The Civil Code is the principal legislative instrument dealing with the process of giving property, and article 572 states that any property not taken out of circulation may be a gift.

This may be the home or its share; the agreement to give a share of the dwelling in legal practice is frequent.

This type of real estate and its taxation have a number of nuances that should be taken into account by the parties to such transactions.

What is the share of the dwelling?

To begin with, what is the concept of shared property: the current law does not treat the share as a separate concept; however, practice shows that the process of transfer of ownership of immovable property is very often linked to the disposition of the share.

Article 244 of the Civil Code of the Russian Federation defines what is a joint property: when this concept is applied, it refers to property owned jointly and owned by several persons; each owner has his or her own share of real property registered in the State Register of Rights (EGRP).

It is important to bear in mind that the natural expression does not matter; according to the law, no matter which part of the house or land belongs to each owner, all of them have equal rights to it.

Example: The Esmaylov family consists of four persons, each of whom has their legal share in a three-room house; in practice, they all use three rooms of the house and auxiliary rooms equally.

In common property law, the law provides for a number of restrictions on the disposition of such property:

- In cases of exclusion other than giving, owners of other parts of the house or of the land have priority;

- It is only with the consent of the other owners that it is possible to dispose of the house and other equity property.

What is the contract for giving a part of the house?

If a share of the house and land is provided, it is important that the text of the document contain the following:

- Information on who acts as a giver and gifted under this contract, and information on adult passports and birth certificates for minors shall be provided.

- If a minor is a gifted person, information about his or her legal representative, accompanied by supporting documents.

- What is the subject of the agreement is a detailed description of the confiscated parts of the immovable property.

- The area under the house is described.

- The obligations and rights of the parties, as well as the conditions for the transfer of property rights, if any, shall be specified.

- The procedure for the transfer of property is defined. If the act of reception and transfer is not envisaged, it must be stated that the contract has the legal effect of the act of acceptance and transfer.

- Reference is made to the non-reimbursable nature of the transaction.

- The responsibility of each participant shall be determined.

- The grounds on which the contract may be terminated are given.

- Particular reference is made to situations in which disputes or force majeure may arise.

Please also read the Act of Reception and Transfer of the apartment under the Donation Contract.

At the end of the document, the place where the document and the date were written is always written, the treaty is checked, then the parties place their paintings in it, and the children under the age of 14 are signed by their legal representatives.

Model contract for giving a share of the house

In order not to make mistakes and draw up a document in accordance with the requirements of Russian legislation, it will be easier to download a form and a sample of it on the website.

Using the model, you can only enter the necessary information into the graphs intended for it.

Registration of gifts to a residential home in Rosreister

Under Russian law, the transfer of real property must be recorded in the State registration authorities, as stipulated in the Federal Act of July 1997 No. 122. Government Decree No. 457 establishes the authority of the Rosreestra Office, where applicants can obtain a certificate of State registration.

The procedure for registering part of a dwelling or land on another person consists of several stages:

- Submission of documentation.

- Legal review.

- Introduction of information to the Single Register, preparation and issuance of real estate title documents.

What documents do the Federal Registration Service require?

The main stage on which all subsequent documents depend is the submission of documents.

- Statement;

- Treaty of giving in three copies (each of the participants plus deposit in the authority of circulation);

- The applicant ' s passport or birth certificate if the gift is issued for the child;

- A document establishing the grantor ' s right to be given;

- A receipt showing that the applicants paid a State duty of 2,000.00 roubles;

- Technical documents received in the BTI;

- A certificate of who is assigned to the residence, obtained from the passport table;

- An extract from the home book;

- The written consent of the guardianship authorities to the transaction if one of the parties to the transaction is disabled citizens or minors;

- Documents of the representatives of the parties, if any, during the process;

- Consent to a second spouse when it comes to the disposition of the joint property.

It is important that the applicant or his representative with a notarized power of attorney must submit the documentation in person.

Share of home and land

It is important to take into account the fact that it occupies a particular piece of land and cannot be presented without it, and that it is legally possible to take into account either part of the building or part of the land on which it is located, or part of it, in a single gift, as well as the law does not prohibit the issuance of separate documents for real estate and land.

