case not only regarding an apartment, but in all cases, are prepared depending on each individual circumstances. This means that in order to legally inherit an abandoned apartment, the above list can be supplemented. It is advisable to clarify which documents you will need during legal consultation.

By will

The list of documents for registering an inheritance in the form of an apartment, if the deceased left a will during his lifetime, is significantly shorter than when taking over rights in the order of legal priority.

Since today all information is entered into a single electronic register, you do not have to contact a notary at the place of last residence of the testator.

In this case, it can be any notary office.

Documents for registration of the inheritance due under the will, that is, an apartment, will include:

- Your personal statement;

- Personal passport;

- Death certificate of the testator;

- The will itself;

- Extract on the removal of the deceased from the place of migration registration.

Since the text of the will itself contains the details of the recipient, in fact he only needs to confirm that he is such.

If the deadline for entering into inheritance is missed

Despite the fact that a fairly considerable period of time is allotted for filing an application about your rights and intention to receive what is due - six months - in practice it is also quite often missed for various reasons.

For example, a person may simply not know about the death of a testator or relative (he may even have been deliberately not notified), or the heir was under circumstances due to which he could not do anything on time (travel abroad, treatment).

Often the deadline is missed due to the fault of the heir himself, ignorance of the rules for entering into inheritance rights.

If documents for inheriting an apartment are not submitted within the prescribed period, even if there are no other heirs, the person does not legally become the owner.

He can use the property, maintain it, live there, make repairs, change plumbing, and so on, but according to the law, he is not the owner until he takes over his rights properly. And in this case, this can only be done by going to court.

Documents for going to court

Documents for the court:

- Statement of claim and its copy (as many copies as there are defendants).

- Personal passport.

- Receipt for payment of state duty.

- Death certificate or other document confirming that the testator is no longer alive (court decision).

- Papers confirming that the deceased person was the owner of the hereditary estate and a list thereof.

- Papers giving the plaintiff the right to inheritance (will, confirmation of family ties and membership in the queue that was called up).

- Evidence that deadlines were missed for a good reason.

It is the last point that is fundamental in such cases, since only if missed for a good reason, the inheritance terms can be restored, and the evidence of such must be as convincing as possible.

Statement of claim

When preparing the documents necessary for inheriting an apartment to restore the term through the court, you should also pay attention to the information in them, which will have to be recorded in the claim. Below is an example of such a statement:

(Name of the judicial authority where you are applying)

(Your full name, address, contact details)

(F.I.O., address, contact details of the defendant)

Statement of claim to restore the terms of acceptance of inheritance

“___” __________ 20___ citizen _____________________________________ died (was declared dead, missing). Upon his death, an inheritance was left, which includes (list the entire inheritance mass).

I am an heir by law of _____________ turn (or by will, its details) and within the established six months I did not enter into my rights for a good reason (indicate the reason and a document confirming this).

Besides me, the heirs are _________________________________________________. They have not entered into inheritance rights and have no claims to the property (if the circumstances are different, describe).

- Based on Article 1155 of the Civil Code of the Russian Federation, I ask you to restore the deadlines for entering into inheritance rights that opened “____” _________20___ upon the death of ________________________________________.

- The following documents are attached to the statement of claim:

- 1 …

- 2 …

- …

- (date) (your signature)

- A sample statement of claim for restoration of the deadlines for accepting an inheritance can be downloaded here

Additional documents

- We are talking about heirs who belong neither to the will nor to the legal order - successors who are entitled to a mandatory share in any case.

- They should also declare their rights through a notary or in court if they need to prove their belonging to this category.

- You will need to have with you:

- Personal passport;

- Papers on the basis of which you are an obligatory heir and giving you the right to an obligatory share;

- Medical certificate of incapacity for work, pension certificate, etc.;

- Papers about inherited property, if available.

Just like other heirs, the notary, after six months from the date of opening the case, will issue a corresponding certificate of rights. With it, you can then re-register the property or part of it in your name.

The law classifies as obligatory heirs the minor children of the deceased, including those not yet born but conceived during his lifetime, disabled children, spouses, parents and other persons who were fully dependent on the testator.

