Today, the sale of new apartments in multi-storey buildings with the help of housing cooperatives is becoming very popular.

A housing construction cooperative is a high-risk form of investment in the construction of residential real estate, which is not strictly regulated by law. For more information about what a housing cooperative is, what are the conditions for its functioning, the main positive and negative aspects, as well as possible risks, read on.

Zhsk - what is it?

Purchasing housing through housing cooperatives was practically the only possible option to obtain ownership of an apartment before the start of privatization of residential real estate.

If you want to find out how to solve your particular problem in 2023, please contact us through the online consultant form or call :

- Moscow: +7 (499) 110-86-72.

- St. Petersburg: +7 (812) 245-61-57.

Even despite the high cost of this method, it was in high demand among the population.

Legislative regulation of the activities of housing cooperatives is carried out by the Civil Code of the Russian Federation (Article 116 “Consumer cooperative”), as well as the Housing Code of the Russian Federation (fifth section “Housing and housing-construction cooperatives”).

The likelihood of using it as a means of raising funds for construction is established by 214-FZ “On Participation in Shared Construction”, where it is determined that it can be used for the purchase of housing on an equal basis with the DDU (equity participation agreement).

This federal law directly explains that a housing cooperative is the only permitted alternative to shared construction.

The acquisition of residential real estate through a housing cooperative looks like this: a construction company creates a cooperative and concludes an investment agreement.

If a housing cooperative is created after 2011, it will independently act as a developer, that is, organize the process of constructing the facility and own a plot of land in accordance with the Housing Code of the Russian Federation (Article 110).

It is important to note that all members of the housing cooperative participate in the construction, subsequent reconstruction and maintenance of the house with their own funds. The cooperative may include legal entities, as well as citizens over 16 years of age.

If you want to find out how to solve your particular problem, please contact us through the online consultant form or call :

- Moscow: +7 (499) 110-86-72.

- St. Petersburg: +7 (812) 245-61-57.

Pros and cons of housing cooperatives when buying an apartment

Advantages

The convenience of the housing cooperative mechanism for home buyers is as follows:

Providing long-term installments when paying the cost of an apartment

The developer offers a flexible payment system in the form of installments, since the payment of share contributions is carried out over several years after the completion of construction.

Transfer of rights to manage the house to the housing cooperative after completion of construction

Persons purchasing an apartment under the DDU, after completion of construction, create an HOA (homeowners' association), which will take over the functions of managing the house. The formation of an HOA is possible only after registration of ownership rights to apartments, which usually takes quite a long time. During this time, the apartment building remains without management.

Advantages of housing cooperatives in case of bankruptcy and insolvency

What is meant here is that if the developer who created the housing cooperative goes bankrupt, its participants can complete the construction of the facility with the help of a new contractor. When purchasing an apartment under a DDU, if the construction company goes bankrupt, the buyers will have to claim their apartments as part of the developer’s insolvency proceedings.

Another way is to create a housing cooperative from scratch and contact the authorities to transfer the unfinished house to the balance sheet of the cooperative. In practice, this process can take a long time.

The right of shareholders to participate in the construction and further operation of a house under construction

Additionally, members of the housing cooperative have direct access to its financial documents and can also re-elect its leadership.

Share contributions are not subject to taxation, which reduces the cost of construction

Thanks to this, an apartment can be purchased much cheaper than on the secondary market.

Flaws

- the transaction of purchasing an apartment through a housing cooperative is not subject to mandatory state registration, unlike the DDU, which increases the risk of double sales of real estate;

- the inability to hold housing cooperatives accountable in case of failure to meet construction deadlines or discover deficiencies after putting the house into operation;

- it is impossible to indicate the exact cost of the apartment and write it down in the contract;

- insufficient legislative regulation of the scheme for the sale of apartments with the help of housing cooperatives, which are regulated by the provisions of the Housing Code and the norms of the Civil Code of the Russian Federation, and not by the provisions of 214-FZ.

In general, housing cooperatives as a mechanism for purchasing apartments in new buildings are becoming increasingly popular. However, it is very important before joining a cooperative to study in detail all the necessary documentation: the terms of the investment agreement, the charter, title documents. And only after that sign the contract.

Procedure for purchasing an apartment

Housing cooperative organization

The process of organizing a housing cooperative is as follows:

- The decision to form a cooperative is made by a meeting of founders, which can be any person. It is they who become its members by voting for the organization of housing cooperatives. After the meeting’s decision is formalized in minutes, the housing cooperative undergoes state registration and receives the status of a legal entity.

- The housing cooperative must consist of 5 or more persons, but not more than the number of apartments in the house. Management is carried out by a meeting of members of the cooperative if the number of shareholders exceeds 50 people. The meeting elects the board and the audit commission.

- The Audit Commission is elected for a term of up to 3 years and conducts a scheduled audit of the financial and economic activities of the housing cooperative once a year.

Purchasing a new building

- By joining a housing cooperative, its member receives from the common fund of shareholders the amount necessary to purchase an apartment, while the cost of the loan will be significantly lower than a mortgage.

