In order to improve the country ' s demographic situation and increase the birth rate, it had been decided to implement a State programme to provide cash assistance to families in two or more children, which had led the Government to extend the law on maternal capital until the end of 2018.

All legislative matters are explained in article 256, which sets out additional measures of financial assistance to the State for families with children.

Dear readers, our articles talk about model ways of dealing with legal issues, but each case is unique.

If you want to know,How to solve your problem is to use the form of an online consultant on the right or call on the phone at +7 (499) 450-39-61. It's quick and free!

What do they call maternal capital?

The programme referred to as maternal (family) capital is financial support for Russians who have given birth or adopted two or more children.

State assistance is available to those who:

- The mother who has given birth or adopted more than two children, or the father who has adopted a second or more children, has Russian citizenship.

- Have not previously benefited from social assistance in the form of such benefits.

In 2017, families receiving mother ' s capital may receive a cash benefit of 45,3026 rubles on a certificate.In the first years of receiving material assistance, the amount was only 250,000 roubles.

It was increased under Federal Act No. 256, article 6, of the Federal Act.The second paragraph of this article refers to the indexing of financial assistance in response to rising inflation and issues certificates in the Russian Pension Fund, not only in paper form but also in electronic form.

The amount of the certificate shall be used only for the purposes specified by the State programme:

- Improvement of housing conditions through the purchase of housing or the payment of the first mortgage, construction or renovation of existing accommodation, repayment of interest and loans taken to housing.

- The child ' s education by paying the cost of higher education, including the cost of community services in the educational organization ' s dormitory.

- Support for the integration and adaptation of a disabled child in society through the acquisition of special services and goods for this purpose.

- A child ' s mother ' s pension savings by investing this amount.

The mother ' s capital can be used if the child is over three years old.There are exceptions to this rule that allow money to be spent without taking into account the child's age.

Watch out!The law prohibits the sale of a mother ' s certificate, which is punishable.

Reasons for the percentage of the child who buys a mortgage

Act No. 256 provides for the allocation of a share of housing to children.If it has been acquired by means of a State subsidy, it is mandatory, as provided for in article 10 of the Act.Children born after this process are also claimed, so the possibility of recalculating shares must be preserved, which should be recorded in the agreement.

The spouse of the holder of the certificate must also be provided with a share.Relatives, even those living with the family, are not entitled to a share.

How to divide shares in an apartment purchased by mother capital is determined by the person on whom the cash certificate is issued.The number of square metres allocated per child should not be less than 9-12, and that is the minimum standard of living area per person.

In order to determine the size of the family members ' real estate, it is necessary to determine how much per cent of the total value of the property is a State grant.

For example, if the amount of the certificate is one third of the total value, one child will have one twelfth of the square metre (with a family size of four).

If there was a problem with the determination of the share, the matter was decided by the court to which one of the spouses applied.Usually all family members are given the same shares by a court decision.

There is no single legal time limit for the issuance of housing shares because:

- The transfer of real property during a transaction is sometimes impossible due to unforeseen life situations, especially those involving minor children.

- Housing may not always become a share of the family's property immediately after the deal, and there may be a delay of many years.

In the absence of an agreement after the purchase of the dwelling giving the child part of the dwelling, the owner of the dwelling undertakes the Pension Fund to allocate a share in the future.

The document is certified by a notary and is intended to protect the rights of the child in various life situations.

Help.Under article 35 of the Land Code, it is mandatory to allocate land shares to all family members.