The procedure for inheriting an apartment

Registration of an inheritance for an apartment requires compliance with the established procedure and is divided into several stages. First of all you will need:

- To remove a deceased citizen from his place of registration, having received the appropriate documents - for this, an application is written to the territorial migration service and a copy of the death certificate or a court decision is attached;

- Collect the required papers, based on individual circumstances (presence of a will, legal order, and so on);

- Visit a notary's office, where you should submit the necessary documents to the heir to register the inheritance of the apartment;

- Receive a certificate of your rights at any time after the closure of the inheritance case;

- Complete state registration of ownership rights to the received property.

If the deadlines for contacting a notary were missed, after collecting the necessary documents, a claim is filed, a court hearing is held (can last a long time if there is a conflict between dissenting heirs), and only after issuing a court decision, which has the same legal force as and a notarial certificate, proprietary rights are registered.

Registration of an apartment after inheritance

You can register your property rights, that is, go through the procedure of registering ownership of an apartment after receiving it as an inheritance, directly through Rosreestr or the Multifunctional Center by submitting the documents required for this. In both options, the list is identical, only the waiting period changes - through the MFC it is a couple of days longer.

The procedure is simple and, as a rule, no one has any difficulties at this stage:

- All papers are prepared for state registration of rights;

- An application is filled out;

- A fee is paid;

- Documents are submitted;

- The result is expected to be issued, for which you need to appear on the appointed day.

The documents themselves submitted for registration of an apartment as property by inheritance are:

- Statement;

- Personal passport;

- Certificate of rights to inheritance issued by a notary, or a similar court decision;

- A receipt indicating that the state fee for the service has been paid;

- An extract from the house register with information about citizens registered in the apartment;

- Cadastral passport of housing (optional);

- A certificate from the personal account stating that there is no debt for housing and communal services;

- Papers that confirm the legality of the redevelopment of the premises, if any;

- If rights to a share of living space are registered, a notarial agreement on division, a court order, etc. are also submitted.

When accepting an application with documents for processing, the responsible employee of Rosreestr or the Multifunctional Center issues a receipt confirming receipt of the originals.

Documents for inheriting an apartment

1,087 views

When registering an inheritance, one of the key requirements is to provide a package of documents to the notary. The primary document is an application for registration of inheritance.

The rest of the list directly depends on the type of inherited property. The heirs who register real estate need to collect the largest package of documents.

Let's consider what documents are needed to inherit an apartment after death.

Documents for inheriting an apartment according to the law (without a will)

When contacting a notary, applicants need to prepare the appropriate papers. An inheritance case is opened upon the application of a potential heir.

To enter into an inheritance, according to the law, you will additionally need to prove your connection with the testator:

- blood connection - for relatives;

- being supported and living together – for dependents;

- the presence of marriage ties between the testator and legal successors (for stepfather, stepmother, stepson, stepdaughter).

If a citizen cannot prove his connection with documents, the recipient will have to prepare a claim and prove his rights to the inheritance in court.

What documents are needed to register an inheritance for an apartment with a notary? Typically, the list of papers depends on the method of accepting assets and the type of property.

List of documentation for inheriting an apartment

No. Document name Comment| 1 | Civil passport of the legal successor/birth certificate | The identity document depends on the age of the legal successor. If the recipient of the property is between 0 and 13 years of age, a certificate is provided. Citizens over 14 years of age must present a passport. If the heir is under 18 years of age, then additional documents of his representative (parent, guardian) are required. |

| 2 | Owner's death certificate | The document is issued by the district registry office at the place of death or registration of the deceased citizen. The basis for obtaining a certificate is a medical certificate of death or a court decision declaring someone dead. |

| 3 | Legal information | Privatization act, certificate of inheritance rights, purchase and sale agreement, exchange, donation. |

| 4 | Copyright data | Extract from the Unified State Register of Real Estate |

| 5 | Relationship data | Certificate of birth, marriage, divorce, change of full name, establishment of paternity |

| 6 | Certificate of registration of the deceased owner of the property | Issued by MFC, Housing Office, Passport Office, Migration Service |

| 7 | Data on the absence of debts on utility bills | Extract from the personal account |