- To become a full member of the housing cooperative, you will need to pay an entrance fee, the amount of which can reach 5% of the price of the apartment. The contribution is not taken into account in the cost of the purchased property.

- Then everything depends on the charter of the particular housing cooperative. In most cases, you need to put down about 10% as a down payment. Then the shareholder regularly makes certain payments to the cooperative account in accordance with the schedule. When the amount reaches 50% of the price of the proposed housing, the housing cooperative purchases an apartment for it, registering it as its property.

- A lease agreement is concluded between the parties, he lives in the apartment, gradually paying off the debt. The repayment period can last up to 10 years.

- As soon as the amount is paid in full, the apartment will become his property.

- Instead of interest on the loan, the housing cooperative participant annually pays administrative fees in the amount of approximately 6% of the loan amount. Moreover, if a member of the cooperative made share contributions gradually, then he is given a lower rate than someone who immediately paid 50% of the cost of the apartment.

Registration of ownership of an apartment

On the basis of these documents, state registration of ownership of the apartment is carried out and a title document is issued.

Possible risks when buying an apartment

When joining a housing construction cooperative, its participants bear some risks:

- The risk of increased construction costs and the need for additional payment in excess of the paid share contribution.

- Risk of double sale due to lack of state registration.

- The risk of failure to meet the designated construction deadlines (even if the deadlines are specified in the contract, they are not binding on the cooperative and will not entail serious consequences for the developer).

The identified risks are significant and have an impact on the protection of the legal rights and interests of housing cooperative participants, and are even more amplified when the management bodies of the housing cooperative are directly or indirectly connected with investment, construction and other companies involved in the construction of the house.

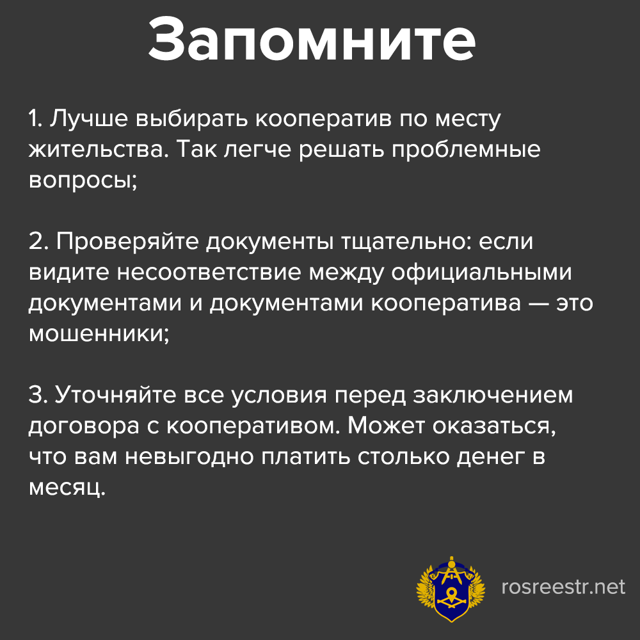

How to protect yourself from deception?

- study in detail the charter of the cooperative, paying close attention to the financial side of the issue (the amount of the entrance fee, the procedure for paying out the share), the duties and rights of the parties, fines and liability for violation of obligations;

- become familiar with the management procedure in the housing cooperative (whether the cooperative itself or a hired contractor is engaged in the construction of the facility);

- make sure you have permits for building a house;

- pay attention to the reputation of the developer, experience and history of its activities;

- carefully read the terms of the contract and sign it only after all conditions are transparent.

Following these recommendations, purchasing an apartment through a housing cooperative will help you acquire housing on attractive terms.

Customer Reviews

Alexei:

Lyudmila:

Valentina:

Most people understand the possible risks associated with buying an apartment through a housing cooperative, so developers use additional measures to attract buyers: low prices, original architecture of buildings, developed infrastructure in the surrounding areas (kindergartens, sports grounds, shops, parks), their reputation, etc. .

- Moscow: +7 (499) 110-86-72.

- St. Petersburg: +7 (812) 245-61-57.

Or ask a question to a lawyer on the website. It's fast and free!

Housing cooperative - buying an apartment without a mortgage and payment

We talk about the rights of members of a housing cooperative and laws for the activities of residential complexes

You are about to buy an apartment. Look at the mortgage services of banks, go there, submit documents - they send you a refusal. If you go to another bank after some time, you also get a refusal. If all else fails, contact the housing cooperative.

We explain what it is and how to choose the right one:

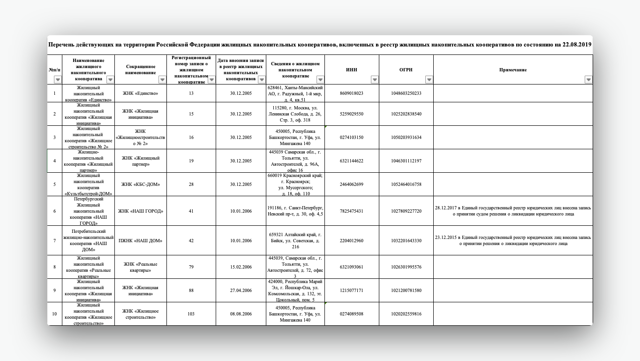

First, you should check cooperatives on the website of the Central Bank of the Russian Federation. There is an Excel table that lists all the cooperatives. Pay attention to the "Notes" column.

