There are two ways to receive the inheritance of a deceased person - by law or by will. In the first case, there are obligatory heirs and heirs of the first priority, who will take over the rights, and in the second, the order of inheritance, in fact, does not matter - those indicated in the will will receive the property.

Most often, real estate and land plots become the property of heirs. We’ll talk further about how to draw up a will for a house and land correctly, what documents are needed for this, and how much it will all cost.

Basic provisions

Drawing up a will for a house and a plot of land, as well as for any other type of property, must comply with the requirements of the Code of Civil Procedure of the Russian Federation. Thus, the testator must meet a number of requirements:

- Must be the sole owner of the property that is going to be bequeathed.

- Must be capable, fully aware of what he is doing, and also bear responsibility for his actions and the consequences of them.

- Must be an adult.

- According to Article 1130 of the Civil Code of the Russian Federation, a will can be revoked by its holder an unlimited number of times.

- By his will, the testator can deprive some of the heirs of the inheritance, even the first priority, but this cannot apply to those who are included in the mandatory list.

- An heir can assume his rights only after the death of the testator after 6 months, but if he is the only one and there is no likelihood that his rights will be challenged, a certificate of accession to inheritance rights may be issued earlier.

If it is not possible to contact a notary, then he can be “replaced” by:

- The head of the penitentiary institution, if we are talking about a convicted person.

- The chief physician of the medical institution where the testator is located.

- The director of the institution where the testator lives. For example, this is a nursing home.

But nothing prohibits you from calling a local notary and drawing up the document correctly. The fact is that when drawing up a will under the direction of a third party, there is a high probability of a procedural error, which makes the document invalid, and it is no longer possible to correct this.

Is it possible to bequeath land without a house?

Is it possible to make a will for a house, but not give away the land? From a legal point of view, the building and the land plot on which it is located are different objects, each of which has its own documentation - a certificate or an extract from the Unified State Register.

Thus, theoretically, it is possible to make a will only for a plot of land, but not for the house itself. But, according to Article 35 of the Land Code of the Russian Federation, when ownership of a building is transferred, the right to use the land plot on which this building is located is transferred to the new owner under the same conditions under which the testator used it.

Also, according to Article 1181 of the Land Code of the Russian Federation, the transfer of ownership of a land plot is carried out on a general basis. That is, the ownership of the buildings located on this site does not pass to the new owner. He only owns the land, as well as the natural resources that are on it.

To avoid delays or, worse, litigation, lawyers recommend bequeathing both the building and the land on which it is located to one person. Also, both of these objects can be divided in shares between several heirs.

What documents do you need to have with you?

The law allows you to draw up a will not only for the property that is already in your possession, but also for the property that you intend to make in your name in the future. Therefore, when visiting a notary’s office, you need to have at least:

- Personal passport.

- Passport or birth certificate of heirs.

If the property is already owned, then you need to take with you the title documents for it:

- Registration or title document for the object - Certificate, extract from the Unified State Register of Real Estate, purchase and sale agreement, certificate of ownership, document on the commissioning of a residential building.

- Technical documentation - extracts from the Unified State Register of Real Estate with a cadastral plan, technical passport, and so on.

A complete package of documents for the object will need to be collected by the heirs when they enter into inheritance rights under the will.

Expenses

The cost of drawing up a will is regulated by Article 333.34 of the Tax Code of the Russian Federation - 100 rubles are paid for each page of the document. Drawing up a will by a lawyer or notary will depend on the specialist’s tariffs - the average bill on the market is from 1000 rubles.

Rules for making a will

The law does not prohibit choosing any notary to draw up a will for a house and land, but it is better to do this at the place of residence or at the location of the inherited property itself - this will greatly simplify the registration process for the heirs, in particular the search for an office in which the inheritance case has been opened.

A will for a land plot (as for any other object) is drawn up approximately as follows:

- The text of the will itself is drawn up.

- The document is checked by a notary to ensure compliance with procedural rules.

- If everything is correct, the notary certifies the document.

One copy of the document remains with the testator, and the second is kept in the notary's office.

The certification of a will can be in open or closed form. In the first case, the will can be read by a notary and certified, and in the second case, the document is presented to the notary in a sealed envelope.

