The topic of whether loan debts are inherited is of concern to many citizens whose deceased relatives have ever taken out a bank loan and did not manage to repay it before their death.

Unfortunately, the answer to this question is in the affirmative, because along with the property (money), the heir is also responsible for paying off the debts of the testator.

Thus, the state protects the lender from possible financial losses in the event of the death of a person who borrowed a certain amount for personal needs.

What debts are not inherited?

Initially, you should find out which inherited debts of the deceased heir will not have to pay for. This list includes:

- alimony debts;

- payment of taxes (with the exception of certain cases);

- compensation payments (usually for bodily injury);

- funds received as an advance payment for the performance of specific services.

In the last of these cases, you will have to go to court and prove the impossibility of fulfilling the obligations of the deceased. For example, the testator undertook to assemble furniture, for which he received an advance payment.

After the death of a person, his heir, due to lack of appropriate skills, cannot perform the work of the deceased and does not have the amount of the advance payment, since it was previously spent by the recipient.

Based on the results of the court hearing, the heir is often relieved of the obligation to return the advance payment to the customer for services (work).

When there are several heirs or they have not reached the age of majority

If the recipients of the inheritance are two or more persons, then they are obliged to pay the debts of the deceased person in proportion to the property received. In other words, everyone repays debt obligations only on items received into ownership.

So, for example, one of the heirs became the owner of a car purchased on credit, and the second - a country house built with a bank loan. According to the debt obligations on the property, the owner of the car is obliged to repay a loan of 50 thousand rubles, and the new owner of the house is obliged to repay 1.5 million rubles.

There are situations when the amount owed significantly exceeds the estimated value of the inherited items. Here the law is on the side of the new owners, while the lender has the right to expect payments not exceeding the current price of the property.

A striking example is an inherited car worth 300 thousand rubles and debt obligations on a loan in the amount of 600 thousand rubles.

The heir needs to repay only part of the debt equivalent to the cost of the vehicle that has become the property.

Sometimes a will is drawn up for minors - natural or adopted children, as well as grandchildren. In this case, the mentioned persons can take ownership of the property only with the consent of:

- guardians;

- parents;

- trustees.

When the age of the heir is less than 14 years, the application for inheritance is written by the legal representative of the person for whom the will is executed. If the heir is 14-18 years old, he submits the application independently with the consent of his legal representatives. Repayment of the debt rests entirely with the legal representatives of the minor citizen.

What are the consequences of non-payment of inherited loan debts?

Often, the direct heirs of property learn about the death of a relative or the person who executed the will, long after his death. During the period of ignorance, the lender may charge a penalty or penalty for late repaid loans.

Many people wonder whether loan debts are inherited along with fines? From a legal point of view, there was an agreement between the recipient of the loan and the organization that issued the funds, the obligation to fulfill which automatically passes after the death of the testator to a specific person.

Ignorance about the death is not considered a valid reason, as a result of which the loan will have to be repaid with accrued interest or penalties.

Will insurance always help?

In order not to set up future recipients of the inheritance, the borrower can insure himself against a tragic turn of events by taking out a policy in case of death. The provided service in various banks is always paid, but in the event of an untimely death, the insurance will cover the remaining payments and the relatives will not have to rack their brains about where to find funds to repay the loan.

At the same time, there are a number of nuances according to which the death of the borrower is not always recognized as an insured event. This may include the following situations:

- an illness about which the insurer was not informed when signing the contract;

- intentional self-infliction of fatal bodily harm by the client;

- borrower suicide, etc.

Often, insured events do not cover death that occurs after drinking alcohol or taking drugs, especially if the person was registered with a narcologist (other doctors). Therefore, when drawing up a contract, you should pay close attention to the clauses that clearly indicate when the insurer will not make payments on the loan.

In addition, sometimes the insurance does not fully cover the loan amount, and the bank will demand the remainder of the debt directly from the recipient of the inheritance. The procedure and timing of insurance payments are determined by the cooperation agreement, and the beneficiaries may be:

- organization that issued the loan;

- the borrower or his heirs.

In the first case, the insurance company transfers the entire remaining debt of the deceased or the amount agreed upon in the agreement to the lender. The payment terms most often do not depend on the period of inheritance of the property, and the new owner will not have to worry about repaying the loan. If part of the amount remains uncovered by insurance, the lender usually notifies the heir in writing.

With the second payment option, the heir will be able to receive the insurance amount only after taking legal rights to the property (you will have to wait at least 6 months).

Until this moment, you will have to make all payments according to the schedule, otherwise the bank has every right to impose a fine or collect a penalty for each month of delay.