If it states that the organization is preparing for liquidation, you should not invest in such a cooperative.

Register of housing and savings organizations

Housing and savings cooperatives are not tied to you geographically: you can live in Sverdlovsk, join a cooperative in Krasnodar, and buy an apartment in Liski. This is expensive: you will have to travel to fill out documents from afar, and if there are frequent problems, you will have to come back again.

There are different conditions for cooperation between a cooperative and a developer: the cooperative sells apartments from one developer, buys apartments in new buildings or on the secondary market, but not more than a certain amount.

First, make an extract from the Unified State Register of Legal Entities. From there, check the last time new members of the cooperative joined, compare the actual and legal address, TIN and OGRN numbers.

After this, if the cooperative has a website, check all documents with official sources: an extract from the Unified State Register of Legal Entities and the register of the Bank of Russia.

Most often, the documents of the cooperative itself can be found on the “Information” tab. If you compare documents and see that the legal and actual addresses differ in the charter documents of the cooperative and official documents, most likely these are scammers. Another scheme: check the number of members of the cooperative.

If the data differs, the cooperative increases the number of participants for mass participation. Most likely, these are scammers.

Extract from the Unified State Register of Legal Entities

What to check in the documents on the cooperative’s website: the charter of the housing cooperative, the regulations on forms of participation and the regulations on the mutual fund. If these documents are not available, you should think twice. Fraudsters will not monitor their reputation for quick profit. Therefore, you should not immediately invest in a cooperative that hides its constituent documents.

It is also worth paying attention to the auditor's report. Housing cooperatives must conduct an independent review of their finances once a year. At the same time, it is not the cooperative itself that chooses the auditing company. This is done on a competitive basis. Therefore, most often neither the cooperative nor the auditing company have worked before. There is no collusion between them.

To join a cooperative, you need to write an application. Take your passport and TIN certificate with you. In reality, the cooperative does not care about your financial well-being: the minimum conditions for entry are reaching 16 years of age.

Sample application to housing cooperative

After you have signed the papers, you need to pay the entrance fee, membership fee and share fee. The entrance fee and share fee are paid immediately, and the membership fee is paid once a month. Moreover, the share contribution is the initial amount for the apartment. Each cooperative sets it individually.

Important : if a cooperative offers you to transfer money to an individual’s account or simply fill out a receipt, they are most likely scammers. How they do it right: they give you receipts for payment of all fees.

After payment, the apartment is booked for five days so that you have time to pay the share fee. Since the transfer is a bank transfer, it may take three business days. After the money has been credited to the cooperative’s account, the manager will call you and give you payment documents.

After this, you can monitor the construction: cameras are installed on the developer’s website. The main thing is to monitor the construction site for more than five minutes. Often, when the camera is not working, there may be a blank there for three minutes. Follow the construction site for two days for ten minutes at a time - then you will be sure that the object is being built and is not abandoned.

In a cooperative, you can take out installments for a maximum of ten years. If you take out a mortgage at a bank and pay interest, then at a cooperative you pay per square meter.

The cost of these square meters is determined by the developer. During construction, the price of a monthly payment can easily increase from 1000 rubles to 3000 rubles.

After the house is delivered, the apartments are assessed by an independent appraisal company. Housing is assessed every three months.

This monthly contribution cannot be missed even for a month. Even if you paid three months in advance, you will still have to pay every month. If you pay more than the monthly payment at once, then it will decrease.

There is a risk that you will not be able to pay the monthly fee. In rare cases, if you lose your job or are seriously ill, your account at the cooperative will be frozen for three months. In other cases, different cooperatives have their own conditions. It is better to clarify them when signing the contract. You can be excluded in two cases:

1) If you had three delays in a year;

2) If there were delays for three months.

If such a situation occurs, you will be able to return the money only in the first half of next year. At the same time, membership and entrance fees will not be returned to you - only share fees will be returned.

After the house has been handed over and the full price has been paid, taking into account all charges, you need to register ownership of the apartment. A cooperative member will have to pay twice: first, when the cooperative buys the apartment from the developer, and then for the transfer of ownership rights from the cooperative to you.

When you have paid the cost in full, the cooperative will issue you a repayment certificate. Afterwards, with this certificate and a receipt for payment of the state duty, you go together with the cooperative’s lawyer to Rosreestr to re-register ownership rights.

The state fee initially costs 22,000 rubles for registering an apartment in a cooperative, and after 2,000 rubles when transferring from the cooperative to you.