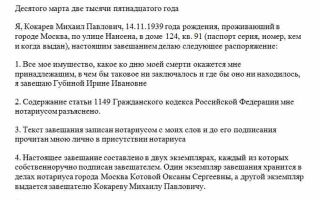

Sample document

The will for the house and land must include the following information:

- Date and place of registration of the will, city.

- Full name, passport details, place of residence of the testator.

- The testamentary disposition itself – to whom, in what shares and under what conditions the bequeathed property is inherited.

- A note that the contents of Article 1149 of the Civil Code of the Russian Federation have been explained to the testator.

- Testator's signature.

- Certification from a notary regarding verification of the identity of the testator, entry into the register, payment of state fees, clarification of the provisions of the law.

- Signature and seal of a notary.

Let us remind you that the will is drawn up in two copies - one remains with the testator, the second with the notary. The notary is obliged to keep the will of the testator secret until it is announced to the heirs, that is, after the death of the testator.

Methods of inheritance distribution

As mentioned above, when drawing up a will for a house and land, it is recommended to bequeath both the first and second objects in full or a certain share to one heir.

The testator has the right to distribute the property as he pleases, but regardless of his will, according to the law there are a number of persons who are obligatory heirs.

It should be noted that when drawing up a will, the heirs can be both individuals and legal entities and there does not necessarily have to be family ties between the heirs and the testator.

Who cannot be left without an inheritance?

There is such a thing as persons who have the right to an obligatory share in the inheritance. This category includes:

- Disabled citizens who were dependent on the deceased and lived with him.

- Minor children.

- Elderly parents, incapacitated children.

Such persons are entitled to less than half of the property that they would receive under the law.

Methods of challenging

A will can only be challenged in court, and only that relative whose rights, in his opinion, have been infringed, can do this. Thus, according to Article 1131 of the Civil Code of the Russian Federation, the following may be the basis for challenging a will for a land plot, like any other hereditary object:

- The heirs were declared unworthy on the basis of Article 1117 of the Civil Code of the Russian Federation.

- The will was drawn up in violation of procedural rules.

- The will was drawn up under pressure, under threat to the testator, when he was placed in enslaving conditions.

- The interests of socially vulnerable citizens who have the right to an obligatory share in the inheritance were not taken into account.

It goes without saying that any of these factors must be proven in court.

To summarize the above

A will for a house and land must be certified by a notary. It is better to do this at the place of residence or at the location of the hereditary mass itself. The testator has the right to name any individual or legal entity as heirs.

Making a will for a house and land

Every person at a certain stage of life begins to think about who he will leave his property to after he passes away. Any property can be inherited, as well as intellectual property, bank deposits and other items of certain value. Most people's main inheritance is their real estate. This includes apartments, houses, land plots and other buildings that belonged to the deceased person. These objects can be passed on to heirs, both by law and by will. To ensure that the successors under the testator's will do not have difficulties when registering real estate as their own, the will for the house and land must be drawn up correctly, taking into account all the features established by law. Let us consider what requirements the law imposes on the testator himself, as well as on his drawing up an order for the transfer of a residential building and land plot to the heirs after death.

Who has the right to make a will?

To ensure that there is no reason to invalidate a will, certain requirements are imposed on the drafters of the will.

When drawing it up, a citizen must meet the following requirements:

- it must be in adequate condition, i.e. be recognized as legally capable and consciously express your desire to inherit real estate to a specific heir;

- to be the sole owner of the bequeathed property, i.e. neither the house nor the land plot should belong, along with the testator, to other owners on the basis of shared ownership;

- The maker of the will must be an adult citizen of at least 18 years of age.

To whom can a will be certified?

The written expression of will of any citizen must be confirmed by an authorized person. The right to confirm the validity of a document is assigned by the state to the notary.

He must help the testator correctly draw up a testamentary document for a land plot and a house, taking into account the title documents for this property, and explain to whom it can be bequeathed so that the document is not recognized as invalid in the future.

In exceptional cases, the right of certification is assigned to the head physician of the hospital, when the last desire to bequeath real estate to a certain heir is documented in the medical institution where the sick citizen is located, but there is no notary nearby, and the testator is not able to visit him.