After six months, the insured amount is credited to the heir’s personal account, after which he has the right to dispose of the funds received at his own discretion. It is not necessary to use them to repay the loan, but you will have to pay off the debt of the deceased person until it is fully repaid.

Sometimes the heir turns to the insurance company about reimbursement of funds due to him, but the organization refuses to fulfill its obligations, citing the fact that the contract was concluded with another person.

You should not delay resolving the issue and it is better to go to court with a claim to protect your rights.

After considering all aspects of the case, the verdict will most likely be rendered in favor of the heir, who will be reimbursed for all insurance payments of the borrower within the agreed time frame.

For violation of the terms of insurance payments, you can demand compensation from the organization for the use of other people's financial resources (this possibility is provided for in Article 13 of the Law “On Protection of Consumer Rights”).

How to Avoid Inherited Credit Debts

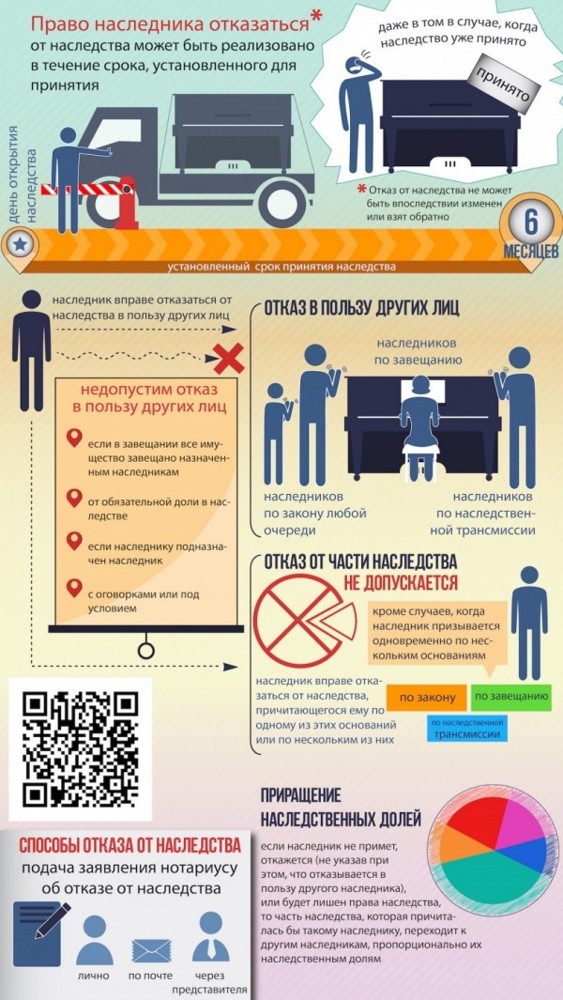

The heir has the right not to repay the loan debt of the deceased person in the following two options:

- refusal of inheritance;

- non-acceptance of property subject to the right of inheritance.

Before entering into legal ownership, 6 months must pass, during which it is possible to formalize an official refusal of inheritance. Ownership rights can be transferred either to other persons or not to indicate them in the document at all.

It is impossible to give up part of the inherited property, since domestic legislation provides for the “all or nothing” principle.

Therefore, if you, for example, want to inherit a house, then along with it you will have to take ownership of a car with an unpaid loan and repay the debt on time.

Non-acceptance of an inheritance is formalized quite simply - for this it is enough not to take any actions in relation to the property due (not to pay utility bills, not to use a car, not to make repairs in the apartment, etc.). If any actions have been taken in relation to the property, the heir automatically has not only the right of ownership, but also obligations to creditors.

From a legal point of view, there is one significant difference between refusal of an inheritance and its non-acceptance. The person who has issued a waiver of the property transfers it to another person (the next in line of inheritance).

In case of non-acceptance, the right of ownership does not even arise, however, the citizen has the option of restoring claims to the inheritance in court.

This must be done within the agreed time frame (6 months from the date of death of the testator) or the claim period can be extended if there are good reasons.

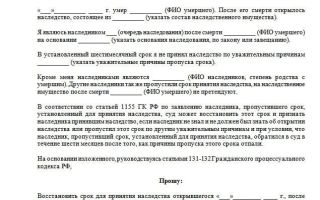

Statement of claim for restoration of claims to inheritance in court

Thus, after death, loan debts are inherited along with the property, which also need to be taken into account by the potential owner.

If any difficulties arise with registering property or making financial claims from creditors, it is best to contact a lawyer.

