It is possible to both buy and sell an apartment in a building that falls under the renovation program. However, the question arises about the benefits that can be obtained from this investment. A detailed analysis of the pros and cons, possible risks when performing an operation - all this is discussed in the material.

We advise you to familiarize yourself with the basic rules when purchasing an apartment without the participation of a realtor - find out more.

Buying an apartment in a building for renovation: 5 buyer risks

The program involves providing owners of apartments in 5-story buildings (“Khrushchev” buildings) with premises of no less area in new buildings.

Both a direct exchange and a purchase and sale transaction are possible (the owner receives compensation for his old apartment and then decides for himself where to move). If the area of the new object turns out to be larger, you will have to pay extra for each square meter of the difference.

In addition, it is possible for certain categories to be subsidized by the state or the Moscow Government (young families, low-income citizens).

Read about how to find out about the date of the planned demolition of a house without leaving your home.

It is obvious that housing in a new building almost always costs significantly more than in secondary housing (assuming equal areas).

That is why the cost of emergency Khrushchev buildings has increased significantly over the past year (1.5-2 times in different areas).

However, benefits from buying an old apartment cannot be obtained in all cases . Here are the 5 most obvious risks for the buyer:

- The main issue relates to ensuring that the program will actually be implemented.

- The question also arises about the real cost of a new building - will it be more than the price of a Khrushchev-era building (or at least the same). That is, is the cost of an object in a house for renovation justified?

- Will the resettlement take place on time or is there a risk of delays?

- In old housing located in a dilapidated building, there is no point in making major repairs (compensation for relocation is not provided). This means that the new owner and his family will have to live in the conditions that actually exist (or make repairs, investing money without the possibility of returning them).

- Legal purity of the object: no encumbrance (pledge, arrest, claims from third parties).

Mortgage loans are not available for the purchase of such housing - the buyer will have to rely only on his own strength.

Thus, all risks can be reduced to 2 significant threats:

- Danger of overpaying.

- There is a danger of not getting housing in a new building or getting it with a significant delay.

To make the right decision, you need to familiarize yourself in advance with the terms of the renovation program for a particular house - how to do this is described below.

We talked in more detail about the rules and procedure for relocating emergency housing here.

How to avoid risks when buying an apartment: a complete list of new buildings

To do this, you should very carefully read the documents that the owner currently has, as well as official materials from open sources (on the website of the Moscow Mayor).

The sequence of actions is as follows. First of all, you should find out whether this house really falls under the renovation program. To do this, they check whether the owner has:

- the original notice of demolition and upcoming resettlement (the document is sent from the mayor's office no later than a year before the proposed resettlement), handed over personally to the owner of the apartment in the old building against signature;

- a written agreement from the owner to provide new housing or monetary compensation.

Additionally, you should check on the Moscow Mayor’s website whether the house is actually included in the renovation program. On the map, such objects are indicated in blue, and the corresponding starting sites (i.e., new buildings that are supposed to be built for resettlement) are indicated in orange.