| 8 | Information about other recipients (full name, residential address) | May be provided orally or in writing. The notary will send them a notice of the opening of the inheritance case. Concealing such data may subsequently lead to the cancellation of the inheritance certificate or the recognition of the beneficiary as unworthy. If there are no other applicants, then the heir makes a note about this in the application for acceptance of the inheritance. |

| 9 | Evaluation report | When contacting a notary again, an expert assessment of the property will be required. It can be ordered from a private or public institution (Rosreestr, BTI). The work is carried out on the basis of a contract. The basis for conducting an assessment for registration of inheritance is usually a document confirming the opening of an inheritance case. The average cost of appraising an apartment in a private company is 3,000 rubles. Based on the results of the necessary activities, the applicant is provided with a written report. The market value of the property is usually higher than the inventory value. Therefore, it will be more profitable for the heirs to contact the BTI. However, this option is not possible for apartments commissioned after 2012. |

| 10 | Loan documents | If the apartment was purchased using a mortgage loan, then the property is pledged to the bank. The heir can accept the property, but he is also responsible for repaying the loan. |

Important! Data on the absence of tax debts and the absence of encumbrances is requested by the notary as part of interdepartmental cooperation.

Additionally, you can attach an agreement on the division of the apartment. The notary will issue a certificate of inheritance rights based on an agreement between the heirs.

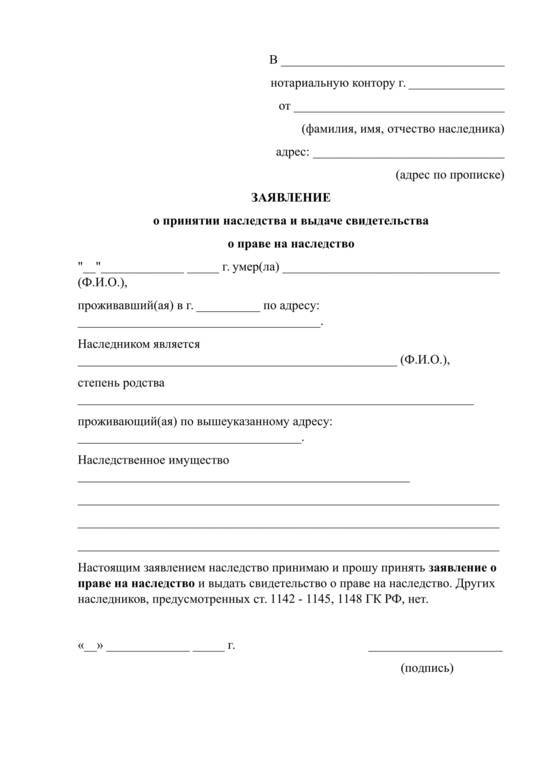

Sample application for acceptance of inheritance

Download the application for acceptance of inheritance

Documents for inheriting an apartment under a will

A citizen has the right to issue an order both for the apartment as a whole and for a certain share. The key point is to have ownership of the object.

However, the heir will have to provide the original order. Unfortunately, testators do not always pass on a will to their heirs. What to do in this case? After all, without a will, the heir will not be able to assume his rights.

The assignee must contact any notary office and obtain data from the unified notarial register. After which, the citizen must contact the notary who keeps the will to obtain a duplicate.

If the order can be found only after the deadline for filing the application has expired, then such an heir will have to prepare papers for the court. If the court restores the deadline, the applicant will be able to resubmit the application to the notary.

Thus, the package of documents when inheriting an apartment under a will is almost identical to the list for inheriting by law. You just need to add a will.

It is mistakenly believed that when inheriting by order, it is not necessary to provide information about family ties. The reason is the presence of an expression of will, which changes the composition of the heirs.

However, when paying state duty, the amount is significantly reduced for children, parents, spouses, sisters and brothers. Therefore, it is advisable to attach data to reduce costs.

Where to submit papers

A package of documents for opening an inheritance must be submitted to a notary:

- at the registration address of the deceased citizen;

- at the location of the apartment (if the address of residence is unknown).

Deadlines for submitting documents

are given 6 months to enter into inheritance . Time begins to be calculated from the date of death of the testator. Missing deadlines has certain consequences. Heirs may lose priority, inheritance rights, or be forced to go to court.