Only a qualified specialist will be able to explain all the intricacies of the legislation, provide practical advice or defend property rights in court.

Are loan debts inherited?

From our article you will learn whether loan debts are inherited, what to do with them, what is the statute of limitations for these debts, whether minor heirs must pay the testator’s loan debts, and we will also consider the procedure for paying off debts on secured loans.

When entering into an inheritance, the heirs of the deceased sometimes do not even realize that their testator owes the bank a certain amount of money on a loan. And they can find out about this when they start receiving letters and calls from the bank or collection agencies demanding to repay the debt.

The reaction of the heirs to this news may be different. This may be indignation that the heir did not take any money from the bank, and therefore is not going to pay this debt. Or there may be a desire to quickly, without understanding, pay off the debt in order to avoid penalties.

Neither option is correct. We will explain why this is so below. In addition, let us clarify the question of what amounts of debt the bank does not have the right to demand.

To pay or not to pay the testator's loan debts

Article 1175 of the Civil Code of the Russian Federation answers this question unequivocally: you need to pay. The law provides that heirs, when receiving an inheritance, receive not only the testator's rights to the inherited property, but also his debt obligations.

These obligations, including loan debts, do not terminate due to the death of the debtor. The debt of the deceased passes to his heirs regardless of the basis on which the inheritance was received: by will or by law.

The degree of relationship also does not matter.

The heir may not contact the notary regarding the issue of accepting the inheritance, but at the same time use it as his own property, that is, actually enter into inheritance rights. And in this case, he is obliged to pay the testator’s debts on loans.

All heirs who accepted the inheritance must pay. Each of them must repay the debt within the value of the property received by inheritance. The market value on the day of death of the testator is taken into account.

You can read about the procedure for inheriting the debts of a deceased testator here.

When and to what extent does the bank have the right to demand that the heirs repay the testator’s debt on loans? You can find out the answers to this and other questions about inheriting a borrower's debts from this video.

Do minor heirs pay debts?

In the case of inheritance received by minor heirs who are under 14 years of age, the inheritance is accepted on their behalf by legal representatives: parents, guardians, trustees. After turning 14 years of age and up to 18 years of age, minors are given the right to apply for inheritance themselves, but the consent of their legal representatives is required.

Obligations to repay the loan in the event of inheritance by minors pass to their legal representatives.

And if in certain cases it is more expedient to refuse the inheritance, then the legal representatives can do this only with the consent of the guardianship and trusteeship authorities.

What amounts of debt does the bank not have the right to demand from heirs?

If the loan debt exceeds the value of the inheritance received, the amount of debt repayment should not exceed this value.

For example: After the death of his father, his son inherited a car worth 350 thousand rubles. At the same time, the testator’s debt on the loan is 420 thousand rubles. The bank has no right to demand that the son repay the loan in excess of 350 thousand rubles.

In addition, the heirs should be aware that only the amount of the loan that occurred at the time of the borrower’s death is subject to repayment. Penalties and fines accrued by the bank after his death, while the bank was looking for heirs and the heirs entered into the inheritance, are not subject to payment.

Some unscrupulous banks, having information about the death of the borrower, deliberately do not make demands on the heirs for repayment of the loan for a long time. At the same time, do not forget to apply penalties under the loan agreement and accrue interest. In this case, the heirs are not obliged to satisfy the demands of the credit institution to collect accrued interest and penalties.

Procedure for loan repayment by heirs

An heir who has accepted an inheritance that includes loan debts is obliged to repay these debts in accordance with the same conditions as the deceased borrower.

The heirs' obligation to pay loan debts arises after acceptance of the inheritance. You can familiarize yourself with the procedure for entering into inheritance according to the law here.

Sometimes, with the consent of the bank, the heir decides to repay the entire amount of the debt at once. This decision is most often made by the heir when there is a small amount of debt. The bank agrees to such conditions if it does not incur material losses when repaying the loan early.

Limitation period for loan repayment by heirs

Having received loan debts along with the inheritance, the heir must pay attention to the following fact: when the testator made the last payment, repaying the loan.

And if this payment was made more than three years ago, then the statute of limitations on the loan has expired.

If a credit institution goes to court, the claim will most likely be rejected due to the expiration of the statute of limitations.

The rules on reinstatement, suspension and interruption do not apply to these periods.

If the bank has missed the statute of limitations, then the claims made by it after the expiration of the period will not be satisfied by the court.

Payment of debts on a secured loan

When issuing a loan to a borrower, banks require certain collateral from him in most cases. This includes insurance, collateral and surety.

