Inheritance by right of representation ensures special rights of certain categories of heirs and partially the will of the testator. The standard in inheritance cases involves a direct transfer of property rights from the testator to his successors. However, along this path, specific situations and the inclusion of unexpected heirs are acceptable.

Inheritance by right of representation: what is it?

This concept is similar to such guarantees in the Civil Code as transmission and sub-purpose. Therefore, it is important to understand what the right of representation in inheritance is in order to defend your legal positions. This is the appointment of a person to replace the failed primary heir (Article 1146 of the Civil Code of the Russian Federation).

The right of representation in inheritance is explained by the death of an heir appointed by will or identified legally (within the seven lines of successors claiming to inherit without a will).

Who does it apply to?

To put it simply, the blood heirs of the heir have the right to claim the role of deputy. Here the categories are defined more specifically than in transmission law.

The right of representation also differs from sub-appointment, since in this case there is clear specificity about the persons sub-appointed by the testator himself in the text of the testamentary disposition.

The right of representation within the framework of inheritance is transferred:

- grandchildren of the testator himself;

- nephews from relatives (not cousins, etc.) brothers and sisters;

- cousins.

In any inheritance, participants are obliged to comply with the status of worthy persons, not to trample on the rights of other applicants, not to refute the will of the testator and to comply with their obligations to him during his lifetime (for example, to pay alimony maintenance assigned by the court).

Otherwise, they may earn the status of unworthy through the court (1117 Civil Code of Russia). This means that the successors of a deceased heir who was unworthy do not inherit by right of representation.

This option is also excluded if a person, during his lifetime, initially did not have the right to inherit by will or by law.

Under what conditions is it permissible?

An important feature is the simultaneity of deaths, which serves as the basis for opening an inheritance (Article 1114 of the Civil Code).

This means the death of the testator and the original heir on or before the same day.

A significant aspect is the possibility of establishing the specific time of death of an heir from the first or other line or according to a will (before the opening of the inheritance, simultaneously with it).

Without a clear knowledge of the time, it is impossible to understand whether the death of the original heir occurred at the same time, before or after the discovery. With accurate information or lack thereof, it is possible to use another legal guarantor - transmission. That is, death without knowing the time automatically means that the incident occurred after the death of the testator

Order of succession

The standardized sequence of the mechanism of inheritance implies its discovery first. Up to this point, the inheritance has not yet occurred. After its formation, the applicants apply to the notary, and if there are claims (to the text of the will, persons involved in the case, etc.) - to the court to receive the inheritance.

Terms of inheritance

The period for accepting an inheritance for standard and those who have entered the path of inheritance in the order of representation of legal successors is six months. The countdown begins with the death of the testator. After this period, the notary issues papers for registering the property with Rosreestr. This period can be shortened in rare cases when the circle of inheritors is finally formed.

This period of inheritance can be extended on grounds defended by interested parties through the court. For example, this may be due to the expected soon expansion of the circle of applicants (the appearance of a newborn dependent) or a delay due to illness, lack of information about the opening and distribution of inheritance by right of representation.

Mandatory actions of successors

If the death of the heir occurs at the time of the death of the testator himself or occurs before that, then the replacement persons enter into rights simultaneously with the rest of the direct claimants.

The standard algorithm for inheritance actions when the right of representation arises:

- A visit to a notary (private practitioner or civil servant) and familiarization with a possible will.

- Writing an application to accept or renounce your share as part of the inheritance.

- Waiting for the end of the legally prescribed six-month deferment.

In the second paragraph, it should be added that the written expression of will is supported by a mandatory request for the issuance of a certificate of the right to inherit property. Providing such a document is mandatory for each new owner so that he can register the received property with the appropriate authorities, if this is required for the further use of the inheritance.

How is it different from hereditary transmission?

The main difference is the replacement of the deceased heir by his successors. Differences: the time of death of one of the original heirs and the determination of persons suitable to be the new successors.