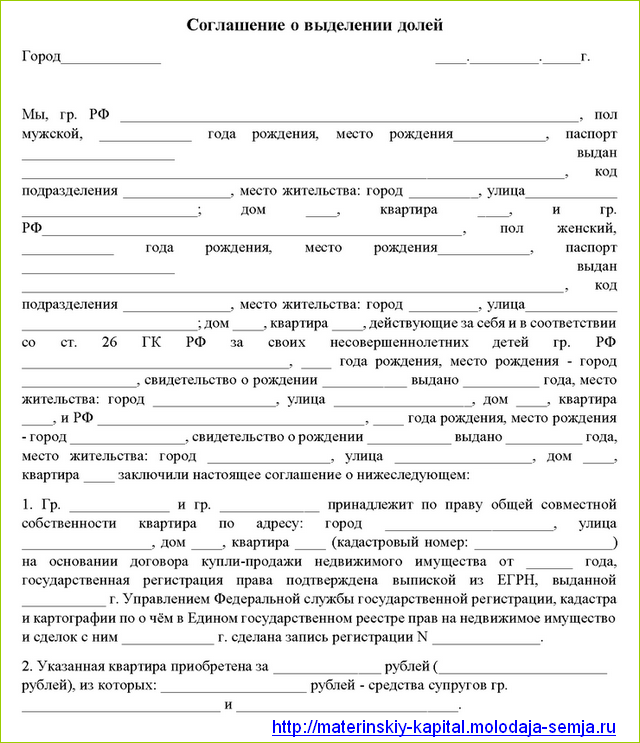

Agreement

In order for the transfer of shares to have legal effect, it is necessary to conclude an agreement certified by a notary.This condition is not provided for by Act No. 256, the requirement is derived from amended Federal Act No. 122, which entered into force in mid-2016.

For a notary, when the agreement is drafted, you need to reserve:

- Identification documents;

- The right to own real estate;

- Documents showing the marriage and the birth of children;

- An obligation given by the holder of the certificate confirming the allocation of parts of the property to his spouse and his children.

Contents

The document should read as follows:

- Places of agreement and date of the procedure.

- Personal details of each party to the agreement, supported by identification documents.

- Personal information on children: Passport data, if available, also by the FIO.

- Place and description of the dwelling.

- The rights to property are shared or shared and the size of each of the consenting parts of the property.

- Tom, the basis on which the property rights arose.

- This is the certificate with the series number and the institution where it was issued.

- Conditions for the distribution of shares and the size of the parts of the property of consenting parties.

- Conditions related to the birth of subsequent children for further reduction of parts.

- Quantity of available copies of the document and location.

It matters!The agreement must be signed by all parties, including minors.

The speciality of signing an agreement is thatIf the child is a minor, his legal representative signs for it.It may also be a parent, and by signing, he indicates that he is acting for himself and for a young child.

The very model of the child share agreement can be downloaded from our website:

Pick up a sample.

Where to Go

With a model agreement for the allocation and proportions of the spouse ' s and children ' s shares according to the certificate of matrimony, apply to RosreestrThe agreement will not be recorded by the registration authorities.

- It is necessary for the registration of property rights of all real estate shareholders.

- This procedure ensures the State ' s protection of property rights and confirms the validity of the document.

- In order to be registered by the State, it is necessary to:

- Provide a notarized agreement.

- I'm gonna pay the mistress, give you the receipt.

- Surrender the package to Rosreister.

Under Federal Act No. 218, the EGRN, the Single Real Estate House, has been established and all information on the registration of real property is being collected.

Conclusion

Certificate holders have the right to determine the purpose of spending money themselves, but 92% spend to improve the housing situation.

Russian legislation sets out the only requirement for the purchase of housing; it must be on Russian territory.

You didn't find an answer to your question?

Find out,How to solve your problem, call me right now:

+7 (499) 450-39-61

It's quick and free!

Agreement on the distribution of shares in maternal capital

Duty to process real estatein common propertyIn the case of the use of the mother ' s capital, the law provides for the transfer of the certificate ' s funds for the most part.partial payment of housing, therefore, the owner can only take advantage of them after a notary obligation has been made available to the Pension Fund.

Under the terms of this document, the buyer of real estate undertakes to allocate shares in the dwelling after full payment of the contract of sale and the possibility of full ownership and disposal.

The performance of the obligation is effected by drawing upof a share agreement between the United States of America and the United States of America (United States of America) and the United States of America (United States of America of the United States of America of the United Kingdom of Great Britain and Northern Ireland of the United Kingdom of Great Britain and Northern Ireland of the United Kingdom of Great Britain and Northern Ireland of the United Kingdom of Great Britain and Northern Ireland of the United Kingdom of Great Britain and Northern Ireland of Great Britain and Northern Ireland of the United Kingdom of Great Britain and Northern Ireland of Great Britain and Northern Ireland of the United Kingdom of Great Britain and Northern Ireland of Great Britain and Northern Ireland of the United Kingdom of Great Britain and Northern Ireland of Great Britain and Northern Ireland of the United Kingdom of Great Britain and Northern Ireland of the United Kingdom of Great Britain and Northern Ireland of Great Britain and Northern Ireland of Great Britain and Northern IrelandOr a treaty of giving.