Factors influencing the deadline for submitting documents

Applicants Established deadlines| Heirs 1st degree | Documents must be submitted within 6 months from the date of death of the citizen |

| 2nd stage applicants | Papers are submitted 6 months after the death of the citizen. They are also given a 6-month period to submit an application. However, if the heirs of the 1st degree do not enter into their rights within the allotted time, then the applicants of the 2nd stage can accept the inheritance within 3 months after the end of the allotted period |

| Heirs who actually accepted the property | No deadlines have been established for this category of citizens. They can contact a notary at any time and receive a certificate of inheritance. Provided that they prove the fact of acceptance of the property. If the notary refuses to issue the required document, then such persons will have to file a corresponding statement of claim in court |

| Inheritance by view | General deadlines for filing papers apply here, similar to first-line heirs. |

| Inheritance through transmission | If the main claimant to the property died after filing the application, then the children, i.e., the grandchildren of the testator, can accept the inheritance instead. The deadline for filing documents depends on how much time has passed since the death of the testator. If more than 3 months, then the sub-heir is given another 3 months to submit an application. If less than 3 months have passed, then the submission of documents is carried out within the general deadlines |

| Persons who missed the general deadlines for filing an application | Developments can occur in two directions. The heirs will independently agree on the inclusion of a new candidate in the list of participants. Then they will need to contact the notary who issued the certificate and submit an application. After which the notary cancels the previously issued papers and draws up new documents. At the same time, the shares of the inheritance are redistributed. If any of the participants refuses to visit the notary, the heir will have to prepare papers for the court. If the judicial authority finds the reason for the omission convincing and restores the deadline, then at the same time it will have to cancel the issued certificate of inheritance and recalculate the shares. The plaintiff will have to register the ownership of the property, which the court will determine for him |

If the deadline for filing papers has expired, then applicants will need to file a claim. Based on the results of the trial, an appropriate decision will be made. When contacting the notary again, applicants will need to provide a judicial act. Based on it, the notary will continue to perform notarial actions and issue a corresponding certificate.

State duty amount

When submitting an application, the heir will have to pay tax. The fee rate depends on two factors - the degree of relationship and the value of the inheritance. Therefore, the higher the price of the property, the higher the tax will be.

Basic rates:

- Close relatives. This includes children, parents, spouses, brothers/sisters. These persons pay 0.3% of the appraised value of the apartment. The marginal tax rate is 100,000 rubles .

- The rest of the candidates. This includes distant relatives, individuals and legal entities. These persons pay 0.6% of the appraised value of the apartment. The maximum rate of state duty is 1,000,000 rubles.

Preferential categories of heirs can reduce the amount of state duty. For example, disabled people of groups 1–2 are entitled to a 50% discount.

Whereas state authorities or local governments are completely exempt from paying tax when performing notarial acts (Article 333.38 of the Tax Code of the Russian Federation).

Additionally, you will have to pay for notary services. Payment directly depends on the region where the inheritance is opened. You can find out more about the tariff on the website of the Federal Notary Chamber.

The cost of a certificate of inheritance rights for an apartment is much higher than for movable property. For example, in 2023 in the Omsk region you will have to pay 3,500 rubles. for each property. At the same time, when inheriting movable property, the heir will pay from 500 rubles. up to 2650 rub.

Inheritance by view

If the legal heir dies before the death of the main testator, the right to receive property passes to the grandchildren, nephews, cousins.

In this case, the list of documents will need to be supplemented. The heir must additionally provide:

- papers confirming the death of the heir;

- evidence of relationship with him.

That is, the applicant for property must prove the death of the testator and the heir whom he represents.

What to do if documents are missing or lost

The heir must take all necessary measures to obtain or restore the papers. In some cases, you will need to make a corresponding request to the registry office or embassy. If the pre-trial settlement method does not produce results, then the applicant for the property will have to go to court.

Often, citizens of retirement age submit an application to the court to establish legal facts. The essence of the requirements is to establish the fact of marriage registration in pre-war times.

Such appeals to the court are justified by the fact that many archives and documents were destroyed during wartime. Therefore, citizens are forced to go to court. There are even relevant clarifications from the Supreme Court of Russia on this matter. The same applies to the heirs of the above persons.