Also has the right to certify a will:

- the head of the penitentiary institution, if the testator has been there for a long time and is afraid of not making it to the end of his sentence;

- captain of a ship on a long voyage;

- the head of an expedition located far from civilization, where the testator is on a long business trip.

Features of inheriting land and houses

Real estate in the form of a residential building and a plot of land attached to the house has its own specifics when it comes to inheritance. First of all, the will maker must have a separate title deed for each of them. Certificates for the house and land must be registered with Rosreestr.

Then they will appear as independent real estate objects, which can be included in the will separately from each other or together. Based on Article 1181, the transfer of the right to own land registered in the name of the owner is carried out according to the generally established rules.

“Inheritance of land plots” (more details)

Important! Upon inheritance, a land plot cannot automatically include the buildings located on it, for which a separate document has been drawn up.

Sometimes the testator owns only a residential building, and the land under it is used on an indefinite lease basis. Therefore, it cannot be indicated in the will as an object of inheritance. In this situation, when transferring ownership of a house under a will, a citizen can simultaneously receive the right to use the land under the building.

Based on Article 35 of the Land Code of the Russian Federation, when registering ownership of a house, if it is located on a plot that does not belong to the previous owner of the house, the transfer of rights to use the land is carried out on the same conditions as the previous owner of the house.

“Transfer of rights to a land plot upon transfer of ownership of a building, structure” (more details)

To avoid disputes between heirs, it is more reasonable to bequeath a residential building located on a land plot, if each of these objects has a separate document of ownership, to one inheriting owner.

The notary does not have the right to demand from the citizen applying for the registration of a will documents of title to the ownership of the land plot and house.

According to the law, it is allowed to indicate in the will not only the testator’s existing property, but also the entire inheritance that will remain after his death. To do this, he only needs to present his passport.

However, in order for the testator not to make a mistake when indicating information about the heirs, including passport data: full name, date of birth, place of registration, he needs to have the documents of the heirs with him.

To identify real estate objects that are the subject of a will, you need to indicate their characteristics in it. For example, when bequeathing a plot of land, its location, total area, purpose, and cadastral registration number are indicated. Therefore, it is better to bring the “Certificate of Ownership” for this plot to the notary.

For an inherited house, it is advisable to have its technical characteristics: floor plan of the building, area and location of communications, if any, as well as the address of the house and cadastral number.

The entire package of documentation for the property will subsequently be needed by the heirs when they draw up documents for it in their own possession.

But if the will specifies as many characteristics of the transferred real estate as possible, this will help avoid confusion when accepting an inheritance.

Rules and procedure for registering the will of the testator

It is better to find out from a notary how to correctly draw up a will for a house and land. It is wiser to choose a notary office that is located close to the location of the property or residence of the testator. In this case, according to the law, you can choose any notary institution.

When preparing a document, adhere to the following rules:

- the document is drawn up in writing or in printed form and signed by the testator himself in the presence of a person confirming the signature;

- The text of the document must contain, first of all, information about his passport data, full name, date and place of registration. Then the expression of will itself is formulated, indicating the full name and passport details of the heir and a description of the object of inheritance;

- the notary must explain to the testator that he does not have the right to leave without inheritance a certain category of heirs designated in Article 1149 of the Civil Code of the Russian Federation, about which there is a corresponding entry in the application form;

- at the end of the document, after the testator’s signature, the notary confirms his identity and certifies the testamentary disposition with the corresponding entry indicating the date of its preparation. After certification, the notary signs and seals.

If the house and land are bequeathed to different heirs, the testator can draw up a separate document for each heir or indicate them in a general will.

Below is a sample testamentary document for a house and land.

From the given example of a will form, it is clear that the duties of a notary include explaining the contents of Article 1149 of the Civil Code of the Russian Federation. It indicates who can challenge the drawn up will if it does not contain mandatory shares in the inherited property allocated to the minor offspring of the testator, disabled people who were not less than a year in his care until his death.

“The right to an obligatory share in the inheritance” (more details)

If there are such heirs, but are not indicated in the will, then the will of the citizen can be adjusted after his death in favor of allocating obligatory shares to these heirs.