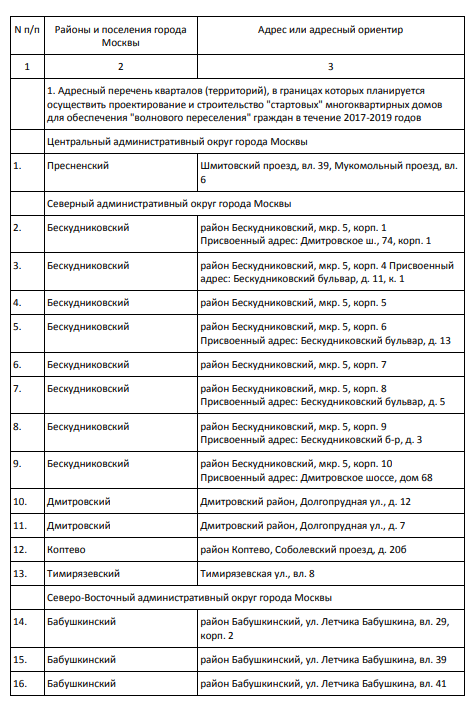

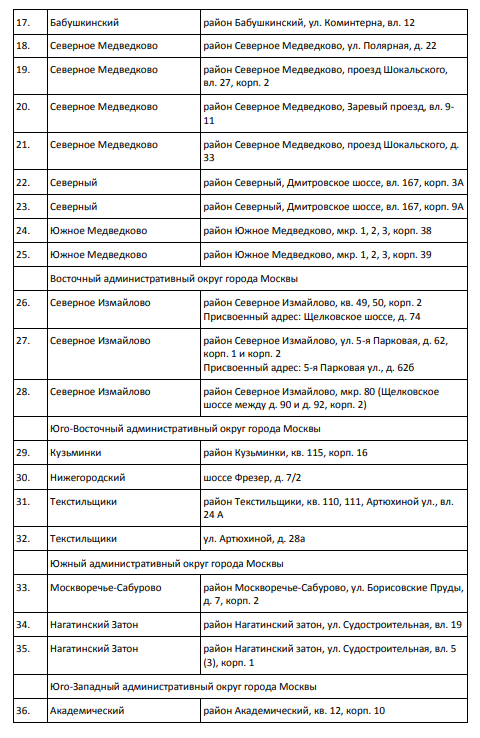

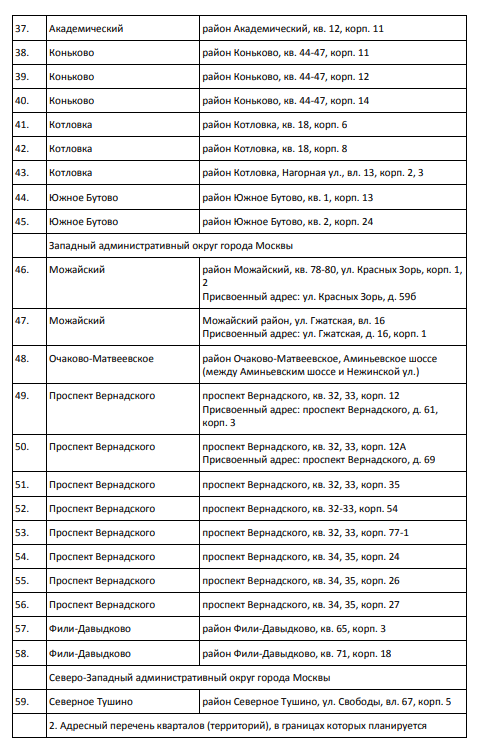

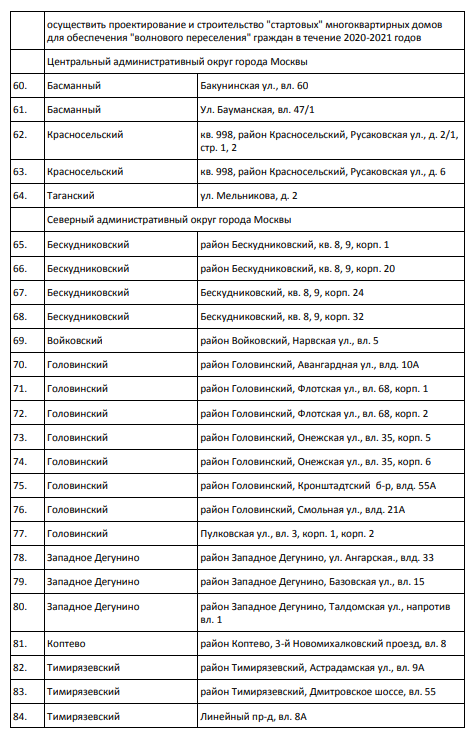

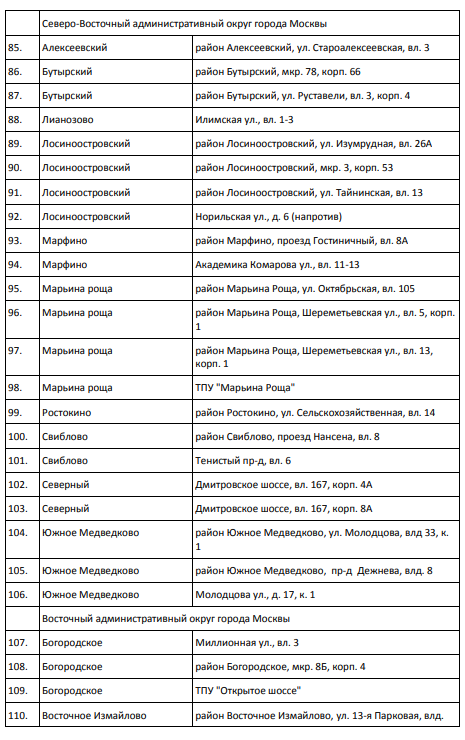

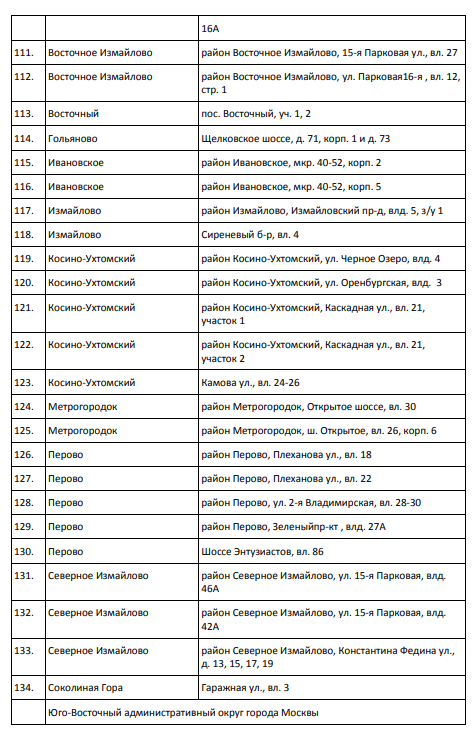

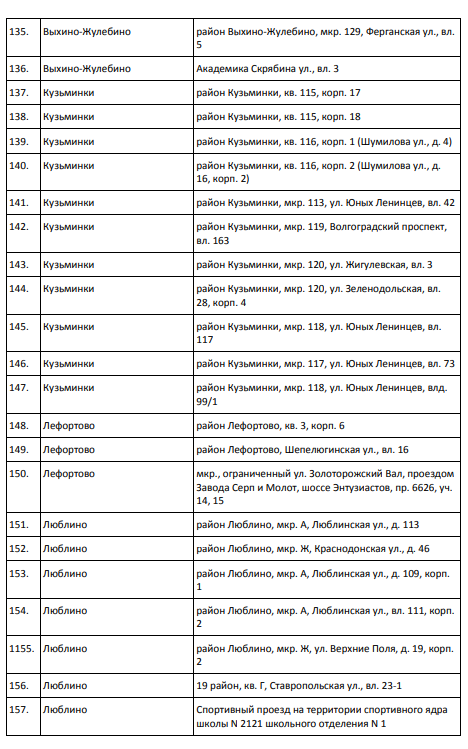

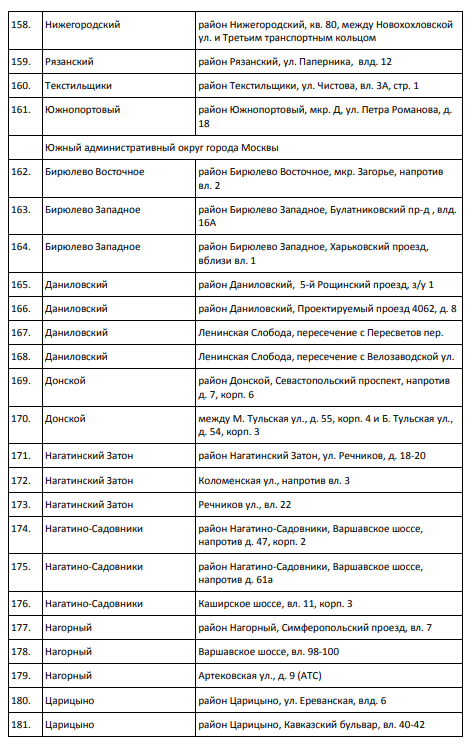

A complete list of launch sites is also provided on the website of the Moscow Mayor - below is the current, complete list:

- To get an idea of the requirements for the characteristics and location of new houses, you should read the original text of the document “Renovation Program”.

- Thus, the buyer can significantly reduce his risks if:

- He will know exactly the location of the new house and the timing of demolition.

- Will be able to correlate the market value of a new property with the price of a Khrushchev-era building in a dilapidated building.

If any of these points raise questions, it is difficult to guarantee a profitable investment when buying an apartment in a building under renovation.

Selling an apartment in a building for renovation: the seller’s risk

Such an operation is also possible, and the seller, unlike the buyer, bears significantly less risk.

In fact, the decision to sell an apartment in a building for renovation has only one drawback: the owner is deprived of the opportunity to get an apartment in a new building.

Therefore, it is possible to sell your apartment profitably if you raise the price for it to such a size that you can independently rent an apartment in a new building in a suitable area.

In addition, in some cases, the timing of resettlement may be changed or the house may be excluded from the program altogether. Thus, if there is no confidence in obtaining a new exchange option, but at the same time the demand for such apartments is quite high, it is preferable for the owner to sell his property at a favorable price .

Features of the purchase and sale transaction

Such a transaction has no fundamental differences and involves performing the same procedures as for a regular purchase and sale:

- Coordination of positions, signing of a preliminary purchase and sale agreement, making an advance payment (with signing the corresponding agreement).

- Collection of all necessary documents (passports of owners, documents for the apartment; if necessary, you will also need a notarized consent of the spouse for the sale or permission from the guardianship authorities to move minors).

- Signing the main agreement (it is not necessary to register with a notary, although it is advisable), submitting documents for registration to the Rosreestr branch or to the MFC. How to carry out a purchase and sale transaction through the MFC is described in detail here.

- Payment of state duty (1500-2000 rubles), receipt of documents for new property (after 5-10 working days).

However, there are also some nuances associated with the fact that the object is located in a dilapidated building:

- If the owner (full or shared) of the previous apartment is a minor, the guardianship authorities may not give their consent to move to emergency housing.

- After the transaction is completed, local authorities may not allow the owner and his family to register in the house for renovation. However, this action is illegal and can be appealed in court. Litigation can last a relatively long time (several months).