Is it possible to act through a representative?

The law allows papers to be submitted to a notary through an authorized representative. What documents are needed for this? The heir needs to contact a notary and draw up a power of attorney (Article 1153 of the Civil Code of the Russian Federation).

The document must contain comprehensive powers, including filing an application, collecting documents, obtaining a certificate. If necessary, you can authorize a representative to register ownership.

A power of attorney is not required if parents acting as representatives act in the interests of their minor children.

What to do after receiving the certificate

After completing the documents and receiving the certificate, the relatives will only have to contact Rosreestr or the MFC. The package of documents will need to be prepared again.

For registration of property rights you will need to pay an additional 2,000 rubles. The processing time for paperwork is 3–5 days. Documents can be submitted electronically or through a notary.

The heir needs to prepare:

- application for registration of rights;

- ID card of the apartment owner;

- certificate of inheritance;

- documents for the property;

- receipt of payment of the fee.

As a result of the procedure, the heir becomes the owner of the inherited property.

The implementation of property rights is directly dependent on the package of documents. If a potential heir cannot prove his involvement with the testator, he is automatically excluded from inheritance.

Such a person will have to go to court to prove the reason for missing the deadline or his relationship with the deceased citizen. Analysis of judicial practice shows that most of the claims remain unsatisfied.

The reason is ignoring the requirements of the law, negligent attitude to the preparation of evidence, and failure to use pre-trial methods to resolve the issue. To avoid loss of inheritance, you should consult an experienced lawyer. This opportunity is available on our portal.

All you need to do is request a call back. A lawyer will contact you and explain step by step what papers the notary will require and where they can be obtained.

- Due to constant changes in legislation, regulations and judicial practice, sometimes we do not have time to update the information on the site

- In 90% of cases, your legal problem is individual, so independent protection of rights and basic options for resolving the situation may often not be suitable and will only lead to a more complicated process!

Therefore, contact our lawyer for a FREE consultation right now and get rid of problems in the future!

Save the link or share with friends

(1 5,00 of 5) Loading...

Documents for inheriting an apartment

Home / Inheritance / Documents for inheriting an apartment

Views 3866

The most labor-intensive and time-consuming part of the inheritance process is collecting documentation. The absence of some kind of “piece of paper” may entail additional procedures (for example, the need to go to court) or even make inheritance impossible.

As a rule, most of the necessary documents are kept by the testator, the rest by the heirs, and only a few need to be obtained from the relevant government agencies.

Therefore, if after the death of a relative you find yourself in your hands with a package of documentation belonging to him, do not rush to throw away what you think are unnecessary “pieces of paper” - they may come in handy in the near future.

Application for inheritance

The day of death is the day of opening of the inheritance. From the next day the countdown of the 6-month period for inheritance begins. During this six-month period, the heirs of the deceased should contact a notary office and declare their intention to enter into an inheritance. This is done by submitting an appropriate application.

Making an application is very simple. It includes data such as:

- Name and address of the notary office;

- Full name, address of the applicant;

- Information about the deceased - full name, date of birth and death, last place of residence;

- The basis for inheritance is a family relationship or a will;

- List of inherited property;

- A request to the notary to accept the application and issue a certificate of inheritance;

- Date and signature.

A sample of such a statement is available at the notary's office. But in order to familiarize yourself with the document in advance, you can study the sample application, which is presented below:

List of documents for inheritance

A package of documentation is attached to the application.

All documents that are submitted to the notary’s office can be divided into groups.

The first group includes basic documents, without which inheritance is impossible. These are documents that confirm the death of a family member and the right of his relatives to inherit.

The second group includes documents for property subject to inheritance. For example, if the subject of inheritance is an apartment, the notary needs to submit title, technical, appraisal and other documents for the apartment.

The third group is additional documents that may be required in exceptional cases . For example, a power of attorney - it is necessary only if all actions on behalf of the heir will be performed by a trusted person.

Let's take a closer look at which documents from each group must be submitted to a notary's office in order to inherit an apartment.

