Last update: 29.06.2018

Question:

I want to sell my apartment in the new building.

Answer:........................................................

Sell the apartment in the new building.It's a lot easier than doing the same thing in the secondary housing market.

'Cause the apartment's in the new building.No legal historyAnd there's no need to collect and check a lot of documents, looking into ownership and ownership rights, it's a primary market, neither of which is here.

There's only one.claimsAnd even if the house is actually built and handed over to the State Commission, it can only be sold on the basis of an act of reception-transfer.Treaty of assignment of rights of claim.

Why is it that before the adoption act is signed, and not before the property is issued? Because once the property is handed over to the donor (under the Act), the developer formally fulfils his obligations under the contract, and the debtor is lost.right of claimto him.

If the landlord has already accepted an apartment under the Act, but the ownership of the apartment has not yet been granted (which may extend for several months), it is in some form of suspension.

Rights of claimHe doesn't have any.Property rightsNot yet, and in this condition the donor is legally entitled to sell the apartment only under the Preliminary Sales Contract.

But buyers are very reluctant to give money to this type of contract, so flats in new buildings are sold either before the adoption act is signed.Treaty of assignment of rights of claimor after obtaining title to property - by customary lawSales contract.

How to accept a developer's apartment is a basic rule.

How do you sell an apartment on a trade-off?

Let us be clear that this is only a matter of transfer of the right under the Treaty of Share-taking (LDA). Although it is possible to assign rights under other types of contract with the Developer, only these contracts are already covered by the grey schemes for the purchase of the new building, under the law, Devolper can only raise citizens ' funds for the construction of multi-family housing under the DDS, in accordance with the law of the FZ-214.

Article 11 of the Act (FZ-214) provides for the right of the debtor to withdraw from the project by assignment (transfer) of the right of claim under the DDS.

Which means that the donor has the right to sell histhe right to an apartmentIn the new structure, any person, regardless of the developer ' s consent (unless otherwise stipulated in the DDU ' s contract with the Developer).

But there is one reservation: if the developer has not yet paid the full amount for the apartment, his consent is already required.

And, together with the transfer of rights of claim, the transfer of the debt to the new debtor takes place at the same time.

A deposit or advance – What form of prepayment is used in sales transactions for apartments?Look at the link in the Glossary.

The process of selling an apartment in a new building on assignment of rights of claimIt can be reduced to several main stages. To this end, the contributor will need to:

- Determine the price of the sale of the dwelling;

- Place advertisements for sales;

- Show the buyer the apartment if it has already been completed;

- Provide the buyer with a proof of payment to the developer for the DAD and payments to be made to the buyer;

- Agree on the terms of the calculation;

- Prepare and sign the Treaty of Assignment of Claims;

- Register the Treaty of Assignment in Rosreister.

Let's go over these points a little bit further.

When does the apartment count as the common property of the spouses, and when does it not count?Look at the Glossary by reference.

Determine withat the price of the sale of the dwellingIn fact, the builder has already done it for us, and it's his current price level for apartments in this house that we're taking as a basis.

Since a number of flats are sold on the same terms and condition in our new building, we are unlikely to be able to improvise at the same cost.

So we just adjust to the builder's price level for similar apartments in the house and, depending on the desired sales rate, we can add or remove 2 to 3 percent of the builder's price.

ForAdvertisement of your apartmentThere's enough Internet today.

How to write and where to place an ad for the sale of an apartment is described in detail in our paper.HEAVY INSTRUCTIONon the relevantstep.

In this case, the principle of advertising an apartment on the primary market is not very different from that on the secondary market, and the buyer already has an idea of the house and the apartments in it, thanks to the developer ' s advertising.

If the developer still has active sales in this house, you can ask him for sales and our apartment along with the others, which may speed up sales, but you will have to accept the loss of some money for sales services.

Where is the husband's consent required for the sale of the apartment, and when is the consent not required?Look at the Glossary by reference.

If the house is completed and the apartment is suitable forInspectionsWe don't hesitate to take a little tour for the buyer, but we'd better make sure it's clean and light inside the premises.

CdocumentsIt's simple. Showing the buyer ours.Share-sharing agreement (DSU)All payments made under this contract are confirmed by the payment statements (the buyer may also request a certificate of reconciliation of payments from the developer).

This is where we add the bank's consent to the assignment of rights (if we bought this apartment as a mortgage), and above it is the notarized consent of the wife to the assignment (if we have the joint property of the spouses).

Next, we notify the developer of our intention to sell the property on a transfer of rights. If, under the terms of our DDS with the Developer, his written consent to the assignment is specified there, he may demand a certain amount of money for it. He will have to give it. Everything here is legal.