The emergence of inheritance rights

The right of representation arises already at the time of the death of the primary heir, which his successors may not be aware of. After their notification, the declarative nature of inheritance works, taking into account the right of representation. This means that they turn to a notary to provide the necessary documents and begin to claim their share along with the direct heirs.

Grounds for recognition

The first basis for the entry of a new heir by right of representation will be proof of the death of the primary heir with confirmation of a family connection with him. The second basis is a statement of consent to inheritance by right of representation or by transmission with a request to issue a certificate.

Circle of heirs

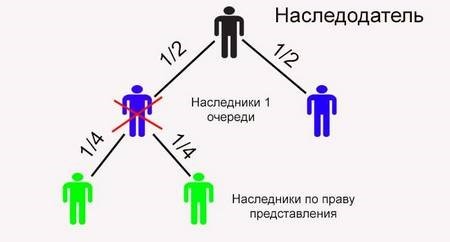

Heirs by right of representation may receive smaller shares than direct applicants, because one person or several citizens can inherit if applications are received from them. In this case, you will have to divide this share among yourself. The same is true with the transmission.

Different groups of heirs are connected here. By transmission, both those on the waiting list and the testamentary successors of the deceased heir can inherit. In this case, there are often persons whom the main testator did not know during his lifetime.

The circle of heirs by right of representation consists exclusively of representatives of the closest family branches (direct and parallel): grandchildren, nephews, cousins. Thus, the inheritance of the first person to die is distributed, with the right of representation, exclusively among blood relatives from different families.

Size of inherited shares

In both cases, the general rules of inheritance apply. The inheritance is divided equally between all relatives by right of representation, since they are in equal positions.

During transmission, the situation changes, which is associated with the possibility of using testamentary and legal standards for division.

Therefore, here the share of the fallen heir will be transferred in accordance with these regulations.

Time limits for taking possession of property

Actual possession of property by registering the right to it occurs after receiving a certificate of inheritance. It is issued by the notary after completing all the formalities and completing the mandatory waiting period (6 months), but by transmission, if the remaining period from the date of opening the case is less than 3 months, then it is extended to 3 months.

How is inheritance by right of representation formalized?

To enter into an inheritance by right of representation, there are rules for determining the notary and the further procedure for carrying out the procedure.

Choosing a notary

Since 2015, applicants for inheritance have the right to contact any notary representative at the place where the inheritance was opened. This is the last place of residence of the testator; in his absence, the location of the objects of his property that are of greatest importance.

Within the boundaries of one notarial district, it is allowed to choose any notary. There is no need to look for who other participants in the inheritance process contacted.

Required documents

With the right of representation, several more documents are added to the regular list, confirming that the applicant belongs to the inheritance case and the persons appearing in it.

List for heirs by right of representation:

- Passport of the applicant.

- Death certificate of the main testator

- Death certificate of the primary heir, whose place the new applicant wants to take.

- Documentary confirmation of family ties with these persons.

Presentation of the document under the second point is relevant if one applicant participated in the inheritance, who also died. Confirmation of the fact of death can be replaced by declaring a person dead through a court (if he previously had the status of missing in action for a long time and unsuccessful searches).

What are the owner's expenses?

In some cases, costs increase due to the need for additional procedures and proceedings within the framework of judicial practice.

Claims imply increased costs (standard inheritance by representation without litigation is cheaper).

Specific situations that arise during inheritance are also possible, for example, loss of documents for property by the primary owner and its restoration through government agencies.

Standard list of expenses for inheritance:

- Payment for notary services depends on their complex and individual pricing.

- State duty for issuing a certificate of inheritance upon presentation: 0.3 or 0.6% of the value of the property, where the minimum threshold is provided for immediate relatives, and the maximum for other applicants.

- State duty for registering property in Rosreestr: 2000 rubles. from civilians.

The prices for the services of each notary depend on the average prices in the region, therefore there is variability in tariffs across the Russian Federation.

Heirs by right of representation may need additional consultations, which are provided for a fee, as well as documentary support and notarial requests to various authorities, which is also accompanied by additional costs.