The presence of an agreement on life and health insurance of the testator can significantly simplify the task of the heir in repaying the loan, but not in all cases, but only in insurance cases. Insured events are considered to be deaths that are specified in the insurance contract. In these cases, the insurance company ensures payment of loan debts. The heirs do not have to pay anything in this situation.

But the death of the borrower is not always recognized as an insured event. Death that occurs as a result of a chronic disease, the presence of which was not notified to the insurance company when drawing up the contract, as well as from HIV infection, suicide and a number of other reasons, is not recognized as an insured event.

One type of loan security is collateral. Most often, a real estate object (house, apartment and other objects) acts as collateral. This method of security is most widespread in cases of mortgage lending.

The death of the borrower does not cancel the bank's right to the mortgaged property. This right is retained by the bank until the loan is paid in full by the heirs. Having entered into inheritance rights to the specified object, the heirs cannot dispose of it at their own discretion (for example, sell it).

To do this, you must obtain the bank's consent.

A guarantee as a method of security is usually used when a bank issues a small loan amount. If there is a guarantor, the heirs pay off the debts of the deceased in the usual manner. The guarantor's obligations to repay the loan after the death of the borrower depend on what conditions regarding the guarantor are included in the loan agreement:

- responsibility for repayment of the loan solely by the borrower;

- responsibility for payment of debts by heirs.

In the first case, after the death of the testator, the duties of the guarantor cease. In the second case, the guarantor is responsible with his property if the inheritance is not enough to repay the loan debts.

Undoubtedly, loan debts that the testator had at the time of his death create certain problems for the heirs. To decide on the advisability of entering into such an inheritance, the heir must clarify the size of the inherited property and loan debts. By comparing these values, you can make a decision.

How are loan debts inherited?

- Lending in our country is very widespread: almost each of us has a debt obligation to the bank.

- There is nothing wrong with this if the loan was taken out consciously and is repaid on time and accurately.

- However, life is unpredictable, and in the event of the death of the borrower, questions often arise about the transfer of the loan debt to his heirs.

To what extent can the loan debt be transferred, from what point exactly, and do you need to pay interest? How to deal with penalties and fines? Let's try to understand the main points.

Are loan debts inherited?

According to Art. 1110 of the Civil Code of the Russian Federation, the property of the deceased passes to other persons in the order of so-called universal succession (that is, unchanged, entirely and simultaneously).

At the same time, the inheritance mass includes not only things and other property, but also property rights and obligations.

That is, you can inherit not only an apartment, a car and home furnishings, but, for example, also royalties, dividends on shares, etc.

Only those rights and obligations that are inextricably linked with the personality of the deceased himself are not transferred (for example, his alimony obligations, payments made to compensate for harm caused to the health of someone, etc.).

The obligation to repay the loan debt is not related to the identity of the deceased. Many heirs, while not objecting to paying the debt itself, challenge the legality of interest on the loan accrued from the moment of the borrower’s death.

There is logic here, because interest is a payment for the use of borrowed funds, and if the heir did not use them, then there seems to be nothing to pay for.

For a long time, in practice, decisions were made according to which the requirement to pay interest for the period after the death of the testator was recognized as unlawful. It was believed that penalties and interest on the loan were not included in the inheritance mass as debts.

However, in 2012, the Plenum of the Supreme Court of the Russian Federation adopted a special Resolution “On judicial practice in inheritance cases,” which established a different approach.

Paragraph 58 of the Resolution establishes that debts are all obligations existing at the time of a citizen’s death that have not been fulfilled by him, and they do not cease with the death of the debtor (Article 418 of the Civil Code of the Russian Federation), and paragraph 59 - that the death of the borrower does not entail early fulfillment of obligations by the heirs ( that is, persons who inherited a debt obligation are obliged to fulfill it as provided in the agreement with the bank).

This Resolution is based on the norms of the Civil Code and clarifies several more important points related to inheritance debts:

- the heir, having accepted the inheritance, is considered a debtor from the date of its opening and must fulfill his obligations;

- interest for delays allowed by the testator (charged under Article 395 of the Civil Code of the Russian Federation) is accrued only on the day the inheritance is opened. This takes into account the time required to accept the inheritance (paperwork, etc.).

- The new debtor is not responsible for the bank’s dishonest actions (delay in presenting a demand for execution of the contract to the heir/heirs).

Thus, according to the norms of civil legislation and law enforcement practice, demands on the heirs from creditors of a deceased citizen are completely legal, both for payment of the principal debt and interest.

How are debts divided?

In practice, there are cases when the property of the deceased passes not to one, but to several heirs (both by law and by will).