In this document, the owner shall indicate the parts of the property to be allocated to the family members, after which the parties to the transaction shall apply to the registration authority and make arrangements for the ownership of the property.

The obligation is deemed to have been fulfilled since the entry into the EGRNnew owners ' records.

In which cases an agreement on the allocation of shares is drawn up

If the funds of the mother ' s capital are sent as the missing amount for the purchase of a ready-made dwelling, a sales contract may be entered into between the seller and the family.with the size of the sharesThe requirement of article 10, paragraph 4, of FL No. 256 of 29 December 2006 will be met and all members of the family will have their shares.

An agreement on the allocation of shares shall be drawn up if the funds of maternal capital have been realized on the basis ofShare commitmentsIn this way, real property is converted into common property in the following cases:

- If ownership cannot be obtained immediately upon the conclusion of a sales contract, the funds of the uterus shall be directed to the housing under construction and until the completion of the construction, it shall not be possible to dispose of the property.

- If the dwelling is in a mortgage, the dwelling is purchased under a loan or mortgage agreement.

After removal of the housing encumbrances, the share of family members must be allocated6 monthsUnder article 131 of the Criminal Code of the Russian Federation, this transaction is subject to State registration, as it implies that citizens have a right of ownership of immovable property; accordingly, the obligation will be fulfilled after the transfer of the right to Rosreestre.

The share agreement must be executed in accordance with the terms of the obligation.Both parentsWe have committed ourselves to allocating shares to children, and the agreement must also be signed on behalf of both citizens.

How to allocate shares of children ' s maternal capital (without and with notary)

The obligation is in a strictly established notarized form and the instrument is valid only after it has been given an assurance.

In the subsequent execution of the obligation, the need to approach a notary depends on the form of the property right of the spouses.The transaction must be certifiedAt the notary's.

The right to common property is divided into:

- Together, the spouses ' shares are not specified and are recognized as equal by law;

- A percentage is defined for each of the participants in the housing sector.

The participation of a notary in the process is necessary if all members of the family are formedjoint propertySince there is a division of common property between the spouses and pursuant to article 38, paragraph 2, of the Russian Federation, such a transaction is subject to a notary certificate.

No notary shares can be allocated if the child3 yearsand maternal capital is used as the missing amount forPurchase of ready-made housingUnder a contract of sale.

For this purpose, a contract shall be entered into with the seller, with the condition that part of the cost of the dwelling will be paid by means of the certificate; once the transaction is registered, the Pension Fund shall transfer to the seller ' s account the missing amount.

How to formalize an agreement to determine shares without a notary

Depending on the form of the right of ownership of the spouses, the process of allocation of shares may be carried out with or without the participation of the notary.

- If real estate has been acquiredsingle parent before marriageor there is no second parent at all, the agreement may be drawn up in simple writing on behalf of the owner, since the sole owner has the right to dispose of the property of his or her own choice, including the removal of part of it by other citizens.

- If the property was acquired by the parentsduring marriage and not in equity propertyEvery person who buys it, that property will be their joint property, and thus they will be able to allocate shares to the children without the participation of a notary if the transaction takes place.the right to joint property will not cease.

The removal of shares from the joint property right must be made with the notary consent of the spouse, but it is not necessary to confirm the agreement.

The law establishes the obligation to allocate shares in property in order to prevent parents from taking advantage of the means of motherhood in good faith and depriving children of their right to housing.

The spouses may retain the right to joint property andAllocate shares only to childrenAs a result, part of the dwelling will be jointly owned by the spouses and the other part of the property of the children.

In this form of ownership, the requirements of the law are met, asall members of the family are allocated sharesThe spouses, in equal parts by virtue of the law, the children, depending on the size specified in the agreement.

Model agreement on the allocation of shares in maternal capital

There is no strict form for an agreement in the law.essential and additional conditionson the subject matter of the contract and the parties to the transaction.

The agreement should contain the following information:

- Information on owners of housing (FIE, residence and other passport data).

- Children ' s data on a passport or birth certificate.

- The information about the apartment is the basis for the establishment of the right of ownership, as well as the data from the EGRN extract.

- Total value of property and amount of maternal capital used.

- Method of acquisition (e.g. by credit contract).

- Data on commitment.

- Size of shares allocated.

Additional conditions may include information on the rights and obligations of the parties under civil law, as well as the number of copies of the document and who bear the costs of the transaction.