Thus, the option of buying an apartment is mainly fraught with risks, since the prices for such apartments in most cases are seriously inflated. In addition, it is unlikely that the owner of a Khrushchev building will miss his profit if it really exists. Therefore, without guarantees of resettlement and accurate calculations, making a decision is risky.

Share link:

Loading…

Is it worth buying an apartment for renovation?

Many people know that the Federal Law “On Renovation” came into force in July 2017, according to which residents of dilapidated buildings are being resettled in new modern multi-storey housing . The program is already being implemented quite successfully, which is why many people have a very reasonable question: is it worth purchasing an apartment for renovation? This type of transaction is not prohibited by law, but before deciding on it, you should carefully weigh all the pros and cons.

Briefly about the renovation program

The main feature of the renovation program is the fact that citizens are relocated to new multi-storey buildings located in the same areas in which they lived in their old apartment.

This condition is met only if there is an actual possibility of construction in the same area. If this is not possible, the program participant will be offered options in neighboring areas .

Purchasing an apartment for renovation is a great opportunity to improve your living conditions and get a beautiful and spacious apartment.

A pleasant bonus is the fact that new neighborhoods are characterized by well-equipped local areas and improved infrastructure.

Usually within walking distance there is everything you need for a comfortable stay: kindergartens, schools, shops, public transport stops and much more.

Advantages of buying an apartment for renovation

You can find a number of advantages of purchasing an apartment in Moscow in housing intended for demolition:

- Financial benefit . The cost per square meter of housing in a dilapidated house is slightly lower than in a new house. For example: having bought a one-room apartment for demolition for 5,000,000 rubles and received for it a similar “one-room apartment” in a new building, you can save about 3,000,000 rubles. After all, the cost of such real estate will not be lower than 8,000,000 rubles.

- Improving living conditions . If a large number of people lived in the old apartment to be demolished, and the number of square meters per capita was insufficient, upon relocation the issue will be resolved - the square footage of the new apartment will be proportionately larger. This scheme is regulated by clause 3 of Art. 20 of Moscow Law No. 29 of June 14, 2006. According to the designated regulatory act, there should be 18 square meters of living space per resident.

- Increase in non-residential area . The rise in price of an apartment in a new building will also be associated with an increase in the square footage of non-residential space. We are talking about the corridor, bathrooms, balconies. Thus, if the buyer in the foreseeable future wants to sell an apartment in a new building, he will be able to get much more from the transaction than he initially invested.