If you still want to try to apply for a mortgage, we have analyzed the common reasons for refusal: https://rosreestr.net/info/banki-otkazyvayut-v-ipoteke If you want to buy an apartment from a developer: we tell you how to choose one and check all the documents: https://rosreestr.net/info/smotrim-dokumenty-zastroyshchika-pered-pokupkoy-kvartiry

Apartments in housing cooperatives

Last update: 10/29/2018

Formally, housing cooperatives are voluntary non-profit associations of citizens created to meet the housing needs of the members of these cooperatives. This is a type of consumer cooperative.

In fact, housing cooperatives are most often created at the instigation of Developers, for whom this form of selling apartments under construction is more convenient than selling apartments under DDU, since the legislative regulation here is much weaker than the strict requirements for shared-equity construction.

For a separate project, a developer creates his own “pocket” housing cooperative (HCC) , with the shareholders of which Share Contribution Agreements or Share Accumulation Agreements , and thus quite legally raises money for the construction of a new house. The initial prices in such a cooperative are often temptingly low, but the responsibility of the Developer is minimized here.

True, since July 1, 2018, legislators have closed this loophole for Developers (more on this at the end of the article).

Scams and fraud with housing (special section). Instructive stories with practical examples.

Features of buying an apartment through a cooperative

The activities of housing cooperatives are regulated by Articles 110 - 123 of Chapter 11 of the Housing Code of the Russian Federation, and the provisions on consumer cooperatives - clause 2, § 6 of the Civil Code of the Russian Federation.

Consumer housing cooperatives can be created in the form of:

- housing construction cooperatives (HBC),

- housing and savings cooperatives (HSC),

- consumer mortgage cooperatives (PIK).

Each of them has its own specific features of buying an apartment and the associated risks. Let's look at them one by one.

What are "apartments"? How are they better than a regular apartment? Or worse? See the note at the link.

Housing and construction cooperative (HBC)

Purchasing an apartment in a housing cooperative was the most common way to purchase housing through a cooperative until July 1, 2018.

Housing cooperative acted as an alternative option (compared to DDU) for attracting funds from the population by the Developer for the construction of apartment buildings. For the Developer, this option is quite comfortable, because... firstly, it was permitted by law (clause 2 of Art.

1 FZ-214 - lost force from July 1, 2018), and secondly, it did not oblige the Developer to comply with strict requirements, as in the case of DDU, incl. made it possible to attract money from the population at the excavation stage, without waiting for all permitting documentation to be completed.

For Apartment Buyers, on the contrary, this situation is not very attractive (not counting the price). Buyers here do not buy square meters of a specific apartment, but shares of housing cooperatives, becoming shareholders .

Members of the housing cooperative act within the framework of the Charter of the housing cooperative. A member of a housing cooperative acquires rights to an apartment only after full payment of the cost of the share (which, by the way, may change during construction). Until this moment, the cooperative has all rights to the apartment.

The activities of housing cooperatives are not regulated by Federal Law-214, but by the norms of the Housing and Civil Codes (see links above), and therefore do not provide the protection of the rights of shareholders that is provided by Federal Law-214.

Shareholders of the cooperative are not directly related to the Developer, but enter into agreements only with the cooperative itself (legal entity - housing cooperative).

The cooperative, in turn, is connected with the Developer by an investment contract, the terms of which determine the responsibility of the Developer to the cooperative (and not to a specific shareholder).

And since the housing cooperative, most often, was created by the Developer himself (more precisely, by a legal entity affiliated with him, in order to legally attract money from the population), it is obvious that the investment contract was always drawn up in such a way as to maximally protect the Developer himself.

The basic rules for accepting a new apartment from the Developer - see the Glossary at the link.

Using the housing cooperative scheme , the Developer in relations with Apartment Buyers is, in fact, no longer a Developer (in the sense of the owner of the land and construction project), but a general contractor. The cooperative acts as a general investor, and its shareholders act as co-investors in construction.

The developer (the legal entity in whose name the land is registered) and the construction customer (the legal entity in whose name the design and permitting documentation is drawn up) can be either the cooperative itself or the Developer who created it. In the latter case, the Developer enters into a construction co-investment agreement with the housing cooperative, regarding apartments paid for by shareholders .

True, acting through the housing cooperative scheme , the Developer also had certain legal risks - from a change of board of the housing cooperative to the loss of the construction site.

And the shareholder always had to remember that the initially lower price of apartments in the housing cooperative is not fixed, and may increase during the construction process. Since the housing cooperative is an investor in construction (i.e.

as if hiring a Developer to build a house), then if there is a lack of funds to complete the construction, the cooperative is obliged to finance this deficiency. At the same time, members of the housing cooperative (shareholders) jointly and severally bear subsidiary liability for the debts of the cooperative to the Developer, i.e.

must pay additional amounts from their own pockets to complete the construction.

In addition, a shareholder of a housing-construction cooperative, in addition to actually paying for shares (i.e., money for an apartment), is forced to bear additional costs for maintaining the cooperative itself (entrance and membership fees), as well as additional share contributions in the event that the cooperative incurs losses.