Inheritance by right of representation

Inheritance by right of representation: concept, essence, differences from general civil representation

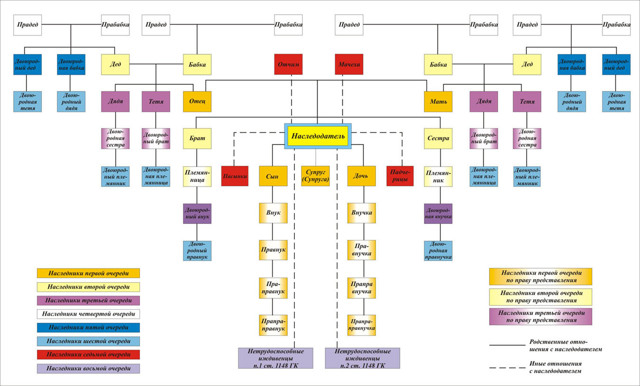

The legal category “inheritance by right of representation” entered notarial practice earlier than the texts of regulations. The circle of heirs by right of representation is clearly specified. It includes only the descendants of the heirs of the first three orders.

It is important to understand that hereditary representation has nothing to do with general civil representation in inheritance matters. Through a parent, guardian or representative by proxy, you can perform many legally significant actions:

- notify the notary about entering into an inheritance or refusing it;

- take part in legal proceedings regarding an inheritance dispute on the side of the plaintiff or defendant;

- register vehicles and real estate with property registration institutions.

General civil representation can only be lifetime. The death of the represented person automatically terminates:

- legal relations of legal representation;

- validity of the power of attorney.

Hereditary representation can only be posthumous. Its essence comes down to replacing the prematurely deceased primary heir in inheritance legal relations with one or more of his descendants. Thus, the rules on hereditary representation are intended to restore social justice.

Representation of inheritance mechanisms in the system

Inheritance by right of representation is an institution of inheritance by law. This is already clear from the arrangement of the articles regulating the mechanism of succession under consideration. Representation in the context of inheritance is mentioned four times in the Civil Code - in Articles 1142-1144, 1146. All of them refer to Chapter 63, devoted to the grounds of inheritance by law.

If the deceased disposed of all the assets during his lifetime, and after his death the legal successor under the will accepted them, the possibility of representation does not arise. When the person mentioned in the will does not live to see the opening of the inheritance, what is due to him is distributed among the legal heirs. Then inheritance by right of representation is possible.

Inheritance by right of representation (law, will, representation, transmission) has an independent character. Therefore, a situation cannot be ruled out when, by right of representation in the manner prescribed by law, a person who is also a successor under a will inherits.

Example: testator N. bequeathed a car to grandson V. He did not bequeath the home ownership to anyone. Of his close relatives, N. had two daughters, one of whom (V.’s mother) he outlived. Thus, in addition to the car bequeathed to him, B has the right to claim 1/2 of D.’s home ownership by way of representation.

Inheritance by right of representation: what it is, how it happens, examples

For the bulk of the population, the term “inheritance by right of representation” means nothing until the moment of distribution of the inheritance comes. Here everything changes dramatically. From the vocabulary of lawyers and notaries, the concept falls to the everyday level.

But ordinary citizens understand little about these issues. Let's try to explain in simple language what inheritance by right of representation means and when an atypical situation arises.

Along the way, let us clarify another concept, “hereditary transmission,” which is often confused with the first term.

What is inheritance by right of representation?

Stated in dry clerical language with a lot of legal terms, the articles of the Civil Code of Russia concerning inheritance by right of representation are difficult to understand without basic legal training. Therefore, we will transfer the main provisions of the Civil Code of the Russian Federation from the legal plane to the everyday one. Let us use a conditional example to explain what grandchildren by right of representation mean.

The right of representation (RP) is the ability of descendants to enter into an inheritance instead of their parents if they die before the person who left the inheritance. So, if the son of a deceased father died before him and left behind children, then, when the inheritance is distributed, the part of the property belonging to him will go to his children, who are the grandchildren of the testator (deceased grandfather).

We have inheritance by grandchildren by right of representation.

