- If selling an apartment is already a familiar procedure for citizens of the Russian Federation, then selling a share of an apartment is a dead end.

- Many questions arise that must be followed, the procedure must be understood, and the necessary documents must be collected.

- At the same time, you need to follow the laws so as not to go to jail for fraud.

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique.

If you want to find out how to solve your particular problem, please use the online consultant form on the right or call +7 (499) 577-04-19. It's fast and free!

Hide content

Legal basis

- On June 2, 2016, Federal Law 172 “On Amendments to Certain Legislative Acts of the Russian Federation” entered into legal force.

- This law made adjustments to the current Federal Law No. 122 “On state registration of rights to real estate and transactions with it.”

- The adopted law obliges property owners to carry out various transactions only in the presence of a notary.

- He notes violations during the sale during the transaction, ensures that no one’s interests are infringed, and also does not allow fraudulent activities.

- Also, amendments to the law in 2016 tightened the rules for real estate transactions where the owner is a minor.

- Again, it is necessary to have a notary, who, in this case, is the defender of the interests of the minor and protects him from unlawful actions on the part of guardians and relatives.

- The sale of his share by the owner, that is, part of the real estate, is not prohibited by law.

- But don't rush to look for a buyer.

- When alienating such real estate, the rule on the preemptive purchase of shares by co-owners applies.

It is established in paragraph 1 of Art. 250 of the Civil Code of the Russian Federation: “When selling a share in the right of common ownership to an outsider, the remaining participants in shared ownership have a pre-emptive right to purchase the share being sold at the price for which it is sold, and on other equal conditions.”

You may be interested in the following articles:

- The document must indicate the sale price and terms.

- The notice is sent through a notary or by mail to record the date the notice was received.

- If the rights of other apartment owners are violated, they may demand cancellation of the sale of the share or change the terms of the sale through the court within three months.

FOR YOUR INFORMATION. The period for other owners to respond to written notice is 30 days.

If several property owners decide to participate in the transaction, the priority right is given to the one offering the highest price.

If after 1 month there is no response from other owners, then the owner of the property has the right to formalize a purchase and sale transaction to third parties.

Where do they apply and where to go?

- To correctly draw up all applications and collect all the necessary documents, you can contact a realtor who will do all the paperwork for you.

- However, you can try to collect the documents yourself.

- The signing of the purchase and sale agreement takes place in the presence of a notary.

- Today, a ready-made package of documents can be submitted in two ways:

- Through the MFC (Multifunctional Center);

- Through the Registrar's Office.

- Through the Rosreestr website (after approval of the application, you must provide the original documents in person within 10 working days).

What documents are needed?

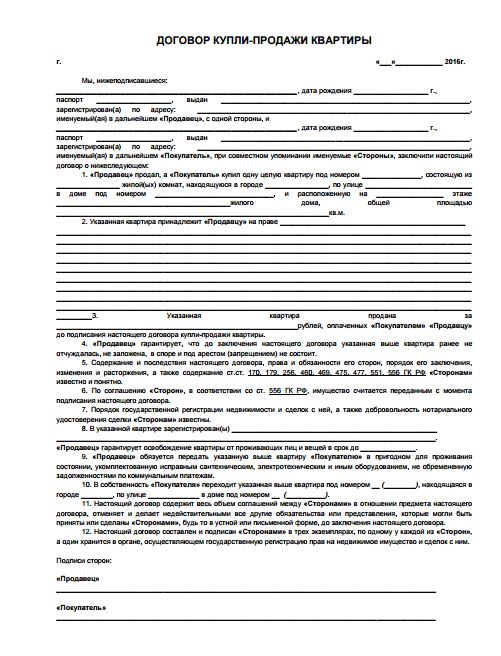

When drawing up a purchase and sale agreement, you must pay attention to the following points:

- Full names of all parties;

- Addresses of all participants in the transaction;

- Description of the subject of the agreement: the apartment itself (address, square footage, number of rooms, etc.), as well as its shares;

- Price;

- Information about restrictions in the form of rights on the part of other persons in shares in real estate.

- This document is certified by a notary.

- Download a sample about the purchase and sale of a share of an apartment

- After drawing up the contract, the entire package of documents must be submitted for registration.

- The entire list of documents is as follows:

- Written refusal of all other apartment owners to purchase;

- In the absence of a written refusal, it is necessary to attach a document confirming the notification of the co-owners about the sale;

- Certificate from the Unified State Register;

- Technical passport from BTI;

- Cadastral passport;

- Contract of sale;

- Statement;

- Identification documents of both parties (passports);

- Receipt for payment of state duty;

- Documents confirming the notification of co-owners about the sale of the share or their refusal to purchase it;

- If a minor is involved in the transaction, a certificate from the guardianship authorities is required.