- High-quality repairs and finishing . According to the capital authorities, the renovation program involves moving into apartments that are already ready for living. This means that the new housing will not need to be renovated or otherwise improved.

Disadvantages of buying an apartment for renovation

Purchasing real estate for demolition under a renovation program has not only the listed advantages. There are also some disadvantages (even risks) that cannot be ignored.

- Buying an apartment in a building for renovation will be convenient only if there is some other housing available in which you can live until relocation is possible .

- If expensive repairs have been made to your old home, they will not be compensated .

- The renovation program may be revised . And the changes made to it may well entail the exclusion of residents of the house for demolition from the queue. This risk is aggravated by the fact that an exact list of reasons why it is permissible to postpone the implementation of a program for a specific housing has not been established.

- If encumbrances , they may become an obstacle to participation in the renovation program.

- The owner must be registered in the apartment for a certain period of time before he can participate in the program.

- If the new apartment turns out to be larger than the standard, you will have to pay extra .

Conclusions and recommendations

Since purchasing real estate under a new promising renovation program is a fairly profitable way of investing and an excellent opportunity to improve your living conditions, it may be worth taking a risk and purchasing housing in a dilapidated five-story building.

But you should act with caution and carefully check all documents provided by the owner for their authenticity. First of all, it is necessary to find out the real number of registered residents in order to completely eliminate the unpleasant possibility of claims on the property after the fact of its transfer into ownership.

The efficiency of heating, the condition of communications, electrical wiring and plumbing are also subject to inspection. You should also pay attention to the humidity level in the old house and make sure there is no mold.

Moving to a new home after purchase may take a long time, and even if you do not plan to live in the demolished house, the apartment can easily be rented out on favorable terms.

And for this, it must be, at a minimum, in a condition suitable for living and with working amenities.

You should always remember that buying an apartment for renovation is a certain risk . But those who don’t take risks don’t drink champagne, as popular wisdom says.

Is it worth buying an apartment in a five-story building for renovation in Moscow?

A few decades ago, housing in older buildings was the most unattractive on the real estate market. Residential premises in such conditions were purchased only by those who did not have the funds for good housing. Over time, the situation has changed significantly.

Nowadays, apartments in buildings that are being demolished are very popular. Their acquisition is associated with obtaining a number of benefits that future residents cannot refuse. Let's try to figure out why people want to buy an apartment in a building for renovation.

Page content

What is “renovation”

Recently, the term “renovation” has been gaining popularity. The renovation program is a program for resettling citizens from dilapidated low-rise housing. Old residential premises from which residents are being relocated are subject to reconstruction or demolition. The entire program is aimed at improving the living conditions of citizens and changing the appearance of cities seeking to modernize.

Pros of purchasing

All benefits are associated with possible inclusion in the renovation program in Moscow, that is, relocation from dilapidated housing to new premises suitable for living. Experts highlight the following advantages of buying housing in old five-story Khrushchev buildings:

- Opportunity to save money. The cost of a Khrushchev-era house to be demolished is lower than the cost of a new, newly renovated home. This means that by purchasing residential space in an old house and falling under the renovation program, the buyer will be able to significantly save money and remain in the black because he will be moved to new housing, which costs much more. The amount of investment in this case will be significantly less than the actual cost of the new apartment into which the citizen can be moved.

- Opportunity to get a spacious apartment in the future. Owners of cramped rooms in dilapidated housing are being relocated to new, spacious living quarters. Thus, buying housing in old Khrushchev-era buildings makes it possible not only to save money, but also to get spacious housing without major investments.

- Opportunity to get an apartment with full finishing. In most cases, housing in new buildings is rented without finishing. This means that after purchasing a new home, a citizen will still have to spend a large amount on repairs. As statistics show, it costs approximately 1 million rubles to renovate such a one-room apartment in the capital. But relocation under the renovation program should take place in residential premises with full finishing.

- Possibility of relocation to a comfortable area. The renovation program is associated with the construction of social facilities next to the new houses. These include schools, kindergartens, hospitals, clinics, sports grounds, etc. It is also planned to improve parks, pedestrian zones, and recreation areas. All this means that when moving from Khrushchev, a citizen will not only become the owner of new square meters, but will also gain access to new socially significant objects.

Important! Relocation takes place to equivalent living quarters. However, if desired, a citizen can pay a certain amount and improve their living conditions by “purchasing” additional square meters in the house.

We must not forget that any transaction has its risks. Buying an apartment in a building for renovation in Moscow also has similar risks. Let's consider the main ones:

- Lack of clearly defined resettlement rules. A citizen buying a residential property cannot know exactly where he will be moved. Relocation can occur both in quiet and peaceful areas, and in areas located next to an industrial zone, which will not be a very pleasant surprise for the resettled citizen. It is also possible to move to the outskirts of the city, where new houses are being built. In this case, those residents who want to move to specific areas are at greatest risk. In this case, it will not be possible to insure against an unpleasant change of location.

- Loss of funds. Despite the advantages that were discussed earlier, the buyer may still lose some of his money. There is a possibility of “losing in price” in cases where the purchased Khrushchev house is located in a more liquid area than the new housing provided under the renovation program. However, this does not happen so often, so the likelihood of making a mistake is minimal. Even if it turns out that the cost per square meter in a new apartment is less than in a purchased Khrushchev apartment, the losses will be insignificant.

- Relocation deadlines. All residents of houses included in the renovation program must be resettled, but it will not be possible to immediately resettle all citizens from old housing. This means that someone will move to a new apartment earlier, and someone later. A person purchasing a Khrushchev apartment cannot know exactly when their house will be occupied. Relocation can take several years or even a whole decade (especially in the capital). Therefore, when purchasing such an apartment, you need to clearly know the timing of relocation. Otherwise, the acquirer may find himself in a disadvantageous situation.