However, life is full of situations when there are no first-line heirs. In this case, the brothers and sisters of the deceased enter into the inheritance. If here too one of the brothers or sisters (let it be a brother) died earlier, leaving children, the nephews or nieces of the testator - the children of the deceased brother - enter into the inheritance by right of representation.

The PP also applies to relatives of the third line of inheritance. In this case, cousins can inherit.

Conditions of inheritance by right of representation

The provisions of the law on succession by right of representation apply under the following conditions:

- the death of the father or mother (direct heirs) occurred earlier or simultaneously with the death of the grandfather or grandmother (testators). This provision relates to the first stage of inheritance and is given to illustrate the use of the inheritance scheme by right of representation in practice;

- the deceased direct heir was not considered unworthy by the court;

- no will was left;

- the presence of family ties among all participants in the inheritance case, which is documented. This could be a marriage certificate, birth certificate, etc.;

- the deceased heir did not belong to the first line of inheritance, but there are no applicants from the highest ranking line ahead of him;

- the deceased heir did not receive his part of the inheritance in the form of a mandatory share.

Priority and order of distribution of shares

When distributing inheritance according to the law (when there is no will), 6 groups of relatives are formed at the legislative level who have the right to inherit. In this case, priority is given to the higher group.

So, if there is at least one applicant for the inheritance from the first line, the remaining relatives will not receive anything. Those in line for the second group can take part in the division of property only if there are no close relatives. For example, the deceased was not married and, therefore, did not have a wife or children, and his parents died earlier. And so on down the chain.

Only relatives of the first three orders can apply for inheritance by right of representation. From group I - grandchildren, from group II - nephews or nieces, from group III - cousins.

As in the case of the main line, members of the family more distantly related (nephews and nephews, cousins) cannot receive their share of the inheritance if there are grandchildren.

Providing the opportunity to participate in the distribution of inheritance by right of representation to relatives of the 4th-6th stage is not provided for by law.

You can only claim under the PP for that part of the inheritance that would go to the direct heir. It is this share that should be divided among grandchildren in the first place, nephews in the second, cousins in the third.

For example, after the death of the mother, an apartment remained. It must be divided among three sons, one of whom died earlier, leaving behind two grandchildren. According to the law, each son is entitled to 1/3 of the apartment (shared in equal shares). The grandchildren receive 1/3 of their father's share and divide it among themselves. Each person gets 1/6 of the apartment.

In what cases is representation not possible?

Life can be very unfair sometimes. This truth is especially often confirmed when it comes to inheritance by way of representation. This cannot be done in two cases:

- in law;

- judicially.

In law

Grandchildren have no right to claim inheritance in the following cases:

- the parent who received a share of the inheritance is alive;

- the parent died immediately after the opening of the inheritance;

- in the executed will, the main heir (the deceased father or mother) is deprived of inheritance.

A clarification is necessary here. For lawyers, there is a big difference between the fact that the heir is simply not indicated in the will - then there will be long litigation on the division of the inheritance, and the fact that the text contains specific instructions about the disinheritance of certain persons in the first line of inheritance. Such an order, without giving reasons, can be made by the testator when drawing up the document.

Judicially

Heirs and grandchildren by right of representation may also be deprived of their right of inheritance by a court decision. Such situations arise if it is proven that the direct heir before his death or the grandchildren during the period of the inheritance case became unworthy of the inheritance.

Such actions could be:

- failure to provide assistance to a deceased parent (testator), not necessarily financially;

- evasion of monetary payments for the maintenance of parents if they were awarded in court (the simplest case in judicial practice);

- the use of any type of violence, physical or psychological, on direct heirs in order for them to renounce their share in favor of third parties, i.e. the one who puts pressure.

Let's take a real life situation as an example. A single woman had two daughters who had a huge quarrel with each other, as a result of which one left the city. After some time, the daughter who remained with her mother also quarreled with her and stopped not only communicating with her, but also providing personal assistance. However, native blood always takes its toll.

At her mother’s request, her granddaughter began to look after her grandmother and support her financially. The daughter is dying. For several years, all the care for the grandmother falls on the shoulders of the granddaughter.