If he bought a DUD apartment before the marriage and the property was already in marriage, would the apartment be the common property of the spouses?

The next step is to negotiate with the Buyer the terms and conditions for the transfer of money for an apartment (for details on how to settle transactions – see the reference in the Glossary).

After that, write and sign it.Contract of assignmentFor details on the composition, nuances and terms of the contract of assignment of the right to an apartment (including its model), see the reference.

This concludes the sale of the apartment in the new building.Certificate of reception/transfer of dwellingThe new stockmaker will sign with the Developer without our involvement.

And what's nice for us is that all the problems that followed with the reception of the apartment, with the issuance of property rights, and so on, the buyer will decide with the Developer as well, not with us.

That's why we gave him everything.claims.

We're just gonna have to pick up the reservation money for the apartment after the registration.Contracts of assignment.

How and where to file documents for the registration of the dwelling transaction?- look at the Glossary by reference.

When's the best time to sell a new building?

From that.Exactly when.We're gonna sell our rights to the apartment in the new building, it's gonna depend on it, andprice...................................................................Of course, our price will have to keep pace with the current prices set by the developer in the same house, but you have to understand that the builder's prices also depend on when the apartments are sold. What does this have to do with the current price?

First of all, the price will be determinedReadiness stageThe lowest price is in the early stages of construction, the highest after the house is put into service.

In addition, the price is influenced byseasonality of the real estate marketandmacroeconomic factors of the economy. High seasons (i.e. high seasons)....................................................................................

Time from mid-September to mid-December (after summer holidays to New Year's holidays) and from February to May's holidays are traditionally considered to be periods of increasing demand.

With regard to macroeconomic factors (exchange-rate swings, structural problems in the financial or construction industries, etc.), there is a need to rely on current market analysis and price trends in the planning of sales.

When you sell an apartment, don't write too much in the paperwork.- look at the link.

How do you sell a flat in a new building without a tax?

BContract of assignment of claim rightsWe will indicate the amount for which we assign these rights to the buyer.Tax amountFrom the sale of our apartment in the new building.

The Physician Income Tax (NDFL) arises here if it is receivedIncome from variancesAnd 13% of the difference we're obliged to give to the state, but if the sum of the sale (the transfer of rights) turns out by some miracle to be equal to the amount for which we bought this apartment from the developer earlier, then the tax base is zero.

For more details on taxes and tax deductions for the sale of apartments (with examples of calculations), see the reference in the Glossary.

You want to have an experienced counselor at your disposal when you buy an apartment?The services of specialized real estate lawyers are here.

A detailed action algorithm for the purchase and sale of an apartment is presented in the interactive map of the RUSSIAN INSTRUCTION(will be opened in the pop-up window).

How to sell an apartment in a new building on a trade-off: underwater stones and tricks

Image source: Laurie Photo Bank

You can sell an apartment in a new building for a variety of reasons: someone bought an investment dwelling and plans to return the investment, someone just changes their life circumstances, but if the house is still being built, that is.

The house has not been put into service, so the procedure will be one: sale of the property on a transfer of rights. This type of transaction itself has long been worked out in the market, but this does not mean that it will be easy to sell its real estate.

Ru asked the experts to explain what difficulties the private seller was facing, and most importantly, how to deal with them.

Private vendors put the deal on hold until the best of times.

Today, the sale of an apartment in a rights-as-you-go house is quite common because, as explained,Irina Goodytov, Chairman of the Board of DirectorsBEST Novostroi, The strategy for investing in the new building is short (18-24 months). "The usual time required is to build a house with a construction schedule, and the most appropriate is to sell at the completion stage, but before the house is put into service and ownership rights," said the expert.

However, experts are currently observing a decline in private-to-private sales in the primary real estate market. "This is due to two reasons," they say.Maria Litenetska, managing partner"Metrium Group".

First, the investors themselves are not ready to leave the project because at the real estate investment stage they were hoping for greater profits, and now such sellers have simply postponed the deal "to the best of times."

Secondly, the demand for a place of assignment is not high today, and because such a form of purchase involves mainly a one-time payment, and today customers able to pay the full amount at once are particularly difficult to find," the expert said.

Theory and practice

There are several aspects of the transfer transaction in the new building: legal, economic, and market.

It's simple enough with the first one, as they say.Vasilia Sharapova, Lawyer of the Development Company"The situationXXIfor the twenty-first century"the legal risks of the seller in such a transaction are minimal.