After approval of all documents and registration of the property rights of another person, he becomes the full owner of the property.

Registration deadlines

During this period, they can give a written agreement to purchase part of the housing.

After collecting all the necessary documents, signing them by a notary, and submitting them to the Russian Register, the processing of the application by law is carried out within three working days, instead of eighteen, as was previously the case.

Registration cost

- To certify a purchase and sale document by a notary, there is a fixed tariff - 0.5% of the value of the real estate share.

- This payment is made once and cannot be lower than the minimum threshold - 300 rubles, and also cannot be more than 20,000 rubles.

- In addition, you must pay a state fee of 2,000 rubles for state registration.

- If the share in the living space has been owned for less than three years and the sale amount is greater than the purchase price, then, according to the Tax Code of the Russian Federation, the owner must pay a tax of 13% of the transaction amount.

- An owner who sells part of a property is subject to personal income tax on the income from the sale.

A transaction up to 1 million rubles is not subject to tax, and an amount exceeding this threshold is subject to tax minus 1 million rubles. Also, the tax deduction cannot be more than 260 thousand rubles.

When can they refuse?

- So, for example, when selling part of an apartment where a minor appears, the presence of a notary is required when preparing all documents, as well as the guardianship and trusteeship authorities .

- The notary must assess the legality of the transaction, and the guardianship authorities must receive confirmation that the child will soon be registered in another living space (in the purchased one or with relatives), since a citizen of the Russian Federation is required to have permanent registration until adulthood .

- The refusal can also be issued at the beginning of the transaction.

- The notary, assessing the intentions of the share owner, may not allow the transaction to take place if he decides that it is illegal.

- The refusal received from Rosreestr indicates the presence of errors in the documents or a lack of documents.

- In this case, you need to contact a specialist for help.

Features and nuances

If one owner

- If there is only one owner in the apartment, then he himself has the right to choose which part of the property he will put up for sale .

- In this case, he receives part of the money from the sale, retaining a share of ownership.

- At the same time, all the rules of shared sale remain, except for notifying other homeowners (since there are none, this point is not relevant).

- To avoid any misunderstandings or conflicts with the other owner, it is necessary to immediately indicate in the contract which part of the property (which room) is for sale, and also indicate the rules for using the property.

When selling an apartment, when there is only one buyer and several owners, everything happens taking into account the following points:

- If all owners agree with the transfer of rights to the property, then a single agreement is concluded, which sets out the rules for settlement with each owner. At the same time, notification of each owner about the sale is not required, since they are all involved in the transaction.

- The main condition is that the contract must be certified by a notary.

You can just draw up applications yourself, collect all the documents, draw up an agreement, but they still need to be notarized .

In other cases, a purchase and sale transaction without a notary is prohibited by law.

Options for quickly selling a share in an apartment

- Often, the sale of a share of property does not sell as quickly as we would like.

- Few people are willing to pay money to live together with other owners in the same area.

- It will be especially difficult to sell part of the apartment at market value.

- So, to quickly sell a share in an apartment, there are several ways:

- Make the cost of part of the apartment below market value.

- Agree with other owners to jointly sell all housing. There are much more buyers for a full living space than for a room in a communal apartment or in an apartment.

- It is worth getting all the documents in order. Thus, the presence of certificates of absence of debts for the apartment can be a significant advantage in the sale.

Other features and nuances

When selling a share of living space, you may encounter various problems and nuances.

Here are the main ones:

- A husband and wife own the same living space. It would be illegal for one spouse to sell a share to another.

- When selling a share to relatives (not a spouse), it is necessary to draw up an act of transfer of money so that the transaction is not considered imaginary.

- To sell part of an apartment that has been inherited, you must wait until the inheritance is officially entered into. Only after this the share can be sold according to generally accepted rules.

Other features and nuances can be discussed with a notary or realtor, to whom the right to register the purchase and sale of a share has been transferred.

Is it possible to sell a share in an apartment that is under a mortgage?

- Answer: yes, it is possible.

- But a number of nuances must be taken into account.

- If you need to sell part of an apartment that is under mortgage, you must first take care of the bank’s consent to the transaction.

- If the loan is not repaid at the time of sale, the sale is not possible.

- You can contact the bank for information about early repayment of the loan.

- If the request is approved, you can proceed with the sale process.

- The easiest way is to sell the mortgage share to your ex-spouse; in this case, banks very rarely refuse the transaction.