After the death of the woman, the daughter who left proved in court that her sister did not provide assistance to her mother, as a result of which she was legally deprived of the right to inherit, thereby breaking the chain of heirs by appointment.

The granddaughter received NOTHING. And by law she could have half of the property left from her grandmother.

The court interrupted the chain of inheritance by right of representation.

The court interrupted the chain of inheritance by right of representation.

Inheritance of a compulsory share by right of representation

The law outlines the circle of persons who must receive their share of the inheritance without fail:

- minor children of the testator;

- children, spouse and parents, if they are pensioners or disabled people of groups I-III.

Inheritance by right of representation

If the deceased heir has descendants, they receive the right to inherit in his place. This type of inheritance is called inheritance by right of representation. It allows descendants who do not belong to any of the queues to inherit property that their parents did not manage to accept.

All information about inheritance by right of representation, its concept, content and subjects is provided by civil legislation. Inheritance by right of representation is not a separate type, but a type of inheritance by law.

Not only when inheriting by law is it possible to inherit by right of representation, but also if the testator has executed a will.

If inheritance occurs through a direct line of kinship, then the right to represent deceased heirs applies without restrictions on the degree of kinship.

The heirs by nomination are not on equal terms with the legal heirs. They can only inherit the share that would have been due to the deceased heir. If there are several such heirs, the share is divided between them proportionally.

The order of inheritance by right of representation

According to the procedure for inheritance by right of representation described in legislation, it is similar to the procedure for accepting inheritance in the general manner. A prerequisite is to declare your desire to exercise the rights granted by law. To do this, you should visit a notary with the necessary package of documents:

- passport and birth certificate;

- death certificate of the testator;

- document confirming relationship.

Based on the submitted application and provided documents, the notary will establish the right to representation, enter this information into the inheritance file and issue a certificate. From this moment on, the heir can begin to formalize his rights.

Features of inheritance by right of representation

A distinctive feature of inheritance by right of representation is that this type of inheritance is possible under the following conditions:

- It is possible to inherit by nomination only if the heir has died. If he is alive, but for one reason or another does not apply for registration of inheritance, it is impossible to inherit by representation;

- the succession line to which the deceased heir belongs must be called to inherit. Children can inherit after their parents only if the parents would have been called to inherit if they were still alive;

- the right to represent an heir must not be revoked by a will. If the testator does not want the heirs by nomination to receive the inheritance, he can limit their rights in the will. In this case, the right to inherit will pass to the next line of inheritance according to the law or to those persons whom he indicates in the will;

- the heir should not have lost his right to inherit during his lifetime, i.e. should not be excluded from inheritance.

Subjects of inheritance by right of representation

Subjects of inheritance by right of representation according to the Civil Code of the Russian Federation (Articles 1142-1144) may be:

- grandchildren and their descendants;

- nephews and nieces;

- cousins.

The descendants of the heir who did not have the right to inherit if he were alive cannot exercise the right of representation. For example, he was deprived of his rights or declared unworthy or deprived of such rights by the testator himself in the will (Article 1117 of the Civil Code of the Russian Federation). In other words, the provisions of the law on unworthy heirs also apply to the right of representation.

Order of succession by right of representation

It should be noted that the order of succession by right of representation is preserved. Which relatives of the deceased heir can expect to receive an inheritance depends on which line the deceased heir belonged to. Inheritance rights are transferred in accordance with the following order:

- the testator's grandchildren can inherit the share that could belong to the heirs of the first priority of inheritance by right of representation, which include spouses after each other, parents and children;

- the share of the heirs belonging to the second line of inheritance by right of representation, which includes brothers and sisters, goes to the nephews;

- representatives of the third line of inheritance by right of representation, which are uncles and aunts, passes to the cousins of the deceased.

The law does not provide other queues with the opportunity to use the right of representation.

It is possible not only to inherit from a grandson by right of representation, but also from a great-grandson (if we are talking about the 1st degree), a great-nephew (in the 2nd degree), and a second cousin (in the 3rd degree). At the same time, the share that they will receive in the property will not change and will be distributed in accordance with the priority.