Basic documents for inheritance

- Heir's passport;

- Death certificate of the testator;

- Documents confirming family ties (if inheritance occurs by law):

- Entries in the passport (about marriage, about the presence of children);

- Birth certificate;

- Certificate of marriage or divorce;

- Extracts from civil registration books;

- Certificate of change of first or last name;

- A court decision establishing a family relationship.

- A will with a notary's note that the will is valid has not been canceled or replaced by another will (if inheritance occurs under a will);

- Certificate of the place of last residence of the deceased (form No. 9) indicating all persons who were registered in the apartment;

- An extract confirming the deregistration of the deceased, issued by the local department of the migration service.

Documents for the apartment

If among the inherited property there is real estate, for example, an apartment, the notary must be provided with documents for the real estate:

- Title documents that confirm the purchase of real estate by the testator. As a rule, these are contracts (purchase and sale, donation), a certificate of inheritance (if the testator once inherited an apartment). It could also be documents on privatization, on full payment of the share of the apartment;

- Document on registration of ownership of the apartment.

If the apartment was registered before January 31, 1998 (in Moscow), a certificate from the Department of Housing Policy and Housing Fund of Moscow is required. If the apartment was registered after January 31, 1998, an extract from the Federal Registration Service for State Registration, Cadastre and Cartography is required.

- Technical documentation of the BTI (which must indicate the inventory value of the apartment as of the date of death of the testator);

- Cadastral documentation . This is an extract from the state cadastre of real estate, which contains accurate information about the apartment (address, graphic plan indicating the area of the premises) and the cadastral value as of the date of death;

- An act of assessing the market value of the apartment on the date of death (if necessary).

Additional documents

In some situations, the notary needs to provide additional documents, for example:

- Applications for refusal of inheritance , if the heirs decide to refuse inheritance;

- Power of attorney, if all actions on behalf of the heir will be performed by a trusted person (in situations where the heir himself cannot do this due to employment or illness);

- Documents confirming the rights of the legal representative of an incapacitated person or a minor child (parent, guardian, guardian) - birth certificate, passport, decision to appoint a trustee or guardian.

Of course, this list is not exhaustive. Depending on the circumstances, other documentation may be required for inheritance.

When and where to submit documents?

The application and package of documents must be submitted to the notary office:

- at the last place of residence of the testator;

- at the location of the inherited property (for example, an apartment). If the inherited property is represented by several objects, you can apply at the location of any of them.

If a notary for some reason refuses to accept the application and issue a certificate, the heir should go to court (read the article “Entering an inheritance through the court”).

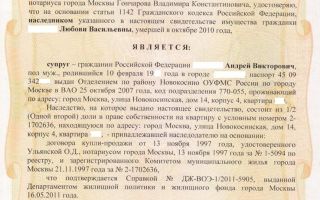

Certificate of inheritance

An inheritance certificate is the only document evidencing the heir’s right to the testator’s property (by law or by will).

The certificate is issued 6 months from the date of opening of the inheritance. During this period, the heirs submit to the notary's office statements of desire to enter into an inheritance and documents that confirm this right.

Registration of ownership

Based on the received certificate of inheritance, the heir can carry out the procedure of state registration of property - register the inherited apartment in his name. To do this, he should contact the Rosreestr authorities. A month after submitting the application, the heir will be able to receive a certificate of ownership of the apartment.

Legal assistance

Inheriting an apartment requires certain knowledge about collecting documents, procedural deadlines, appeal procedures and other nuances. It is difficult for an unprepared person to immediately understand the procedure.

Well, if the division of the inheritance is accompanied by squabbles between the claimants, then there is a great risk of losing part of the property altogether. Other heirs may retain property in their possession, hide documents, file complaints, and even falsify certain papers.

It is very difficult to cope with a heap of problems alone. That is why you should not ignore contacting experienced lawyers.

Have you encountered difficulties when dividing the apartment of a deceased relative? Leave a request to our lawyer and a specialist will contact you at a time convenient for you. Our experts provide free legal advice on inheritance. By stating your problem, you will receive the most comprehensive answer.

The lawyer will advise what position is best to take in the issue of inheriting an apartment, you will find out what documents are needed in your case, what to do if the notary refuses and how to correctly draw up an application? Timely legal assistance will save you from illogical steps and loss of precious time.

What documents are needed to register an apartment as an inheritance?