- If the sale is made to a third party, the following options are possible:

- Independent sale of an apartment without consent. In this case, the borrower transfers the loan amount to the bank account. These funds go towards the early closure of the mortgage, and the purchase and sale can be completed according to the usual rules.

- Execution of documents and registration actions by the bank itself, repayment of the loan and transfer of the mortgage to the buyer. In this case, the full presence of the bank in the purchase and sale process makes the transaction safer for all parties.

- Re-registration of the mortgage to the buyer.

At the same time, it is necessary to take into account other apartment owners.

ATTENTION: The rule on the priority of selling to other owners of an apartment does not lose its force when selling an apartment that is under a mortgage.

- Drawing up a purchase and sale agreement for a share in an apartment requires serious preliminary preparation for the procedure.

- The best option is to seek help from professionals who will monitor the process and accompany you throughout the sale of part of the apartment.

Didn't find the answer to your question? Find out how to solve exactly your problem - call right now:

+7 (499) 577-04-19 (Moscow)

It's fast and free!

Mortgage for a share in an apartment

But sometimes, due to financial problems, buying part of a home remains the only chance to get your own roof over your head.

In this article we will find out what a mortgage loan for the share of an apartment is, what its advantages are and how to apply for it.

According to Article 5 of Law No. 102-FZ “On Mortgages,” a share of housing that belongs to an individual as an owner can be used as collateral for a mortgage, as evidenced by an entry in the State Real Estate Register.

The living space must be liquid and usable. Otherwise, it will be difficult to implement if the borrower is unable to fulfill loan obligations.

Let's look at how to buy a share in an apartment with a mortgage. According to current legislation, there are two types of shared ownership:

- On the basis of common property. All apartment owners have equal powers to use their shares. Dimensions are determined by square meters belonging to them.

- The share is treated as private property. The most striking example is a communal apartment. Each individual has a separate room, and only a specific individual can fully use their meters. A person is the owner of a certain plot.

Each unit of private property must be registered with Rosreestr, otherwise shared ownership is considered common.

The procedure for acquiring a share is complicated by the presence of several owners of residential space who do not always want to share square meters with strangers. Because of this, it will be difficult to obtain a mortgage.

How to get a shared mortgage

Banks offer their clients a variety of lending programs, but none of them will suit absolutely everyone; each case must be considered separately.

The most common situations in which people go to the bank to apply for a mortgage:

- The borrower already owns several shares and needs the last one to own the entire property. The bank will have the whole apartment at its disposal, not a share. And the most likely approval of the mortgage will be precisely this case.

- The borrower owns only one share, but wants to expand the living space by purchasing another one. There will be a greater chance of obtaining a mortgage if each of the owners provides their written consent to the terms of the mortgage. Interest rates are usually high, since the price of a full-fledged living space on the market is higher, and it is easier to sell it than one part.

- The borrower wants to buy a share in the apartment, but is not the owner of other parts. Here, most likely, there will be a refusal. But if you have a good relationship with the owner of the apartment, you can get around the restrictions by dividing the shares.

Part of the housing for general purposes (kitchen, toilet, corridor, storage rooms and other non-residential areas) cannot be shared ownership. Therefore, during separation their quadrature is not taken into account.

Documentation

One of the conditions for obtaining a mortgage is the willingness of the individual taking the loan to incur additional expenses: pay for the services of a notary, realtor, and state fees.

To obtain bank permission, you need to collect and provide:

- passport;

- SNILS;

- marriage certificate, birth certificate of children (if available);

- income certificate;

- a copy of the work book.

The bank considers the application within 2-5 working days.

Let's look at how to get a mortgage for a share in an apartment. The registration procedure is as follows:

- Selecting a bank. The borrower considers the requirements of various financial institutions.

- An application is submitted. The borrower must collect a package of documents that is necessary to provide a mortgage (the seller’s passport, an extract from Rosreestr on the registration of the purchased living space).

- The co-owners write a waiver of the priority right to purchase the share (if the apartment is the last part, consent is not required).

- The bank makes sure that the co-owners are not relatives of the borrower, and also provides a document stating that the apartment meets all standards.

- The seller must give the bank a certificate of ownership and a contract for receipt, an extract from the house register, confirm that all co-owners have been notified and provide evidence and permission from the spouse (if any).

- If the bank agrees, an agreement is drawn up with the borrower.

- Search for real estate.

- Valuation of the share in the apartment that is the subject of the pledge. The assessment is made by an independent person who has official permission for such activities. Services are paid by the borrower.

- An apartment purchase and sale agreement and a mortgage agreement are concluded. The first agreement is concluded with the owner of the apartment, the second - with the bank.