Inheritance of a compulsory share by right of representation

The law grants the right to an obligatory share to those heirs whose inheritance rights are infringed for one reason or another. This right is personal and cannot be inherited. It can be implemented even against the will of the testator and does not require the consent of other heirs.

The persons who have the right to receive the obligatory share are clearly established by law. Heirs who have the right to inherit by nomination are not considered mandatory. In other words, it is impossible to inherit an obligatory share by right of representation. The heir must determine for himself which right is more profitable for him to use.

When inheriting by right of representation, the period allotted for accepting the inheritance does not differ from the terms of inheritance under the usual procedure and is six months from the date of death of the testator.

If the period determined by law expires, it will be considered missed and subject to restoration only in court.

Inheritance by right of representation and hereditary transmission

Inheritance by right of representation and hereditary transmission refer to the norms that ensure the transfer of inheritance rights from persons who are “failed” heirs to their legal successors.

Hereditary transmission consists of ensuring the right of hereditary successors who are called to inheritance and receive the right to accept the opened inheritance, instead of deceased heirs who were unable to accept the opened inheritance.

If an heir, called by will or by law, dies after the inheritance has opened and does not have time to accept it, the right to accept the inheritance that was due to him will pass to the heirs by law. If the estate was bequeathed, then the inheritance goes to the heirs specified in the will (Article 1156 of the Civil Code of the Russian Federation).

However, inheritance by right of representation and hereditary transmission do not apply when it comes to the acceptance by the heir of a mandatory share. The obligatory share cannot pass to the heirs through hereditary transmission.

To accept an inheritance through hereditary transmission, the general procedure for accepting an inheritance is applied, as in the case of the main inheritance.

However, due to the fact that the registration of the right to two independent inheritances is being considered, their acceptance must be formalized by two independent acts.

Thus, the fundamental difference between transmission and presentation is that transmission can only occur after the opening of the inheritance (i.e. after the death of the testator).

Transmission will not occur if the heir died without having time to formalize the inheritance. The transmission will not be applied even if the heir missed the deadline for entering into the inheritance and did not apply to the court for its restoration.

If a claim is filed, but a decision was not made to the heirs during their lifetime, his heirs can become legal successors and receive the inheritance if the court restores the missed deadline.

Inheritance by right of representation

The right of representation is a special type of inheritance, which provides for a special mechanism for calling upon legal successors determined by law. So, according to Art. 1146 of the Civil Code, inheritance in this manner involves receiving the share of an heir whose death occurred before the death of the testator or simultaneously with him.

Remarkably, the provision applies only to the principal deceased successors at law who would have been called to inherit if they were alive, and applies only to their legal successors, subject to the principle of priority.

https://www.youtube.com/watch?v=04Ikijp0BS4

Not all successors of the deceased main heirs by law can take advantage of the opportunity to represent, but only the descendants of representatives of the first three lines of inheritance.

So, according to paragraph 1 of Art. 1146 of the Civil Code, only the grandchildren of the testator and their descendants (clause 2 of Article 1142 of the Civil Code), nephews (clause 2 of Article 1143 of the Civil Code), as well as cousins (clause 2 of Article 1144 of the Civil Code) can have the right of representation.

These descendants inherit property within the line in which their deceased ancestor was called. In this case, the share of the inheritance due to them will be equal to that which the deceased ancestor could count on, and in the case of calling several successors by nomination, the specified share will be divided equally .

Due to the absence of other heirs, after the death of N, his only legal heirs were his two siblings, as well as his maternal sister, who, however, died with him in a fire.

In addition, during the investigation of the fire, it turned out that its instigator was one of N’s siblings, for which reason, after the court passed a guilty verdict, according to Art. 1117 of the Civil Code, he was an unworthy heir and could not be called to inherit.