In accordance with the Tax Code of the Russian Federation, a single tariff in the amount of 100 rubles is established for the service of certification of a testamentary document. for one page of text. Additionally, the notary may charge a fee for preparing the document itself, printing it on a computer, and providing legal advice to the client. Such services can cost up to 1 thousand rubles or more, depending on the region.

Last changes

In 2023, there are no significant changes in legislation on this issue.

Our experts monitor all changes in legislation to provide you with reliable information.

What is better, a deed of gift or a will for a house and land?

A person who owns real estate (house, apartment, land) - sooner or later, asks the question of transferring his property rights (including, for example, deposits through Agroprombank, described here). How can this be done more conveniently, how can we guarantee the transfer of rights to exactly the person we would like, and at the same time protect ourselves?

What to choose – drawing up a will or a deed of gift? These are two completely different procedures, the essence of which is the transfer of legal rights, but the consequences of these procedures can be said to be diametrically opposed (and, in any case, they should not be confused with ordinary transactions in which a separate passport is drawn up).

Is it better to draw up a deed of gift or a will for a house?

When asking the question of what is better - donation or execution of a will for real estate, land, the owner, first of all, must sincerely answer the question: what is more important for him personally, to ensure the safety of his own rights during his lifetime or to make it more convenient for another person to receive property ( heir and donee)? It is important to note that laws aimed at protecting legal entities (for example, Federal Law No. 294, described here) are not always applicable in this procedure.

It must be clearly understood that when registering a deed of gift, the legal ownership passes to the donee during the life of the donor, even if, in fact, the donor continues to own the property (in certain cases, even if we are talking about a company with an established staffing table). Cancel the deed of gift, i.e. Thus, it is possible to restore the former owner of the home in his rights in exceptional cases, if there is evidence that at the time of the transaction the donor was incapacitated and did not realize the ongoing process and its consequences.

With the method of transferring ownership of a house, through the execution of a will, the heir assumes his rights only after the death of the testator (as at work, out of turn, you can only get leave at your own expense, and you will have to wait for a paid one). Once a testamentary document has been written, it can always be changed. The document drawn up and signed by the last person will have testamentary force.

It is also important to consider that in any case the inheritance will be subject to appropriate tax. More details on this issue are here.

Challenging a will for a house by first-priority heirs

The testator must take into account that his property may not be completely transferred to the heir he has determined (for example, unlike the sale of an apartment, in case of inheritance it can be divided).

This document may be challenged by first-degree heirs who do not agree with the terms of the testator’s last will.

Minor children, disabled people and dependents who are supported by the testator during his lifetime will in any case receive their share of the inheritance.

Is it possible to challenge a will on a house after death?

If among the relatives, the primary heirs, there is no common position regarding the bequeathed property, and there is no agreement with the distribution made by the testator, then the emergence of disputes after the death of the testator is inevitable.

A testamentary document can be challenged in court, and the property specified by the testator can be redistributed among the first-priority heirs, in accordance with the law.

How to make a will for a share in a house?

The property right to a certain share in a house is not fundamentally different from the right to a whole house. The owner is free to dispose of this share at his own discretion. The only exception is the moment of selling your share. There must be a refusal from other owners to purchase it. For acts of donation and bequests of shares, the consent of other owners is not required.

Probate tax on house and land

For the testator, the execution of a testamentary document for real estate and land will not be burdensome in material terms; the state duty for it is small. When signing with a notary, it is 100 rubles, in addition, you will need a certain amount (one and a half to two thousand) to pay for the notary’s services when preparing the written text of the document.

Heirs who accept property after the death of the testator will have to spend money. This includes not only the state duty for obtaining the certificate of inheritance itself, but the collection and preparation of a whole package of documents, different in a particular case. Which will require not only financial, but also significant time expenditure. You can't do it without the help of a lawyer.

For those receiving property rights from a testator or donor, in terms of spending time and money, a gift agreement is preferable.

Calling a notary to your home to draw up a will

In special cases, when a citizen who wants to draw up a testamentary document cannot leave his home (for health reasons), it is possible to call a notary directly to his home.