Model 2023 share agreement

How much does it cost to give the kids a share of the notary?

In order to take advantage of the funds, it is necessary to draw up a commitment and submit it to the RPF.500 rubles.

An agreement to determine a notary ' s share may be made by a notary (at the request of the parties to the transaction), even if joint or sole ownership and certification are not necessary.

If a notary is required, the certificate will be priced.0.5 per cent of the cost of the dwellingIf the request for notary action is voluntary, the cost of giving shares to family members will be as follows:

- With a value of up to 10 million, 3,000 roubles plus 0.2 per cent.

- Over 10 million — 20,000 rubles plus 0.1 percent but not more than 50,000 rubles.

The calculation shall be taken from the cadastral or estimated value of the dwelling, to the discretion of the owner.

According to a letter of recommendation from the Ministry of Finance, only the government is required to pay for the certification of such transactions.500 rublesHowever, in practice not all notaries adhere to this recommendation and set a tariff on the cost of the dwelling.

An agreement to give children a share of their mother ' s capital

A deal in terms of children ' s shares is in the sense of a gift contract, because the partiesfree of charge to the propertyProperty.

Only children can accept real estate.with the consent of their legal representativeswhich parents are supposed to play.

When drawing up a gift contract or agreement in the text of the document, the parent signs for himself and for his minor children.

If a citizen is 14 years of age, he or she isshall be present independentlyAll documents must, however, be certified by the signature of the parent.

The law indicates that shares are determined by agreement between family members, but in this case it is not the document itself, but the fact that citizens are given ownership of property.

The law does not, however, contain a type of contract such as a "participation agreement".citizens are free to conclude a contractand is entitled to formalize the transfer of ownership by means of any legal instrument that is not contrary to the law.

How to correct the allocation of shares in maternal capital

The State provides material support to the families in which the second child is born.Agreement on Children ' s Share, since the money allocated has the sole purpose of improving the living conditions of parents with children.

If you use the money of your choice, the certificate holders will be punished.

When a second child is born, the state gives parents their mother's money, and for many families this money is a substantial support to improve housing conditions.

However, domestic legislation established a strict list of options for the use of the funds in question; parents were not entitled to spend the sum at their discretion; if they cashed the funds of the uterus and used the money for a non-target purpose, they would face a certain penalty, up to criminal liability and up to five years ' imprisonment.

The parents may use the uterus immediately upon receipt of the certificate or after the expiry of the three-year period.

If adults choose to purchase real estate with the funds of the uterus, children are required to receive shares in housing.

With regard to the subsequent sale of housing, adults must draw up a document showing whether minors have received an equivalent share in a different apartment; after the sale of an old dwelling, the mother and father register the child in a new apartment.

The recipient of the money has several options for using the money from the certificate:

- Payment of part of the mortgage;

- The payment of rent for the sale of dwellings;

- The last payment for the purchase of the flat in instalments or for the payment of the JSC kickbacks;

- Payment for reconstruction work in the home;

- Establishment of an act of transfer of dwellings to service if the recipient of the uterus is part of the construction;

- An extract from the GERN with the data from the cadastre, if the house is built on its own.

According to the RPF regulation, the owners of the dwelling are required to register the mortgage and the encumbrance within six months after full payment of the mortgage and cancellation of the encumbrance, and the adults are in the process of issuing an agreement to establish the children ' s shares and then make all the changes to Rosreestrester.

If one owner, the shares are given to minors and the second spouse, if two, the proportion is limited to children.

Thus, the allocation of shares to children guarantees their protection of part of the property in the dwelling, and the rights of every adult owner to the share of the dwelling are also preserved even when the marital union is dissolved.

If the parents immediately indicated at the time of purchase or construction of the house what percentage the minors would receive, the transmission of a certificate of uterus does not require adults to re-assembly the proportion of the children.

The obligations discussed concern only those children who are born to adults.

Domestic legislation does not establish specific rules requiring adults to determine shares for each owner.

Regardless of the percentage, parents are not entitled to claim a child ' s share, and children are not entitled to parental property. As a result, specialists are advised to divide the housing equally according to the number of household members.

Domestic legislation establishes the following procedure for the allocation of housing shares.

1. To take the certificate for the uterus

Once the second child is born, the woman visits the local RPF office to register the certificate, and she will need to provide staff with a certificate application and a legal documentation package. The list of required certificates and papers depends on the specific circumstances of life – for example, the mortgage contract, the housing sale agreement.