- The transaction is certified by a notary.

- State registration of the mortgage is carried out. The borrower is assigned the rights to the purchased share.

- Mortgage insurance, which guarantees the financial institution will repay the loan if the property is damaged or lost.

The sequence of execution of the entire procedure has its own nuances in each specific case.

Where to go to get a mortgage

To get a mortgage to purchase a share in an apartment, you need to contact any bank that provides such a service.

You will also need to visit:

- Realtor. The borrower can choose the property himself.

- Notary.

- An insurance company, if the lender himself does not arrange for property protection.

- The transaction must be registered with Rosreestr.

Other options for purchasing a share of an apartment

If the bank refuses to issue a mortgage on the share, you can take out a consumer loan . The interest rate will be higher, the sale procedure will take place under a gift agreement.

Consumer loan is one of the types of lending. Anyone can use it to buy goods, housing, and services. The borrower must return the funds to the borrower on the latter’s terms, almost always with interest for a certain period.

Another way is to get a mortgage secured by existing real estate. Types of such mortgages:

- Pawnshop. The borrower must pledge real estate to the bank in order to obtain a mortgage. The borrower must have his own property, or it must be with a co-borrower/guarantor/other person who is willing to mortgage the property for you. An additional agreement is drawn up.

- A mortgage secured by the purchased living space. The borrower receives funds to purchase a new home. It is pledged to the bank. And under a pawnshop mortgage, real estate that the borrower already owns will be used as collateral.

A pawnshop mortgage has a number of advantages over a classic one. Advantages of the scheme:

- It is not necessary to report on what these funds are used for. The loan can be distributed at your discretion.

- This type of mortgage is given without a down payment.

- You can buy living space that you cannot buy with a regular mortgage (with redevelopment, communal space, dorm room, and so on).

Flaws:

- Banks will not issue a mortgage against an apartment if it is in poor condition.

- Insurance required.

- It will be difficult for individual entrepreneurs, business owners, and top managers to get such a mortgage. The bank may assume that the person is taking out a mortgage for the business.

- The rate is higher, and the difference sometimes reaches 3%.

Is it possible to buy a share in an apartment with a mortgage? Article 224 of the Civil Code of the Russian Federation indicates the possibility of joint ownership, i.e. Several persons can own the same living space by registering their shares in it.

According to Article 246 of the Civil Code of the Russian Federation, owners have the right to dispose of part of their property as they wish: they can sell it, transfer it by inheritance, give it as a gift, or use it as collateral if credit obligations arise.

Banks

Let's find out which banks provide mortgages for a share in an apartment in 2023:

- Delta Bank;

- Gazprombank – product “Apartment on the secondary market”, where you can buy a share;

- Anchor Bank issues another living space and share as security for existing real estate;

- Opening – the “Apartment” loan allows you to buy a home or its share;

- Asia Pacific Bank;

- Bank Education – product “Rooms and Shares”;

- Plus Bank and Aktiv Kapital Bank.

Previously, Sberbank and VTB had similar programs. But now these banks are wary of such borrowers, since the share is not entirely suitable as collateral. But you can leave a preliminary application.

A mortgage to buy out a share in an apartment will not be granted if third parties have a share in the property and do not intend to sell it. Before starting your search for a bank, it is better to discuss this issue with all apartment owners in advance.

Why do banks pursue a cautious policy in the field of shared mortgages?

Let's imagine that there is a three-room apartment and two owners. One owns two rooms, the other one. If the second does not object, the first pays him monetary compensation, which is equal to the market value of this room, and receives a full apartment.

And the sole owner will deal only with the bank, since it was this institution that issued the mortgage for the acquisition of the share. But banks do not very often agree to issue this kind of mortgage.

Causes:

- In most cases, such situations occur among relatives: shares are shared by divorced spouses, children and parents, brothers and sisters. For example, a borrower receives a mortgage for a share in a home. He gives the money to his relatives, becomes the owner of the apartment and pays off the mortgage with the same money, because the relatives, by agreement, returned it to him. Relatives are getting involved in this because they themselves may be in debt on loans. There can be a lot of assumptions here. This is not a completely clean scheme, and banks value their reputation.

- It happens that the borrower, after receiving a mortgage, does not become the sole owner of the apartment. With the funds borrowed, he buys only one room. If the borrower goes bankrupt, the bank will not benefit from such property. Selling a room is more difficult than selling an entire apartment. There is low demand for shares in apartments and private houses in the country. The financial organization will be left with a load that is useless to it, with a piece of real estate that is difficult to convert into money. For this reason, it is almost always a mandatory condition of the bank that after buying out the share, the borrower must become the sole owner. But in Moscow, with such expensive living space, there is a greater chance of getting a mortgage for a share in an apartment than in a small town.