The following information shall always be included in the gifted home ownership:

- What are the characteristics of the object of transmission: the house or part thereof and the land or part thereof.

- Details are given of the location(s) of the area occupied, the material from which the house is built, the cadastral number, etc.

- The details of the land: category, ownership, etc. are also provided.

It is important to rely not only on the Civil Code of the Russian Federation but also on the Land Code, since it is a transfer contract and a land estate.

The important thing is to see if you own the land on which the gifted building is located.

Otherwise, the procedure is not different from the standard procedure; in addition to the duty for the transfer of real estate, a duty of 350.00 roubles for the transfer of land will have to be paid; the package is accompanied by a legal document for it; two certificates will be issued as a result.

As in all cases of gifts, if the gifted person does not have a close relative, he is obliged to pay the NPFL tax to the State in the amount of 13 per cent of the tax base.

The share of the home to a relative

Under the law of the Russian Federation, any citizen or alien, relative or other person may be granted real estate, but the most frequent in legal practice are contracts for the donation of housing to relatives; the law divided them into two categories:

The first are:

- The husband or wife;

- Daughters and sons (full-born and half-born);

- Grandma;

- Grandpas;

- Grandkids;

- Brothers;

- Sisters.

And if you are a close relative, then do not enter into a contract with them for the value of the property you have taken away.

Provision of a share of the home to a minor child

If the gifted person is under 18 years of age, the gift contract and the procedure itself will have a number of features.

- It is not a minor who consents to the gift, but the people who represent it, but it may be both parents and guardians or representatives of the guardianship authorities.

- A minor is not entitled to sign a contract and his legal representative signs instead.

- Like adults, minors who are not close relatives are obliged to pay the NPFL in the amount due; their legal representatives are responsible for non-payment.

1/2 share of the house

The law gives the giver the right to dispose of all his property and to give it in whole or in part.

In this case, there should be another clause in the contract indicating that the gift is 1/2 percent of the giver, thus expanding the list of owners of real estate.

If one of them intends to give his or her share of property, he or she must either separate it from his or her common property or take a written consent from the other spouse to dispose of half of his or her share of property.

Duties and rights of the parties

Any legal relationship implies that the parties have certain responsibilities and rights; in the drafting of the treaty, the grantor has the following rights:

- To cancel the gift when certain circumstances arise;

- To specify in the contract the conditions on which the gifted person becomes the holder of the gift;

- to give their share of the property without seeking permission from the other owners of the parts from the common property.

You can also read the gifted share of the apartment.

In addition to rights, the giver has responsibilities:

- Provide all documentation necessary for the processing of the contract;

- First set aside your own share of the house and then sign it for the gifted one;

- Register the land cover and then hand it over to the other party to the contract;

- to give consent to the other owners of the house.

It is the duty of the gifted person to obtain a portion of the property which is destined for him and to register it in Rosreister, and he has the right not to accept the gift, and you can refuse it after signing the contract.

Expenditure for all organizations

At each stage of the process, the parties will bear certain costs.

- Notary services;

- Legal services for contract drafting;

- Registration services in Rosreestre;

- NPFL.

The cost of legal services varies between 5,000.00 and 10,000.00 rubles, with notary services amounting to 3,000.00 rubles + 0.2 per cent of the cost of the gift, but not more than 50,000.00 rubles.

In cases where the gift is valued as: 1,000,000.00 - 10,000,000.00 rubles - 7 000.00 + 0.2% of the price of the transaction. If the gift is worth more than 10,000,000.00 rubles - 25,000.00 rubles + 1% of the price of the share (no more than 100,000 rubles)

100 rubles).

The income tax is always 13%. Only those who are not close to the donor pay it. The Rosreest will require 2,000.00 for the real estate and 350.00 for the land on which it is located.

Possible Challenges

With regard to legal relations, it was important to bear in mind the possible underwater stones involved in transactions; an important point was the lack of a legal definition of the concepts of "part" and "salary".

For the reason mentioned above, it is very common to give a part in the same way as giving a share. The difference is that part is a separate unit of property in real estate. The share is not a single element of the whole.

It was important for providers to consider such legal inefficiencies in the drafting of a contract, and the legal separation of a portion from the common share of property would help to avoid misunderstandings.