Once the employees have made a positive decision on a woman's application, they issue a certificate.

From the date of transmission of the certificate, the parents receive certain financial obligations for the management of the money.

2. Remove the encumbrance

This is relevant for those who have taken a mortgage dwelling; once the borrowers have paid the last payment, they will need to apply to the financial institution for a mortgage and then visit the Rosreestre office to cancel the encumbrance.

Once the Rosreistra staff have reviewed the application, they will issue the applicants with an extract from the EGRN, which confirms the right of ownership of the dwelling.

Finally, homeowners have the right to dispose of their housing, and the first thing they need to do within six months is to distribute shares by including them in the list of owners and children.

3. To write an agreement on the establishment of shares

Adults may issue a share agreement or a share agreement, and Rosreestra staff may advise parents on the best option available to them.

4. Register the transfer of ownership

After all the above actions have been carried out, the parents will be required to submit a statement on behalf of each owner to Rosreest, providing the staff of the authority with all the necessary documents.

- Passports of applicants;

- A document on the conclusion of a marital union;

- Certificates of the birth of infants;

- Law-making documents: a mortgage agreement, a contract of sale or equity;

- Housing registration certificates and papers;

- A membership agreement certified by a notary agency employee;

- A receipt establishing the payment of the Minister's office.

The documentation package is allowed to be submitted not only to the Rosreestra branch but also to the IFC, the duration of which is 10 days, followed by an extract from the EGRN, which contains information about the owners of the dwelling, both parents and their children.

The essence of the document under consideration is that the joint property rights of adults are terminated; they are redistributed among all homemakers, including children, with a determination of the proportion of each person.

In this case, the parents act as:

- First owners of housing;

- Legal representatives of their children who make a transaction on behalf of a minor under the age of 14 or consent to the transaction from the age of 14 to 18;

- Buyers of shares in joint equity property.

The agreement will need to specify:

- Date and address of the document;

- Information on the parties to the agreement: FIO without any abbreviations, date of birth, passport data;

- Children ' s information: Non-abbreviated PIF, date of birth, data from birth certificates;

- Data on the dwelling purchased: the address of the property, its area, the number of rooms, the deck, the technical and cadastral records of the dwelling;

- An indication of the right of ownership (dual or joint) as well as the amount of the share held by each owner;

- The manner in which the dwelling was purchased is through a mortgage bank, a contract of sale, inheritance, or gift;

- Information from the certificate of mammary: series, No., date of discharge, address of issue;

- Information on the determination of the total share ownership of the dwelling, with the amount of the share held by each household member;

- Information on how shares will be redistributed if new children are born in the family;

- References to legislation;

- Data on the number of photocopies of the agreement;

- A list of the attached documentation;

- The signatures of the persons who drafted the agreement.

Pick up a sample of the child share agreement.

Without a notary, the agreement will have no legal effect, so the paper will need to be certified by a notary agency official, and the specialist will further check the validity of the agreement so that the parties do not have problems in the future.

Domestic legislation states that the agreement will require the payment of about 500 rubles to a member of a notary agency, but in practice many professionals follow a different rule: they set the fee for the service at 0.5% of the transaction, at least 300 rubles, at a maximum of 20,000.

% is calculated according to a market, inventory or cadastral valuation of the value of the dwelling purchased. If a notary official is offered several assessment certificates, he or she will choose the lowest number.

Additional fees would be required for a technical and legal documentation specialist, not more than 2,000 roubles.

The cost of State registration of ownership will be 2,000 roubles.

If the parents do not establish the proportion of their children, they will be punished accordingly, and if they do not do so with a certificate, they will be liable to criminal liability; if adults, for example, cash the funds of their certificate, they will be at risk of being deprived of their liberty for a period of between 24 months and 5 years.

Here are some of the consequences that parents may have if they have not established their children ' s share of the mother ' s capital:

- A court order imposing fines;

- Cancellation of the sale of housing;

- Provision of a child ' s share with the assistance of a MTSP staff member on a mandatory basis.

Thus, obtaining a certificate of masculinity requires that shares be allocated to all domestic workers, including children.

This will require an agreement to be drawn up and certified by a notary officer and then registered with the property.

If the use of uterus is inappropriate, parents run the risk of administrative or criminal liability.