- The borrower intends to buy a share of the apartment to which one of his relatives already has rights, by will or deed of gift. The potential legal owner has the right to challenge the deed of sale and purchase through the court. Afterwards, the borrower will lose his share, and the bank will lose the collateral.

That's why banks carry out checks. How then to buy out a share of an apartment with a mortgage? Sberbank is also involved in equity lending, albeit not very willingly.

But the following conditions must be met:

- after purchasing a share using a mortgage, the property must be transferred to the borrower;

- or the remaining part of the apartment is assigned to the ownership of the spouse of the borrower or borrower.

It is almost impossible to get a mortgage to purchase a share in an apartment if the potential borrower wants to buy a share of living space to which he previously had no rights. Or a potential borrower wants to buy a share in an apartment where he already owns some part, but after the transaction the object will not become his full property.

It’s difficult to say with 100% certainty whether banks will give a mortgage for a share in an apartment, but if you can’t wait to buy your own corner, you can also take out a consumer loan or borrow money.

It will also not be possible to officially sell the share to an outsider, since the co-owners have the first right of redemption.

And if the seller has a bad relationship with them, it will be very difficult to get a written refusal from them.

If you own other real estate, you should consider the option of registering it as collateral . After the mortgage agreement is registered, the borrower will receive money, which he will spend on settlements with the seller to purchase a share in the apartment.

You can look for a bank with lower interest rates if you can document the intended use of the funds. After the loan is received and the purchase and sale agreement is signed, it is enough to present a copy of the agreement to the bank.

Video: Mortgage loan for a room and share of an apartment

How to sell a share in a mortgaged apartment

When co-borrowers take out a joint mortgage, they rarely think about how to share housing in the event of separation.

Content

If, nevertheless, a divorce (or separation) occurs, and the loan to the bank is not repaid, the question arises: how to sell the share in the mortgaged apartment. It’s already difficult to find a buyer for such an object, and then you still have to negotiate with the co-borrower and the bank. This procedure has a number of features that the future seller should know about in advance.

Share in a mortgaged apartment: legal nuances

The very concept of “part of mortgage real estate” can have different meanings:

- a dedicated room in a communal apartment with a separate personal account. You can get a home loan to purchase a dedicated room, although this is associated with a number of difficulties. For St. Petersburg and the Leningrad region, the purchase and sale of allocated shares in a communal apartment using a mortgage is a common occurrence. The buyer of a room in a communal apartment, if desired, can receive a minimum interest on the mortgage and become the owner of the allocated part of the housing. It is especially easy to get a mortgage to buy out the last room in a communal apartment;

- unallocated share in real estate purchased with a mortgage jointly with a co-borrower. It is more difficult to find a buyer for such an object, because the documents do not indicate which part of the property the ownership of the share owner is assigned to. Personal accounts of co-owners, as a rule, are not separated. To attract a buyer, you can allocate a share. To do this, you will have to go to court together with the co-borrower;

- the property is pledged under a mortgage, the share being sold is not mortgaged. In this case, the seller will still have to obtain permission from the bank for the transaction. Although there are no direct debt obligations, the encumbrance gives the bank the right to control any actions with the collateral housing.

How to transfer your debt to the new share owner

The borrower has no right to carry out any actions with the collateral real estate belonging to him without the consent of the bank. Therefore, if you are planning to sell a share in a mortgaged apartment, contact your lender first.

If all formalities are met, the bank may allow the transfer of debt from the debtor to another person. If the borrower has found a buyer for his share, and the buyer wants to take out a mortgage, a change of debtor will occur.

For example, citizen Ivanov is the owner of a room in a communal apartment and pays a loan for it. One day Ivanov lost his job and decided to sell his room to citizen Petrov. Petrov has small savings, but these funds are not enough to buy a room.

Therefore, Petrov applies for a mortgage to the bank where citizen Ivanov once took out a loan. If the bank recognizes Petrov as a suitable and reliable borrower, Ivanov can count on approval of a change of debtor on the loan.

It is unlikely that Ivanov will benefit from this deal, but he will definitely pay off his bank debts.

Typically, a bank issues a mortgage for a room in a communal apartment or an unallocated share only when the entire apartment is pledged to the bank for the repayment period of the mortgage.

This is why few banks provide loans for the purchase of rooms in communal apartments.

And few borrowers agree to such conditions: it is necessary to negotiate with the neighbors so that they agree to the collateral encumbrance of the entire apartment.