N’s maternal sister had two sons – N’s nephews. Due to the fact that their mother died along with N, according to Art. 1146 Civil Code, clause 2, art. 1143 of the Civil Code, the right to inherit for N passed by right of representation to them. Based on this and paragraph 1 of Art. 1141 of the Civil Code, brother N received 1/2 of his inheritance, and the nephews divided the share due to their mother and received 1/4 of each.

This rule, however, does not apply to the obligatory share of the inheritance (Article 1149 of the Civil Code), since the circle of persons claiming it is exhaustively defined.

In addition, inheritance by right of representation is permissible if all of the following conditions are met:

- The deceased main successor must belong to the line that provides for representation and which, in a particular situation, is called upon to inherit . Since inheritance in this order also requires compliance with the principle of priority, the heir by right of representation, who belongs to the representatives of the second priority, will not be able to inherit if there are successors of the first priority.

- The death of the main successor must occur before the death of the testator or simultaneously with him , but in any case before the opening of the inheritance. If the heir died after the opening of the inheritance, then only hereditary transmission can be used (Article 1156 of the Civil Code).

- The deceased main successor should not be deprived of inheritance by will (Article 1119 of the Civil Code) or due to recognition of his unworthiness (Article 1117 of the Civil Code). If these facts occur, inheritance by representation is impossible (clauses 2, 3 of Article 1146 of the Civil Code). This condition also applies to the descendants of the main legal successor.

- Part of the estate or all of it remains untested and can be inherited by law. If there is no property that is subject to inheritance by law, the right of representation does not apply .

Persons who inherit by nomination, in this case, act as legal successors not to the main heir whom they represent, but rather to the original testator .

Thus, inheritance rights are transferred to them only due to the use of a special method of calling to inheritance, and not in the order of succession to the main successor.

Moreover, it seems quite realistic that such successors inherit by nomination instead of the main heir, but do not receive his inheritance, since it is bequeathed to other persons.

The order of inheritance by right of representation

As is known, inheritance by right of representation is not carried out on equal terms with other successors called by law - regardless of the number of successors called in a special order, they inherit only that part of the inheritance that was intended for the successor they represent . Since these heirs receive property by right that belongs to them, and not by that which belongs to their deceased ancestor, then in all other respects, the order of inheritance by them is not much different from inheritance in the generally accepted mode .

Since the right to inheritance of such successors arises in the general manner - at the time of opening of the inheritance, the period during which it is necessary to go through the entire procedure is six months from the moment of opening of the inheritance (Article 1154 of the Civil Code). Within this period, potential assignees must take the following steps:

- Collection of documents . To certify inheritance rights at the request of the successor, the notary will need a number of documents confirming their availability. It is noteworthy that documents can also be submitted by other heirs; in this case, to exercise the right of representation, it will be enough to submit only an application to the notary.

- Submitting an application to a notary to accept an inheritance or to issue a certificate of title to it . One of these applications, submitted to any notary at the place of opening of the inheritance (Article 1115 of the Civil Code), will indicate the will of the successor to accept part of the inheritance mass. All necessary documents are submitted along with this application. If one of the heirs has already submitted such an application, all others claiming the inheritance must apply to the same notary (subject to the correct determination of the place of opening).

- Payment of state duty . According to Art. 333.24 of the Tax Code, for issuing a certificate of the right to inheritance, a notary collects a state fee, the amount of which for close relatives is 0.3% (not more than 100 thousand rubles) and for all other heirs - 0.6% (not more than 1 million rubles) from the value of the share of property received by the applicant.

- Obtaining a certificate of inheritance . The specified certificate is issued to successors by right of representation both before and after the expiration of the six-month period for accepting the inheritance, depending on the presence of other heirs (Article 1163 of the Civil Code).

Differences between the right of representation and hereditary transmission

According to Art. 1156 of the Civil Code, hereditary transmission is the transfer of the rights of a person called to inherit, but who died after the opening of the inheritance and did not have time to accept it, to his legal successors under the law or, if he left a will, to his successors under the will. The essence of this procedure is to call for inheritance the successors of a previously called heir, but who died without having time to accept the property due to him.