Usually the buyer bears the bulk of the legal risk of assignment, i.e. the new equity investor that will take the place of the former equity investor in the contract with the developer.

The key risk to the seller isDelay in payment of the buyer ' s claimThis risk can be reduced through a mechanism of bank cells as well as bank letters of credit.

The latter explains to Vasily Sharapov that the buyer deposits the money due to the seller in a special credit account with the bank.

The seller shall have access to these funds once the registered supplementary agreement to the DDS to transfer the claim to the new equity investor has been submitted to the bank holder of the letter of credit account.

The only downside of this arrangement is that the bank takes a decent commission for this service – 1% or even more of the money – the expert notes, so where this is legal, the parties to the transaction can settle in cash by renting a bank cell – it's also reliable and substantially cheaper than a letter of credit.

Don't forget the income tax on the sale of property.

"If the assignment of the right to an apartment takes place at an increase in value, the seller is obliged to pay NPFL 13% of the price difference," says attention.Maria Litenetska, managing partner of the Metroum Group.

For example, the landlord bought housing for 5 million rubles and sells for 7 million rubles. He has to pay the government a tax of 2 million rubles, or 260,000 rubles. So many sellers are undervalued. The question is, is the buyer willing to make such concessions?"

However, the main difficulty of a trading transaction in a new house gives it a market dimension.

According toSvetlana Condakovova, managing partner, Director GeneralUrban Realtyone of the biggest problems they've ever had.The non-conformity of expectations with the real market value of real estate.

Over the past two years, housing prices in the Moscow region have fallen by an average of 10-15 per cent in the ruble equivalent, and the number of people wishing to sell "transferable" apartments has increased significantly.

At the same time, the proposals of the developer are much more attractive both at the price and on the various equity programmes and on the variety of schemes for financing new structures for buyers.In such circumstances, rights sellers are forced either to reduce prices severely or to withdraw their apartments from the market.

On the theme:All of New Moscow's new constructions are in one convenient catalogue of relevant prices.

The "best time to sell a flat"

When should we sell an apartment on a change of rights? How can we find the right moment? And should we leave the project today if there is no pressing need for life? Experts say that there can be no explicit recommendation here because it depends on the individual investment strategy, the state of the market, the growth of prices in the new structure and the life situation of the seller.

In general, the most advantageous period for assignment of housing claims is –When the house is almost ready but not yet owned, i.e. after major price increases, says.....................................................................Maria LitienskyThe "Metrium Group".

"In this case, the investor can count onRates of returnfrom:........................................................25-30% and higher if the project is liquidThe fact is that, once the apartments have been converted into ownership, most investors tend to be active in placing offers on the market.

Because of the high level of competition, many of them end up having to lower prices, so it is better to deal with the assignment of claims before then," the expert explains.

New SAO buildings: Moscow ice and flame of 2.9 million rubles

How to sell an apartment in a new building on a change of rights.

Let's say all the questions about whether to sell an apartment in a new building on a transfer of rights have been clarified, and then the strategy needs to be worked out, and the first interesting point here is,Where do you think you're going to find a buyer for a place like this?

"The trade market is very difficult and complicated," she says.Svetlana CondačkovaUrban Realty). In the face of the developer's proposals, a natural person who offers his uninformed property seems unconvincing.

There's not much chance of selling these apartments on your own.

Either the developer's sales department should be contacted if it has a dedicated "transfer" unit or specialized real estate companies that carry out such projects on behalf of the developer himself," the expert advises.

Because a private seller has to compete not only with other sellers but also with a developer, the question arises –What should be the price of the developer?

Vladimir Kasirtsev, CEO of the company"Gillia code", Recommends starting with an analysis of the value of the flats installed at the site by the developer. "The cost should be set at 50 to 100,000 roubles below. A lower-priced dwelling, against the background of the standard prices of the developer, will attract the attention of a potential buyer more quickly."

Maria Litenetska (Metrium Group)The price tag will depend on several factors at once. "First, on how quickly an asset needs to be sold, the cost of an apartment will be lower on an urgent sale. Second, the price of an entry: if an investor bought an apartment at the start of the sale, the amount of the discount may be larger.

And third, from how many similar apartments are sold by the developer.If, for example, an investor sells a liquid "one" that the developer no longer has, the price may not be lower, but it may be slightly higher.

On average, however, the prices of investment apartments tend to be cheaper than those offered by the developer by 5-10 per cent."

On the theme: A convenient search for apartments in the new buildings of Underwater.

How do you negotiate with the developer himself (the transaction always takes place with the latter's consent)?

"As usual, the developer agrees to the deal,Vasily SharapovXXIfor the twenty-first century).