The arrival of a notary must be discussed in advance, preferably directly at the notary's office, or, as a last resort, by telephone if the testator does not have relatives or other close people who can organize the notary's visit.

At the notary's office you can find out how much it costs to draw up a will from a notary and find out the cost of sending it home. For large cities, this amount ranges from 4 to 7 thousand rubles, depending on the region of residence. Before the notary arrives, it is necessary to prepare the package of documents specified by him.

Sample will for land and house

To draw up a testamentary document, the notary must submit:

- passport (original);

- a list of all presumptive heirs, indicating their full names, surnames, patronymics and places of their birth and residence;

- documents confirming ownership of the bequeathed property. If you have a house and land - a cadastral passport.

Download sample

If you have questions, consult a lawyer

You can ask your question in the form below, in the online consultant window at the bottom right of the screen, or call the numbers (24 hours a day, 7 days a week):

- 8 (800) 350-83-59 — all regions of the Russian Federation.

(3 3,67 of 5) Loading...

Will for land and house: how to draw up, how much it costs, sample

Making a will for a house and land may be necessary if the testator wishes to transfer the property to persons who will properly care for it.

Then the right to draw up a will for specific heirs comes to the rescue. To prevent the will from being challenged by interested parties not included in the list of heirs, the rules for drawing up the document must be followed.

The article describes practical recommendations for writing a will for a house and a plot of land.

Who can act as a testator?

The will is drawn up on the basis of Ch. 62 Civil Code. In Art. 1118 provides for the possibility of a citizen to indicate the fate of his belongings in the event of death. The testator must meet the following criteria:

- The testator must be the owner of the bequeathed property. Objects that do not legally belong to him cannot be included in the will and estate. For example, confirmation that a person is the owner of a house is the title papers for the object - a deed of gift, a purchase and sale agreement, an extract from Rosreestr, where the testator is indicated as the owner. If the house is owned by several persons, a will can only be drawn up for the share belonging to the testator.

- For a will to be valid, the testator must have legal capacity. Capacity is determined by the ability to be aware of one’s actions and bear responsibility for them. In the case of a will, a citizen must understand what exactly he is doing: what property he wants to dispose of and to whom it will be bequeathed. Notaries have the right to require a medical certificate of legal capacity from a person if there are suspicions that the client is not fully aware of what is happening. If the testator is elderly, it is worth contacting a medical institution in advance and asking for observations to be carried out to determine legal capacity, which will result in a certificate for a notary.

- Persons who have reached the age of majority have the right to make a will.

- The will indicates the will of only one testator.

Important! If it turns out that the testator does not meet one of the above requirements, then the act of last will can be challenged in court.

The testator has the right to distribute property in any shares (equally or not). However, such objects as a house extension, a garage, a bathhouse cannot be transferred separately. But even if the document lists indivisible things, the will is not invalidated. The distribution of such property occurs according to Part 2 of Art. 1122 Civil Code.

The testator has the right to establish the conditions for the successors to receive the inheritance, but cannot force them to dispose of what they received in the future.

Circle of heirs

Art. 1121 of the Civil Code allows the testator to appoint successors of his choice . They can be family members, friends, acquaintances, shelters, orphanages, in short, any individuals and legal entities.

When drawing up the document, the testator must determine what property is transferred to a specific heir. If one object is bequeathed to several people, the testator has the right to establish a part that will be allocated to each successor.

- Such rights of the testator are secured by the principle of freedom of will - the testator has the right to dispose of the property, relying on his wishes.

- It will not be considered a violation of the rights of the heirs if the testator does not indicate any relatives in the act of last will.

When bequeathing real estate acquired during marriage, the testator must remember that such property is considered joint property. This means that such a house cannot be bequeathed in its entirety.

Before drawing up the document, you need to allocate the spouse’s share, and only after that bequeath your share to the heirs. The object of joint property can be indicated in full in the will only if the second spouse writes a waiver of his share. The refusal is drawn up in writing and is also subject to notarization.

To make sure that the house and land will go to specific heirs in full, you need to check whether there are people around the testator who are entitled to an obligatory share. Their list is indicated in Art. 1149 Civil Code.