In addition, inheritance is often distributed not in equal shares, but differently.

The Civil Code of the Russian Federation establishes that the heirs, having accepted the inheritance, are jointly and severally liable for the debts of the deceased, but within the limits of the value of the property received (clause 1 of Article 1175 of the Civil Code of the Russian Federation).

Such liability means the bank’s right to demand payment of the debt from any of the debtors individually, and from all of them jointly, both the full amount and part of it (Article 323 of the Civil Code of the Russian Federation).

Having received part of the debt from someone, the creditor can claim the unreceived balance from other heirs. The latter remain debtors until the entire debt is repaid one way or another.

For example, if three heirs received ½, ¼ and ¼ of the property, respectively, they owe the creditor equally.

One of the heirs, having paid the entire debt or a significant part of it, has the right to bring a legal claim against the other heirs by way of recourse (compensation).

Important:

- it is impossible to demand payment of a debt that exceeds the amount of the inheritance itself;

- if the inheritance is not accepted (neither documented nor actually), the obligation to pay someone else’s loan does not arise;

- even after entering into an inheritance, it (and the debts of the deceased) can be abandoned.

At the same time, you should know that according to Article 1157 of the Civil Code of the Russian Federation, refusal of inheritance cannot be changed later.

Mortgage and debts on it

Inheriting real estate encumbered with a mortgage is an expensive pleasure, since in this case, according to Art. 1175 of the Civil Code of the Russian Federation, the heir/heirs are liable for the debts of the testator to the extent of the value of the property.

When inheriting a mortgaged apartment, the so-called replacement of persons in the obligation occurs (Law of 1998 “On Mortgage (Pledge of Real Estate)”) - instead of the original borrower (testator), the person (persons) who accepted the inheritance becomes obligated under the mortgage agreement.

When registering an inheritance, you will need to sign documents with the creditor bank on the pledge of the inherited real estate for the amount unpaid by the testator.

In addition, you will have to spend money on insurance and registration. If there are several heirs, the remaining portion of the loan is divided into shares.

It should be remembered that in addition to the mortgage agreement, real estate can be the subject of collateral for another loan: consumer or for the purchase of another home.

Receiving real estate as an inheritance, even if encumbered with collateral, is still a valuable acquisition, especially if a certain share of the debt has already been repaid by the testator.

In addition, heirs often sell such real estate, pay off the creditor bank, dividing the remainder among themselves.

How to reduce payments

If refusing to accept property is not part of the heirs' plans, and paying debts is difficult, you can take a number of steps to reduce debt obligations.

First of all, having learned about the existence of a loan agreement, you should find out whether there is an insurance agreement with it.

Banks often provide loans only if the borrower has life and health insurance. In the event of the borrower's death from an accident or illness, the debt is paid by the insurance company in proportion to the amount of insurance.

Warning

If, due to the insurance company’s evasion from fulfilling its obligations, the bank accrues fines and penalties, they are also subject to payment by the insurer, and not by the heir.

The heirs will have to collect documents for payment of compensation, even if the insurer is aware of the fact of the death of its client.

It should be remembered that after submitting the documents, the insurance company must make a decision on payment within five days (or give a written refusal indicating the reason).

There are a number of other opportunities to reduce payments on the testator’s loan:

- Changing the terms of the contract. You can try to reduce the size of payments, increase the loan term. In fact, recently banks have been quite loyal to such changes. Seeing the new borrower’s intentions to resolve the situation, the likelihood of reaching agreement on changing the terms of the loan agreement is quite high.

- Reducing the amount of interest accrued during the period of inheritance. As a rule, some time passes between the opening of an inheritance, the heirs receiving information about the availability of loans from the testator, the execution of documents, and the establishment of contact with the bank. Interest for this period may be reduced by the bank or withdrawn altogether. This is done either by signing a bilateral agreement, or such a decision is made by the bank. In any case, this option is beneficial for the heir.

- Don't forget about tax deductions (especially when inheriting real estate). It is necessary to submit documents for such a deduction after registration of the inheritance.

Accepting an inheritance is not as simple a step as it seems at first glance. Sometimes it involves not only the acquisition of new property, but also the need to pay off the debts of the testator.

There is no legal way to avoid paying a loan for a deceased person without abandoning the inheritance itself. Therefore, if the value of the testator’s property is small, but the debts are significant, it is worth considering the advisability of entering into inheritance rights.

Are loan debts inherited?

Every tenth person has bank and other debts: such loans are taken out for various purposes, starting from purchasing a telephone and ending with a mortgage on an apartment. Therefore, a transferable loan by inheritance is a situation that has not surprised anyone for a long time.