For a borrower who is forced to solve financial problems using this method, the sale of part of the mortgaged housing will most likely bring losses. It is difficult to find a buyer for part of a residential property with a bank encumbrance; you will have to make a significant discount. The discount can be up to 20% of the market value of the property.

If the marriage breaks down and the mortgage is not paid

A typical situation is that shares in mortgaged real estate are allocated to each family member. The marriage has broken up, the former spouses do not want to live together. One of them, for example the husband, wants to sell his share, which is under a bank encumbrance. What to do in such a situation?

There are several options for the development of events

- husband and wife are co-borrowers, the wife is against the husband selling his share. My husband moves out and doesn't pay the mortgage. The wife has to bear financial responsibility for her husband's debt;

- the wife has a priority right to purchase a share in the apartment in accordance with Russian law. If she has the means or the opportunity to take out a loan to add to the existing mortgage, she can buy out her husband’s property;

- the wife gives her husband notarized consent to sell the share in the mortgaged apartment. Next, the borrower must find a buyer for his share and repay the debt to the bank.

If the interests of minors are involved in the sale of part of the residential premises, the number of legal difficulties during the transaction will increase sharply.

If the child is registered in a living space and the parents did not use maternity capital to buy housing, you can try to bypass communication with the guardianship authorities. It is enough to issue a permanent registration for the child at a different address and then decide on the issue of selling the share between the adult owners.

If a minor child is the owner of a mortgaged home, the share of which one of the co-borrowers plans to sell, in addition to the bank, the guardianship authorities will control the transaction.

What to do in a difficult mortgage situation

Selling a share in mortgaged real estate involves many legal difficulties. You will have to spend time, money and nerves to implement your plans. If you want to avoid loss of nerves and paperwork, contact the Mortgage company. We will solve your mortgage problem with maximum benefit for you.

How to sell a mortgaged apartment, is it possible to sell a mortgaged apartment, share

The statement that to sell an apartment purchased with a mortgage is a common myth. Making such a deal may not be easy, but it is quite possible. But to successfully complete the procedure, it is important to know how to sell a mortgaged apartment correctly.

Is it possible to solve the problem of how to sell a mortgaged apartment?

If there is a desire and opportunity, the mortgage debt to the bank is repaid, after which the apartment ceases to have encumbrances and the owner can dispose of it at his own discretion. However, this option is not always feasible. As a rule, questions arise when selling an apartment with loan debt.

The process of selling a home taken on a mortgage is complicated by the fact that not only the seller and the buyer take part in the transaction, but also a third party - the banking institution that issued the mortgage.

The last participant in the transaction cannot be ignored, since it is he who formally has the right to dispose of the apartment until the loan is repaid and it acts as collateral.

Thus, a positive answer to the question of whether it is possible to sell a mortgaged apartment should be obtained from a banking institution.

Features of the transaction under which an apartment is sold on a mortgage

The main rule that an owner who is interested in how to sell a mortgaged apartment and buy another should remember is to notify the banking institution.

Regardless of who issued the mortgage loan - VTB, Sberbank or any other loan - he must be notified of the seller’s intentions before the transaction. This clause is specified in any mortgage loan agreement.

If this rule is ignored, the bank has the authority to prohibit the execution of the relevant transaction.

An application for early repayment of a mortgage loan must indicate the basis on which the apartment is planned to be put up for sale. For the bank, early settlement means loss of income in the form of interest payments on the loan, so it will require a detailed explanation.

- After full repayment of the loan, it is recommended to obtain a certificate from the bank confirming full payment of the debt, as well as a marked mortgage on the apartment.

- All family members, including children under age, must first be discharged.

- If the borrower stops making payments for the apartment on time, the bank has the right to go to court and force it to be put up for sale at auction to recover its costs.

To sell an apartment purchased with a military mortgage, the main rule remains the need to first remove the encumbrance from it. Until this moment, it is pledged property both from the bank and from the Ministry of Defense of the Russian Federation.

If the apartment was purchased using maternity capital, its sale will require, among other things, obtaining permission from the guardianship and guardianship authorities.

Ways to sell a mortgaged apartment

There are three main ways to sell an apartment with a mortgage.

- Sell mortgaged housing with debt for cash, which will be used for early repayment of the loan. In practice, it works like this: you need to find a buyer who will agree to pay in advance the amount of the seller's outstanding mortgage loan. At the same time, to insure risks (primarily the buyer), it is recommended to conclude a special deposit agreement. This money is transferred to the bank, the loan is considered fully repaid. Next, you need to make sure that the bank removes the mark on the encumbrance from the housing to the authorized bodies. The apartment owner visits the specified institution, accompanied by a bank representative, to submit an application with an attached package of required documents. After the apartment ceases to be collateral, an agreement for its sale can be drawn up. The buyer pays the rest of the money immediately before the transaction.