Example. Gr. O made a will for a house with a plot of land and designated his grandson as heirs. At the same time, the testator has a disabled wife, whom he did not include in the will. Since the obligatory heir has the right to claim half of the property that would be due to him by law, the wife will be able to challenge the will.

Testator's rights

All obligations arising from the will come into force upon the death of the testator. Until this moment, the testator is the full owner of the bequeathed property. The citizen is not obliged to report to the heirs about the contents of the act, or to name the shares that he allocated to each. Relatives may not even know that a will was drawn up.

Before death, the testator has the right to change the contents of the will - to exclude and include heirs and bequeathed property, Art. 1130 GK. The new act automatically gives the previous document the status of invalid. The will can be completely revoked, then inheritance occurs according to law.

Where to go to make a will?

According to Art. 1125 of the Civil Code, the act of last will is certified by a notary. The testator must contact the notary office at his place of residence.

If there are no notary employees at the place of residence, the law allows to certify wills of other persons, including. 1127 Civil Code:

- if a person is being treated in a medical institution or is staying in a social institution (for the elderly or disabled), it is certified by the head physician and director of the organization;

- if a citizen is on a ship, the certificate is provided by the captain;

- if the testator is a participant in an exploration, Antarctic or other expedition, it is certified by the chief;

- for military personnel of stationed troops, their commander is responsible for the certification;

- if a person is serving a sentence in prison, the will is certified by its chief.

Cases of certification of a will by the above persons are exceptions; most acts are certified by notaries.

Recommendation! You should not look for other specialists, since notaries have experience and special knowledge, they will give advice on how to correctly draw up a will for specific property. A notary officer will examine the documents for legality and, if necessary, allocate the spouse’s share.

The notary chosen by the testator will subsequently open the inheritance and issue a certificate to the heirs.

Types of will

The Civil Code distinguishes two types of registration of the act of last will:

- Open will. Its contents become known to those present during the preparation - the notary, the witness, the translator, if they are invited. It is drawn up in two copies, one is provided to the testator, and the second remains in the notary's office. If the testator does not want to inform relatives about his orders, he needs to hide the document well, otherwise everyone will know about his last will.

- Closed. Only its author, the testator, knows about the contents of such an act. Even a notary is not allowed to read the document, part 1 of article 1126 of the Civil Code. Such a will is written by hand and signed personally by the testator, after which the latter puts it in an envelope and seals it. The envelope is signed by two witnesses to confirm the transfer of the document to the notary. The notary writes on the envelope information about the testator, the date and place of drawing up the act. The heirs become aware of the contents of a closed will after the death of the testator, in accordance with Part 4 of Art. 1126 Civil Code is fine.

Since an open will can be checked by a notary for inaccuracies, there is a greater chance that it will not be challenged.

What to write in a will?

The will must contain the following information:

- The date and place where the document is drawn up.

- Passport details of the testator - full name, date of birth, series and number of passport, place of residence.

- Formulate an order. Here you need to indicate a list of property, its details and data on title documents for real estate. A list of heirs and their shares is also indicated.

- A note indicating that the person and the notary have read the text.

- Proposal regarding the fact of explanation by the notary to the testator Art. 1149 Civil Code.

The citizen signs the document, after which the notary makes his notes.

Download a sample will

List of documents

In order for a notary to certify a written order, he must check documents about the identity of the testator and his rights to the bequeathed property. To do this, the applicant must provide:

- passport;

- documents for the house (for example, a purchase and sale transaction, deed of gift, certificate of inheritance), technical documents, extract from Rosreestr;

- papers on ownership of a plot of land, its cadastral number;

- if the property belongs to one owner, you need to confirm this fact - a certificate of absence of marriage or classifying the property as the personal property of the spouse:

- appraiser's conclusion on the value of the object.

The notary will verify the authenticity of the documents, after which their data can be entered into the will.

How much does registration cost?

Clause 13, Part 1, Art. 333.24 of the Tax Code obliges the testator to pay 100 rubles for certification of the act of last will. For opening a closed will you will have to pay another 300 rubles .

The remaining costs are of a technical nature and are determined in each notary office individually.