Real estate and cars are the main types of inherited property that can be received by beneficiaries after the death of the property owner. How to inherit an apartment?

How can you become an heir?

There are two ways to become an heir to an apartment: by law, the circle of applicants for housing is established by the Civil Code; by will, the successors are appointed by the testator himself.

In law

When inheriting, the law establishes the order of heirs, whose rights are transferred from generation to generation. The main beneficiaries are the parents, spouses and children of the deceased. They belong to the first line of inheritance. A spouse can claim half of the apartment if it was purchased jointly during marriage. The remainder will be divided between her, the children and the parents.

According to the law, heirs with a mandatory share may have the right to inherit an apartment. They have the right to this even if there is a will. They are entitled to at least half of that part of the property that could go to them by law.

If there are no main applicants for the deceased’s housing, then their right is transferred to the next circle of recipients. Refusal of inheritance is also possible.

By will

The second method of obtaining an apartment provides for the opportunity for each citizen to independently appoint a circle of applicants for the property. The will specifies a list of persons who can take part in the inheritance of the deceased's property. It is possible to indicate the shares of each recipient or not to indicate this. In this case, the property will be divided equally between them.

The testator also has the right to appoint an unworthy successor. Such a person will not be able to join. It is extremely difficult to challenge the decision of the deceased.

The procedure for registering an apartment by inheritance

To receive property by inheritance, for example, after the death of parents, you need to follow a certain procedure. The entire procedure takes 6 months. After this period has expired and there are no claims from the recipients regarding the division of property, the notary issues a certificate to all identified recipients.

A certificate of inheritance is a fundamental document of the right to further registration of the apartment as the property of the person who entered into it. It is possible not to register the entry, but to make the actual acceptance.

This method involves the use and maintenance of an inherited apartment after the death of its owner.

If the fact of acceptance is proven, then you can register your right to square meters at any time.

If the inheritance is actually accepted, keep all documents, extracts, receipts that may indicate your use of the inherited apartment. Based on these papers, you will be able to prove your right to join, even if the deadline is missed.

The first thing the heir or relatives of the deceased need to do is contact the registration authority with an application to remove the testator from the register at his place of residence. At this stage, a certificate of completion of this action will be issued, which will be needed to contact a notary office.

The second step is contacting a notary . You must declare your rights to a specialist by writing an application to accept the inheritance. It is important to complete this step within six months from the date of death of the apartment owner. Otherwise, it will be much more difficult to restore your right to join.

The next stage is the collection of documents for registration of the inheritance case . After accepting the application for entry, the notary will issue all applicants for the deceased’s property with a list of required papers.

It will be necessary to prepare title documents for entry into the possession of the testator's property. At this stage, it is also necessary to conduct an assessment examination of the housing and, based on its results, pay the established state duty.

A check or receipt for its payment must also be provided to the notary.

The final action is waiting for the consideration of the inheritance case at the notary's office . Upon completion, the specialist will issue a certificate of inheritance.

All about entry and registration deadlines

The period for receiving real estate by inheritance is limited. During the specified period, you must contact a notary's office and write an application to receive the property of the deceased. If this is not done, then it is possible to restore the deadline for formalizing acceptance in two ways:

- Based on a written agreement with other identified applicants for the apartment. If consent is received from the receivers, the notary will accept the application from the late candidate and redistribute the inherited property.

- If the heirs do not agree to accept the new recipient, then it is possible to restore their right to receive an apartment through a lawsuit. To do this, you need to go to court with a statement of claim to restore the terms of entry. If there are compelling arguments (illness or ignorance), the court will decide in favor of the new heir.

The period for entering into inheritance under Article 1154 of the Civil Code of the Russian Federation is 6 months from the date of death of the testator. The day of the report may also be a court decision to declare a citizen dead.

There are several ways to claim your rights to an apartment. The first and most common of them is the receiver’s personal appeal to a notary to write an application. It is also possible for this document to be written by the recipient's representative, but only on the basis of a written power of attorney.

If the applicant is unable to personally contact the notary’s office at the place of last residence of the testator, the application can be sent by mail.

A candidate for an apartment by inheritance has the right to write an entry document from any notary in the country. A certified copy must be sent by registered mail.