Unlike the conditions of the DDU, purchasing an apartment through a housing cooperative does not provide clear deadlines for completion of construction, and also does not protect the Buyer from “double sales”, because agreements between a shareholder and a cooperative do not undergo state registration (although the cooperative itself, of course, maintains its own register of shareholders).

And most importantly, the shareholder cannot influence the Developer, nor make claims against him, nor recover damages (including it is extremely difficult for the shareholder to defend his rights in court).

You can read more about purchasing a new building through housing cooperatives

Housing and savings cooperative (ZhNK)

ZhNK , in essence, is an alternative to purchasing housing on credit. This is a kind of mutual aid fund. When joining a housing cooperative , a new shareholder makes an initial contribution and determines for himself a convenient scheme for saving money for an apartment - the timing and amount of the amounts contributed.

When the accumulated amount is 40-50% of the cost of the selected apartment, the shareholder has the opportunity to take the missing money from the general cash register (at %) and buy the apartment for the cooperative. He himself can register and live in the purchased apartment, gradually paying off the debt to the cooperative.

The shareholder receives ownership of the apartment only after full payment of the debt.

An apartment in housing complex can be purchased both on the primary market (in a building under construction) and on the secondary market (finished housing). In addition, repairs can be made to the purchased apartment using funds from the “common cash”, if this is stipulated in the terms of the shareholder’s participation in the cooperative.

If an apartment in a new building is purchased through a housing cooperative during the construction process, then here, just as in the case of a housing cooperative, the shareholder cannot make demands on the Developer directly, since the agreement with the construction company is concluded by a cooperative (legal entity). The shareholder can make claims (on terms of transfer, quality of construction, etc.) only to the cooperative itself, and his responsibility to the shareholder here is much lower than the responsibility of the Developer to the shareholder under the DDU.

Buying an apartment in a civil marriage - what is the best way to arrange it?

And in the event of liquidation (including bankruptcy) of the cooperative housing cooperative, the shareholder loses the right to purchase (receive) an apartment, even if it has already been purchased by the cooperative, and the shareholder himself has already moved into it. An exception is if the shareholder managed to pay the full cost of the share before the liquidation or bankruptcy of the housing cooperative.

In the event of liquidation, the remaining shareholders are returned to the property of the cooperative (proceeds from its sale) after the claims of all creditors are satisfied. The balance of these funds is distributed in proportion to the shares.

A housing and savings cooperative (HSC) differs from a housing cooperative by more detailed legislative regulation (FZ-215 dated December 30.

2004 “On Housing Savings Cooperatives”), and their activities are controlled by the Federal Service for Financial Markets (FFMS).

Therefore, if the Developer, before July 1, 2018, chose a scheme for raising money from the population through a housing cooperative , then he, as a rule, chose a more free form of housing cooperative .

What happened after July 1, 2018 – read at the end of the article.

How the purchase and sale of an apartment takes place, and whether a realtor is needed for this - see this article.

Consumer Mortgage Cooperative (PIK)

PIK , in its purpose, is the same ZhNK , but in a broader sense. PIK , like ZhNK , is NOT aimed at construction, but at purchasing existing apartments on the real estate market, using funds “from the common pot” of the cooperative.

But if the activities of housing cooperatives are regulated by a special federal law FZ-215 of December 30, 2004 (see link above), then the activities of a consumer mortgage cooperative (PIK) are regulated only by general provisions on housing and consumer cooperatives (see.

links to these laws at the beginning of the article).

A consumer mortgage cooperative is the same alternative to a mortgage as a housing cooperative , but in a freer and less controlled form.

Compensation fund for the protection of the rights of shareholders. What it is? How it works? See the link.

From the above, it follows that the risks of purchasing an apartment through a cooperative (in any form) are significantly higher than the risks of purchasing an apartment according to the strict rules of Federal Law No. 214 (i.e.

under the Share Participation Agreement).

But since prices in housing cooperatives are very attractive, there is still a demand for cooperative apartments, and they are still present on the market.

At the same time, a housing cooperative is created for the construction of a specific apartment building, and a housing cooperative or PIK are not limited by these frameworks - a member of a housing cooperative or PIK can buy an apartment in any building on the market. But in all cases with cooperative apartments , having moved into such an apartment, the shareholder does not receive ownership rights to it until he fully pays off the cost of the share (as opposed to buying an apartment with a mortgage).

Schemes for purchasing new buildings through housing cooperatives , although completely legal, are relatively rare on the market. Obviously, the number of minuses of this scheme is still greater than the number of pluses. Banks are also not very fond of “housing cooperative schemes” - it is extremely difficult to get a mortgage to buy an apartment under such a scheme.

And after the latest amendments to the law Federal Law-214 (see clause 4, article 8, Federal Law-275), raising funds from citizens for the purpose of constructing apartment buildings under the housing cooperative and housing cooperative schemes is prohibited from July 1, 2018 . Only these cooperatives are allowed to operate if they were created before the specified date.