If you have any questions, our on-call lawyer is ready to consult you for free.↓

Children ' s share in the use of maternal capital

Through the Federal Maternal Capital Programme (MC), families with children are entitled to improve living conditions through the purchase of housing, the construction of a new residential home or the reconstruction of an existing one.

How to determine the size of shares

In practice, the division of acquired property is carried out equally among all members of the family. In this approach, parents give a portion of the property to the children. Since the rights of the children are not violated, such a division is not opposed by the RPF.

The minimum children ' s share is calculated on the basis of the following: housing costs can be met from three sources:

- Personal savings;

- Mortgage;

- The Government of the Republic of Moldova has made a number of efforts to reduce the incidence of maternal mortality and to reduce the incidence of maternal mortality and to reduce the incidence of maternal mortality and to reduce the incidence of maternal mortality and to reduce the incidence of maternal mortality.

The Family Code of the Russian Federation establishes a rule according to which children do not have rights to the property of their parents during their lives, and loans are granted in the form of a mortgage.

Children are not involved in the process and are not bound by it because of their limited legal capacity; the only source for which children are involved is their mother ' s capital.

According to the law, MK funds belong equally to family members.

If the family is made up of four persons, the current year ' s MK (453,026 rubles) is divided into all persons (i.e.453 026 / 4 = 113 256,5It is also the case that the Government of the Democratic Republic of the Congo is a member of the United States of America (i.e., the Republic of Korea, the Republic of Korea, the former Yugoslav Republic of Macedonia, the former Yugoslav Republic of Macedonia, the former Yugoslav Republic of Macedonia, the former Yugoslav Republic of Macedonia, the former Yugoslav Republic of Macedonia, the former Yugoslav Republic of Macedonia, the former Yugoslav Republic of Macedonia, the former Yugoslav Republic of Macedonia, the former Yugoslav Republic of Macedonia, the former Yugoslav Republic of Macedonia, the former Yugoslav Republic of Macedonia, the former Yugoslav Republic of Macedonia, the former Yugoslav Republic of Macedonia, the former Yugoslav Republic of Macedonia, the former Yugoslav Republic of Macedonia, the former Yugoslav Republic of Macedonia, the former Yugoslav Republic of Macedonia, the former Yugoslav Republic of Macedonia, the former Yugoslav Republic of Macedonia, the former Yugoslav Republic of Macedonia and the former Yugoslav Republic of Macedonia.

For example, the family purchased an apartment at a cost3 000 000One child in its value owns one fourth of the MK, which means his/her share of the total cost of the apartment will be:

113 256,5 / 3 000 000=0,038Or a little bit more.1/26.

The value of children ' s shares becomes important in the following situations:

- The sale of real property acquired using the MC until the children reach the age of majority;

- Divorce of parents and division of property;

- The smaller the child ' s share, the smaller the amount of monetary compensation to be paid or the deposit in the sale of common property.

Obligation to allocate shares

Mortgage or construction may last for years. There is a time gap between the receipt of maternal capital and the ability to report on its use.Certificate holder allocates shares to children within 6 monthsAfter the events mentioned above have occurred and the registration has been completed.

For such situations, it's made up.Commitment to allocate children ' s shareThis obligation is made by parents and is made available for payment of maternal capital when it is not possible to provide the RPF with a certificate of ownership with information on the size of the child ' s share.

These are usually cases of property acquisition:

- with the participation of a mortgage;

- On the Treaty of Share-based Participation (MA);

- By joining a housing cooperative;

- Construction or reconstruction of the facility: a particular feature of these situations is thatThe need for maternal capital arises earlier than the possibility to register the right.

The registration of the law may be carried out:

- Once the mortgage has been fully repaid and the pledge has been terminated;

- Under the DM agreement, after full contributions have been made and the house has been put into operation;

- In a housing cooperative after full membership fees have been paid;

- In the case of construction or reconstruction following the commissioning of the facility.

How to Compute

The obligation must be "confirmed in accordance with the established procedure", as stated in Government Decision No. 862 of 12 December 2007 of the Russian Federation. The established procedure is notary testimony.Nowhere does it say that only a notary must write it?.

It's important to sign it in the presence of a notary and ask for a full inscription. It's going to cost much less.

So the notary will have reason to demand only a fee for the certification.

In the production of a document by a notary, it will require a fee in addition to the tariff for legal and technical services and a stamp form.

Unfortunately, the notary is likely to refuse to make a commitment on the grounds of non-compliance with the law.