However, he may charge a separate commission by agreement of the parties to the transaction for the provision of legal or other services related to the transition of the law to a new investor.

Its size and availability as such depends on the policy of the particular developer and the actual arrangements between the parties to the transaction and the developer."

Does the developer always agree, and does he not have any special conditions that must be accepted by the seller of the apartment in the building house?

According toSvetlana CondačkovyUrbanRealty)If the contract involves obtaining the consent of the developer for the assignment, the only difficulty that may arise is the timing of the negotiation of the transaction; in order not to sink into the complexity and wisdom of all the processes, the expert recommends that the preparation and conduct of the transaction be entrusted to specialists.

Vasily SharapovXXIfor the twenty-first century)Also indicates that the agreement of the developer depends to a large extent on whether the equity investor ' s debt to the developer has been repaid by 100 per cent or is in arrears.

If the apartment is not fully paid, the developer will look closely at the financial viability of the new equity investor and, if he finds any flaws, he may refuse the transaction.

"The case is that, under the legal rules, claims should be transferred to a new equity investor with a transfer of the debt to pay the remaining unpaid equity investors to the developer," the expert says.

Therefore, for the developer, the ability of the new debtor to meet its equity obligations is important, in which case the developer may ask the new equity investor to repay the former equity investor's debt in advance to the developer in exchange for his agreement to transfer the right to the developer."

So, despite a number of difficulties, the assignment of claims in a new building is quite common today, and the most important thing is to pick a good moment for a deal, which is already dependent on the specific situation at the site, the investment strategy, and the seller's life circumstances.

PortalMetrPryce.ru.I wish you a good deal!

What must be specified in the equity agreement?

Second hand

What's the deal and what's to be feared when you buy housing that's under construction from someone who's not a developer, in short cards.

Photo by Alexander Tarasenkov/Interpress/TASS

The purchase of housing in a house under construction does not necessarily imply that a transaction can be made directly with the developer; the sale of apartments in new buildings by other legal entities, as well as by the first shareholders, is a very common practice; in fact, they do not sell the apartments themselves, but change their rights to them.

Short cards describe how such transactions are made, their characteristics and risks.

Transfer of rightsWhat kind of deal is this?

The transfer of rights is a purchase transaction at an unconstructed apartment house that was previously purchased from the developer. "Simplicitly, it is the replacement of one subscriber for another in the multi-family building contract," explains the head of sales department of the "Incom Real Estate" New Buildings Department, Valery Cochetkov.

The fact is that in the building house, the object itself (the apartment) does not yet exist physically and does not have an accurate postal address.

There is only a right to share in the contract and this right can be transferred to another person.

In fact, the original debtor transfers to the buyer the right of the developer to transfer the apartment after completion of the construction and other rights and obligations under the DDU.

VendorsWho usually sells unconstructed housing

First, wholesale investors are typically legal entities that have purchased several dozen apartments under the DDS.

Second, the vendors are contracting organizations, and the developer has paid them for their work in square metres, and they need to convert them into money.

- Third, these are private investors (individuals) who also profit from the sale of an almost finished apartment purchased at the minimum price at the boiler stage.

- The fourth type of salesman in a normal living situation: for example, it was possible to buy a larger apartment or a different area while the house was under construction.

- "It is not uncommon for people to first buy a one-room apartment, then, as the price rises by the time the house is handed over, it will shift to the same project, but in the next round, they will buy an already larger flat at the start-up price," notes the chairman of the Board of Directors of Best Novostroy, Irina Goodhotov.

DeveloperDo you need his permission?

Many developers have been charging the commission for the authorization (consent) for the assignment.

This paragraph is regulated by the DDS itself: if the contract of equity is made subject to the condition that the agreement of the developer is required for the assignment, it will have to be fulfilled. "The Commission's measurement may be fixed (30-60,000 roubles).

"The head of the consulting company, TOP Ideas Oleg Stupenkov, explains: "The head of the consulting company, Oleg Stupenkov, and the head of the consulting company, Oleg Stupenkov, and the head of the consulting company, Oleg Stupenkov, and the head of the consulting company, Oleg Stupenkov.

Moreover, the developer may even impose a ban on the sale of an apartment on the basis of a trade-off, so that the first shareholders do not enter the market on a mass basis with offers of resale, but if there is no prohibition on assignment in the DDU, the new developer will only have to notify the developer after the transaction, attaching a copy of the registered contract and his contacts to the letter.

CommissionWhy are the construction companies taking it?