Exceptions. It is also allowed to create housing cooperatives for the implementation of state housing programs with the provision of municipal land plots to them for free use. And it is allowed to create housing cooperatives by “defrauded shareholders” to complete the construction of problem objects in the event of bankruptcy of the Developer. These exceptions are specified in the law here - clause 3, clause 2, article 1 of Federal Law-214.

How a Buyer should behave (what and how to check) when purchasing a cooperative apartment (housing cooperative or housing cooperative) on the secondary market is described in the corresponding step of the INSTRUCTIONS at the link.

Transaction support by an experienced lawyer ALWAYS reduces risks (especially for the Buyer of an apartment). The services of specialized real estate lawyers can be found HERE.

- "SECRETS OF A REALTOR":

- The rules and sequence of preparing a transaction for the purchase and sale of an apartment are on the interactive map “STEP-BY-STEP INSTRUCTIONS” (will open in a pop-up window).

Buying an apartment through a housing cooperative

Buying an apartment through joining a housing cooperative is one of the ways to acquire your own home.

Such an association implies the consolidation of citizens , whose common activities will be aimed at obtaining housing .

Such an association is created by approving a charter at a meeting, which sets out all the key aspects of the activities of the future cooperative.

In practice, there are several types of such associations, the purpose of which is aimed at obtaining housing:

- housing (purchase of housing);

- housing construction (home construction);

- housing-savings (construction of apartments is carried out not in one building, but in several);

- consumer mortgage (the transferred housing is encumbered with collateral - a mortgage);

- consumer credit (participants receive loans to purchase housing).

who have reached the age of sixteen can be members of a cooperative . They have various rights and obligations established both by law and by the association's charter. Ownership of the apartment is issued only after full payment of all required contributions.

Participation in such cooperatives involves some risks , which must be studied before deciding to join the association.

What is a housing cooperative (LC)?

A housing cooperative is a voluntary association of citizens (and in some cases, legal entities) based on their membership, created for the purpose of obtaining housing for citizens, as well as for the purpose of managing an apartment building.

The legal status of housing cooperatives is established by Chapter. 11 of the Housing Code of the Russian Federation (LC RF).

Members of the association participate in the acquisition, reconstruction, and maintenance of an apartment building, which is the purpose of creating such a cooperative.

At least five citizens can take part in the creation of a cooperative , but no more than the number of apartments that exist in the purchased building.

The decision to create a residential complex is made by a meeting of its founders . The specified body approves the charter, after which state registration occurs.

A distinctive feature of a housing cooperative, by which it could be distinguished from other types of such associations, is the opportunity established by law to purchase a house (with possible further reconstruction and management). That is, such an association is prohibited from constructing a new facility. For this purpose, another form of cooperative is being created - housing and construction.

Constituent documents

The founding document of the Housing Code is the charter , approved by the meeting of founders. Approval of the charter, like any other decision of the meeting, must be documented in the form of minutes .

By virtue of the direct instructions of Art. 113 of the Housing Code of the Russian Federation, the charter must contain :

- the name of the cooperative, as well as its location;

- subject and goals of activity;

- procedure for joining and leaving the cooperative;

- the procedure for issuing a share contribution and (or) other payments upon exit;

- the amount of share and entrance fees, as well as the procedure for making them;

- provision on liability for breach of obligations;

- the competence and composition of both the management bodies of the association and the bodies monitoring the activities of the cooperative;

- the procedure for making decisions by management bodies;

- the procedure for covering losses incurred by members of the cooperative;

- regulations on liquidation and reorganization of the cooperative.

The charter may include other provisions not included in the above list, but they must not contradict the law .

The Housing Code of the Russian Federation directly provides for only two types of cooperatives:

- housing;

- housing construction.

The difference between the above types is that when creating the first, it is implied the acquisition of a house and its subsequent management (with the possibility of reconstruction), while the purpose of creating the second is not the purchase of a house, but its construction .

However, there are a number of other cooperatives:

- housing-savings;

- consumer mortgage;

- consumer credit.

The housing savings cooperative is regulated by Federal Law dated December 30, 2004 No. 215-FZ “On Housing Savings Cooperatives.”

Such an association is created for the same purpose as a housing construction cooperative, however, the construction of apartments can be carried out in different buildings . Another distinctive feature is the “cumulative” nature.

In practice, a member of the association pays a certain percentage, after which an apartment is purchased and transferred to him for use. Transfer of ownership is carried out only after payment of all fees .

Unlike a housing and savings cooperative, in a consumer mortgage the apartment is registered immediately, after which a mortgage is issued on the apartment - a mortgage .

The activities of a credit consumer cooperative are regulated by the Federal Law “On Credit Cooperation” dated July 18, 2009 No. 190-FZ.

The operating principle of such an association is to form a fund from the entrance fees of its members and further provide loans to the members of the association for the purpose of purchasing housing.

Thus, there are quite a lot of types of such citizen associations. There are several options for purchasing housing using this form of association of individuals and legal entities.