Are loan debts inherited?

Is loan debt passed on by inheritance? Such a situation is not only possible, it is enshrined in law: Article 1110 of the Civil Code of the Russian Federation emphasizes that the transfer of all property according to the order of inheritance falls within the scope of universal succession, suggesting its transfer in its entirety.

Considering that the inheritance mass includes things, valuables, property, rights and obligations, the answer to the question of whether loan debts are inherited will be positive.

The assignee is able to inherit an apartment, jewelry, shares and dividends on them, and royalties received for copyright.

This also includes the powers and obligations inherent in the deceased person personally: any debt, alimony debts pass to the heir.

A loan debt cannot be attributed to the personal obligations of a deceased person. There is a practice of challenging interest rates for the use of a loan accrued for the period following the death of the borrower.

According to the norms established by the Civil Code and some Resolutions of the highest judicial bodies of the Russian Federation, the following principles of inheritance of debt obligations are noted:

- obligations of a debt type that were not fulfilled by the subject before his death are subject to execution without ceasing in connection with his death;

- early fulfillment of the borrower's obligations due to his death is impossible;

- the person who accepted the inheritance receives the status of a debtor, starting from the moment the inheritance is opened;

- the subject of the inheritance receives obligations to pay interest for late payments (but only accrued on the date of opening of the inheritance);

- The bank's delay in registration procedures does not entail liability on the part of the legal successor who received the loan as an inheritance.

According to the norms of Russian legislation, demands for payment of debts received from the testator to the successor are absolutely legal and subject to timely payment. This applies to debts and interest accrued on them.

Features of inheritance of loan obligations

The order of inheritance of credit obligations can take place in two options:

- Testamentary: the corresponding document is drawn up by the testator before his death, indicating the subjects and the values transferred to them.

- Legal: involves entering into inheritance powers in accordance with the sequence established by law.

Many heirs are concerned about the question: are alimony debts passed on to inheritance? Unfortunately, this practice exists; moreover, debts are transferred to minors in full. The law takes into account the fact that they cannot pay the sums of money on their own, so this burden falls on the legal representatives.

- Ages up to 14 years: debts are paid by parents, guardians, trustees.

- Age 14-18 years: after providing written permission from the parents, the heir acts on his own behalf.

- After 18 years of age: a person is independently responsible for acquired obligations.

According to the law, the right to pay debts can appear simultaneously in several heirs who have assumed these rights. Here everything depends on the shared distribution of the entire property of the testator; not only values, but debts are subject to division into proportional parts. The size of the successor's share in the inheritance mass corresponds to the number of debt obligations incurred by him.

For example: when a family of five gets an apartment in shared ownership, each member will be liable for the obligations incurred in the amount of their share (1/5).

The bank receives the right to collect loan payments from the heir within a period of 3 years.

When, within the period established by law, none of the heirs has indicated their affiliation, the financial institution receives the authority to independently search for the debtor’s legal successors.

Before the heir enters into inheritance rights, debt collection is impossible.

This gives rise to a choice for the subject: accept the inheritance and receive property and debts, or give up everything.

What happens if you don't pay off inherited debts?

Judicial practice has cases in which successors do not know not only about the death of relatives, but also about the availability of loans. If the heirs do not repay the loan, penalties and penalties determined by the bank in the loan agreement come into force.

Lawyers emphasize the fact that debts and alimony by inheritance are automatically transferred to the person who received the property. The successor's ignorance of the existence of debts does not lighten his burden, eliminating the need to repay loans.

Judicial practice shows that a decision can be made in favor of any of the subjects of such legal relations.

There are no clearly defined instructions for credit institutions on such grounds.

The only thing that is determined is the need to pay the amount of debt, which begins not from the moment when the testator died, but after the successor assumed the powers of inheritance.

To resolve the issue, a citizen must contact a credit institution; as a rule, they make concessions to the client, hoping to receive compensation of even the minimum possible amount.

How to reduce payments

The procedure for paying off loan obligations is confirmed and established by the relevant agreement concluded by the testator with the financial institution. If there is a need to protect the interests of both parties in a judicial manner, this procedure is established by the authorities.

The statute of limitations for inheritance cases is established by law; the successor, upon receiving property of this kind as an inheritance, is forced to pay the debt and interest on it.

Reducing the amount to be paid is permitted only through the court, for this you need to file a claim. Credit institutions, taking advantage of the new payer’s ignorance, increase fees, fines and penalties. Therefore, it is important to carefully study the loan agreement and independently calculate the amounts.