The real reason would be to seek additional income for the services imposed.

However, if the client insists on not overpayment for unnecessary services, he or she may file a complaint against the actions of a notary with the registration office of the Office or the Ministry of Justice of the region or the court.

The obligation is signed by the parent who is:

- A mortgage loaner;

- Member of the DDU;

- Member of the housing cooperative;

- The owner of the land on which the house is built;

- The owner of the reconstructed house.

If the spouses are with borrowers under a mortgage agreement, the distribution of the property already includes the marital shares, the obligation is both signed; there is no approved form or mandatory requirement for the creation of the obligation; it can be printed in an arbitrary form on a simple sheet of paper.

For the correct formulation of the obligation, it shall specify:

- Name, surname and patronymic of persons and details of drafters: date and place of birth;

- Address of place of residence;

- Passport data;

- One of the additional identity details is: INS, insurance number, driver ' s, pension or other special certificate details; the same information for children whose shares are beneficial; for those under 14 years of age, the birth certificate data;

- Details of real estate in which shares are identified: name of real property: apartment, room, house, share of the newly built facility;

- Address of location (post or construction);

- Inventory or inventory number;

- The characteristics of the building: the material of the walls, the deck; the right-making documents and their details;

- Share-sharing agreement: date, number, parties;

- A document of the housing cooperative confirming membership and indicating the date of admission;

- The details of the land document, including the name, date of issue or conclusion, the number of the authority, and the description of the site itself: location, area, cadastral number, authorized use;

- characterization of the reconstructed house: location, year of construction, material bearing walls, decks and details of title documents (contract number, date of conclusion, number and date of certificate of ownership).

Deadline - 6 months from the date of one of the following events:: Full payment of mortgage obligations, signing of the acceptance certificate for the equity contract or the admission of a dwelling from a housing cooperative, signing of the certificate of acceptance of the completed construction or reconstruction of the housing facility, size of the children ' s share.

Also, the agreement should contain a phrase stating that "the owner(s) of the real estate undertake to allocate a share thereof in the amount... in favour of each of the children (names, names and patronymics)".

Whether an obligation must always be drafted

No, not always, the obligation is not necessary if, at the time of the application for maternal capital, the sales contract is already registered with the children ' s share and size, and this is the case in two cases:

- Real estate is acquired with its own funds and maternal capital; the sales contract is registered with the condition of deferred payment (in terms of maternal capital) and with the allocation of children ' s shares;

- The purchase is made at the expense of its own funds and credit; the seller receives a full settlement; the sale contract is registered with the allocation of children ' s shares;

- If children ' s rights are not registered, the Pension Fund will require an obligation and, without it, will refuse to provide maternal capital.

How to allocate the share in the purchase of housing per mother ' s capital

There are no strict rules, except for the minimum percentage of children. How to calculate this percentage is described at the beginning. The funds of maternal capital belong equally to all members of the family, but parents are adults who are fully legal and capable.

They are free to share their share of the mother's capital by their own free will, and it is easier to distribute the property into equal shares among all the parties to the transaction.

If the spouses ' contributions to the acquired dwelling are not equal, it is reasonable and fair to divide the shares in proportion to the contributions of each of them.

If the spouses plan to sell a dwelling or make a different transaction, it is advisable not to allocate a share; transactions with a single owner are easier to deal with than with a few owners; the question of the distribution of the share in the purchase is usually of no practical importance; it arises when the spouse divorces and the sharing of the property is necessary.

Agreement on Children ' s Share

There are two ways to distinguish the shares:

- Indicate the shares in the contract of sale;

- To make an agreement to transfer the share or to give it to you.

When a family has sufficient means to purchase a dwelling only with maternal capital, it is easy to allocate children ' s shares.

Children are included in the sales contract as buyers, andthe size of the sharesThe number of copies of the contract is calculated by the number of buyers, so that each child has the original.

The State registration of the treaty completes the procedure for the allocation of children ' s shares.

The original contract and copies are provided to the Pension Fund as a basis for the payment of money and as proof of the owner ' s obligation to allocate a percentage of the children ' s share in the use of maternal capital.

A share agreement, or a share agreement, is regarded as a separate subject of State registration, and one per family.

Each document can be prepared on its own, ordered by a realtor accompanying the deal, a lawyer or a notary.