In this way, they try to regulate the behaviour of investors who bought a pool of flats on a boiler to prevent the sale of large amounts at lower prices than he owns. Investment apartments are often 5-10% lower than those set by the developer for similar dwellings.

"There are projects in which concessions play no role at all and have no impact on the rate of realization by the developer," said Oleg Stupenkov. "In most cases they are large housing complexes with a high sales rate, but in point projects where the sales plan of the developer per month is not more than 1,000 square metres, the loss of benefits will already be significant."

Buyer.................................................................What's he doing for a purchase like this?

The benefit of buying an apartment on a change of rights is that you can buy an apartment in a house under construction cheaper than the developer himself, who regularly carries out planned price increases as the facility prepares; moreover, if the bulk of the apartments in the facility concerned have already been sold, it is likely that an interesting option can be purchased through a trade-off from the original payers.

LimitationsWhat prevents the conclusion of such a transaction

A contract of transfer of rights can only be concluded within a certain period of time: from the time of State registration of the contract of equity participation (LDA) to the signing of the transfer document between the donor and the developer; once the apartment has been issued, the contract of sale is already in place.

The debtor cannot overturn the claim under the DUD if he has not yet paid for the contract. "This may be the case, for example, if the apartment was purchased in instalments," says the manager of the Metrium partner, Maria Litenetska.

In this case, replacement of the debtor is possible only with the agreement of the developer, and the contract of assignment with the transfer of the debt is signed.

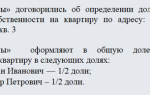

The text of the agreement includes language to the effect that Dollars No. 1 transfer to Dollars No. 2 a debt owed to the developer in the amount indicated."

DealHow it's made up

The original debtor and the buyer enter into a contract of assignment of rights of claim (DLT), and the final buyer is given the original of the document and the equity contract (DDU).

At the same time, the contract of assignment of rights also requires a reference to the DDS and provides basic information on the object, its characteristics and its value, and must confirm that the seller ' s financial obligations to the developer have been fully complied with.

In turn, the developer provides the new buyer with payment documents; if the mortgage dwelling, the final buyer needs to obtain a certificate of discharge of the encumbrance.

The transfer certificate of all the above documents is then drawn up and certified by both parties under the contract of assignment of rights of claim, and the package of documents is transferred to the FICC for registration by DUP in Rosreestre, followed by payment for the purchase, and upon receipt of the registered documents, the buyer acquires the legal right to claim an apartment.

RisksWhat should be feared in transfer transactions

The risk of delay in the construction period is not reduced, as is the case with the conclusion of the DDU, so it is important to carefully verify the reliability of the developer; for example, the number of flats offered for sale by the first installers can be estimated.

"A large number of proposals for the sale of flats from natural persons may indicate problems for the developer and the risk of breaking the deadline for the completion of the construction," notes the Director-General of Miel Novostra, Natalia Shatalin.

There is also a risk that the transaction will be declared null and void, among the reasons that may lead to this is the first debtor's recognition of bankruptcy within a year of the sale of the apartment, and the absence of notification of the right to change of claim to the developer.

" Finally, many of the risks inherent in the purchase of secondary housing remain for the buyer, " said Maria Litinetska.

For example, it would be better to know in advance whether there are minors among the owners of the DUD and whether there are other properties for them that are not smaller in size.

The buyer also needs to determine whether the seller was married at the time of the purchase of the apartment and, if so, whether the seller obtained the written consent of the husband to sell it."

The buyer should make sure that the original DUD (or a notarized copy of it in the case of a large amount of flats) will be given to the buyer, advise Natalia Shatalin, and the original documents (originas or notarized copies of payment orders, certificate from the developer on the performance of obligations) must also be valid.

Buying from a lawmanIs it safer to buy an apartment from contractors than privates?

There are risks here that need to be known, and there are situations where a gene-contracting company negotiates with a developer to offset a job, with a price of 1 square metre.

"The contractor and the developer are simultaneously signing the DDU and the contract describing the netting terms, " said Oleg Stupenkov. " The DDU is immediately on its way to registration, but it may not yet be paid at the time of the subsequent assignment because it is tied to the contract.

Therefore, the final buyer who intends to enter into a contract of assignment with the contractor must verify not only the DDU but also the intercalculations, invoices and the contract in which he/she has an interest in the apartment proposed for the assignment, and when entering into the contract of assignment with the physical person he/she should also request a certificate of reconciliation and payment by checking the payment of the DDS.

Therefore, the most important advice is to make contracts of assignment only in the developer's sales office."

MortgageCan you buy an assignment dwelling using credit?