This must be done no later than the last day of the 6-month period from the date of death of the testator.

List of documents that will be needed

Documents for inheriting an apartment are provided to the notary who is handling the case. What do you need to have on hand? The first type of paper is information about the deceased owner of the property. These include:

- Certificate from the registration authority about the last place of residence of the testator.

- An extract from the registration of the apartment owner from the place of residence due to his death.

- Death certificate (issued by the registry office).

Next, you need to prepare documents for inheriting an apartment by law or will, which are the basis for registering the heir as a recipient:

- Applicant's passport, application for entry.

- If you have a will, you must provide this document. Read how to find a will.

- When inheriting by law, you must provide evidence of your right.

Entry by law requires proof of the degree of relationship with the testator in order to determine the priority of the successor or whether he has a mandatory right. Such documents include: a birth or marriage certificate, a guardianship or adoption order.

What other documents are needed to inherit an apartment? In addition to all this, recipients of the apartment must provide evidence of the deceased’s ownership of the property:

- Certificate of state registration of rights (since 2017 this is an extract from the Unified State Register).

- Agreement for the purchase and sale of housing, its donation or exchange, certificate of receipt of an apartment by inheritance.

- Cadastral passport of real estate indicating its market price at the time of purchase.

- Technical passport and plan issued by BTI.

The given list of papers is not the entire list of documents. If necessary, the notary has the right to request additional certificates and extracts from the receivers. Registration will be complicated if the apartment was registered as the property of a deceased person before 2000 or is not privatized at all. If documents are missing, they must be restored by contacting the archives.

Tax on receiving real estate by inheritance

The Tax Code (Article 333.38) provides for a tax upon inheritance of an apartment - a state duty.

Its size depends on the value of the property at the time of the death of its owner and on the degree of relationship of the recipient.

Thus, for heirs of the first and second priority (by law and by will), a state duty is provided in the amount of 0.3% of the price of the inheritance, but not more than 100 thousand rubles.

For all other applicants for apartments, the amount of payment in favor of the state is equal to 0.6% of the price of the inheritance, but more than 1 million rubles.

A list of persons who may be exempt from such payment is provided. These include:

- Minors and incompetent heirs.

- Receivers who lived with the testator.

Pensioners and disabled people can receive a partial benefit in the form of a tax reduction.

If the person who inherits the apartment sells the property immediately after registration, then additional income tax is paid. Its size is 13%. The transaction amount is indicated in the declaration and sent to the tax authority.

There is no need to pay tax when selling an apartment if more than three years have passed since the ownership of the property arose.

Do I need to register ownership of an apartment?

The actual inheritance of an apartment does not require the recipient to take any action regarding registration of ownership of the apartment. But in this case, there will be no full rights to dispose of the inherited apartment. Without property documents, it is impossible to sell or carry out any other transaction.

To obtain a title document, you must contact the state registry. You must provide the following upon registration:

- Certificate of inheritance or court decision to determine the recipient of the property.

- If there are several heirs, an agreement is required to allocate each applicant his share.

- Documents of the testator for the apartment (confirmation of his ownership rights).

- Extract and technical passport for the apartment from the BTI.

- Passport, application for re-registration and receipt of payment of the fee.

After the heir applies to Rosreestr and submits all documents, registration is completed within 30 days, on average 3 weeks. After the expiration of the period, the authority’s specialist issues an extract from the Unified State Register of ownership.

On our website you have the opportunity to ask your question and get an answer from an experienced inheritance lawyer. You can do this completely free of charge. Our specialist will quickly answer you and help resolve your situation.

When inheriting a share in the authorized capital of a company, you must confirm the right to inheritance. The notary will need to provide:

- charter of a legal entity;

- extract from the list of participants;

- extract from the Unified State Register of Legal Entities;

- certificate of the value of the share in the authorized capital.

The heir can independently apply for an extract from the Unified State Register of Legal Entities to the tax office. To do this, you must submit an application and pay a receipt for the state fee. Other documents are provided by the company.

As a rule, a legal entity transfers information only at the request of a notary or at the request of a court.

The peculiarity of inheriting a part of the authorized capital is that it is not the share itself that passes to the heir, but its cash equivalent.