The hereditary transmission, like the right of representation, does not transfer to the obligatory share due to the deceased heir (clause 3 of Article 1156 of the Civil Code). Similarly, the rights transferred within the framework of the transmission are not part of the hereditary mass of the deceased transmitter (clause 1 of Article 1156 of the Civil Code). They are implemented by the legal successors of the deceased heir on a general basis and equally (in the case of transmission by law).

However, both of these procedures have a fairly large number of differences, which it is advisable to consider in more detail, in particular:

- The moment of emergence of inheritance rights . The right to represent a deceased heir arises from his descendants before the opening of the inheritance, since he dies before the testator, while hereditary transmission is carried out after the opening of the inheritance and only in relation to those called to inherit, but who did not have time to accept it.

- Grounds for calling . Inheritance representation extends exclusively to deceased heirs by law. Transmission applies not only to legal successors, but also to those to whom the deceased testator bequeathed something (clause 1 of Article 1156 of the Civil Code). Thus, the bequeathed part of the property can also pass to the heirs of the deceased by transmission.

- Circle of those called for inheritance . Hereditary representation can be applied only in the event of the death of a successor who is among the representatives of the first three lines of inheritance by law, and only in relation to their descendants directly specified in the law (clause 1 of Article 1146 of the Civil Code). Regarding the transmission, any circle of subjects to which its use is permissible is not strictly defined . Thus, it always applies regardless of the order of the called and deceased successor, and also regardless of the basis of inheritance by his legal successors.

- The size of the shares received in the inheritance . In both cases of transfer of inheritance rights by law, both during presentation and during transmission, the successors of the deceased heir share the share due to him equally. However, if the deceased successor leaves a will, the parts of the inheritance due to him are divided among his successors, taking into account the distribution of his inheritance between them according to the will, which may not divide the shares equally.

- Deadline for accepting inheritance . Within the framework of inheritance representation, a general six-month period is applied from the moment of opening of the inheritance to formalize one’s inheritance rights (Article 1154 of the Civil Code). For transmission, special periods are provided, the duration of which begins from the moment the inheritance is opened, and even before the heirs of the deceased legal successor have the right to transmission. However, if the remaining part of the period for accepting the inheritance after the main successor is less than three months, it is extended exactly until such a period (clause 2 of Article 1156 of the Civil Code).

Registration of inheritance by right of representation

As already indicated, receipt of inherited property upon presentation is formalized in the general manner , within the six-month period provided for in Art. 1154 of the Civil Code, by submitting to a notary or an official authorized to issue the relevant certificate an application and the necessary documents required by him for registration.

Any private or public notary operating in the district at the place where the inheritance was opened can register such

When registering an inheritance in relation to representatives of a deceased successor, a notary opens an inheritance case .

Within its framework, he requires and keeps records of documents received from potential heirs, gives them explanations and advises them on issues of interest, searches for and notifies other successors and interested parties, takes measures to protect the inheritance, makes decisions, issues the necessary certificates, etc.

To register an inheritance by representation, the successor will need to submit the following documents :

- Passport.

- Documents confirming the death of the testator, such as a death certificate.

- Documents confirming the relationship of the deceased heir to the testator.

- Documents confirming that the successor is a descendant of the deceased heir and has the right to represent him.

- Certificate of residence from the last place of residence.

- Documents confirming the location of the inherited property.

- An appraisal report or any other documents confirming the value of the inherited property.

- Title documents, etc.

Please note that registration of inheritance inevitably entails some expenses on the part of the applicant.

Thus, his expenses will consist of the cost of assessing the inherited property ; the cost of legal and technical services provided by a notary (drawing up applications, certificates and other documents, their production, copying documents, consultations, etc.) and the cost of which is set by him independently; cost of state duty .

After submitting all documents and paying all expenses, the heir can only wait for the expiration of the deadline for accepting the inheritance (Article 1154 of the Civil Code). Only after its expiration, according to Art. 1163 of the Civil Code, the applicant can receive a certificate of the right to inheritance, which ends the registration of inheritance .

Having received the specified certificate, on its basis, the successor can transfer the inherited property to himself.