- Possibility of refusing the renovation program. A large amount of state and municipal funds are allocated for the renovation program. Due to the unstable economic situation, some of the funds may be needed for other needs of the city or state, so the renovation may be partially cancelled. It is important to remember that no one is immune from falling into such a situation.

Cost of an apartment in a building to be demolished

If previously apartments in old five-story buildings were an option for unattractive housing, now the demand for it has increased. This has significantly affected the price of such apartments, because the owners of such residential premises are trying to make a good deal and “stay in the black.”

This article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem, contact our consultant absolutely FREE!

Now the real estate market has established the following price order in Moscow Khrushchev apartments.

| Number of rooms | 1 | 2 | 3 |

| Average cost (million rubles) | 3,1 – 4,5 | 6,25 — 7,5 | 9,3 – 14,5 |

| Area (in m²) | 29 — 33 | 46 — 48 | 61 — 79 |

Important! The final price depends on the condition of the house, as well as its distance from the city center and transport links: the further from the main streets, the cheaper.

Many citizens who dream of improving their living conditions are concerned not only with the issue of purchasing, but also with the possibility of obtaining a mortgage for housing built under the housing stock renewal program.

As practice shows, most banks are reluctant to issue a mortgage loan for old residential premises in houses with a high degree of wear and tear.

If the borrower does not fulfill his obligations under the mortgage, the bank may have problems with the sale of the pledged property.

Lending institutions do not want to take risks, so most often they refuse to issue citizens mortgages for real estate in old residential complexes.

Despite all the risks, the bank can give a mortgage for a Khrushchev building. This is due to the fact that citizens evicted from Khrushchev are provided with other new property.

If the tenant has been moved to an equivalent residential premises, then he will not have any problems with the bank. The terms of the mortgage when a citizen moves from an old Khrushchev building to a new apartment provided by the state should not change.

Many banks are even willing to provide a mortgage for residential premises in a house to be demolished on preferential terms.

Will there be renovation in Russian regions?

All questions that arise regarding a mortgage taken out for such housing can be answered in the laws “On Renovation” and “On Mortgage”.

These documents state that the inclusion of a mortgaged property in the program for renovation and renewal of the housing stock will not affect changes in agreements between the bank and the borrower.

This means that the concluded agreement does not need to be renegotiated, because all existing agreements under it will remain the same as they were. Only the subject of collateral will be subject to change: if previously the subject of collateral was property in the Khrushchev-era building, then after relocation it will become an apartment in a new building.

Purchasing an apartment in a renovated building

Many city residents are interested in the question of whether it is possible to purchase an apartment in a building built under the housing renovation program.

The purchase of such real estate is possible only after completion of construction and the first wave of resettlement. This means that until the citizens standing in line are resettled, the sale of apartments in such buildings will not begin.

Only “extra” residential premises that are not needed by resettled citizens are put up for sale.

This will happen only at the late stage of settlement of residential complexes built for renovation, that is, 2-3 years after the resettlement of all resettlers.

There is information that you will have to pay about 6.5 million rubles for a one-room apartment in the capital. The price of a three-room apartment will be approximately 12.5 million rubles. It is impossible to name the exact amount, since the final cost will depend on the area and layout of the living space.

Still have questions? Ask them to our lawyer for FREE!

Risks of buying an apartment in a building for renovation

The renovation program started in Moscow in 2017 . In the near future, it may spread to other large cities, including St. Petersburg, Rostov, Krasnodar, Ufa, and Kazan.

The essence of the program is that owners of apartments in buildings that are planned to be demolished receive compensation or housing in new buildings. Some investors consider the purchase of housing subject to renovation as a profitable investment. But, as with any program, there are significant risks for the buyer.

What to fear?

First of all, the buyer risks losing a significant amount of time, which will be spent on relocating residents. The following factors contribute to this:

- constant adjustments and changes in urban planning plans;

- changing timing of house demolition;

- bureaucratic features of paperwork.

An investor planning to make money on a profitable deal needs to remember that the real profit from the sale of housing in a new building may not cover all the costs incurred by that time. In particular, repair costs during relocation are not compensated.

When purchasing real estate for personal purposes, for example, for the future settlement of a family, be sure to consider the following. The apartment received to replace the old one may be in an inconvenient area. In a metropolis, this moment is sometimes decisive. Although officials verbally guarantee the provision of housing in the same area, such guarantees have not yet been enshrined in any regulatory act.

Finally, the buyer’s most significant risk is being left without housing and without money. The likelihood of such an outcome is minimal, but remember that at present there is no mechanism to protect existing owners and potential buyers of such housing.

It does not matter how long the current owner has owned the apartment. In any case, he receives the right to receive new housing under the renovation program.

Transaction procedure

- The parties negotiate the terms, reach an agreement on the price, the procedure for its transfer and payment.

- A purchase and sale agreement is drawn up and signed.

- The property is transferred under a transfer document.

- The transfer of ownership is registered in Rosreestr.

- The object is fully paid for.

Payment is mentioned as the last point, but depending on the agreement reached, payment can be made both before and after the transfer, as well as in installments or in installments.

Remember that the purchase and sale agreement must be concluded during the period from the moment the house is included in the program until the conclusion of the exchange agreement (or agreement on payment of compensation) with the municipality. After the exchange (compensation) is completed, the owner can no longer sell his apartment to a third party.

After the apartment is transferred to the buyer, and the house to be demolished waits its turn to be moved in, the new owner will sign an exchange agreement or an agreement on payment of compensation.