A few years ago, banks generally did not approve of the issuance of a mortgage for the purchase of housing under a contract of assignment.

But today they are much more likely to agree to finance such transactions for accredited real estate: this suggests that the DUPT mechanism is already well under way.

Among the credit institutions that are willing to mortgage on these terms are Sberbank, VTB24, DeltaCredit, Bank of Moscow, and others.

Tendering: the tricks of the transaction, instructions to the buyer

Tendering is a pretty popular kind of deal when you buy an apartment in a new building.

We suggest we figure out how to manage it with the best benefit and minimum risk to the buyer.

The manner in which the transaction is conducted varies according to the contract under which the developer carries out the apartments: by agreement of equity participation or by joining the housing and building cooperative.on a Treaty of Share-based Participation.

What's the point of a trade?

The construction of a multi-storey house takes several years, and the price of the "quadrat" is gradually increasing as the construction of the facility approaches the deadline for delivery.

It is at this point that investors prefer to buy an apartment for sale.

When the apartment is resold before the house is put into service, there is a special deal – a transfer of rights of claim (the contract of the procession).

What the buyer must understand is that it does not acquire the dwelling itself but the right to claim it, which means that it is transferred not only to the right to receive the dwelling, but also to the risks it carries when investing in the facility under construction, as well as to the obligation to perform the equity contract.

Bonus of assignment

Often, it's the only way to live in an attractive house if all the apartments are sold or the price of them has increased significantly. In order to remain competitive, the donor (investor) offers the apartment much cheaper than the developer sells the remaining options. In addition, the housewarmings don't have to wait long – usually change their rights in practically built houses.

Tricks of bidding or how to obtain maximum benefit

In order to maximize profits, investors try to sell an apartment on an assignment closer to the point of commissioning, and they need to be sold before signing an act of acceptance.

An average of three to five months passes between the signing of the act and the issuance of the property, during which time it is not possible to resettle the apartment.

Accordingly, in houses with a large number of apartments, closer to commissioning the facility, it is possibleTo negotiate with vendors with courageandsignificant savings on purchase.

The same is true of contractors who have received housing from the developer in the account of the services or supplies provided; such companies usually offer flats at lower prices because they need working capital.

Where do underwater stones come from?

First of all, there is a risk of buying a problematic dwelling that will be delayed for an unknown period of time, or it will not be completed at all, and perhaps the first donor (Cenator) decided to reschedule the apartment because he found some technical problems and irregularities.

Therefore, the buyer's main task is to find out the reasons for the assignment, thoroughly check the information about the developer, and carefully examine the equity contract itself.

The potential contributor should also be prepared for the following financial costs:

- The seller may transfer to the buyer "deductive" – the cost of the reassignment (about 30 to 50,000 rubles)

- If the dwelling purchased in the mortgage is transferred, the bank may request payment of the charges for the discharge (1-2 per cent of the outstanding debt).

- The notarized documents required for the transaction will cost approximately 3,000 rubles.

- A step-by-step transaction instruction for the buyer

- Once you have settled the future apartment and agreed with the seller, it is necessary to:

- Review and prepare documents

- We are studying the "basic" equity contract, paying particular attention to the rights and obligations of the contributor, at which point it will be possible to agree with the seller on the sharing of financial obligations (costs of processing).

- Request reconciliations (as well as reconciliations) confirming full, or partial, payment by the current landlord of the housing under construction.

- Conclude the notarial consent of the spouses or a certificate of absence.

Sign the contract

- The signing of the assignment agreement usually takes place in the office of the developer, who also approves the contract (if the contract specifies such a requirement).It's important:If you are willing to pay the full price of the dwelling, the bank may request payment of the charges for the discharge of the burden.

- Registration of a supplementary agreement to the contract on transfer of rights and obligations to the public registration service (Rosreestre), which is generally provided by the developer.Legally, only after registration shall the assignment take effect.

Transfer of funds to the seller

The most popular and safe way to calculate--through the bank cellThe seller takes the money only after the registered documents have been received from Rostreestra, i.e. when the property rights have already been formally converted into you.

Sometimes the seller can offer a discount forMoney transfer at the time of the transactionso as not to wait for the re-registration of the treaty, which usually takes weeks to months.

In this case, however, there is a risk that the contract will, for certain reasons, fail to register: incorrect payment of the government service, mistake in the contract, notarized documents, etc.

This risk is small, but it is up to you to decide whether to play the candle.

After the transaction, you must receive the original assignment agreement and the equity agreement with the Rosreestra seal, and you must also take the first payer's documents for the dwelling.