Delays incurred during the period from the death of the father until six months are not paid by the heirs. In addition, the amount of debt cannot exceed the entire amount of the inheritance received.

Successors must remember that they will only have to pay the amount of the loan available at the time of the borrower’s death. All fines and penalties accrued by the credit institution after this point, during the period of searching for successors, the procedure for entering into inheritance rights, and filing an application for recognition of heirs, are not subject to accrual.

Unscrupulous financial institutions, having received information about the death of the loaned entity, deliberately postpone the process of creating requirements for repayment of the loan by the heir. During this period, they actively impose fines and charge interest. This situation does not require the successors to satisfy the amounts that were accepted during this time period.

Will insurance help in such cases?

Taking out insurance is a mandatory part of the procedure for lending to an individual. The health and life of the borrower are subject to insurance. This process is not mandatory, but many banks simply refuse to issue a loan due to lack of insurance.

If the person who received the borrowed funds has an insurance policy, upon his death, the insurance company makes payments according to the signed agreement in relation to the financial institution. The debt, with this outcome of the case, is paid off almost completely by insurance payments, which frees the heirs from such an obligation.

Not every insurance contract considers the death of the borrower to be an insured event.

The death of the testator caused by a disease when the insurer did not know about its presence leads to refusal of payments by the insurance company. In this case, the heir will have to pay with his own property.

Insured events do not include death from:

- immunodeficiency virus;

- drugs;

- alcoholic drinks;

- suicide, etc.

By studying the insurance contract, you can obtain reliable information about the presence of such exceptions. This procedure is very important for the successor, he must read the document before contacting the insurance company to pay for the death of the borrower.

Is it possible to refuse an inheritance with debts?

Entry into inheritance in the Russian Federation is regulated by the norms of a special section of legislative practice. Some people prefer not to receive the property they are entitled to at all, so as not to pay loan debts. Is it possible to refuse an inheritance?

You definitely won’t be able to hide from credit institutions. Employees of financial institutions are specifically engaged in obtaining information about the death of debtors and obtaining rights to inheritance by other entities. They turn to notaries to obtain information on inheritance and may file lawsuits.

There is only one way to avoid the need to pay the testator's loan debts - to completely refuse to receive all valuables, but before the expiration of the six-month period.

If this deadline is missed, it becomes necessary to seek help from the judicial system in order to recognize the refusal of the right to inherit.

You should not believe the promises of some lawyers who claim that you can avoid paying debts if the statute of limitations has expired.

If it is necessary to obtain a waiver of inheritance by a minor, mandatory notification of the guardianship authorities is required.

Each case requires individual consideration, calculations of the benefits acquired and the necessary expenses to pay off debts. For example, a person receives property worth about 500 thousand rubles, while loans need to be repaid for 700 thousand rubles. It is quite natural that such a situation implies refusal of inheritance.

To resolve possible problems, you should contact a notary in a timely manner, draw up the necessary documents and resolve all issues with a financial institution.

Credit by inheritance after death - are debts transferred, are they transferred, consumer, how not to pay, what to do

Heirs by law and will, even having received a certificate of property, often do not know about the existing loans of the deceased.

Notices of delinquency may arrive a year or two after death, with interest and penalties already accrued, the amount of which may exceed the amount of the principal debt many times over.

The statute of limitations (3 years) must be taken into account.

Accrued fines, penalties, and penalties must be within reasonable limits and can be reduced at the request of the debtor if there is reason to believe that there is abuse of rights and unjust enrichment.

Transfer of loan debts

The heirs and the guarantor must be responsible for the debts of the testator.

If the loan is secured by a guarantee, the bank will make a claim against this guarantor to fulfill the obligation.

The guarantor bears joint liability for the loan, i.e. the bank has the right to request that the money be given to the person who guaranteed that the obligation will be repaid in a timely manner.

What does the law say?

A loan by inheritance after death must be paid in accordance with the rules of Article 1175 of the Civil Code of the Russian Federation.

The heirs are obliged to repay the debt within the value of the property transferred to them.

If the loan was secured by collateral, then foreclosure on the property is carried out in the manner prescribed by Articles 334-356 of the Civil Code of the Russian Federation.

The procedure for concluding a guarantee agreement and liability for such a transaction is established by Articles 361-367 of the Civil Code of the Russian Federation.

Inheritance loan after death

- The loan obligations of the deceased owner must be divided among the heirs, according to their share of the property received.

- The shares of persons who received things as an inherited transmission or an obligatory part of the property are also taken into account.