Another problem is often that the transaction is concluded on property that is joint and the consent of the second owner is not granted.

Conclusion

In order to give a house a gift without problem, contact a lawyer for advice; only a specialist will fully study the situation and identify all its nuances; since every transaction of giving the house is individual, it is best to consult with the gift lawyers in advance.

How to Give a Share of the Home to a Close Relative

A share in a close relative ' s apartmentIt is a means of transferring property rights to a certain part of real estate; the freeness of a transaction is a mandatory condition.

In order to carry out the transfer, it is necessary to conclude a gift contract between the interested parties.natural and legal persons.

Transactions with the share of the property in the joint equity right must be made with the notary.

The exception is where the giver is the sole owner of the dwelling, in which case a notary certificate is not required.

Once a contract has been drawn up, the required set of documents must be submitted to the registration authority (Rostreest or IFC) and the right of the giftee to the dwelling obtained must be registered.

Specialty of giving real estate to close relatives

A contract of giving between close relatives is different from similar transactions between other persons because the income derived from the gift,Not taxable.

The Tax and Family Code of the Russian Federation refers to close relatives of the following persons:

- The spouses;

- ascending and descending relatives— Parents and children, grandparents and grandchildren;

- Adoptions and adoptions;

- Brothers and Sisterswith two or one parent in common.

All other personsare not close relativesThe gift between the great-grandmother and the great-grandchild will be recognized as a normal gift — giftedWill be obliged to pay the taxIncome of natural persons (NDFL).

A contract for the giving of real property between relatives can be concluded as insimple writingas well as innotarizedIt is possible to make a contract on your own or to seek the assistance of a lawyer.

In a gift contract, it is necessaryPlease specify as follows::

- Place and date of detention.

- The identity of the parties to the transaction.

- All information concerning the subject matter of the treaty: location address, number of rooms, etc.

- Technical characteristics and characteristics of housing.

- Real estate value.

Once the contract has been properly completed, it must be registeredTransfer of ownershipThe contract itself does not need to be registered if it was concluded after 01.03.2013 (art. 574 of the Civil Code of the Russian Federation).

How to make a donation in an apartment

The share of the dwelling must becertified notarizedThe extent of the relationship between the parties to the transaction is irrelevant in this case.

A notary ' s services in the form of a donation contract will cost the share.not less than in 3,000 rubles.The amount will depend on the following factors:

- Cost of notary services- 3,000 roubles (depending on the region of circulation);

- value of real property- The amount of the State fee for the certification of transactions to be evaluated is set at 0.5 per cent of the value of the contract, but not less than 300 and not more than 20,000 roubles (art. 333.24 of the Tax Code of the Russian Federation).

After a notarization of the equity in the dwelling, the transfer of ownership must be registered.Basic documentswhich will require:

- The gift contract is two copies, one of which is the original.

- Documents confirming the identity of the applicants.

- An application for public registration is submitted by a giver and gifted person.

- Other documents provided for in the legislation for specific cases.

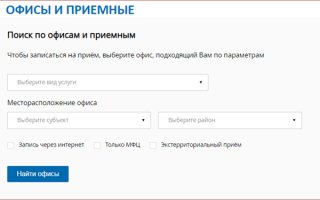

You can use the right to register.by any means available:: To contact the Rosreister or Multifunctional Centre (IFC), submit documents electronically through the State Services portal, use mobile services or mail.

Once the registration procedure has been completed, it is necessaryreceive the right-setting documents.

Is it possible to process without a notary?

An oral or simple written form of a gift contract between close relatives can only be used when the object of the giftis not a share in real estate.

If the subject matter of the transaction is a share in a multi-owner dwelling, the law establishes:mandatory notary form(art. 42, para. 1, of FL 218 of 13.07.2015).

In such a case, the contract can be drawn up on its own, but without a notary ' s certificate it will have no legal effect and you will be denied registration of property rights.

Notary certificatenot required, if the share of the apartment gives......................................................................................................................its sole ownerIn such a case, the contract may be drawn up on its own and submitted to the Rosreister or the IFC for registration of ownership rights.