- Sale of an apartment to a buyer on the terms of re-registration of the mortgage. As you know, you can attract bank financing when purchasing housing on both the primary and secondary markets. If a citizen planning to take out a mortgage is considered as the buyer of an apartment, first of all it is necessary to find out how much of his own funds he has. It should be enough to pay off the seller’s debt to the bank. In this case, the size of the approved loan should be enough to pay the remaining part of the cost of the apartment. In this case, the procedure until the encumbrance is removed from the apartment is similar to that discussed in the previous paragraph. After this, the parties to the transaction contact the bank to re-register documents. You must have a complete package of documents with you. Next, the purchase and sale agreement is concluded and registered. If everything goes well, after the transaction is completed, the remaining amount for the apartment is transferred to the seller by the bank where a new mortgage is issued.

- Selling through a bank. In this case, the bank is engaged in searching for a buyer and preparing the relevant documentation upon request. You can find out how banks sell mortgaged apartments on their official websites. Please note that under this condition, the bank is not interested in the most advantageous offer; the main thing for it is the return of its own funds. It is not a fact that in such a transaction the seller will get anything.

Bankiros.ru team

800 views Subscribe to Bankiros.ru

Previous article

Requirements for a mortgage borrower

Next article

Mortgage loan for maternity capital

Mortgage loan for the share of an apartment: shared mortgage and its nuances

Welcome! The topic of our meeting today is shared mortgage, namely a mortgage loan for the share of an apartment. Buying and selling shared property has always been difficult both for citizens of our country and for financial organizations.

But due to financial problems, purchasing part of the housing remains the only chance to get your own roof over your head. Sometimes even the cost of individual square meters is beyond our means and we have to turn to banks for help.

So, let's figure out how relevant is a mortgage for a share in an apartment or house, and how much will you have to pay for using this type of loan?

Types of shared ownership

Before you consider shared mortgage lending, you need to understand the types of fractional ownership. The essence of this issue is that financial institutions will not be able to provide financing for the purchase of housing if it does not meet certain requirements.

According to current legislation, there are two types of shared property:

- On the basis of common property. In this case, all home owners have equal authority to use their shares, and their sizes are determined not by a specific part, but by the square meters that belong to them.

- Share as private property. A striking example of such shared property is a communal apartment, where each individual has a separate room, and only he and no one else can fully use it. That is, a person is the actual owner of a particular plot.

Important! Each unit of private property, be it a share or the entire residential premises as a whole, is registered with Rosreestr. In other cases, shared ownership is considered common.

Based on the types of shared property described, the procedure for purchasing a share is complicated by the presence of several homeowners who may not agree that a complete stranger may become part of their home, not to mention legal restrictions due to which obtaining a mortgage may be impossible.

Features of obtaining a shared mortgage

We have already dealt with the types of partial ownership of property, but a shared mortgage can only be issued in certain cases. Banks operating in our country offer their clients various lending programs, but none of them is a ready-made solution for the borrower, since each case is considered separately.

There are three most common situations in which people turn to a bank to apply for a share in a mortgage:

- The borrower already owns several shares and only needs one part to fully own the property.

- The borrower owns only one of the shares, but wants to expand his living space by purchasing another one.

- A bank client wants to purchase a share in an apartment without being the owner of other parts.

The procedure for obtaining a mortgage implies the presence of collateral, which in fact is the property being purchased. At the same time, not a share, but an entire apartment will be placed at the disposal of the financial institution, so the most likely approval of financial mortgage assistance will be in the first case, when the borrower lacks only one share to fully purchase a home.

The second situation is a little more complicated, but if each of the owners gives their written consent to the terms of the pledge, the chances of obtaining a mortgage increase. The disadvantages include high interest rates, since the cost of a full-fledged home on the market is much higher, and it is much easier to sell it than just a part.

In the third case, you will most likely be refused, but if you are on good terms with the owners of the property, you can get around the restrictions by dividing the shares. You will have to spend a little money on the paperwork procedure, and then go to the bank with confirmation of the purchased share. But even in this case, the chances are quite small, so it’s not worth the risk.

Important! There are restrictions in the law regarding the minimum number of square meters that are required for one person to live. At the same time, part of the housing for general purposes (kitchen, toilet, corridor, storage rooms and other non-residential areas) cannot act as shared ownership; therefore, when dividing into parts, their square footage is not taken into account.