Free consultation. If you have any questions, please do not hesitate to ask them to a lawyer in the online chat on the right, in the form below, or by calling the hotline: 8-800-350-84-21

( 1 rating, average 5 out of 5 )

How to make a will for a house and land

If a citizen owns real estate, then after his death it will become the property of his heirs. However, the owner can dispose of the property during his lifetime if he knows how to draw up a will for a house or land plot. He can determine the shares, the order of inheritance of a land plot or residential premises.

Will for a house and land: basic provisions

The testator is the person who has complete control over the property and determines who he wants his property to pass on to when he dies.

Receiving property by will differs from inheriting a plot of land by law in that the owner of the estate himself determines his successors, as well as their shares.

The maker of the will can rewrite or supplement it several times.

Heirs can take over as owners only after the death of the testator. Then they can do whatever they want with the property: transfer it to another person, sell it, donate it, etc. However, with real estate that cannot be divided into parts, it is not always easy to carry out all these manipulations if there are many heirs and they cannot come to a common agreement.

The testator can foresee this point and formalize a testamentary refusal. This is the obligation of one of the successors who receives a house or land plot to pay compensation or grant the right to use the property to another heir. Such a condition must be fulfilled in order for the will on the house or land to come into force.

Is it possible to bequeath land without a house?

A land plot refers to the same type of real estate as a private house or apartment. Its owner registers it with the Rosreestr authorities and receives a document of ownership rights.

A will for a land plot is drawn up in the same manner as for buildings. The inheritance of land after the death of the owner is the same as receiving a house.

But the testator has the right to divide the land among several successors.

The situation is more complicated if the land belongs to one person, and the buildings on it are the property of another citizen. In this case, the inheritance of land will occur according to all the rules. The successor will take possession of plants, ponds and other natural objects, but the buildings will remain the property of other persons.

Documents for a will for a house and land

The main document for drawing up a will is the paper itself on which the testator expresses his will. The testator can do this in the presence of a notary, who will certify the paper, or alone.

Sometimes it is not possible to contact a notary office. This happens if a person is in an emergency situation, is in prison, hospital, undergoing military service, has gone on a long voyage, or has gone on a business trip.

Then the testamentary document is certified by a representative of the administration in front of witnesses.

Let's figure out what documents are needed to draw up testamentary papers.

In addition to the written expression of will, you will need the testator's passport and papers confirming the rights of the owner, since it is impossible to make a will for a house, land, or other property without them.

These notarized data are written down in the testamentary document itself. Without them, the will can be challenged in court. It will be declared invalid, and property will not be transferred to inherited citizens.

In some cases, when drawing up a will, passport data of the heirs is required. In this case, people wonder whether it is possible to challenge a will without this data.

When the person who makes the will does not have such data, but adheres to the correct execution of the document and clearly states what goes into possession and to whom, then the passport data of the successors may not be required.

If we are talking about land and buildings on it, then in addition to the certificate of ownership, it is better to add to the testamentary paper a cadastral plan of the site, a purchase and sale agreement, a certificate of privatization, etc. This will help to avoid incorrect identification of the bequeathed object and unnecessary legal delays. A receipt for payment of the state duty is also attached to the document.

The document is drawn up in two or more copies. And so that there is no doubt about the adequacy of its contents, it must be accompanied by certificates confirming that the testator does not have drug or alcohol addiction, mental disorders or other illnesses that prevent the preparation of the paper.

Expenses

The costs associated with drafting the document are small. According to the law, the owner of real estate and land must pay a state fee - 100 rubles per page of the will. The services of a notary office are also paid, but the amount is different for each region. When legal assistance is required to write a will document, this is paid separately.

The inherited person will also incur costs: he pays for the land plot and the house received into ownership. The state duty for close relatives is 0.3% of the cost of the house and land. For other relatives and third parties, the state duty is doubled. However, the heirs cannot pay more than a million for 1 object.

Rules for drawing up a will, sample document

A person can draw up a will for a house or plot of land:

- has reached the age of majority;

- being of sober mind;

- not limited in its actions.

The text is written personally by the owner of the property. If the paper is drawn up by a trustee, then this must be indicated and supported by the signature of the testator. Information about witnesses is also included in the document.