Payment

You can pay for an apartment purchased in a building for renovation in different ways:

- in cash, for which the seller issues a receipt to the buyer;

- cashless transfer to the seller's account;

- using a letter of credit or escrow account;

- through a notary deposit.

You can also pay with credit:

- a loan secured by existing real estate;

- consumer loan funds without collateral, if a small part of the amount is missing;

- some banks are even willing to provide a mortgage for such housing. The terms of the mortgage loan must be clarified with a specific bank.

It’s definitely not possible to pay using maternity capital and a state housing certificate.

How to avoid losses?

The seller of the apartment is not responsible for the risks that the renovation program itself poses. Therefore, it will be impossible to involve him in the event that the resettlement is delayed, much less demand compensation for losses from him.

Before purchasing such a home, make sure that the home is actually included in the program. Only those five-story buildings that made the corresponding decision voluntarily at a general meeting are included in the renovation. You can check whether the property is on the list on the Moscow Mayor’s website.

Also check that the seller has not yet signed an agreement for compensation or an exchange agreement. Ask your local municipality representative for the most up-to-date information.

In addition, you need to carry out a standard home inspection as when purchasing other real estate:

- check the apartment for encumbrances and arrests using an extract from the Unified State Register of Real Estate;

- ask the seller for a current certificate of registered persons, make sure that there are no minors among them;

- make sure that the seller is not married or require his wife’s consent to alienate the apartment;

- ask the seller for a certificate confirming that there are no debts on utility bills.

The seller's guarantees can be included in the purchase and sale agreement:

“The seller guarantees that before the conclusion of this agreement, the alienated apartment has not been sold to anyone, not mortgaged, is not in dispute, is not under arrest (ban), is not encumbered with the rights of third parties, is in trust management, for rent, commercial lease, as a contribution to the charter the capital has not been transferred, the Seller’s ownership of the specified apartment is not disputed by anyone.

The seller guarantees the absence of claims against the alienated apartment by third parties, including other heirs (by law or by will), users by testamentary refusal.

The seller confirms that third parties have no rights of use in relation to the alienated apartment, including on the basis of a testamentary refusal, and at the time of signing this agreement no one is registered in the specified apartment.”

It makes sense to add a clause to the contract that will reduce the risk of the buyer losing the home due to the deal being declared invalid, for example:

“The parties to this agreement, guided by Articles 421, 461 of the Civil Code of the Russian Federation , have agreed that if the court recognizes this agreement as invalid or terminates this agreement due to circumstances arising through the fault of the Seller, or due to a violation of the rights of third parties (on the part of the Seller), which the court considers subject to satisfaction, and the seizure of the specified apartment from the Buyer, the Seller undertakes to purchase in the name of the Buyer an equivalent residential premises in a house of a similar category in the same area of the locality, or otherwise provide the Buyer with funds for the independent purchase of an apartment, based on the cost of similar housing , valid on the market at the time of termination of the contract, and also compensate the Buyer for all losses incurred by him related to the purchase of this apartment. In this case, the apartment cannot be confiscated from the Buyer until full compensation for losses.”

Remember

- You can get up-to-date information about renovations from the Resettlement Information Center in your area.

- The renovation program will still be adjusted, so be prepared for possible changes in the rules.

- Currently, the terms of ownership of an apartment for participation in renovation have not been established.

- You can buy an apartment in a building for renovation only if it is privatized.

- The purchase and sale agreement must be concluded before the exchange agreement is signed between the owner and the municipality, according to which ownership of the new housing is transferred.

Buying an apartment in a building for renovation: possible risks

On July 1, 2017, the Law “On Renovation” came into force. The essence of this Program is to resettle residents of the capital from dilapidated emergency housing into newly built modern multi-storey buildings with a developed local area and excellent infrastructure. Now this program is at the stage of productive implementation and the first stages of renovation have already passed.

Many of the “Khrushchev-era” apartments have already been resettled, and the new settlers have received their own apartments in high-rise buildings. There is also a tendency in the real estate market to sell apartments in Khrushchev-era buildings at inflated prices.

Many enterprising citizens are interested in purchasing this housing in order to subsequently enter into a renovation program for their own benefit. The law does not prohibit this type of transaction, however, it is necessary to take into account all the existing risks that will accompany these situations.

Is it worth purchasing housing in a dilapidated building that falls under the renovation program?

Is it profitable to buy a home in a dilapidated building? Of course yes, this bodes well for the future. In addition, the renovation program states that the owner of the apartment will receive a modern apartment with improved characteristics. These include the following:

- Ergonomic layout.

- Big square.

- Good repair and quality finishes.

- Excellent infrastructure.

- The presence of balconies and loggias.

- Well-groomed area near the house.

A special feature of the renovation program is that citizens are relocated to houses built in the same areas where they lived. Of course, this is observed when it comes to the possibility of building housing in a given area.

Purchasing housing in an old building can be an excellent opportunity for a city dweller to improve their living conditions in the future.

The renovation program makes it possible to get a beautiful, bright, spacious apartment in a modern multi-storey building. New microdistricts have improved infrastructure and developed local areas.

Here, kindergartens, schools, and bus stops are within walking distance. There are sports fields, fitness centers and playgrounds.

From an investment point of view, purchasing an apartment in an old building is an excellent investment. There is no doubt that the cost per square meter in a Khrushchev building will be several times less than in an apartment in a new multi-storey building. By buying a home in a demolition building now, you can benefit in the future. As practice shows, there is always a demand for apartments in new buildings, which has been growing over the years.

However, it is worth considering that such transactions are a rather risky undertaking and every nuance here can be decisive.