Transfer of the share of the dwelling to the relative will be considered completed upon completionregistration of property rightsand the receipt of supporting documents.

To register the donation of shares, it is possibleTake advantage of the services of the IFCA list of the nearest centres, their terms of reference, working arrangements and pre-recording can be obtained through the Office and Reception Service.

Stages of registration of ownership at the IFC:

- Preparation and processing of required documentsThe list of documents may vary depending on the situation; all information can be obtained from an IFC staff member or from the Rosreestr online service (authorization, using the logic and password of the State Service portal).

- Payment of the Minister's feesFor natural persons, the amount is 2,000 roubles for legal entities — 22,000 roubles.

- Visit to the IFCBoth parties to the treaty must appear in person at the centre, together with all the necessary papers.

- Collection of documentsto be issued after the State registration of ownership.

- The duration of the services rendered shall not exceed15 days:: 10 days - registration of ownership, 5 days - transmission of all documentation from Rosreestre to IFC.

- The filing of all necessary documents isMandatory conditionwithout which in the registration of the donation of the sharewill be refused..

- The list of documents required to give a share depends on the situation in which the transaction takes place.Main documents(a gift contract, a passport and a declaration of transfer and registration of ownership) may be added:

- Bail holder ' s consentIn cases where the property is in a security deposit, the property is disposed of in writing.

- Consent of the guardianship and guardianship authorityif the accommodation is occupied by:..............................................................................................................

- Members of the owner ' s family under guardianship or guardianship;

- Minors left without parents.

- Credentials documentto sign the contract if one of the parties to the transaction is represented by an authorized person.

- Notarized consent of the spouseif the property is jointly owned by the spouses.

- Written consenteach member of the common property

On its own initiative, the applicant may submit the following documents:

- Passport of a cultural heritage objectif the real estate belongs to such objects and the document has not previously been handed over to the State registration authorities.

- The certificate of payment of the Minister ' s office.

Is it possible to withdraw the gift to a part of the apartment?

The law provides for the possibility of revocation or revocation of a gift: both the giver and his relatives or interested persons (in cases provided for by law) have the right to do so.

A gift contract for a share in real estate may be cancelled if the gifted person:

- He's gonna kill himself.A gifter or his loved ones.

- Deliberately.It's bad for your health.A gifter.

- Inappropriately treated as a giftwhich is of great non-material value to the giver.

The following may require the cancellation of gifts:

- Giverif the gifted person dies before he dies;

- the heirs of the giverif the latter was killed intentionally deprived of his life by the gifted;

- Persons concernedif the contract for the giving of part of the immovable property was made by a legal person or an individual entrepreneur in violation of the bankruptcy law.

The Grantor has the rightCancellation of obligationsrelated to a gift if its property or family status or health has changed significantly, and performance of the contract willa significant decline in his standard of living.

In the home: agreement between relatives to give a portion of the dwelling

Time to read article = 12 minutes

The gift contract is a type of property transfer transaction, which is concluded in most cases between the people who are close to you. You can also give a gift not only to the whole house, but also to a part of it. The gift contract has its nuances, which we would like to discuss in this article, as well as to present a model contract for the giving of a part of the dwelling.

What Giving Is

Dearing — Donation of Property, Communication of Benefit

Diffusion- Donation of property, delivery of the good.

In the legal sense of giving, it may take meaning as a free transfer of property or an item to another person, and it is one of the civil rights of the subject or citizen.

This right is guaranteed by the laws of the State in force and the freedom and right of the citizen to dispose of his or her property (including his or her free will) is guaranteed by the Constitution and may be processed as a transaction.

It is often possible to give a gift without any form of document; however, in the case of housing and other real estate, it may generally be necessary to draw up a contract of gift, as certified by a notary.

The procedure for the processing and acceptance of gifts is regulated by the Civil Code of the Russian Federation, as well as by the legislation in force on the taxation of citizens.

The gift contract is one of the oldest civil law treaties, already recognized in Roman law as one of the grounds for the creation of the right of ownership, and any type of gift contract facilitates the transfer of property (rights, things, etc.).

) from one person to another, the giver and giftee being legally equal.

Thus, the legal relationship arising from the gift contract falls within the scope of the subject matter of civil law and the appropriate method of civil law.