Notarization of these papers is not required by lawwith one exception, by the time the child-sharing agreement was filed for registration, the spouse had already registered the right to share property, and the child-sharing agreements would change the amount of the marital share.

Transactions with shares in joint ownership are certified by a notary. On 31 July 2023, Federal Act No. 76-FZ of 1 May 2012 entered into force, which provides for the cancellation of the compulsory notarization of certain transactions with shares in common property, but this applies primarily to disposition and mortgages.

To download the form of the child share agreement

Disbursement of shares after repayment of mortgage

The mortgage is secured by the bank ' s guarantee of the property to be purchased, and a special entry is made to the Single State Real Estate Register (EGN) when the contract of sale is registered.

You can do this at any time after you have fully paid your credit obligations. The "automatic" burden is not lifted. You have to do certain things. First, you have to go to the bank.

Depending on the bank ' s internal regulations, it issues one of the following documents:

- A certificate of repayment of the loan;

- A mortgage with full payment marks;

- Bank ' s declaration of consent to the termination of the bond in connection with the repayment of the loan.

The bank may make its own application to Rosreister for the termination of bail, and it may also make a joint visit to the IFC or the debtor ' s Rostreister and the bank ' s representative to make such an application.

The representative of the bank should have the authority and the identity document with him/her.

The debtor should make an appointment in advance and notify the bank's employee of his or her time.

The spouses may leave the sole owner of the spouse to whom the original contract of sale has been issued; this will not affect the property regime; each spouse shall have equal rights to real estate.

If marital shares are not distributed, children ' s shares can be allocated under a gift contract.

In addition, it will be necessary to:

- Credit contract;

- Passports and birth certificates of the parties to the transaction;

- A certificate of ownership of the acquired dwelling, or an extract from the EGRN with details of the pledge, with the date of issue not later than 1 month by the time of the visit to Rosreestre.

When the documents are collected, all parties to the transaction visit Rosreister or the Multifunctional Centre (MCC) of the public and municipal services "My Documents", where a special statement is filled in, and the above documents are attached.

There is no need for children under the age of 14 to be present, and parents are to be registered for them.

Registration actions for the exclusion of bail from the EGRN are carried out free of charge, with a share fee of 2,000 roubles for the registration of shares.

Registration actions are carried out within five days when the documents are submitted directly to the Rosreest, within seven days when they are submitted through the IFC; removal of the encumbrance and allocation of shares need not be registered at the same time.

Between these events, parents have another six months during which they can use their accommodation without involving their children in the transaction.

What happens if we don't make a cut?

If the children ' s share of the property purchased with the participation of maternal capital is not allocated, the Pension Fund will send the relevant information to the Public Prosecutor ' s Office, and the latter will file a lawsuit for recovery from forgetful recipients of maternal capital.

Do you have to give a share to your husband?

In accordance with the Family Code, property acquired by spouses during marriage is subject to joint marital property.

If the dwelling is purchased only with the funds of the mother's capital and the mortgage of the marriage, then both the obligations and the property are shared between the spouses in half, and it is better for the spouses not to share their share of the marriage during the marriage.

In transactions involving property with one owner, fewer documents are issued for registration, in particular, notarization of the ownership ' s consent to the common property transaction will not be required.

The division of property may be necessary in the event of divorce, but in this case the spouses or former spouses may agree freely to sell or change the dwelling with compensation for one of the spouses; the absence of a State registration of the right of one of the spouses does not deprive him of the right to the property.

This is not the case ifOne of the spouses invested money in the purchase of a common dwelling.which are not subject to the regime of marital property:

- Premarital savings;

- Property or funds derived from its sale, donated or inherited during marriage.

For example, the husband had an inheritance following the death of relatives in the form of an apartment in another city, which he sold and invested in the purchase of housing for the family, on which the mother ' s capital was also spent.

In this case, the husband is interested in allocating shares at the conclusion stage of the contract and is entitled to claimproportion proportional to the size of his personal investmentsGovernment Decision No. 862 of 12 December 2007 refers to the allocation of shares to all family members, including the spouse.

But it regulates the use of maternal capital, and capital is not shared between family members; it can only be divided between spending lines.

The shares are allocated in property acquired with his participation, not in the capital itself, and the division of property is regulated by legislative acts: the Civil and Family Codes of the Russian Federation, which have more legal force than a government decision; therefore, it is better for families and spouses to decide on the allocation of shares based on the law as well as their own interests.