Art. 111 of the Housing Code of the Russian Federation establishes a list of persons who can be members of a housing cooperative. First of all, these are citizens who have reached the age of sixteen . In addition, legal entities can also be members of such an association:

- in cases established by law;

- if such a legal entity is the owner of premises in an apartment building, the common property of which is managed by a housing cooperative.

listed in Art. 49 Housing Code of the Russian Federation:

- low-income citizens (recognized as such in the prescribed manner);

- other persons recognized in accordance with the established procedure as needing housing.

Rights and obligations of members of the Housing Committee

The rights and obligations of members of a housing cooperative are established by Ch. 12 Housing Code of the Russian Federation. Based on the decision of the general meeting of members of the association, its member is provided with residential premises in accordance with the size of the share.

From this moment on, such a member has the right to the share paid by him as a contribution. Members of the cooperative, subject to prior notice, may allow temporary residents (subject to the conditions established by Article 80 of the Housing Code of the Russian Federation).

There is also the possibility of renting apartments for a fee.

If the share belongs to several persons, then they have the right to divide the apartment . However, this can only be done if there is a real possibility of creating isolated premises.

The right of ownership to the occupied apartment arises only after payment of all share contributions (Article 129 of the Housing Code of the Russian Federation). Before this, a member of the cooperative has only the right to use such housing.

A person’s membership in a cooperative is terminated if:

- withdrawal of a member from such an organization;

- his expulsion (by decision of the meeting for gross failure to fulfill his duties);

- liquidation of a legal entity;

- liquidation of the association itself;

- death of a cooperative member.

In the event of the death of a member, his heir has the right to join the housing cooperative. If a member was expelled, then no later than two months he is paid the entire share that he contributed to the cooperative.

In addition, in the event of demolition of a house (on the grounds provided for by the Housing Code of the Russian Federation), members of the cooperative are subject to the rules specified in Art. 32 and art. 86 Housing Code of the Russian Federation. It does not matter whether the rent for the apartment has been paid in full.

How to join a housing cooperative

In accordance with Art. 121 of the Housing Code of the Republic of Kazakhstan, in order to join a housing cooperative, you must submit an application to the board of such an organization.

Such an application is considered within a month and is also approved by a decision of the general meeting. In order for a citizen (or legal entity) to be recognized as a member of an association, an entrance fee .

After this, the authorized body enters the new member of the cooperative into the appropriate register.

The procedure for paying further contributions, providing an apartment and other issues are established by the charter of such an association, which already applies to the new member of the cooperative.

All decisions of the meeting, including those on the admission of new members, must be documented in minutes .

Ownership of a cooperative apartment

The ultimate goal of participating in a housing cooperative is to obtain ownership of an apartment. In accordance with Art. 129 of the RF Housing Code, ownership rights are acquired by a member only after payment of all share contributions in full. This provision is also confirmed by Art. 218 of the Civil Code of the Russian Federation.

Example

Korneev V.S. joined a housing cooperative that acquired an apartment building.

After a year of using the provided apartment and timely payment of all fees, Korneev was given ownership of the specified apartment, the right to which was registered in the manner prescribed by law.

Subsequently, the cooperative, of which Korneev is a member, managed the apartment building.

Registration of ownership of an apartment occurs in the general manner . When registering a right with an authorized body, you will need to provide:

- a document confirming payment of all fees;

- charter of the cooperative;

- minutes of meeting decisions on admitting a member to the cooperative.

Withdrawal from members of the cooperative

According to Art. 130 of the RF Housing Code, along with other grounds for termination of membership, there is the possibility of leaving the cooperative . In this case, the person wishing to leave must provide an application for voluntary exit . Consideration of such an application takes place in the manner established in the charter of the association.

It is worth noting that when a member leaves the organization, he is paid those contributions that he had already managed to pay by that time.

The payment procedure is also established by the charter , but the period should not exceed two months from the date of the meeting’s decision on the member’s withdrawal from the cooperative (based on the considered application).

Risks of participating in a cooperative

The main risks of participating in a cooperative come directly from the very essence of such an association. In the case of a housing cooperative, the acquisition and reconstruction of a house is carried out independently, and in the case of a housing construction cooperative, such an association acts as a developer, then all responsibility falls on the association itself and its members.

Example

An incorrect calculation was made and the share contributions for reconstruction or construction are not enough. In this case, it becomes necessary to make additional contributions by all members of the cooperative.

In addition, risks may arise associated with late payment of cooperative contributions, which may entail:

- increasing the construction or reconstruction time of a house;

- problems with the contractor, the change of which often leads to additional costs.

Also, no one is immune from the mass exit of cooperative members from it. This can happen for completely different reasons.

The cooperative will have to return the fees paid, and therefore there may not be enough .

Replacing departed members with new people may take a long time, which will also, at a minimum, lead to an increase in waiting times for housing.

The above risks should be taken into account when choosing a method for acquiring home ownership. For some, joining a cooperative and being prepared to take such risks is the only opportunity to purchase an apartment.