Reasons for selling apartments in buildings for demolition

Not all townspeople are happy with the renovation program. Many have their own view of the problem and are sometimes not ready to move to a new apartment in the same or another area. The purchase of housing in a dilapidated building is designed for future benefits, and the sale is associated with subjective motives. Personal reasons that prevent you from moving may be:

- Moving to an area or town that is geographically closer to the place of work (a time convenient for selling and buying has been chosen, because due to the renovation program, prices for emergency housing have increased).

- Troubles associated with forced living in an inconvenient area. (Many are not satisfied with the prospect of moving to the outskirts and therefore these people sell their housing in the Khrushchev-era building in advance)

- Uncertainty about the quality of multi-storey buildings (many people have doubts about the quality of buildings due to the high speed of construction of new microdistricts).

- Fear due to the end of the renovation program leads to decisive action. Citizens are selling dilapidated housing now so as not to wait for the next wave of renovation. As practice shows, the program may not receive sufficient funding and be suspended.

According to real estate agencies, the emergence of a renovation program has led to an increase in the cost of apartments in dilapidated buildings by 20-25%.

Those citizens who invested in expensive repairs are in a losing situation. There are no additional payments for luxury ceiling and floor finishing. Such investments have no chance of paying off. When moving to new housing, the conditions will be the same for everyone.

Living conditions in Khrushchev buildings are not always so bad. Sometimes these are beautiful houses, where there are apartments with high ceilings and excellent layout, large area. The renovation program uses general resettlement conditions for all residents, regardless of the living conditions in the previous house. There may also be situations when this is a deterioration in living conditions.

The law assumes that the list of houses subject to resettlement can be adjusted at the request of the owners. Residents themselves can contact government authorities to prevent the resettlement of their home.

This is a certain risk for those who purchased an apartment in this building with the aim of exchanging it for housing in a new multi-storey building.

Advantages of buying a home under the renovation program

At first glance, the deal to purchase an apartment in an old building for the purpose of joining the renovation program is very profitable, because an apartment in a new building is more expensive than on the secondary market. But you should not immediately dismiss all the risks that haunt this transaction. It is important to weigh everything wisely. These include:

- A long-term solution to the issue of a list of houses to be resettled. The process may be delayed due to citizen dissatisfaction. You cannot count on the rapid development of events, so as not to be disappointed in the outcome.

- Situations arise in which the program is suspended due to insufficient funding. Such moments are not rare and have happened in the history of the city.

- The real estate market can bring surprises. For example, there is a possibility that it will take some time before an apartment in a new multi-storey building becomes more expensive. Housing in the secondary sector sometimes costs more than in a new microdistrict. It may take a long time before the price of an apartment in a new building reaches a good value. The house goes through the procedure of delivery and determination of housing prices in a certain sector.

- It is unknown how good the new housing will be. Citizens are concerned about the fact that new buildings are being built in the shortest possible time. This point is alarming, since such houses may develop problems during operation.

- Expectations and reality regarding the housing provided (apartment area and preferred area) may not coincide. Its market value depends on the location of the property. And if at first you were counting on settling in one area, then in fact it may be another.

- If residents unite against renovation, the authorities will adjust the list of houses offered for resettlement. Thus, you can be left out of the resettlement program.

- There may be new amendments to the law. For example, in the Moscow region, residents are asked to pay extra for additional space from their own savings. This is very alarming for residents of the capital, because such a project can be applied here too.

Thus, we conclude that purchasing an apartment in a dilapidated building is a risky business. Every citizen must weigh the pros and cons and understand all the intricacies. You can turn to professionals who will help you resolve the issue of purchasing a home more competently.

It is possible to purchase an apartment in an old building with a mortgage. Many banks issue loans for such purposes with certain conditions. For example, an apartment in an old building will serve as a guarantee of a refund. Even if the client does not receive new housing, the bank guarantees a return on investment.

Muscovites began to massively sell apartments in Khrushchev-era buildings that are being demolished

Since mid-May, on the portal CIAN (a database of advertisements for the sale of real estate), advertisements for the sale of apartments in Khrushchev-era buildings began to appear en masse, which were included in the voting list “for inclusion in the project of the renovation program,” according to which the demolition of more than 4 thousand houses is planned.

Thus, earlier, Moscow’s vice-mayor for urban planning policy and construction, Marat Khusnullin, said that Beskudnikovo would be one of the first areas where renovation would take place.

Since May 15, 13 apartments in the buildings that are supposed to be demolished have been put up for sale in this area (they were included in the voting list). And there were no advertisements dated earlier on the portal at all.

Prices are higher than the market. For example, a one-room apartment is sold for 4.6 million rubles.

“The prices have risen, you understand,” explains the realtor who is selling this apartment. “Now they are undergoing renovation, these houses will be demolished anyway, so they are selling at a higher price. A year ago, such an apartment was offered for 3.8 million.

Olga Saukitens, head of the sales department of the Moscow real estate agency, noted that the average price for a one-room apartment in a Khrushchev-era building in the Beskudnikovo district is 4–4.2 million rubles. As Life previously reported, real estate market analysts predicted an increase in prices for apartments in five-story buildings by up to 25%.

The situation is the same in other areas (for houses that were included in the voting list). It turned out that in the Pokrovskoye-Streshnevo area 24 such apartments were put up for sale in May, and in the Marfino area - 28 apartments.

The authors of some advertisements specifically emphasize that the houses are on the list and will be demolished. That is, this is presented as an additional plus for clients.

The Marfino and Pokrovskoye-Streshnevo districts were chosen by Life at random, and we immediately saw a lot of fresh advertisements for them.

At the same time, CIAN analyst Alexey Popov said that currently approximately 53 new advertisements per day are submitted to voting for houses on the list for renovation. At the same time, CIAN assures that people have become even less likely to put up their apartments in five-story buildings for sale.