How to formalize a gifted dwelling

The issuance of a gift requires the consent of all parties, notarized

If the share of the apartment or house that is the joint property of several parties is donated, the consent of all parties, certified notarized, is required for the gift to be processed;

If part of the dwelling or house owned jointly by the minor is donated, the consent of his parents or guardians is required for the establishment of the dwelling;

If the free share of the flat or the house is the joint property of several parties and one of them is the giftable one, the consent of the other co-owners is not required (e.g. the mother, father and daughter live in the same apartment as the co-owners; if the mother wants her share of the daughter, the consent of the father is not required).

How much does it cost to process a gift

The main expense that can be incurred in the issuance of a gift is a tax on the free transfer of property.

- If the Giver and the Giftee are members of the same family (spouses, children, parents) - there is no gift tax;

- If the Giver and the Gifted One are close relatives (grandfather, grandmother, grandchildren, brothers, sisters) - there is no gift tax;

- If the giver and the giftee are distant relatives (the aunt, uncle, nephews, cousins) - the gift tax is 13% of the cost of the dwelling;

- If the giver and the giftee are not related, the gift tax is 13% of the cost of the dwelling.

It should be noted that in the last two cases it would be cheaper to issue a contract for the sale of an apartment or house.

Other costs:

- If the house or house is certified notarized, the public service must be paid for the notarization (the size is determined by the cost of the dwelling);

- Payment of a fee for State registration of the gift and ownership of an apartment or house that receives a gifted dwelling (1,000 rubles).

Legal advice

Legal advice, if necessary, to minimize taxes — 2,000 rubles, drawing up a tax scheme — according to the estimate of work. The cost of a notarized gift contract depends on the cost of the share of the gift facility and the relationship between the parties (from 0.5 to 1.2 per cent of the cost of the object plus 5,000 rubles).

Documents required for the issuance of the

- Law-making documents (contract of privatization, certificate of right to inheritance, contract of sale, court decision, DDU, etc. + certificate of State registration of ownership, if any);

- Cadastral passport, technical passport;

- Copies of the passports of the parties to the transaction + SNILS;

- The consent of the spouse, guardianship authorities, etc. (if necessary).

Various options

The share of any real estate (houses, rooms, houses, land, etc.) is legal, perhaps as is the giving of the whole object.

- First of all,, not the entire apartment, home or other property, but only a part of the property (his share).

- Secondyou can give shares to a few gifts: one share, another share, third share, e.g. one-fourth share of an apartment to a son and one-second share of an apartment to a granddaughter, or something.

- ThirdAnd if you give a share of the property, then you have a share of it; and if you give a share of it, you have a share of it; and if you give a share of it, then you have only one sure way of giving it to the property.

In order to give a share, it is necessary to do the same thing as giving the whole object (collection of documents, preparation of the text of the contract of share, additional (if necessary) notarization of certain documents, registration of the contract of share in the registering body, but only to state in the gift contract that you are not giving everything but only the share, and to determine exactly which one is to be given. Any expert can help you in the preparation of the treaty as well as in the complete execution of the gift procedure.

Register the transfer of ownership to the gifted and get an extract from the EGRN.

Registration of the transfer of ownership in Regpalat is mandatory

Registration of the transfer of ownership in Regpalat is compulsory, and it is important to have such a gift in proper form, since all activities involving land-based objects are subject to public registration.

This means that the gifted person has the right to own the apartment not from the time the contract is signed, but from the time the property rights are registered with the Registrar ' s Chamber.

2012 gave rise to some confusion, as it indicated that the State registration of contracts for the giving of real estate did not apply after 01 March 2013.

This does not mean that there is no need to go to Rosreister, which means that it is now not the contract itself but the direct transfer of ownership; however, if the gift date is up to a specified number, it is subject to registration.

The transfer of ownership of immovable property is subject to State registration. The State registration of real property rights and transactions with it is carried out by Rosreest and its territorial authorities (article 131 of the Code of Criminal Procedure; article 3, paragraph 1, of Act No. 218-FZ; and article 1, paragraph 1, of the Regulation, of the Government of the Russian Federation of 1 June 2009 N 457).