Making a will for a house and land includes the date and place of writing (must be indicated). Everything that the owner transfers to the specified person must be written down.

If there are several heirs, then the testator must indicate all of them and register those parts of the property that he bequeaths to each of them.

At the end, you can indicate a list of necessary documentation attached to the testamentary paper.

A sample testamentary document can be obtained from a notary office. The paperwork for the buildings has been completed and the plot is kept there. The heirs may not know about the existence of such a document, so the notary bears all responsibility for opening the document after the death of the owner. By law he is required to do this within 15 days.

How to draw up a will for a house and land: sample, procedure, necessary documents

By law, every person has the right to decide the fate of his property in the event of his death.

If the testator wishes to leave a plot of land or a cottage to a person whom he considers worthy, he can express his will in writing.

How to correctly draw up and formalize a declaration of will regarding a residential building or land? What does the sample look like? What is the difference between a will and a deed of gift? Let's figure it out together.

Basic provisions

The will must be drawn up in writing by the testator himself. In order for it to gain legal force, it must be certified by a notary.

Particularly close attention should be paid to names, dates, addresses - any information, the distortion of which could lead to an incorrect interpretation of the text of the last will. It is advisable that the declaration of will be written by the testator in his own hand; only in the event of a serious illness or injury of the testator, the legal representative has the right to sign for him (only with the consent of the testator).

Registration procedure

A will for an individual residential building and the land on which it is built is drawn up similarly to documents determining the fate of other property of the testator. The testator must remember that this is a one-sided transaction. He is not obliged to notify anyone (including relatives) not only about the contents of his last will, but even about the fact of its preparation.

Collection of necessary documents

Before going to a notary to formalize and certify his last will, the testator will need to collect a package of documents. If the testator wishes to formalize his will regarding real estate, for example, an individual residential cottage or land plot, then he will need to prepare and provide the notary with the following documentation:

- a document proving the identity of the testator (usually a general passport is sufficient);

- a certificate of the testator’s legal capacity (can be issued at a psychoneurological dispensary; as a rule, a certificate stating that the testator is not registered with this institution is quite sufficient) - the presence of such a paper will reduce the risk of appealing the testator’s last will and declaring it invalid, especially important for testators elderly (70 years and older);

- information about who the heir is (full name, date of birth, registered address, etc.);

- documents of title to the object that the testator wishes to bequeath;

- a certificate of the inventory value of the bequeathed property (to make a certificate, you will need to contact the BTI);

- certificate of ownership of a land plot with an attached cadastral plan and diagrams of the location of communications (everything located on the site must be listed in as much detail as possible, sometimes situations arise in which offended heirs legally cause damage to communications, green spaces, fences - if all this listed in the text, the heir will be able to protect his rights and recover compensation for damage);

- other certificates, extracts, documentation at the request of the notary (if an employee of a notary office asks to provide additional papers, then there is no need to regard this as his whim and resist his request - additional documentation always helps protect against protest).

Visit to a notary

Having collected all the necessary papers, you can contact the notary office at your place of residence. The notary will help you write the text of the will correctly and advise you on the specifics of inheritance. In particular, the testator must be explained the nuances of inheriting a compulsory share (if there are legal heirs who are entitled to it).

Sample will

The last will of the testator must be drawn up by the testator individually, taking into account the characteristics of the specific situation. The sample testamentary document for a house and land given below is for informational purposes only - based on the text presented, you can get an idea of how to compile the text part, and then begin to develop your own version.

How does a will differ from a deed of gift?

The main difference between a deed of gift and a will is the period of entry into force. The gift agreement will enter into legal force from the moment of its registration, that is, through a deed of gift you can transfer your property to another owner free of charge during the lifetime of the previous owner. The will comes into force only after the death of the testator.

INTERESTING: is it possible to challenge a will for a house after the death of the testator?

If the property was transferred in accordance with a gift agreement, then it is extremely difficult to challenge such an agreement (especially after registration of rights by the new owner). In a situation with the distribution of property according to the will of the testator, the heirs by law (that is, the relatives of the deceased) will have at least six months to find shortcomings and protest the last will of the deceased.