Conditions of TOP-5 banks

The situation on the market regarding shared mortgages is quite sad, since it is not profitable for banks to work with inferior property, even if the entire apartment is left as collateral. Getting a mortgage for part of an apartment is possible in only a few financial institutions:

- Sberbank offers the opportunity to purchase residential real estate on general mortgage lending terms. The minimum amount is 300 thousand rubles, and the repayment period is up to 30 years. At the same time, Sberbank boasts a small minimum annual rate, which is only 11%. You shouldn’t count on the minimum, but this is precisely an indicator of stability. Sberabank also provides loans to pensioners and takes into account additional payments. Income without documents.

- Gazprombank also has a mortgage for the purchase of a share in an apartment, but this program only applies to the purchase of the last share in an apartment or room. Rate from 11%. PV from 15%. If there is maternity capital, then the PV is 5%. There are discounts for employees of gas industry enterprises, major bank partners, salary employees and public sector employees. Duration up to 30 years. Amount from 500 thousand rubles. up to 45 million

- Tinkoff Bank. The advantage of this organization is the possibility of obtaining a mortgage for a separate share, which can be called exclusive on the domestic market. The interest rate is 13.35% (minimum) and the minimum payment is 25% of the home. The mortgage will be issued not by the bank itself, but by partner banks. There are some difficulties with collecting and transmitting documents. Tinkoff Bank acts as a mortgage broker.

- Otkritie Financial Corporation. The largest private bank provides the opportunity to purchase shares of an apartment (the last one) with a mortgage, on the terms of a 12% annual rate and 20% of the down payment (if there is a 2NDFL certificate, otherwise only 30%). The bank is quite picky about its clients.

- Deltacredit is one of the most flexible mortgage banks. It allows you to buy not only the latter, but also just a share in the apartment. The rate is quite attractive from 10.75%, but they ask to pay a commission of up to 4% of the loan amount so that it is minimal. The down payment also affects the rate. It can be from 15%, but the maximum discount will be if there is 50%. Mortgage term up to 25 years.

The procedure for obtaining a mortgage for a share

First of all, you need to get the bank's decision. To do this, you must provide a standard package of documents for the borrower and co-borrowers/guarantors (if required):

- Passports

- SNILS

- Marriage and birth certificates (if applicable)

- Certificate of income

- Copy of work

The bank reviews the application within 2 to 5 working days. When the decision is received, you need to collect a certain package of documents regarding the share in the apartment.

Applying for a mortgage on a share in an apartment for each of the cases described in the first part of the article has its own characteristics, but the procedure itself looks something like this:

- The borrower collects a package of documents necessary to provide mortgage funds (seller’s passport, extract from Rosreestr on registration of the purchased property).

- The co-owners waive in writing the priority right to purchase the share (if the part of the apartment is the last, consent is not required).

- The bank collects information that the co-owners are not relatives of the borrower, and the latter provides documents indicating that the housing meets all standards.

- The seller provides the financial institution with a certificate of ownership and a contract for receipt, an extract from the house register, confirmation of the fact of notification of other co-owners, if any, as well as the permission of the spouse (if any).

- Next, the financial institution considers the possibility of providing mortgage funds, and if all conditions are met, an agreement is drawn up with the borrower.

It is quite difficult to describe the sequence of the procedure, since the submission of various documents is carried out at different stages. In addition, some co-owners may be located outside the country.

Alternative purchasing options

If the bank refuses to issue a mortgage for the share, you can take a few tricky steps by applying for a consumer loan. In this case, the interest rate will be much higher, and the sale procedure is carried out under a gift agreement. This approach is often practiced, since no one wants to provide their home as collateral so that someone can buy just a part of it.

You can also consider a similar option, but a mortgage is taken out against existing real estate.

The modern banking system provides for the possibility of purchasing housing on mortgage terms. Such long-term loans have low interest rates and fairly favorable terms. But financial organizations are reluctant to work with incomplete property, namely shares, since there are many nuances that must be observed.

With almost one hundred percent probability, banks will provide mortgage funds if you want to buy out the last share, but if you just want to get your own corner, you will most likely have to take out a consumer loan or borrow money.

Of course, when purchasing, you can cheat by signing a donation agreement for a separate part, but this procedure is also associated with some difficulties. It will also not be possible to officially sell a share to a stranger, since the co-owners have the first right of redemption, and if the seller has a negative relationship with them, it will be almost impossible to obtain a written refusal.

If you have difficulties registering a share in an apartment and you need competent legal assistance, then simply ask our free online lawyer a question in a special form in the corner of the screen.

As always, we welcome your questions below. If the article helped you, please rate it and click on your favorite social network button. And, be sure to subscribe to project updates.