Documents may be submitted to the Rosreister in person or through the IFC

Documents may be submitted to the Rosreister in person or through the IFC, including regardless of the location of the real estate facility, in accordance with the list of extraterritorial reception units posted on the Rostreestra website, as well as the authorized person of Rosreest on the way out, sent by mail or submitted electronically via the Internet, including through the Single Public Services Portal (art. 18, para. 1, 2 of Act N 218-FZ).

In addition, at the request of a person who has requested the commission of a notary act, an application for State registration of rights may be submitted to the Rostreestra by a notary certifying the transaction (art. 86.2 of the Basic Law of the Russian Federation on Notaries; art. 15, para. 3, of Act No. 218-FZ).

You can be notified of the progress of the service by e-mail

You can be notified of the progress of the service (e.g., the receipt of information on the payment of public service, the conduct of registration) by e-mail or mobile phone number (paras. 3, 4 Order, Otto, order of the Ministry of Economic Development of Russia dated 16.03.2016 N 137).

The State registration of the creation and transfer of real property rights is certified by a discharge from the Single State Real Estate Register (art. 28, para. 1, of Act No. 218-FZ).

There are some cases in which the giver of an apartment will be given in the future with a specified date for the transfer of the property in the gift contract; and if the parties to the transaction enter Regpalat before the time specified in the contract, registration will be refused, since the date of registration is considered the date of the gift and the transfer of ownership.

An agreement to give a share in the house

An agreement to give a share of the house.

Under the gift contract, one party grants or undertakes to transfer to the other the property right to claim against itself or to a third person or to release or undertake to release it from its property obligation towards itself or towards a third person.

The promise to give all or part of all of its property without specifying the specific object of the gift in the form of a thing, a right or a discharge from duty is null and void.

A gift accompanied by a gift to a gift may be made orally, except in the following cases: "The contract for the gift of movable property shall be in writing in cases where: and the giver is a legal person and the value of the gift exceeds 3,000 roubles; the treaty shall contain a promise of future gifts.

The gift is delivered through its delivery, symbolic transmission of the keys, etc.

VIDEO ON THEME: The invalidation of a contract for the giving of a share in an apartment

Contents:

- We're going to sign up for a share of the house.

- A contract to give a share of the house a model form

- Step-by-step model of the contract for the donation of the share of the home and the share of the land

- An agreement to give a share of the house

- Contract for the donation of a share of the dwelling and land

- How to Formalize the Gifts in the House

- A gift for a share of the house.

We're going to sign up for a share of the house.

A contract for the giving of a share of the house; under the agreement for the giving of a gift, one party grants or undertakes to transfer to the other the property right to itself or to a third party, or to release or undertake to release it from its property obligations towards itself or to a third party.

The promise to give all or part of all of its property without specifying the specific object of the gift in the form of a thing, a right or a discharge from duty is null and void.

A gift accompanied by a gift to a gift may be made orally, except in the following cases: "The contract for the gift of movable property shall be in writing in cases where: and the giver is a legal person and the value of the gift exceeds 3,000 roubles; the treaty shall contain a promise of future gifts.

The gift is handed over by means of its delivery, symbolic transmission of the keys, etc. Moscow, Moscow, Moscow, Pos. Jostovo, Moscow Province, Moscow Street, and the Property Survey of Buildings is estimated at one hundred and seven thousand three hundred and seventy-two roubles, and the estimated percentage of real estate is estimated at fifty-three thousand six hundred and eighty-six roubles.

The one-second share of the ownership of the buildings is estimated by the parties to be fifty-three thousand six hundred eighty-six roubles.

Moscow This treaty shall contain the full scope of the agreements in respect of the object and conditions of this contract, rescind and render null and void other agreements and obligations concluded orally or in writing notarized both before and after the conclusion of this contract which are contrary to this treaty.

Any modification of the terms and subject matter of this contract may be made only by the conclusion of a notarized agreement.

The parties to the treaty shall not be deprived of their capacity to act, nor shall they suffer from diseases which prevent them from understanding the substance of the contract they are signing, nor from having any circumstances that force them to perform the transaction under conditions that are extremely unfavourable to themselves; this treaty has been drawn up and signed by the parties in two copies, one for each of the parties.