- You can avoid paying the debts of a deceased borrower only by renouncing the inheritance from a notary - within 6 months after the death of the testator.

Does it pass?

You should pay attention to the provisions of Article 1175 of the Civil Code of the Russian Federation:

- if the heirs have registered ownership of the transferred property, then banks will attempt to foreclose on it as compensation for an overdue loan;

- the heir is liable to the bank only for the amount of the property received; the rest of the property of the successor remains inviolable.

Consumer

- The obligation to pay an overdue consumer loan also rests with the heirs or guarantors.

- If the money was issued on collateral, then the bank has the right to foreclose on it through the court or by agreeing with the heirs on the procedure for selling the pledged property.

- When a consumer loan was not secured by collateral and a guarantee, the bank searches for the heirs and demands that they repay the loan.

Mortgage

- The heirs are obliged to pay the mortgage loan instead of the deceased borrower if they do not want to lose the living space they received.

- According to Federal Law No. 102 “On Mortgages,” the owners of such an apartment may lose their real estate, even if it will be the only home of the heirs.

- The best solution is to continue paying the mortgage instead of the testator.

Nuances

The heirs are liable for debts only with the property transferred to them. To foreclose, it is necessary to establish its value.

The assessment of things carried out to pay the state fee for registering an inheritance with a notary is taken into account.

Some experts recommend not registering the transferred valuables before the expiration of the statute of limitations for repayment of the debt.

But such a trick does not guarantee that the bank will not find the heirs and present a claim to them, since it is assumed that the certificate has been drawn up and the successors have the opportunity to dispose of the received property.

Minor heir

If the child is under 14 years of age, then the parents (legal representatives) of the minor are responsible for all obligations.

From 14 to 18 years of age he has the right to:

- dispose of property (with the consent of parents and legal representatives);

- accept inheritance and pay off debts.

If there is a guarantor

The guarantor bears joint liability with the debtor for the loan.

This means that the bank has the right to make a claim against either one of the guarantors or several.

According to paragraph 4 of Article 367 of the Civil Code of the Russian Federation, the death of the debtor does not terminate the guarantee. Consequently, the bank has the right to demand the entire loan amount from the guarantor.

A person who has repaid the debts of the deceased has the opportunity to file a claim with the heirs and demand the return of the paid amounts through recourse.

Does insurance matter?

- The bank turns to the insurance company and receives compensation if the death of the debtor is recognized as an insured event.

- The borrower's life and health insurance contract defines a list of such situations.

- Insurance may not be paid if the borrower committed suicide or died from an exacerbated chronic disease.

- Then the credit institution will demand the debt from the guarantors or heirs.

Fines and interest

- The question of whether loan debts are inherited requires clarification of the situation with interest and fines.

- They must be paid in full by the heirs or guarantors.

- But the accrued penalty is not paid within 6 months after the opening of the inheritance.

New debtors have the right to demand in court that the amount of the fine be reduced to a reasonable limit.

The amounts already repaid and the remaining debt are taken into account.

Bank actions

The Bank has the right:

- search for heirs - independently or with the help of a notary;

- file a claim in court;

- If you win the case, contact the bailiffs to demand forced collection of the debt.

The credit institution can also sign a settlement agreement with the heirs or enter into a loan agreement on new terms.

What to do?

- Before accepting an inheritance, you should make sure that the amount of property received will be higher than the debts of the testator.

- If the amount of loan debt exceeds the inheritance estate, then lawyers recommend abandoning the property in favor of solvent persons.

- When the only home is inherited, the bank does not have the right to foreclose on it, but will have to pay the remaining portion of the loan.

Repayment procedure

It is provided for in the loan agreement.

The procedure can be determined in a court decision if the bank or heirs decide to protect their rights in this way.

Both the principal and accrued interest are paid.

Reducing the amount of payments

The amount of loan payments can only be reduced through the court. It is possible that the bank will overestimate the amount of commissions, penalties, and fines.

Necessary:

- study the loan agreement;

- Calculate all amounts yourself.

Payment is not subject to late payments made within 6 months after the death of the testator.

Is it possible not to pay?

In order not to fully repay the loan, you need to refuse the inheritance.

It will not be possible to not pay the transferred obligations at all, provided that the inheritance rights are properly formalized.

If the bank finds heirs, then there is a high probability that it will demand payment of the loan in full.

Disputes between banks and heirs regarding the testator's loan are not uncommon.

You should:

- carefully calculate the value of the transferred property;

- compare the amount received with the amount of debt;

- only then make a decision on inheritance.

In such situations, the help of a qualified specialist is desirable.