So let's sum up:

- Tendering is a real opportunity to save on buying an apartment.

- Documents should be carefully examined and the terms of the transaction checked

- It is important to find out from the developer and the bank (if the mortgage apartment) about the financial costs and to agree on their distribution with the seller.

Package of documents required by the buyer for the assignment

| 1 | Identification document (passport) | original |

| 2 | The certificate of payment of the Minister ' s office | original and copy (2 parties) |

| 3 | Registered DDU | original |

| 4 | Contract of assignment of right of claim with all modifications and annexes | 4 copies |

| 5 | Notarized consent of the other spouse to the conclusion of the contract (if the object is acquired as joint property) | original and copy |

| 6 | Consent of the guardianship and guardianship authority to the assignment of the right of claim under the contract if the party to the equity building is a person acting on behalf of a person under 14 years of age or a person declared by a court to be incompetent | original and copy |

| 7 | Written consent of the developer to assignment of contract claim (if required) | original |

Procedure for assignment of right to an apartment

Article updated: 22 May 2023

The transfer of property rights to an apartment, i.e. the sale of an apartment before the completion of the construction of the house, is referred to as a cession.

transfer to the assignee (buyer) the right to obtain a new apartment at a higher price than he himself acquired from the construction company.

The buyer must be aware that by buying an apartment on an assignment it is transferred not only to the right of the builder, but also to the obligations and risks arising from the defects caused by the developer.

Pending the issuance of the assignment transaction

- In the case of a transfer of rights under a contract of equity participation (LDA).Before selling the flat under the equity agreement, the seller is obliged to pay the developer the full amount of the debt for the dwelling or the remaining amount of the debt may be transferred to the Buyer; this is the purpose of the Debt Transfer Agreement for the new owner; this type of sale may be repeated, but only until the house is put into service and the owner has received a transfer certificate for the apartment. The sale of the flat under the Equity Agreement requires compulsory registration with the FDS.

- In the case of a transfer of a right under a preliminary contract of sale.When buying an apartment under a pre-contract, the right of claim also remains with the seller, i.e. the buyer will not be able to sell the apartment to a third party upon assignment of the right of claim. On 1 April 2005, the law on compulsory registration of the equity contract or the investment contract with the Registrar came into force; accordingly, if the flat was acquired by 1 April 2005 under a contract of equity participation with the Developer in a simple writing, the transfer of rights will not be subject to compulsory registration with the Registrar; it is sufficient for the buyer to conclude an assignment agreement with the Developer.

In both casesTransfer of rights of claim may only be made upon payment by the seller to the developer of the amount of the contract concluded between themor, at the same time, the conclusion of a contract for the transfer of the remaining debt to the buyer.

Procedures for the processing of the assignment

I've divided the assignment into four main stages.

Phase 1 — verification of the availability of the required documents from the developer

Before proceeding with the transaction of assignment, it is necessary to verify the existence of the permit documents from the developer, and it is sufficient to contact the company office and ask for the necessary documents:

- The founding documents of the construction company, namely the constitution and constitution;

- Certificate of registration with the tax authority;

- Documents confirming ownership of land;

- Accounting for the last quarter of this year;

- Construction permit;

- A construction project which should specify:

- A building permit;

- The right to the land on which the building of the house is taking place: if the developer is not the owner of the plot, the lease agreement shall include the cadastral number and the area of the plot;

- The objective of the project;

- Construction phase;

- Time frame for implementation;

- The expected date of commissioning of the house.

- A project declaration specifying the manner in which the construction company ' s obligation under the contract should be discharged;

- A contract specifying the funds on which the building of the house is to be carried out.

Before selling an apartment on a transfer of ownership, the seller must:

- Notify the Developer of the sale of an assignment dwelling.

To do so, it is necessary to come to the company's office or to notify the developer in writing of the intention to conduct a legal assignment of the claim.

If the construction company is not notified of the change of buyer, the transaction may be declared invalid.

A representative of the construction company (the developer) should preferably be a third party in the transfer transaction.

- Get the developer's written consent to sell the apartment.

You can get the consent from the company's office, most often the Developer requires 5% for the procedure of assignment of the claim and giving consent to the transaction, most often the seller sells the apartment at a higher price than the developer's bought.

The construction company ' s interest is calculated from the seller ' s sales price, for example: the flat was purchased from the developer for 1.5 million rubles and sold for 2 million rubles, 2 million* 5 per cent = 100,000 rubles.

- This amount is deposited in the front account of the construction company's bank.

- Take the Developer's certificate of no debt to him.

It should state that the contract settlement has been completed and the seller ' s obligation to pay has been met in full.

A construction company ' s certificate can only be obtained upon full payment of the debt or upon conclusion of the Agreement for the Transfer of the Balanced Debt to the Buyer between the Vendor and the Buyer.

A third party must identify the developer in the contract.

- Get notarized consent of spouse(s)To sell an apartment on the basis of a transfer of equity rights if the apartment was acquired during the marriage.

- Take Bank ' s written consentThe agreement of the Bank will only be given after full repayment of the mortgage debt.

- Get an extract from the EGRN to an apartment (formerly EGRP).

This statement must identify the seller, as the right holder, in the event that the equity contract or investment contract has been registered with the registering authority; the statement must be paper; in order to know how to order it, go through the link.

What the Buyer needs to do

Before buying an apartment on a transfer of rights, the buyer must claim:

- To obtain the consent of spouse(s) for the purchase of an apartmentIf both spouses enter into a transaction or a marriage contract between them for a separate property, their consent shall not be required.

- Sign and obtain a loan and mortgageif you buy an apartment by mortgage (or other credit).

Third stage — drafting of a treaty on the assignment of rights

Then you have to draw up a contract of assignment between the seller and the buyer, and I suggest you write it from the lawyer, because it will help you get it right, and it will take into account all the nuances and conditions of the sellers and buyers. You can download the sample from here. You can use our legal consultant to order the preparation of the contract.

You can also consult with him free of charge. Ask your question at the window of the online consultant on the right of the screen or in the comments. You can also call the numbers (round-the-clock and without the weekend): 8 (499) 938-45-06 - Moscow and all regions of the Russian Federation; 8 (812) 425-64-92 - St. Petersburg and round; 8 (800) 350-29-86 - all regions of the Russian Federation.

Instructions on how to rent your apartment (in hire).

Since 2017, in many cities, registration documents can only be submitted to the IFC, and then the IFC staff themselves transmit the documents directly to the Registration Chamber, i.e., the Reg.palats no longer accept citizens, but only through an IFC intermediary. If you can file the documents directly to the Reg, then it is better to do so.

The filing of documents with the IFC or Reg.Palat is the same, so I wrote the instruction with the IFC.

- The seller(s) and buyer(s) need to contact the IFCto pay the government fee and to file the signed contracts with the rest of the papers.

- In addition to signed copies of the treaties, an IFC staff member needs to be provided:

- The passport of each person involved in the transaction, if the person in charge is the person in question, the passport and notary power of attorney.

- The husband ' s consent to purchase and sell an apartment if the apartment is bought or sold during the marriage.

- A contract of foundation originally concluded with the Developer, which may be a contract of equity participation, a pre-sale contract, an investment contract or a co-investment contract.

- A certificate of no debt to the construction company or a contract for the transfer of debt to the buyer concluded between the seller and the buyer.

- Written consent of the developer to the sale of an apartment upon transfer of the right of claim: Most often, when a contract of assignment of a claim is registered, the developer is present during the transaction and is a third party where he consents to the sale of the dwelling.

- Bank ' s written consent to the sale of a right-as-usual dwelling if the apartment was in the Bank ' s mortgage.

- A mortgage and a loan agreement with a bank if the dwelling is purchased by mortgage.

- The staff member will fill out the application for registration on the basis of the attached documents, indicating the real property, its technical characteristics, the data of all parties to the transaction.Each party to the transaction signs the declarations., each one of its own.

- Next thing you know, he's gonna pick it up.Applications, originals (except passports) and copies of all documents submitted;He's gonna give it to me.The seller and the buyer, on receipt of the documents, which indicate the date of receipt of the registered contract of assignment of the rights of the claim and the contract of basis originally entered into with the developer (the equity contract, the pre-sale contract, the investment contract or the co-investment contract) and other documents filed.

- Then, with the IFC, the documents received are sent by courier to Reg.lata, whereThe registrar will checkIf all is correct, the contract will record the transfer of the right to the buyer(s) and the EGRN will have a record. The legal time limit for registration of the transaction is 7 working days. You can call the registration authority and specify the date of receipt of the documents.

- On the appointed dayThe buyer must take the registered contract of assignment of rights of claim and the seller of the contract must have the basis originally entered into with the developer (to pay the tax on sale), but they do not have to take them at the same time, at different times and days.

The State has a registration fee of 2,000 rubles, and it is paid by the buyers, sharing equally, and can be obtained from the employee, and the payment cache is usually located in the IFC building itself.

The documents for the sale of the apartment are with instructions on where and how to obtain them.

Answer:........................................................

Answer:........................................................