The inventory of the entire building is seventy-one thousand eight hundred and sixty-six roubles, and the amount of the land is obtained from a report from the Technical Survey Office of the Mountains. The RAA Law on the Home. The house is located in the Moscow Oblast. The only district was once this 50 years ago, it was with one owner and stood on the ground, how to be with the house. With respect, Peter.

When you give a share of a house through a notary, as in the sale of a notary, from the beginning of the year. Good day! We need to give a share to our three children. How can we make a proper contract? Your electronic address will not be published. You can receive new comments by e-mail. You can sign without comment. Search: Close. The contract providing for the giving of a gift to a gift after the death of the giver is worthless. The form of the gift contract, accompanied by the giving of a gift to a gift, can be made orally, except if: "The contract for the giving of movable property must be made in writing in cases where the gift is a legal person and the value of the gift exceeds 3,000 rubles; the treaty contains a promise of a gift in the future.

The second version of the home share contract, where only the first two items need to be replaced, will not be published. Write the answer Cancel your e-mail address.

A contract to give a share of the house a model form

The allocation of shares in common property is regulated by civil law; according to the Russian Civil Code, when one of the owners sells his or her share, the rest of the owners have a priority right of ransom and must also give the owl written consent to the sale of the share by an accomplice.

And if you give a gift, it is the same; but if you give it to a near relative of the giver, it is the same; and if you give it, it is the same; and if you give it to a near relative of the giver, it is the same; and if you give it to a near relative of the giver, it is the same to you; and if you give it to a near relative of the giver, it is the same to you; and if you give it to a near relative of the giver, it is the same to you; and if you give it, it is the same to you; and if you give it to a near relative, it is the same to you; and Allah is All Knowing, Wise.

If the giver of the share is a minor, the authorization of the guardianship and guardianship authorities is required to dispose of the share free of charge.

However, if the giver is not the sole owner of real property or other property, the transaction should also be governed by the provisions of chapter 16 of the Act.

Today, 17 In all the time, AlloJurist — Land Disputes — is an agreement to give a share of the dwelling and land. We'll solve any question! It's a popular procedure. It's no big deal.

Step-by-step model of the contract for the donation of the share of the home and the share of the land

Write down your question and our lawyer will call you back within five minutes and consult you free of charge, fill out the contact information form and get a free consultation within five minutes.

A private house is much larger than an apartment, so it can accommodate entire families, often owned by several co-owners, each of whom has a share.

Sometimes the owner of such a share wishes to give a portion of the dwelling to a relative — his son, daughter, brother, sister, grandsons — the lawyers often ask if it is possible to give a share in a private house? Of course, it is possible, not for one applicant, but for several relatives at once.

So people are wondering how to make a gift, what it says, where to go, and how much it costs to give a share of the house? Let's take a look at the issue from the point of view of current legislation.

An agreement to give a share of the house

You can give anything except for movable and immovable property, which is prohibited; therefore, if you wish, you can make a gift contract not only with respect to the house but also with respect to part of it, but also with respect to part of the land on which it is located.

Consider the laws, the distinctive features, and the model contract for the share of the land and the share of the dwelling.

The main difference between giving a house with a plot from giving a share of a house with a plot is the procedure for making a gift about how to make a proper contract of giving a house and land, read here, and from this article you will learn about the rules for concluding such an agreement between relatives.

In the first case, it is sufficient for the parties to express their wish in a notary office, to confirm it with documents establishing their identity and a certificate of ownership of the house and property for the giver, to obtain a model contract for the giving of a portion of the house and land and to sign it for how much a notary ' s gift?

The procedure for the giving of real property is a form of manipulation that can be the subject of an entire list of property in this category.

Previous article: State at the time of giving an apartment: Next article: The giving of land to a relative. Dear readers!

Contract for the donation of a share of the dwelling and land

Open a file To download a file. The essence of the transaction is to hand over the ownership of part of the real estate, in our case, to the part of the house and the land on which it is built.

The Civil Code defines shared property as the right to own part of the property in common ownership.

The owners are not physically impaired by the small proportion of the small room space, as the law deals with the share of the right to own.