Conclusion

There are many options for purchasing real estate to solve the housing problem. However, not everyone has enough money to purchase a home right away.

For most people who want to own property, it is much more convenient to pay in installments, giving away a certain amount of their earnings. One of the possible options in such a situation is to join one of the types of cooperatives .

This form of purchasing an apartment involves paying fees for the apartment while already using the housing.

The right of use becomes ownership only after all fees have been paid. If you approach the choice of the type of cooperative with an understanding of your capabilities, as well as assessing the degree of risk , you can choose the best option for a cooperative, the result of participation in which will be the receipt of an apartment as your own.

Withdrawal from a housing cooperative and refund of contributions

I joined a housing construction cooperative and regularly pay my dues. However, in connection with the opportunity that has arisen to purchase an apartment immediately in another building, without waiting for the completion of the construction of the cooperative building, I wish to leave such an association. Is it possible to leave such a union? Will my paid fees be refunded? Art. 130 of the RF Housing Code presupposes such grounds for termination of membership in a cooperative as the withdrawal of such a member. This means that you have every right to leave the cooperative. According to Art. 132 of the Housing Code of the Russian Federation, you have the right to receive the amounts paid no later than two months from the date of leaving the association.

Buying an apartment with the help of a housing and savings cooperative

A housing and savings cooperative (HSC) is similar to a mutual aid fund - part of the money for the apartment is paid by the shareholder, and the rest is paid by the cooperative. General Director of MIEL-Novostroika Sofya Lebedeva told the Novostroy-M.ru portal about the features of housing complexes and the risks associated with purchasing real estate under such a scheme.

What is ZhNK

A housing and savings cooperative (HSC) is a voluntary association of citizens created to purchase housing using jointly accumulated share contributions. ZhNK is regulated by 215-FZ and other laws that control the activities of consumer cooperatives.

According to the law, the cooperative has the right to use the funds of shareholders for the purchase or construction of housing (including in apartment buildings).

Also, a housing cooperative can itself act as a developer, or play the role of a participant in shared construction (using common funds). The minimum number of cooperative members is 50 people, and the maximum is 5000.

Any citizen over 16 years of age can join the organization.

- The process of joining the ZhNK is quite simple:

- 1. the future participant writes an application to join the organization in accordance with the Charter of the cooperative and 215-FZ;

- 2. after a positive decision by the management of the housing cooperative to accept a citizen into the organization, information about him is entered into the unified state register of legal entities (in accordance with 129-FZ);

- 3. the participant pays the entrance fee and the first share payment;

4. Afterwards, the shareholder receives a document confirming his membership in the cooperative. This could be a share accumulation agreement or a similar one, for example, an agreement on participation in a housing cooperative.

At the same time, the legislation does not provide for a minimum contribution for joining a housing and savings cooperative - each association determines this amount independently.

It should be noted that cooperatives also independently calculate the amount of share contributions and the amount by which a participant can accumulate housing to purchase housing or begin its construction. The management of the housing cooperative also sets a schedule for making share contributions and possible conditions for raising borrowed funds.

That is, upon joining a cooperative, a participant makes an initial contribution. Then, according to the schedule, he pays the share contributions, and, having accumulated the required amount, buys himself an apartment (finished or in a house under construction).

Then he, also according to the schedule, pays the balance of the cost of the apartment no later than the period agreed upon as the maximum for repayment. Of course, the calculations take into account the fact that the share contributions of the association’s participants must compensate for the organizational costs of the housing cooperative.

In other words, shareholders also pay membership fees (usually a small percentage of the cost of housing, for example, 0.05%).

of forms of participation in housing and communal services .

The main requirements for the housing and communal services form are compliance with current legislation and the reliability of the organization from a financial point of view. It should be clarified that the form of participation in the housing cooperative means the method of making share contributions (schedule), their sizes, as well as the conditions under which the participant can purchase an apartment (the amount that needs to be accumulated, for example, 50% of the total cost of the apartment).

According to clause 2. Article 27 215-FZ forms of participation in housing cooperatives must be established:

- 1. the minimum and maximum periods for making share contributions, the minimum amount of contributions (or the method for determining their sizes), the part of the share contribution, after the accumulation of which the cooperative can purchase an apartment for the participant or begin its construction;

- 2. the maximum period intended for repayment of the remaining part of the share contribution;

- 3. amounts and schedule of payments on account of the share contribution;

4. possible conditions for raising borrowed funds.

Separately, it is worth noting that a housing cooperative participant can contribute part of the share contribution to offset the old apartment (as in the mutual offset system link). It must be remembered that in this case the property is sold, as a rule, at a price below market value.

participants can complete the construction of the facility with the help of a new contractor. When purchasing an apartment under a DDU, if the construction company goes bankrupt, the buyers will have to claim their apartments as part of the developer’s insolvency proceedings.

participants can complete the construction of the facility with the help of a new contractor. When purchasing an apartment under a DDU, if the construction company goes bankrupt, the buyers will have to claim their apartments as part of the developer’s insolvency proceedings.