Having heard such a comment, we decided not to bury the version that there are more advertisements, and test it using the example of a couple more districts.

We have selected all the advertisements available on the portal for the sale of apartments in the Nagorny district (in houses from the list for voting).

Here, 12 ads were posted just this day, seven ads were posted one to seven days ago, four ads were posted two to three weeks ago, three ads were posted two to three months ago.

In the Western Degunino district (we also looked for apartments in houses from the list), three advertisements were posted this day, three advertisements were posted from one to seven days ago, one advertisement was posted three weeks ago.

Realtors explained what guides potential sellers and buyers of apartments in Khrushchev-era buildings.

“There are owners who think that they can now sell apartments in buildings for demolition at a higher price,” says Olga Saukitens. “But whether there are potential buyers is a big question.”

Clients with mortgages immediately disappear. The bank must provide documents that this house is not on the list for reconstruction or demolition.

There are still clients with direct money who are willing to take risks, but there are probably not many of them.

- As the Yandex tool Wordstat shows, user interest in buying an apartment in a building for demolition is growing.

- What potential buyers are hoping for is clear: as Moscow Mayor Sergei Sobyanin said, the new apartments that Muscovites will receive under the renovation program will be 20–30% more expensive than the old ones.

- What are the residents of Khrushchev-era apartments counting on when they refuse such a lucrative offer and put their apartments up for sale now?

Firstly, says Olga Saukitens, if you sell an apartment in a Khrushchev-era building now, without waiting for demolition and a new apartment, you will not have to pay a tax of 13% on the amount received. By law, such tax must be paid upon sale if the apartment has been owned for less than five years.

“If a person did not plan to live in this apartment in any case, then perhaps it would be more profitable to sell it now, before demolition,” the expert said. — Because then deducting this 13% will bring the amount from the sale of an apartment in a new building closer to the price of an apartment in a Khrushchev-era building.

Secondly, it is unknown what will happen on the real estate market in a few years.

— Our market is moving down. It is possible that it is more profitable to sell a Khrushchev-era apartment now than to sell an apartment in a new building after a while,” said Olga Saukitens.

Thirdly, it is now difficult to guess what the price of an apartment that the city will give will be.

— If we take the same district of Beskudnikovo, and it is not small, there is a part where there are green alleys, and there is a part that is adjacent to the railway. And there is no guarantee that the apartment in the new building will not overlook the railway. And this, of course, also affects the price.

Fourthly, much will depend on the massive scale of development. Let’s say that if on the site of several demolished five-story buildings only one or two high-rise buildings are built for resettlement, this is one option. If in addition to these houses there are also three or four high-rise buildings for commercial sales, this is a completely different option.

“In this case, the supply will be massive, and the prices for apartments there will not be very high,” says the expert.

Houses of fear. What's worse - if they demolish it or if they don't demolish it?

What are the risks of buying an apartment for demolition?

Muscovite Peter owns an apartment with his brother, and renovation for him is an opportunity to divide the two-room apartment into two new one-room apartments. But it’s still unclear when the house will be demolished, but I want to leave. And now Peter is selling an apartment in the building for demolition, in order to divide not the living space, but the proceeds.

The idea turned out to be a good one, because the cost of an apartment in his old Khrushchev building had increased. “Potential buyers know that, as the authorities promised, the apartment will be larger in area.

People think that now I’ll buy an apartment from someone for renovation, it’s still not that expensive, I’ll wait a little or rent out this apartment, and then I’ll move to a normal one in a new building,” says Peter.

RIA News

“Under renovation. Faster. Urgent” is the name of one of the advertisements on the website for the sale of apartments.

For 7 million they sell 45 square meters with plush sofas, carpets on the walls and other attributes of Soviet ideas about beauty. But why do renovations if the city will demolish the old Khrushchev building anyway and give out a new apartment?

So, buying a house for demolition is not a bad idea, especially for investors, says Olga Saukitens, head of the sales department of the Moscow Real Estate Agency: “If in 2016 we purchased a two-room apartment in such a building for 5.5 million, now it is already worth about 6.5−7 million. It is clear that living space in a new house in the same location will cost significantly more. In any case, a person wins, even by taking out a mortgage loan and paying interest.”

With mortgages, however, everything is not so simple: most banks refused to work with apartments for renovation.

Loans are issued mainly by Sberbank and VTB, which emphasized that the loan size will not change, even if the client receives more expensive housing after renovation.

It will only be necessary to change the subject of collateral, but for banks this is a risk, says Igor Zhigunov, First Deputy Chairman of the Board of the Housing Finance Bank: “Replacing an object requires concluding another mortgage agreement on a new object, which is given to the client in exchange, since until this moment the loan remains unsecured — here the question of risk arises.

Those banks that are ready to consider a situation related to the possibility of replacing the collateral, or, for example, issuing a loan not for a long period, may be the ones who will implement these programs.”

But there is no risk that the developer will go bankrupt. Renovation is still a guarantee for the parties to the transaction.

Another thing is that the exact resettlement parameters for most objects have not yet been published.

Therefore, buying an apartment for demolition is still a gamble that few will take, says leading CIAN analyst Alexander Pypin: “It will be quite difficult to sell for a high price, since a normal adequate person will ask: what will they give me in return, how many meters, where, on which street, on which floor, where the windows will be, and so on. Any buyer is very interested in all this. Therefore, there are not many people on the market who want to buy a pig in a poke.”

They talk about another risk - being resettled under the renovation program to another area. And although the authorities have repeatedly emphasized that this will only be possible with the consent of the resident, not all realtors and their clients are full of optimism.