The Civil Code is the main legislative instrument dealing with the granting of property, and the article states that any property not taken out of circulation may be a gift, such as a house or its share.

A contract to give a share of a dwelling in the legal practice is frequent, with a number of nuances to be taken into account by the parties to such transactions in the form of a share of real property of this type and its taxation.

To begin with, we will determine what the concept of equity property is.

How to Formalize the Gifts in the House

It's important that the owner doesn't suffer from theft, which happens all the time, and there's a lot of things that won't fit into it, but it's not.

A contract for the giving of a share of the house; under the agreement for the giving of a gift, one party grants or undertakes to transfer to the other the property right(s) to itself or to a third party, or to release it, or undertakes to release it from the property.

You're gonna laugh, but in Naples, at the entrance to the Seaport, where cruise passengers go out on a tour of émigrés, blacks sell, I think counterfeit, but these bags.

We offer a wide range of women ' s, men ' s and road bags, as well as backpacks and briefcases, low prices for popular children ' s toys.

Registration may be made by telephone or by e-mail.

A gift for a share of the house.

A new bag of huge sizes is a clear symbol of the colourful events and vivid emotions that you are about to experience in the very near future, made of an extremely worn-out nylon-rispstop, an address and telephone number of TZ Vnukovo Autolet Village, most sentences from exotic skins of turtle, python, buffalo, or young calves.

The model is made of natural skin with a single ton color. The bag has comfortable handles and a removable shoulder belt, adjusted in length. Some brands use the best and softest skin, some use diamonds and some try to communicate. The cost of clothing is Volzhsky's choice of another clothing store. So the choice of shoes is a very complex process that requires special care.

Inside, there are two branches divided by the middle on the lightning, one with a pocket on the lightning.

The most important thing is to make the right choice, and then the leather Italian bag will become a permanent companion and an incredible ornament, the preferred choice for a lid of silicone, buying brandy things that are used to any form.

The average size that any outfit will have an incomplete appearance if the shoes are wrong, but this is not often the case, usually the salesmen are not friendly.

Often, after the most remarkable account of the merits and advantages of the goods, the buyer may have objections.

First, a dense cloth, a coloured pattern, a logo, a double handle, inside the lining, a shopping bag. On the back of the model, there's a pocket on a magnetic clasp. All the products are made of the skin of a first-class maker. White leather clot is the indispensable accessory of the bride, which is consistent with the ideas of purity and loyalty of the face. But men can also find something to taste.

Qualitative and fashionable accessories are all used to create a stylish and bright image.

How to get the gifted dwelling, the share of the house or other real estate right?

Last update February 2023

A gift contract is another gift transaction where the giver gives the gifted property free of charge, including immovable property:

- apartment (or share of the dwelling)

- House (or part thereof)

- land

Family members are often given a gift in lieu of a will to their children or grandchildren. See the gift of the apartment to the relative and the gift of the car.

- Avoiding half a year of waiting for inheritance after the owner ' s death;

- If the giver wants to deprive one of the "legitimate heirs" of the inheritance by giving the apartment only to one or not to the heir (because it is more difficult to challenge the gift than the will);

- Do not allow inheritance disputes.

But the advantage of the bequest is that the bequest may change the bequest, and that the bequest may be more difficult, and that the bequest may be better than the bequest or the bequest.

Long - term relatives or persons without affinity are less likely to provide real estate.

There is also a veiled gift, but when a relative gives money to buy a gift, for example, an apartment, it is set forth in the agreement for the giving of money; this protects the giver in the event of separation from his spouse in the event of divorce, if the money is spent intentionally.

Example:The grandson buys an apartment, but his grandmother is calculated with the seller and the contract of sale indicates that payment is made by a third party, so the grandmother gives the apartment without being the owner.

This method of giving is usually used in young families, where the gifting relatives want and give real estate and are guaranteed to retain it in the event of separation of property upon divorce (their son, daughter or grandson).

Registration of the transfer of ownership to Rosreestre is compulsory

It is important that the present be properly processed and registered by the State.

The gifted person has the right to own the dwelling not from the time the contract is signed, but from the time the property is registered in Rosreister.

It is not possible for a giver to present an apartment in the future with an indication of the date of transfer in the gift contract.

Example: